THE WORLD BANK

Mongolia

Korea

Cambodia

Palau

Micronesia

Marshall Islands

Papua

New Guinea

Solomon

Islands

Vanuatu

Samoa

Kiribati

Australia

New Zealand

FISCAL YEAR

2010-2011

ANNUAL REPORT

OFFICE OF THE EXECUTIVE DIRECTOR

Tuvalu

ABBREVIATIONS AND ACRONYMS

ADB Asian Development Bank

AED Alternate Executive Director

CAS Country Assistance Strategy

CIN Constituency Information Notes

CODE Committee on Development Effectiveness

CRW Crisis Response Window

DSA Debt Sustainability Analysis

DWG Development Working Group

FCS Fragile and Conflict-affected States

FIF Financial Intermediary Funds

FSM Federated States of Micronesia

FY Fiscal Year

G8 Group of 8

G20 Group of 20

GAFSP Global Agriculture and Food Security Program

GCF Green Climate Fund

IoC Instrument of Commitment

IBRD International Bank for Reconstruction and Development

IDA International Development Association

IDA16 International Development Association/16

th

Replenishment by IDA Donors

IEG Independent Evaluation Group

IFC International Finance Corporation

IMF International Monetary Fund

IT Information Technology

LLP Loan Loss Provision

MAP Mutual Assessment Process

MDRI Multilateral Debt Relief Initiative

MTSF Medium-Term Strategy and Finance

MTFS Medium-Term Fiscal Strategy

NGO Non-Government Organizations

ODA Official Development Assistance

PACT Partnership & Capacity Building Trust Fund

PICs Pacific Island Countries

RMI Republic of Marshall Islands

SABER System Assessment and Benchmarking for Education Results

SAW Strategy for Agriculture and Water

SDR Statutory Drawing Rights

TFs Trust Funds

UN United Nations

UNFCCC United Nations Framework Convention on Climate Change

VSP Voice Secondment Program

WB World Bank

WBG World Bank Group

WDR World Development Report

All monies expressed in US$ unless indicated otherwise

FY11 – refers to 1 July 2010-30 June 2011

WORLD BANK – EAST ASIA / PACIFIC CONSTITUENCY

OFFICE ANNUAL REPORT FY11

CONTENTS

EXECUTIVE SUMMARY

Issues of Special Interest to our

Constituency Office.......................................................................... i

Bank Group Strategy and Leadership...... ........................................................................................... ii

Operational and Strategy Issues...... ................................................................................................... ii

CONSTITUENCY OFFICE MATTERS

Travel .......................................................................................................................................... .......1

Communications... .............................................................................................................................. 1

Meetings with Government, Parliamentary, and Non-Government Delegations... ............................ 1

New Constituency Member Tuvalu... ................................................................................................. 1

Office Staffing .................................................................................................................................... 2

Constituency Representation Rotational Agreement ..................................................................... .... 2

POLICY ISSUES OF SPECIAL INTEREST TO OUR CONSTITUENCY

Voice Secondment Program........ ....................................................................................................... 3

Small States ........................................................................................................................................ 3

World Development Report 2011: Conflict, Security, and Development .......................................... 4

World Development Report 2012: Gender Equality and Development ............................................. 4

Global Agriculture and Food Security Program (GAFSP) Update .................................................... 5

Donors Official Pledges to GASP Fund ............................................................................................. 6

Individual Executive Directors’ Budget...... ....................................................................................... 8

BANK GROUP STRATEGY AND LEADERSHIP

Climate Change........ .......................................................................................................................... 9

Medium-Term Strategic and Financial Framework....... .................................................................... 9

G20 Update: Seoul Outcome and Next Steps... ................................................................................ 10

OPERATIONAL AND STRATEGY ISSUES

Education Strategy..... ...................................................................................................................... 11

Trade Strategy...... ........................................................................................................................... .11

IFC 2013 Implementation Update.... ................................................................................................ 12

IFC 2013 Change Initiative.. ............................................................................................................ 12

DEVELOPMENT EFFECTIVENESS AND RESULTS

A Focus on Results...... .................................................................................................................... .14

IEG Results and Performance Report 2011...... ................................................................................ 14

FUNDING DEVELOPMENTS

IBRD Finances........ ......................................................................................................................... 16

IDA15 Updates........ ......................................................................................................................... 16

IDA16 Replenishment..... ................................................................................................................. 17

Trust Fund Reform........ ................................................................................................................... 18

Trust Fund Portfolio ......................................................................................................................... 18

Update on Reform of Trust Fund Management ................................................................................ 18

Reform Roadmap........ ..................................................................................................................... 19

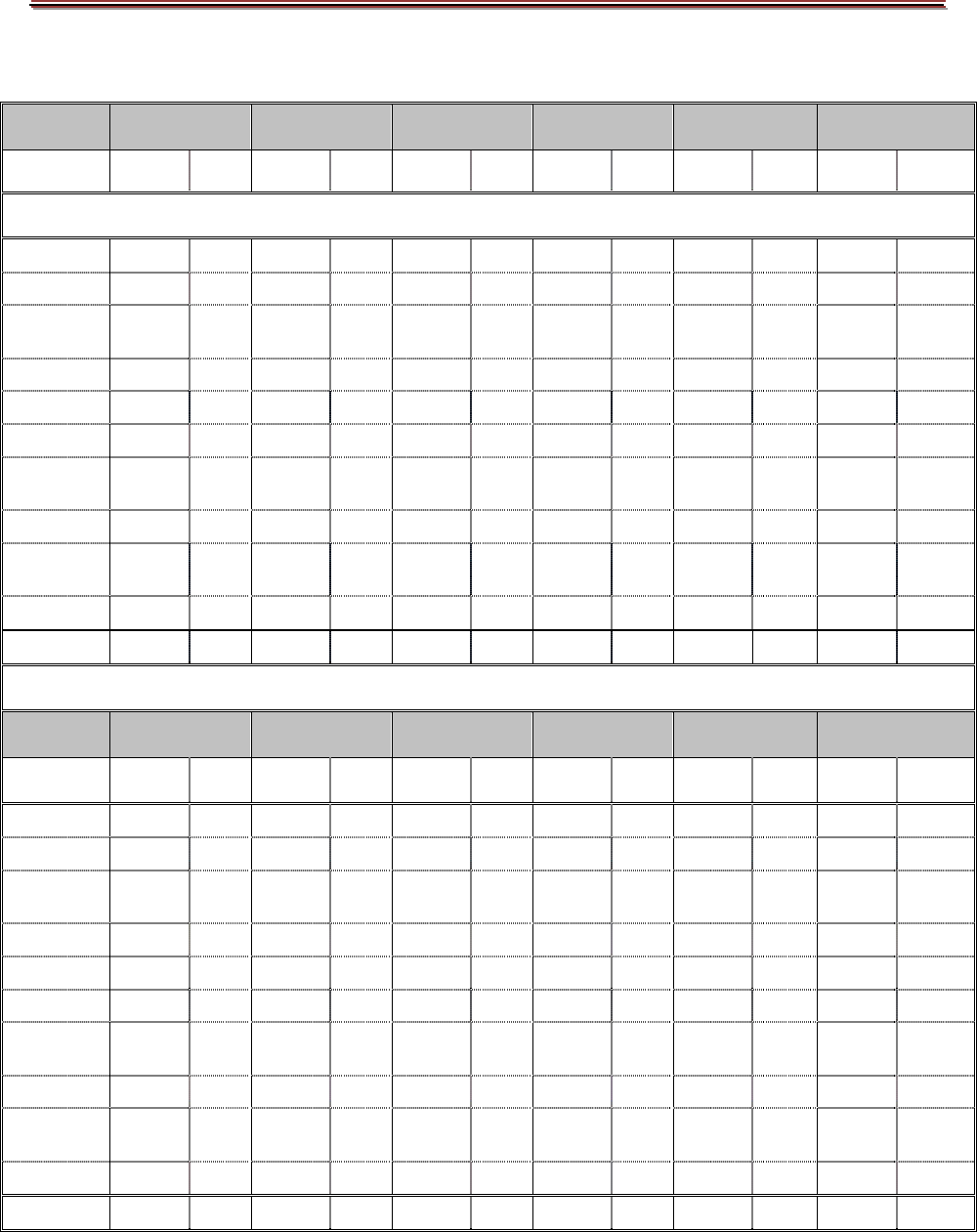

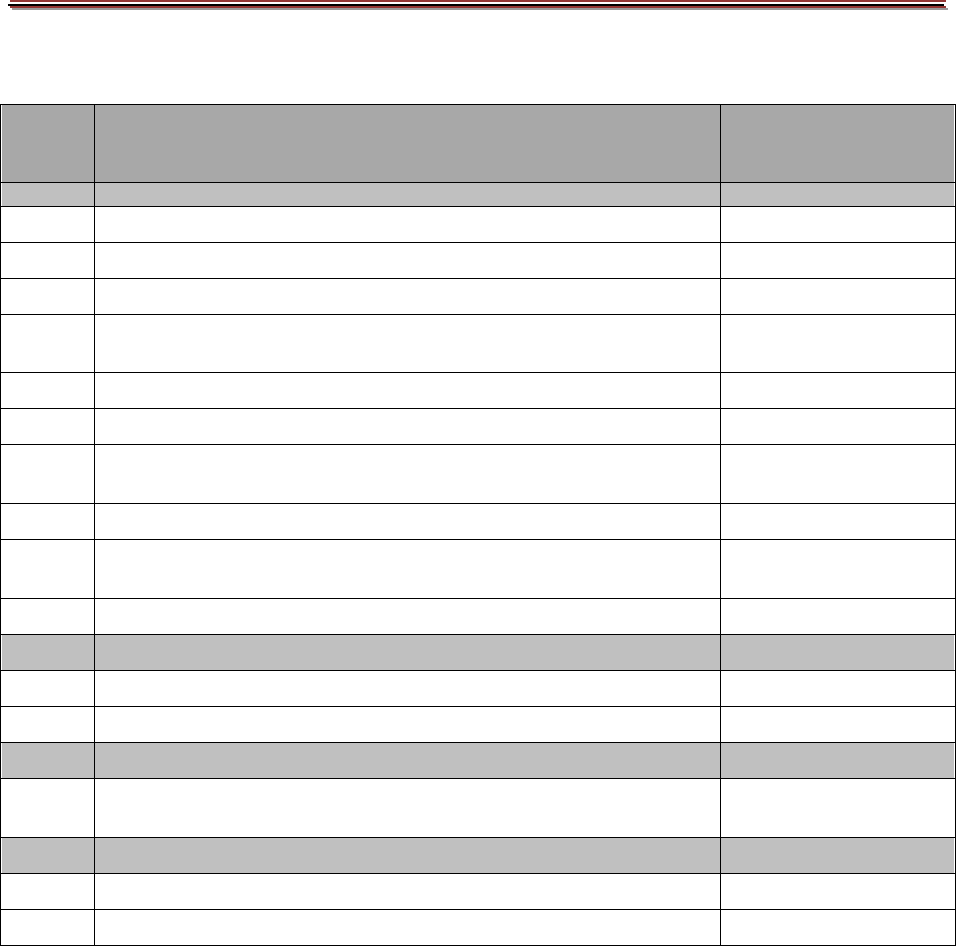

ANNEXES

Annex 1. Constituency Country Developments..... .......................................................................... 20

Annex 2. WBG-Financed Projects to June 30, 2011 ........................................................................ 23

Annex 3. Governors’ Resolutions .................................................................................................... 24

Annex 4. FY11 – Office Work Summary Results... ......................................................................... 25

Annex 5. Consultations with Constituents in FY11..... .................................................................... 26

Annex 6. Visits by Official Country Delegations and NGO’s ......................................................... 27

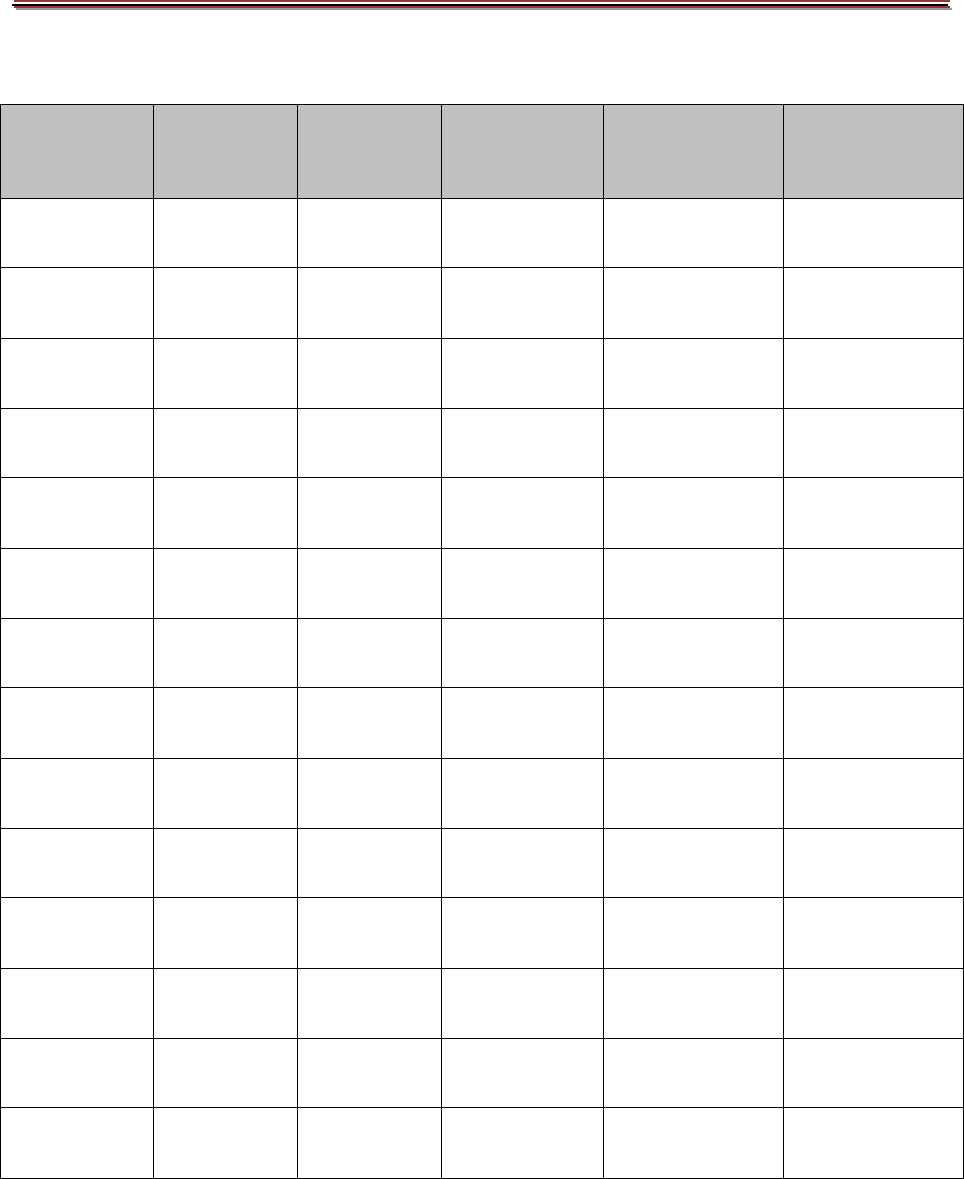

Annex 7. World Bank Constituency Rotational Agreement 2013-2024 .......................................... 28

EXECUTIVE SUMMARY

During the Fiscal Year 2011 (FY11) the constituency office continued work to push for

improvements in the World Bank Group’s (WBG) development effectiveness and overall

operational performance; to represent our members’ interests at the Board and with World Bank

staff; and, to assist our constituency members with their overall relationship with the WBG.

The constituency office experienced high turnover of staff in FY11 from Alternate Executive

Director to Advisors, but remained fully staffed throughout. One of the year’s milestones was the

agreement by constituency Governors to a new agreement covering constituency representation

arrangements (attached as Annex 7), to begin when the existing arrangements expire at the end

of 2013.

Members of the office visited most constituency countries during FY11, supplemented by

consultations by the Executive Director, Dr. Jim Hagan, during the IMF/WB Annual Meetings

and the ADB Annual Meetings. The office has continued its practice of issuing quarterly updates

and ad hoc Constituency Information Notes (CINs) on topics of particular interest.

Issues of Special Interest to our Constituency Office

The constituency office continued its support for the Voice Secondment Program (VSP) for

developing country officials. Unfortunately, due to a diminished funding profile and increased

competition, no constituency country was able to participate in the program this year. The office

is continuing its efforts to seek a more sustainable long-term funding profile for the program, and

hopes that a constituency member will be able to participate in the FY12 program.

The office continued work to raise the profile of Small States Issues and the development

challenges they face at the Board and with World Bank Management. The Bank has undertaken

to develop individual Country Assistance Strategies for the Pacific Island Countries and, in

FY11, developed the first joint IFC and World Bank Country Assistance Strategy for Kiribati.

The office was actively engaged in discussions surrounding the 2011 and 2012 World

Development Reports, on Conflict, Security and Development (2011 WDR), and on Gender

Equality and Development (2012 WDR). This office has emphasized the importance of these

WDRs for the direction and operations for the Bank Group, and has joined other EDs in

encouraging the Bank to fully implement the WDR policy insights within the Bank Group.

Bank Group Strategy and Leadership

The office continued to follow the developments in the World Bank’s strategies for Climate

Change and its implications for constituency member countries.

The World Bank has stepped up its support to the United Nations Framework Convention on

Climate Change (UNFCCC) Secretariat and the UNFCCC itself, and has taken on the role of

Interim Trustee for the new Green Climate Fund (GCF).

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

ii

Within the constituency, climate change is of particular interest to Pacific Island members. This

office was pleased to see the development of the Samoan Strategic Program for Climate Change

Resilience as an important innovation in integrating and co-ordinating efforts to mitigate the

effects of climate change.

Our office has actively supported Korea’s effort to better reflect development issues on the G20

agenda in close collaboration with the WBG. As part of our efforts, we facilitated the successful

hosting of the Korea-WB High Level Development Conference in Busan, Korea in June 2010

which provided the ground work for the development agenda setting for the G20 Seoul Summit.

We also supported various G20 outreach activities to enhance communication with non-G20

countries.

Operational and Strategy Issues

This office has been closely involved in the development of a World Bank Energy Strategy,

which has not been straightforward. At the Committee on Development Effectiveness discussion

of April 11, 2011, there were strong disagreements on a range of issues, including the role of the

World Bank in financing greenfield coal power stations. Management indicated an unwillingness

to proceed to further develop the strategy until there was clearer guidance and consensus at the

Board level on how to proceed. Our office has initiated a series of off-line consultations among

Board members to explore alternative text and identify potential room for a consensus.

The WBG launched its ten-year Education Strategy in April 2011. The strategy focuses on

“learning for all” and investing early, investing smartly, and investing for all. Our office, in

conjunction with other Executive Directors, reemphasized that education - investing in people -

is key to reducing poverty and achieving sustainable growth. We also encouraged Management

to strengthen collaboration with the other development partners in the area of education.

Our office had closely engaged in preparing the World Bank’s Trade Strategy. While we

welcomed the priority areas as relevant to the needs of small states, we emphasized that

improvement of trade corridors should not be restricted only to land corridors and should also

include sea corridors. We cautioned that the Trade Council must not become another

bureaucratic layer of process that could slow down country-driven processes and weaken the

World Bank’s support to countries’ own initiatives and its use of country systems.

The IFC 2013 Strategy continued to be implemented and will enhance the IFC’s development

impact in a financially sustainable way, including through an improved delivery model. This

change process includes responding to an increasing number of local and regional clients;

demand for a greater focus on IDA countries and other frontier markets; moving from a

“transaction-driven” organization to one focused on development impact; and shifting from a

focus on Project Finance to a focus on Corporate Finance products.

In 2011, the WB produced its first Corporate Scorecard and the Independent Evaluation Group

produced its 2011 WBG-wide Results and Performance report. These report on recent

performance of the WBG and are summarized below under Development Effectiveness and

Results.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

1

CONSTITUENCY OFFICE MATTERS

During FY11, the constituency office continued its efforts to push for improvements to the

WBG’s development effectiveness and operational performance; to represent the interests of our

constituency members at the Board and with Bank staff; and, to assist our constituency members

in their overall relationship with the WBG.

Travel

During FY11, most of the constituency countries were visited, and the Executive Director, Dr.

Hagan, had the opportunity to consult with all authorities during the IMF/WBG Annual Meetings

in Washington, DC as well as during the ADB Annual Meetings held in Hanoi, Vietnam. As in

past years, Dr. Hagan, given time constraints and Board commitments in his schedule, asked

Senior Advisors and Advisors to travel on his behalf. This practice continues to be beneficial to

staff as they see firsthand the needs and economic constraints of our developing country

members.

Our office also travelled to other countries to attend various meetings, including IDA 16 in

Belgium and the ADB Annual Meetings in Vietnam. Dr. Hagan joined EDs’ Group Travel

programmes to Morocco, Lebanon, and Israel.

Communications

We continued our efforts to improve communications with our constituency members, especially

our developing country members. We reported electronically on Board matters and posted

regular updates on our office website to facilitate engagement with civil society. We continued to

issue Office Newsletters and Constituency Information Notes (CIN). Produced every quarter, the

Office Newsletter summarizes for government officials the key policy developments at the

World Bank and the use of Bank resources, while CINs supplement this with more detailed

information on topics of particular interest to our member countries.

Meetings with Government, Parliamentary, and Non-Government Delegations

It has been a busy year for hosting visitors from capitals and for meeting with NGOs. Among

those we have met this year were Senator Cormann, Australia’s Shadow Assistant Treasurer;

Australia’s Aid Review delegation; numerous AusAID officials; Oxfam staff from Australia and

America; Bank Information Center; Greenpeace Australia Pacific; Results Australia and many

others. See more detail on country delegations in Annex 6.

New Constituency Member - Tuvalu

In FY11, we welcomed Tuvalu as the newest member of our constituency. Tuvalu has similar

socio-economic issues and cultural traditions to a number of our constituency member countries,

and has close bilateral relations with many. We will endeavor to represent Tuvalu’s interest well

at the Board and in all the work we do with Management.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

2

Office Staffing

Our office was fully staffed during FY11 by 12 staff, including the Executive Director, Alternate

Executive Director, two Senior Advisors, five Advisors and three Administrative Assistants.

The office had many staff changes in FY11, including:

- Mr. Manu Momo, from Papua New Guinea, started as Senior Advisor in August 2010.

He replaced Mr. Rick Houenipwela who had left earlier that year;

- Mr. Sopheap Chan, from Cambodia, filled in a vacant position as Advisor, also in August

2010;

- Dr. Robert Christie, from Australia, finished his term as Advisor and was replaced by Ms.

Beth Delaney, also from Australia, in November 2010;

- Ms. Damba Baasankhuu, from Mongolia, finished her term as Advisor and was replaced

by Mr. Enkhbayar Namjildorj, also from Mongolia, in March 2011;

- Ms. Betty Zinner-Toa, from Vanuatu, finished her term as Advisor and was replaced by

Mr. McKinnie Dentana, from Solomon Islands, in April 2011; and

- Mr. Do-Hyeong Kim, from Korea, Alternate Executive Director, finished his term in late

April 2011 and was replaced by Mr. In-Kang Cho, also from Korea, in early May 2011.

Constituency Representation Rotational Agreement

During the October 2010 Annual Meetings, Executive Director, Dr. Hagan, agreed to develop, in

consultation with our member countries, a new agreement for constituency representation

arrangements for the World Bank’s constituency office up to 2024. The current agreement is

coming to an end in 2013. He had several consultations with capitals, both by correspondence

and in person with some, presenting options for possible rotation arrangements by position and

year. The option unanimously agreed upon earlier this year by the Governors is shown in Annex

7.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

3

POLICY ISSUES OF SPECIAL INTEREST TO OUR CONSTITUENCY

Voice Secondment Program (VSP)

Our office continued its support to the Voice Secondment Program (VSP) for developing country

officials. We informed eligible constituency members about developments in this program and

solicited nominations for the program in financial year 2012.

Funding for the program has been reducing since last year, due to the end of a Trust Fund (PACT

- Africa Partnership and Capacity Building Trust Fund), which had supported the program for

the last five years, and due to reductions in the World Bank Human Resources Administrative

Budget. Our office, through the Executive Director, has initiated and convened a working group

of the Executive Directors to find the Voice Secondment Program more sustainable funding.

The diminished funding resulted in a reduced cohort size for the FY11 program. The number of

participants for the FY11 program was reduced to 12 officials from across the Bank’s developing

country members, down from the usual annual cohort of 25. This resulted in much stiffer

competition and, in the process, no official from the developing member countries of this

constituency was able to participate.

Funding for the FY12 program has not increased and there may well be only 12 participants for

the FY12 program. We have received four nominees from our constituency developing member

countries, from Cambodia, Mongolia, Vanuatu and Papua New Guinea. It is likely that we will

only have one participant from these four for the FY12 program.

Small States

The office continues to advocate on Small States’ issues. We continue to draw Board and

Management’s attention to the development challenges in small states and, in particular, the

small Pacific Island Countries (PICs), most of whom are represented by our constituency office.

We have been actively pushing for the WBG to look at the Pacific from a strategic viewpoint.

The WBG Management is now responding and there has been good progress made, including

expanded IFC engagement in PICs. The IFC is now partnering with the private sector to provide

financial services and business lines to the small businesses in the region.

The World Bank has also started to develop individual Country Assistance Strategies (CASs) for

each of the small PICs. This is a positive development; as such strategies should set out the

WBG’s engagement and dialogue with these countries, and should help to deliver good quality

and timely assistance of the type the countries would most value.

In March 2011, Management developed and presented to the Board the first joint World

Bank/IFC Country Assistance Strategy (CAS) for Kiribati. We will continue to encourage the

Bank to develop individual CASs for the remaining PICs and within a clear, firm timeframe.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

4

Also in FY11, the Bank reclassified the Federated States of Micronesia (FSM) and the Republic

of Marshall Islands (RMI) from IBRD countries to IDA-only borrowers. Both countries will now

have access to IDA resources starting in FY12 as per the framework agreed with donors in the

context of the IDA16 Replenishment. The reclassification was in line with the IDA Eligibility

rules for small island economies.

Our office continues to be very active in the preparation of the Pacific Seminar and the Small

States Forum for the 2011 Annual Meetings of the World Bank.

World Development Report 2011: Conflict, Security, and Development

The office was actively engaged in consultations and discussions surrounding the 2011 World

Development Report (WDR) on Conflict, Security and Development (2011 WDR). The 2011

WDR was launched on April 14, 2011, in the margins of the IMF-World Bank Spring Meetings.

The overall message of the 2011 WDR is that organized violence, which disrupts development,

comes in a number of forms and often occurs in repeated cycles. Strengthening national

institutions and governance to provide security, justice and jobs for citizens is crucial to breaking

these cycles. The process of institution building is iterative, must be locally driven and fitted to

local conditions.

Drawing on the findings of the 2011 WDR, World Bank staff prepared “Operationalizing the

2011 World Development Report Conflict, Security and Development” (DC2011-0003), which

was discussed by Governors during the Development Committee Luncheon. This report focused

on the implications of the findings of the WDR. For the World Bank, the WDR calls for a

paradigm shift in the development community’s work on Fragile and Conflict-affected States

(FCS). It requires the Bank to position fragility, conflict and violence at the core of its

development mandate and to significantly adjust its operating model, while remaining within its

established mandate and focusing on development and poverty reduction.

The office assisted in facilitating subsequent regional launches in Solomon Islands, Australia and

New Zealand during May 2011, for which there was positive local feedback and press coverage.

As a first step in operationalizing the 2011 WDR, the World Bank’s new Global Center for

Conflict, Security, and Development began operations in Nairobi, Kenya. The Global Center

will draw staff from both the operations area and the Africa Region. This represents a change in

World Bank approach and aims to place operations support closer to the country teams for

quicker advice and support.

World Development Report 2012: Gender Equality and Development

The office has also been actively engaged in consultations and discussions surrounding the

forthcoming 2012 WDR on Gender Equality and Development. The Executive Director gathered

the signatures of 18 other Executive Directors and wrote to World Bank Management to

encourage them to use the opportunity of the 2012 WDR to shape the international agenda and to

harness the commitment of leaders with respect to advancing gender equality.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

5

The final draft of the 2012 WDR was presented to the Board on July 12, 2011. Our office was

instrumental in preparing a joint statement with 20 other Executive Directors offices that noted

the contribution of the analysis in the report but sought Management action on improving the

communication of the report’s messages and emphasizing the importance of clear and practical

policy recommendations.

The key message coming out of the 2012 WDR is that gender equality matters for development

outcomes and for development policy making. Gender equality is a core development objective

in its own right. It can enhance productivity and improve other development outcomes, including

the prospects for the next generation and the quality of policies and institutions. Gender equality

matters for policy makers because (i) broad-based economic development closes some but not all

gender disparities, and (ii) bringing a gender perspective to policymaking can make other

policies more effective. Corrective policies are needed that focus on gaps, especially those that

persist even as countries get richer, like access to economic opportunities and societal voice.

The 2012 WDR report is scheduled to be launched at the Annual Meetings in September 2011.

As with the 2011 WDR, World Bank Management has prepared a companion piece looking at

the implications of the WDR for country strategies, lending operations and analytical work

within the Bank. This will be presented to Governors as a background paper to the Development

Committee at the 2011 Annual Meetings.

Global Agriculture and Food Security Program (GAFSP) Update

The Global Agriculture and Food Security Program (GAFSP) is a multilateral mechanism to

assist in the implementation of pledges made by the G8 Summit in July 2009. It was set up in

response to a request from the G20 in Pittsburgh in September 2009. The objective is to address

the underfunding of the country and regional agriculture and food security strategic investment

plans that are being developed by countries in consultation with donors and other stakeholders.

This will make aid contributions toward the achievement of the Millennium Development Goal 1

to cut hunger and poverty by half by 2015 more predictable.

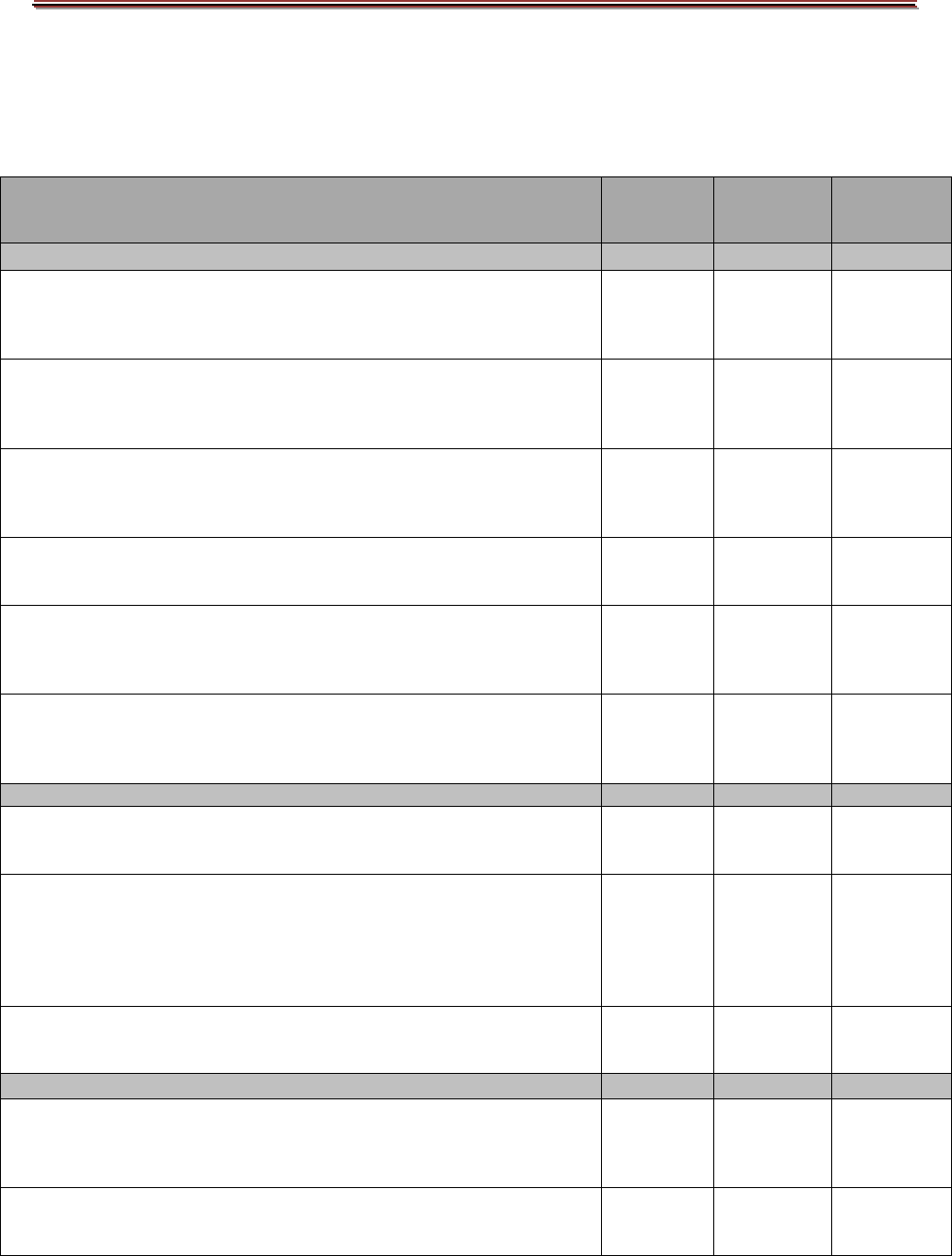

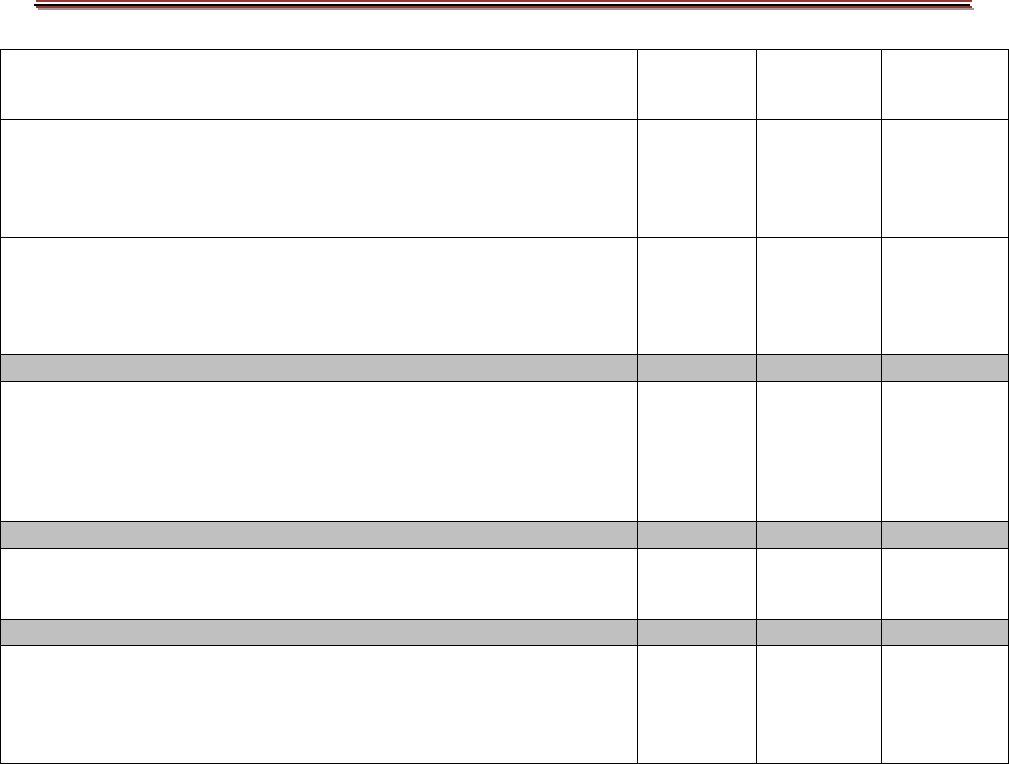

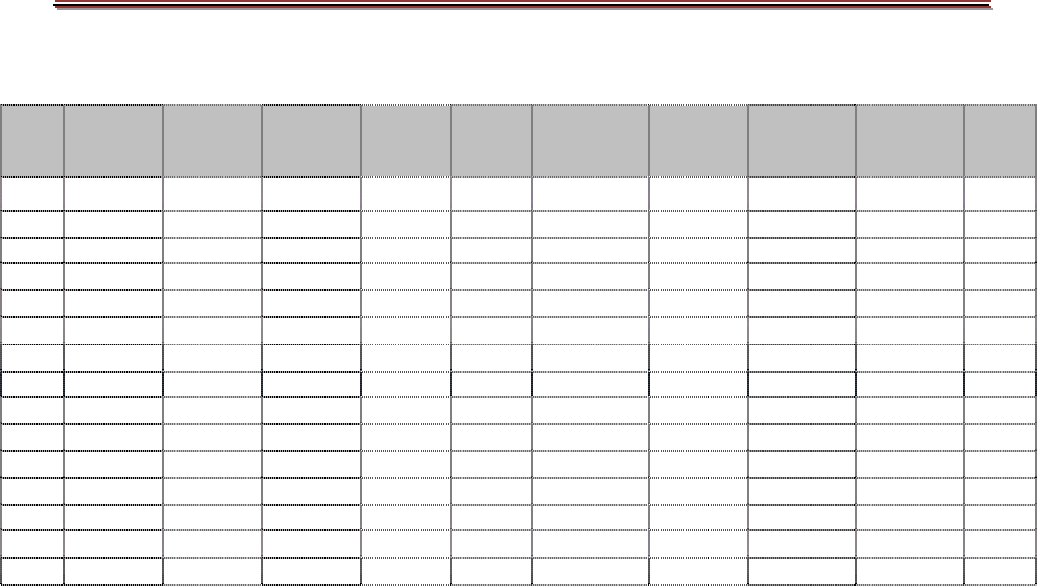

The total amount pledged by donors to the GAFSP, equivalent to $925 million, is allocated

between public and private sector windows. The resources received from the donors as of June

15, 2011 are equivalent to $521 million for the public sector window, representing 56 percent of

the total pledge. The following table presents contributions to the GAFSP Trust Fund as of April

30, 2011.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

6

Donors’ official Pledges to GAFSP fund

(as of April 30, 2011)

In millions

Public

Sector

Private Sector

Donor

Currency

Window

Window

Total

USD equal

Australia

AUD

50.0

-

50.0

46.3

Canada

CAD

180.0

50.0

230.0

229.8

Gates

USD

30.0

-

30.0

30.0

Ireland

EUR

0.5

-

0.5

0.7

Korea

USD

50.0

-

50.0

50.0

Spain

EUR

70.0

-

70.0

93.4

United States

USD

450.0

25.0

475.0

475.0

Total

925.2

The GAFSP Steering Committee met in Washington, DC on June 7-8, 2011, and awarded a total

of $160 million in direct project funding to four program eligible countries including: Cambodia

($39.1 million), Liberia ($46.5 million), Nepal ($46.5 million), and Tajikistan ($27.9 million).

These projects will be implemented within the next few years.

The next call for proposals is expected in the Fall 2011, pending availability of funding. Details

of this will be posted on the website as soon as timing is determined by the Steering Committee.

From our constituency office area, Mongolia was awarded $12.5 million in 2010, and Cambodia

was awarded project financed $39.1 million this year.

Liberia

GAFSP funds will enhance the income of smallholder farmers, particularly women and youth,

through irrigable land expansion, land husbandry improvement, and improvement of market

access. It will also build capacity for adaptive agricultural research and improve agricultural

advisory services.

Nepal

GAFSP funds will enhance household food security in the poorest and most food insecure

regions through increased agricultural productivity, household incomes and awareness about

health and nutrition in the mid-western and far-western development regions.

Tajikistan

GAFSP funds will increase food security through increased crop production resulting from

improved sustainable irrigation and drainage infrastructure and improved water resource

management policies.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

7

Mongolia

The $12.5 million fund will reduce rural poverty and household food insecurity on a sustainable

basis in livestock-based farming systems. There are two components:

• Linking Farmers to Markets: GAFSP financing will increase access to domestic and

international markets on a sustainable basis. The outcomes of the component would be:

(i) market channels for livestock commodities further identified and accessed; (ii)

incomes of farmers increased; (iii) capacity of cooperatives increased to operate as small

agri-business units.

• Raising Livestock Productivity and Quality: GAFSP financing will improve livestock

productivity and quality in order to enhance access to domestic and regional markets, to

protect the environment and to raise the incomes of herders.

Cambodia

The $39.1 million in GAFSP funds will be for agricultural productivity growth and diversity in

selected areas that are deemed to be highly food insecure and economically depressed.

GAFSP funding for Cambodia will support the Royal Government of Cambodia’s Strategy for

Agriculture and Water (SAW), the overall framework of agricultural and water resource

management. The SAW is designed to improve food security and economic growth by enhancing

agricultural productivity and diversification and by improving water resource development and

management. Indirectly, it will create opportunities for further diversification and intensification

of production within various farming systems. The components are:

• Agricultural Productivity: GAFSP support will aim to help local farmers achieve higher

crop yields by providing relevant advisory support, improving resource management

strategies, and enhancing the quality of seeds, use of fertilizers and access to machinery

and appropriate fertilizers. GAFSP funding will allow for the adoption of proven

technologies, and for training that will allow farmers to participate in food processing,

marketing, and trading activities to improve their incomes.

• Agricultural Diversity: Currently 80 percent of the population in Cambodia has a diet

high in carbohydrates and low in both fats and proteins. Diversification of crops will

allow the country to decrease its dependence on imported fruits and vegetables. It will

also expand its high-value crops for export, such as high quality rice and fine herbs and

spices.

GAFSP funding for Cambodia will increase earnings and incomes for the rural poor, which will

in turn allow affected households to access other foods, goods, and services that will improve

nutritional status and general welfare.

For more information on GAFSP, see: www.gafspfund.org

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

8

Individual Executive Directors’ Budget

Executive Directors’ Budgets face increasing pressure due to increased demand combined with

the flat real budget being applied to WBG operational costs. The addition of the 25th Executive

Director to the Board in mid-FY11 has exacerbated these pressures. The overall Budget has been

supplemented for FY11, and some reductions are being applied in 2012. It is expected that a

more substantial cut to the overall budget (around four percent) will be discussed in 2011 and

applied in FY2013. This is likely to include re-assessing the staffing level and composition of

EDs’ offices, as well as their travel budgets.

Subject to protecting our ability effectively to service our constituency members, there are

powerful arguments to constrain the significant overhead represented by the costs of

constituency offices as this funding is no longer available to assist member countries.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

9

BANK GROUP STRATEGY AND LEADERSHIP

Climate Change

The Bank has stepped up its support to the United Nations Framework Convention on Climate

Change (UNFCCC) Secretariat and the UNFCCC itself. The UN climate talks in Cancun,

Mexico, in December 2010 were the latest attempt to make progress towards a new global deal

on tackling climate change after last year's meeting in Copenhagen failed.

The “Cancun Agreements” reached in Mexico included an invitation for the World Bank to

assume the role of Interim Trustee for the new Green Climate Fund (GCF) that governments

decided to establish in the coming months/years.

World Bank Management believes that it will take 2-3 years for the GCF to be established and

become fully operational. The World Bank noted that important issues need to be resolved

including the governance structure of the GCF, defining the funding framework and

mechanisms. In preparing itself going forward, the World Bank has started to engage in

preparatory work on key principles and issues to be considered in the design of the GCF, and has

offered to second a senior staff person to the technical support unit of a transitional committee of

the GCF. The Bank has also provided extensive submissions on substantive issues related to the

establishment of an Adaptation Committee, as well as work programs related to carbon market

reform and mitigation action by developing countries.

At the constituency level and especially for more vulnerable countries like the Pacific Island

countries, Climate Change is an important issue. The strategy of the World Bank in the Pacific

is to rationalize donor support and reduce the burden on client countries’ limited capacity by

addressing the Climate Change Adaptation Strategy in an integrated manner. We are pleased to

report that the Samoan Strategic Program for Climate Change Resilience was the first of its kind

in the region. Jointly prepared with ADB, the program aimed to mitigate the effects of climate

change on Samoa, which include floods, damage resulting from strong winds and high seas,

coral bleaching and droughts.

Medium-Term Strategic and Financial Framework

Continued volatility in the external environment reinforced the pressure on the World Bank to

maintain flexibility and protect its ability to respond to unforeseen events at multiple levels over

many years. Combined with the reality of a tight operating environment, the World Bank

continued its focus on priorities under its modernization agenda endorsed at the 2010 Spring

Meetings of the Governors of the WBG. This agenda was further refocused by the Board of

Executive Directors at the review of the World Bank’s Medium-Term Strategy and Finance

(MTSF) paper in May 2011.

The MTSF 2011 paper reinforced the World Bank’s commitment to: (i) further work program

alignment with the Bank’s post-crisis direction, which provide a strategic framework that ensures

operational focus on institutional priorities and critical client needs such as food security, crisis

preparedness, and disaster risk management; and (ii) targeted implementation of reform efforts to

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

10

modernize the World Bank, making the institution more accountable and effective in achieving

results through improved management of product mix, knowledge management, decentralization,

and support systems and processes.

In terms of financial planning going forward, the World Bank continued to align its strategic

direction with its financial framework. With the Board of Executive Directors’ guidance in its

July 2011 deliberation of the World Bank Budget for FY12, the Bank further committed to focus

on budget flexibility and increasing operational and organizational effectiveness. At the

meeting, the Executive Directors also highlighted that the quality of World Bank operations and

services to clients must remain a high priority. The Executive Directors reinforced their

commitment to work with management to ensure that the Bank has systems to monitor the

quality of operations at the design stage and during implementation.

G20 Update: Seoul Outcome and Next Steps

Our office has actively supported Korea’s effort to better reflect development issues in the G20

agenda, in close collaboration with the WBG. As part of our efforts, we facilitated the successful

hosting of the Korea-WB High Level Development Conference in Busan, Korea in June 2010

which provided the ground work for the development agenda setting for the G20 Seoul Summit.

We also supported various G20 outreach activities to enhance communication with non-G20

countries.

During the last G20 Seoul Summit in November, the G20 leaders endorsed the Seoul

Development Consensus on Shared Growth and its Multi-Year Action Plan covering actions in

nine pillars: infrastructure, human resource development, trade, private investment and job

creation, food security, growth with resilience, domestic resource mobilization, knowledge

sharing, and financial inclusion. France indicated its strong commitment to take forward the

work on development under its presidency. The Global Partnership for Financial Inclusion was

launched in December 2010 and the high-level panel on infrastructure investment has been

established. Our office will continue to encourage the World Bank to strongly engage in the G20

discussion on development issues through the Mutual Assessment Process (MAP) and the

Development Working Group (DWG) that will oversee follow-up to the Seoul Development

Consensus and Action Plan.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

11

OPERATIONAL AND STRATEGY ISSUES

Education Strategy

In April 2011, the WBG launched its Education Strategy for the next ten years. The strategy

focuses on “learning for all” and investing early, investing smartly, and investing for all. The

new strategy will support reforms at the country level that strengthen education systems’

capacity to achieve learning goals through operational, financial and technical assistance. At the

regional and global level, the World Bank will help develop high-quality knowledge products

based on education reform. To inform and guide policies that strengthen education systems and

achieve results, the World Bank will invest more in impact evaluations, learning assessments,

and new initiatives such as the development of the System Assessment and Benchmarking for

Education Results (SABER) program. SABER will provide detailed analysis of countries’

capacities across the education system from early childhood development programs and teacher

policies to tertiary education and skills development to help them use evidence to inform policy-

making.

Our office, in conjunction with other Executive Directors, reemphasized that investing in people

through education is key to reducing poverty and achieving sustainable growth. We encouraged

Management to strengthen collaboration with other development partners in the education area.

As for the SABER, we cautioned that the World Bank should focus more on providing better

policy advice based on the assessment, rather than simply rating or ranking the countries’

education system in the implementation phase.

Trade Strategy

In order to improve the inclusiveness of trade, and to promote its impacts on reducing poverty

and inequality, in June 2011 the WBG prepared its first Trade Strategy (Leveraging Trade for

Development and Inclusive Growth: The World Bank Group Trade Strategy) to guide its work

over the next decade.

The trade strategy focuses on four pillars: (i) Trade competitiveness and diversification to

support countries in developing policy environments conducive to nurturing private sector

development, job creation and sustainable poverty reduction; (ii) Trade facilitation, transport

logistics and trade finance to reduce the costs of moving goods internationally in terms of time,

money and reliability; (iii) Support for market access and international trade cooperation to

create larger integrated markets for goods and services; and (iv) Managing external shocks and

promoting greater inclusion to make globalization more beneficial to poor households and

lagging regions.

The strategy proposes four actions: (i) the development of multi-year trade programs by each of

the Bank’s regional groupings; (ii) establishing several new “communities of practice” to

facilitate the transfer of knowledge and experience (iii) creating an internal WBG-wide Trade

Council to coordinate WBG trade support, and (iv) establishing more regular interactions with

key external partner organizations and trade practitioners. A new World Bank-wide trust fund

will be established to support the strategy.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

12

Our office has closely engaged in preparing the World Bank’s trade strategy. While we

welcomed the priority areas ase relevant to the needs of small states, we emphasized that

improvements of trade corridors should not be restricted only to land corridors but rather also

include sea corridors. We cautioned that the Trade Council must not become another

bureaucratic layer of process that could slow down country-driven process and weaken the

World Bank’s use of country systems and support for countries’ own initiatives.

IFC 2013 Implementation Update

The IFC 2013 was conceived to enhance the IFC’s ability to realize greater development impact

and improved client service in a financially sustainable way, including through an improved

delivery model, taking advantage of the IFC’s decentralized, global nature.

IFC 2013 aims to help realize IFC’s organizational principles, which include being client-

centered and decentralized, with the objectives of: (i) clarifying accountabilities, (ii) improving

efficiency, (iii) investing in talent management, and (iv) enhancing knowledge management.

IFC 2013 Change Initiative

IFC 2013 was undertaken to better enable the IFC to deliver on its vision and strategic

objectives, and is therefore an integral part of its long term strategy. IFC’s Vision remains the

same: “That people should have the opportunity to escape poverty and to improve their lives.”

While this vision is clear, to make it a reality the IFC needs to adapt and respond to an ever-

changing environment. In this respect, during the past decade, four important forces have shaped

the IFC’s business:

i. An ever-increasing number of local and regional clients, which have changed the

composition of IFC’s client portfolio in a significant manner. The latest numbers indicate

that the IFC has over 1,650 clients, located in almost 150 countries. In FY10, new

commitments took place in 103 countries, against 66 countries in FY06.

ii. A stronger demand from IFC stakeholders to focus more in IDA countries and other

frontier markets, and to provide more and better coverage of smaller and poorer

countries, expanding its development impact.

iii. Moving from a “transaction-driven” institution to an institution that is primarily and

fundamentally focused on developmental impact and that, therefore, needs to better

understand and act upon the different key components of development as they impact

each region and country.

iv. Finally, moving from a concentration on Project Finance type of products to more

Corporate Finance products, requiring closer understanding of the local companies’ needs

and operating environments.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

13

In order to respond to these forces, IFC’s management initiated a process to decentralize its

operations. This allowed it to increase its impact and grow substantially its volume and number

of operations, covering a much larger number of countries.

IFC’s growth and extended reach in frontier markets, in particular IDA countries, is a direct

result of such decentralization efforts. The increased diversification has also contributed to IFC’s

ability to continue being financially sustainable in recent turbulent times.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

14

DEVELOPMENT EFFECTIVENESS AND RESULTS

A Focus on Results

Ensuring the WBG is delivering results through its support for client countries is a key objective

for the office. This agenda has been raised regularly in Board and Committee meetings.

IEG Results and Performance Report 2011

The Independent Evaluation Group (IEG) has produced its 2011 WBG-wide Results and

Performance report drawing on recent IEG evaluation evidence and combining it at the WBG-

wide level. It addresses: (i) the recent progress made by developing countries towards core

development goals (economic opportunities, human development, socio-economic and

environmental risks, and governance and public sector effectiveness); (ii) the effectiveness of the

WBG in supporting this progress, including the mitigation of major global events (e.g. financial

crisis); and (iii) institutional effectiveness.

In the report, IEG found that substantial progress was made in reducing poverty in the early

2000s, accompanied by strong economic growth and improvements in key health and education

indicators. Global economic crises and natural disasters contributed to development setbacks

since then and major challenges remain to reduce poverty further.

IEG found that interventions aimed to help expand economic opportunities (85 percent of WBG

operations over the evaluation period 2008-10) had been effective. The WBG helped improve

economic policy frameworks; however, challenges remain in advancing complex, politically

sensitive reforms and in ensuring the sustainability of public infrastructure. There were uneven

results in education and health and shortfalls in achieving key public sector reform objectives

(such as civil service reform and reducing corruption). The WBG’s response to recent disasters

and global economic crisis had been successful – but the IEG report points to a need to focus on

preparedness going forward.

Outcome ratings of World Bank-supported projects were similar to those evaluated in the 2010

report although there was a drop in Bank performance ratings in the Middle East and North

Africa region. In contrast, IEG reports improvements in IFC-supported project outcomes in this

region. MIGA-supported projects were particularly successful in the financial sector where its

guarantees played a small but useful role in supporting economic recovery.

The IEG report states that all three WBG institutions are strengthening monitoring and reporting

of results. Challenges include: (i) ensuring aggregate indicators are not overly influenced by

larger countries and projects, (ii) ensuring the diverse needs of clients are reflected, (iii) ensuring

the costs of getting results are adequately reflected, and (iv) ensuring high-quality data gathering

and reporting are achieved.

The World Bank is now finalizing its first Corporate Scorecard and Results Annual Report for

2011. Next steps in taking forward the results agenda at the World Bank include the

development of an interactive web-based dashboard to provide easy access to information on

results.

2011 ANNUAL REPORT FOR THE YEAR ENDING JUNE 30, 2011

_

_

_

_

_

_

_

_

_

_