Financial Conduct Authority

Mortgage lenders’ arrears

management and forbearance

February 2014

Thematic Review

TR14/3

Financial Conduct Authority 1February 2014

TR14/3Mortgage lenders’ arrears management and forbearance

Contents

1. Executive summary 3

2. Our findings 6

3. Economic context 15

Financial Conduct Authority 3

TR14/3

February 2014

Mortgage lender

s’ arrears management and forbearance

1.

Executive summary

Overview

This report summarises the key findings of our thematic review of mortgage lenders’ arrears

management and forbearance.

It considers whether firms have improved policies and practices since the Financial Services

Authority (FSA), our predecessor organisation, last reviewed this.

1

It summarises areas where

firms can strengthen their practices so they are well placed to consistently treat customers in

financial difficulty fairly.

We found that:

• Arrears management in rms has improved since the last review.

• However, mortgage lenders and administrators need to place greater emphasis on delivering

consistently fair outcomes for customers based on their individual circumstances.

We want firms to take steps to identify risks to borrowers posed by changes in the macro-

economic environment and take proactive steps to reduce the impact on the most vulnerable.

Arrearsmanagementinrmshasimprovedsinceourlastreview

Firms have addressed a number of the specific issues that we raised, improved policies and

practices, and strengthened their control environments.

As a result, firms now:

• place greater emphasis on the need to treat customers in nancial difculty fairly rather

than focusing primarily on their own interests

• offer a wider range of forbearance options, and

• take more time to engage with customers and place a greater focus on borrower affordability

1 FSA reviews of ‘Mortgage Arrears and Repossessions Handling’ 2008 and 2009:

www.fsa.gov.uk/Pages/Library/Other_publications/Miscellaneous/2009/mortgage_arrears_1/index.shtml

4 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

Mortgage lenders and administrators could do more to produce consistently good

outcomes for customers

We found:

• cultures which focus on treating customers fairly and delivering good customer outcomes

are not always fully embedded at rms

• rms did not always adopt proactive and forward-looking strategies to identify and

effectively engage borrowers in nancial difculty

• collections agents often followed overly process-driven ‘one size ts all’ frameworks which

failed to allow for sufciently exible, judgement-led solutions that consider borrowers’

individual needs and circumstances, including specic customer vulnerabilities

• front-line staff sometimes lacked the experience, knowledge and skill to make informed

judgements and decisions in customers’ best interests, reecting their individual nancial

and personal circumstances

• rms’ governance arrangements are not always sufciently focused on customer outcomes,

and

• rigid systems and processes, due in part to lack of investment, sometimes prevented staff

from delivering good customer outcomes and made it difcult for customers to engage

Actions for rms

We are concerned about the risks to borrowers from potential interest rate rises.

We want firms to build on the progress made to date by investing in their systems and people

to:

• better support and empower front-line staff to make appropriate decisions at all stages of

the arrears cycle, and

• provide greater exibility to support fair treatment of individual customers, based on their

specic personal and nancial circumstances

We also want firms to take proactive steps to identify borrowers who could be susceptible to

potential interest rate rises and have strategies to treat these customers fairly.

We are working with the industry to help them to improve their arrears-handling

practices and taking rm-specic action where appropriate

We are working with firms and industry bodies to explain our concerns and help them strengthen

their arrears management practices. We will take action where we observe customer detriment.

We have asked the firms that participated in our review to make specific improvements. Some

firms were making positive changes to their approach at the time of our review and others are

already acting on our findings.

Financial Conduct Authority 5

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

We recognise that this is a challenging area for the industry and want to work with firms to

get this right.

Key ndings

Chapter 2 provides further details of our findings, including examples of practice within firms.

Embedding a customer-orientated culture in arrears management is key to achieving good

outcomes for borrowers.

Identifying borrowers experiencing financial stress at an early stage, engaging appropriately

with them and tailoring solutions to their individual personal and financial circumstances

(including providing timely debt advice) is likely to result in better outcomes.

Factors that are more likely to result in poor customer outcomes include:

• lack of skill, knowledge and experience in collections agents

• governance and oversight focused on process failings rather than customer outcomes

• weaknesses in the oversight of outsourced activities

• inappropriate incentivisation of collections agents

• an overly process driven approach which fails to take account of individual borrowers’

nancial and personal circumstances

• inappropriate application of fees and charges

Economic context

Chapter 3 focuses on the risk posed by over-indebtedness and the impact of potential interest

rate rises on borrowers.

Mortgage Market Review

Our Mortgage Market Review comes into force on 26 April 2014 and will strengthen our

existing arrears and repossessions regime. Our rules are also being extended to include ‘payment

shortfalls’ which will protect borrowers in financial difficulty at an earlier stage.

2

Who will be interested in this report?

Our findings will primarily be of interest to mortgage lenders and administrators. This report

does not constitute guidance but provides a factual summary of our observations.

2 Further information on the FCA’s Mortgage Market Review can be found here: www.fca.org.uk/firms/firm-types/mortgage-brokers-

and-home-finance-lenders/mortgage-market-review

6 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

2.

Our findings

This chapter provides further detail that explains how firms’ cultures, strategies, arrears

management infrastructure, assurance frameworks and staff capability can affect customer

outcomes. It includes examples of practices seen to illustrate our findings.

Embedding a customer-oriented culture in arrears management is key to achieving

good outcomes for customers

We expect senior management in firms to promote cultures in arrears management functions

which focus on delivering outcomes aligned with the best interests of customers.

Management need to provide leadership and direction to create an environment that enables

capable and competent collections agents to make informed judgements, and take decisions

that reflect the specific personal and financial circumstances of individual borrowers.

In our review we found:

• Some rms’ senior management and front-line staff could not demonstrate they understood

the risks to customer outcomes that can arise from poor arrears management, and

• Collections frameworks which placed insufcient focus on the customer experience because:

–

process-driven approaches allowed little exibility for collections agents to apply

judgement or tailor actions to individual customer circumstances

–

rms focused on mitigating regulatory risk rather than on delivering good outcomes for

customers, and

–

assurance functions did not assess the suitability of decisions or quality of outcomes for

individual customers

Proactively and effectively engaging borrowers at an early stage is likely to result in

better outcomes

We expect firms to have clear strategies for engaging with customers and proactively managing

them through the full arrears cycle (from pre-arrears to post repossession). Customers and firms

benefitted from better outcomes where the collections and litigation functions were seamlessly

connected and the consequences of actions were transparent to customers, with ‘no surprises’.

This also promoted better customer engagement.

Financial Conduct Authority 7

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

Some firms proactively reviewed their customer information to identify customers who were

particularly susceptible to changes in economic conditions. These firms were taking action to

engage their customers and provide support before they faced difficulties paying their mortgages.

The role of money advice

Over-indebtedness is a significant driver of arrears. Many lenders encouraged customers to

contact sources of free, independent money advice. Customers were often actively encouraged

to examine the possibility of making insurance and/or state benefit claims.

Third-party agencies can help customers who are experiencing financial difficulties by providing

debt and benefits advice, support and information. This is particularly important where lenders

are reluctant to discuss wider debt issues with borrowers.

The earlier borrowers receive advice about their debts, the more likely they will be to agree

affordable and sustainable arrangements to pay.

3 This data was not used to facilitate cross-selling or targeting of additional products or services which benefitted the firm but were

not in the best interests of the customer.

Pre-arrears strategies which identied early nancial stress

One lender had made changes in its processes to identify financial stress in performing

borrowers. The firm also developed an impairment information and performance

tracking system to proactively segment their pre-arrears population. Scenario testing

was undertaken to assess the impact that stressed conditions would have on those

groups.

Another firm was actively developing a proactive contact strategy which used the

outputs of an analytics model. The firm contacted borrowers if there was a high risk

the loan would move from performing to being one or more payments in arrears in a

defined period.

Both strategies allowed these firms to detect and act upon ‘early warning signs’ such

as borrowers consolidating debt or failing to meet all of their financial commitments.

This allowed them to develop effective early engagement strategies and offer proactive

solutions or money advice which increased the chance of better outcomes for both

customers and the firm.

3

8 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

Capability in front-line staff is key to achieving good customer outcomes

Firms that demonstrate good outcomes typically focus on building capability in collections

agents so that they can have high quality conversations with borrowers at an early stage.

Agents need to be able to deploy a full range of arrears management and forbearance solutions,

taking account of the personal and financial circumstances of individual borrowers.

Our review highlighted that most collections agents wanted to ‘do the right thing’ but that

some lacked the knowledge, skill and experience to deal with more complex cases.

These issues were compounded at some firms which had introduced overly process-focused

‘one size fits all’ approaches that failed to empower agents to tailor solutions to individual

customer circumstances.

We found that some collections agents did not always:

• accurately identify the root cause of borrowers’ inability to pay

• effectively probe and consider all factors which were relevant to individual borrowers’

circumstances and their ability to repay

• undertake robust assessments of borrowers’ income and expenditure to establish their

ability to make mortgage payments

• consider the full range of forbearance options in the context of individual borrowers’

circumstances or

• make well-informed decisions when assessing or establishing the suitability and sustainability

of forbearance options, including arrangements to pay

Firms that made it easy for customers to obtain early money advice saw

better outcomes

One lender had piloted a ‘hot key’ system which allowed agents to transfer borrowers

directly to a third-party debt advice agency. The advice was independent and free of

charge to the borrower.

As a result of these referrals, some borrowers prioritised their essential outgoings

against non-essential expenditure. The lender experienced up to a 50% increase in

payments received, resulting in reduced levels of arrears and improved outcomes for

both borrowers and the firm.

Financial Conduct Authority 9

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

Customers with circumstances which require particular care

Firms need to engage sensitively with borrowers who have specific needs or circumstances

which are likely to limit their ability to engage effectively, for example, customers dealing with

bereavement or terminal illness, or those with physical and mental health issues (this is not an

exhaustive list).

These circumstances were not consistently identified or appropriately probed by front-line staff

in some firms, even when they were explicitly referred to by borrowers. Referrals to specialist

teams were also missed or made late in the process.

This resulted in firms failing to treat some customers sensitively and failing to provide the

benefit of short term leniency set out in their policies.

Front-line staff don’t always feel empowered to make judgements

One lender used a matrix which set out a range of arrangements to pay which were

acceptable to the lender at different stages of the arrears cycle.

This allowed borrowers to negotiate very low-cost short-term arrangements to pay in

early months (which were significantly lower than the contractual monthly payment).

In later months the firm would insist on arrangements to pay equal to, or in excess of,

the regular monthly commitment unless limited exceptions applied.

Some staff did not validate or challenge affordability for borrowers in early arrears.

They agreed very low payment arrangements which did not necessarily reflect a

borrower’s ability to pay. The matrix also led staff to decline offers to pay for customers

in more serious arrears because they did not meet the minimum criteria, even though

proposals were informed by detailed affordability assessments undertaken by field

agents and debt advisers.

Borrowers making very low initial arrangements to pay risked seeing their arrears

escalate quickly and experienced sudden payment shocks which were not clear to

them from early discussions.

Although this policy was intended to control risks and provided guidance for exceptions

it did not promote or enable solutions focused on borrowers’ individual personal and

financial circumstances. Staff reflected that they followed the process and did not feel

empowered or capable of making judgements to deliver effective and timely solutions

tailored to the facts in individual cases.

10 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

The benets of governance and oversight focused on customer outcomes

Senior management rely on front-line quality assurance and control functions to provide them

with assurance that the firm is treating customers fairly. Some firms’ quality assurance focused

on reviewing compliance with only limited parts of the arrears process. For example, firms

listened to calls in isolation or tested compliance with individual processes.

These firms did not have a holistic end-to-end view of the customer experience and were

unable to assess the suitability of decisions and quality of outcomes for individual borrowers.

Quality assurance that is not focused on customer outcomes

One firm failed to take account of borrowers’ individual personal and financial

circumstances when assessing the quality of judgements made. The firm failed to

assess the fairness of customer outcomes such as the suitability of arrangements to

pay, and the appropriateness of a decision to instigate litigation proceedings.

Another firm’s quality assurance team identified issues in the early stages of the arrears

process but considered these ‘out of scope’ and took no steps to provide feedback to

collections agents or remediate the issues noted.

These firms failed to identify weaknesses in the quality and fairness of judgements made

by collections agents, or the root causes of poor decisions. Supporting management

information also gave management false assurance of the overall customer experience.

Senior management were not aware of poor customer experiences and there was no

opportunity for staff to learn from mistakes.

Some firms appear to have concentrated on strengthening control environments rather than

focusing on front-line activities. Others have introduced structured frameworks to promote

consistency of approach but failed to identify where this could inadvertently drive poor

outcomes.

Firms need to remain alert to the possibility of unintended consequences arising from their

policies and arrears management practices to ensure they treat all customers fairly.

Impact of unintended consequences

Collections agents at one firm repeatedly asked customers to provide information

which was already known to the firm, and in some cases, which had already been

provided earlier the same day. This was because the firm’s quality assurance placed

inappropriate focus on mandatory requirements which required staff to verbally

request specific pieces of information on each call. As a result, customers became

disengaged and staff spent less time focused on delivering good customer outcomes.

Financial Conduct Authority 11

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

Managing outsourced providers effectively reduces risks of poor customer outcomes

Where a firm outsources any part of the arrears-handling process it remains responsible for

how that work is carried out.

Although standards in outsourced providers have improved since the FSA’s last review,

we identified weaknesses in some firms’ oversight of outsourced arrears management,

administration, litigation and recoveries.

Some firms demonstrated better oversight of outsourced activities.

Lack of investment in back-ofce infrastructure: inexible processes and systems

We identified fewer issues in processes and policies adopted by firms compared to the FSA’s

last review. Overall, staff had more flexible mandates and were typically able to spend more

time discussing a customer’s circumstances and agreeing solutions. However, we observed that

lack of investment in infrastructure made it difficult for staff to carry out their jobs or made it

difficult for customers to make arrangements that suited their circumstances.

Inadequate monitoring and oversight of outsourced providers

One firm relied extensively on service-level agreements and process monitoring to

provide assurance. This resulted in a focus on compliance with stand-alone elements

of the process and promoted a ‘tick box’ mentality amongst collections agents. The

firm did not have sufficient access to the outsourced provider’s systems or customer

information to support risk-based sampling. The firm was not in a strong position to

assess and monitor borrowers’ experiences and was unable to demonstrate effective

oversight or control of the risks inherent in an outsourced model.

A different firm outsourced litigation, recoveries and field agent visits to third party

firms and identified regulatory breaches and deficiencies in service, e.g. failing to issue

regulatory communications on time and failing to correctly identify complaints. Issues

were dealt with on a piecemeal basis and no root cause analysis was undertaken. This

meant that poor practices recurred and were not tackled effectively by the firm.

Managing outsourcing risks effectively

One firm applied a full QA and monitoring regime to the outsourced provider, mirroring

the standards which were applied to in-house activity. The firm had full access to

all customer and case material, allowing effective oversight and identification of risk.

Outsourcing contracts also included clawback provisions which were triggered if QA

thresholds were not met.

12 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

We found that some firms:

• were unable to switch direct debit payment dates to suit borrowers’ circumstances, for

example to facilitate prioritising of secured versus unsecured payments or to reect the

timing of salary payments

• made errors in manual ‘workarounds’ resulting in incorrect information being recorded on

case les, or unnecessary delays to case management, and

• had poor quality record-keeping and limited system performance, restricting staffs’ access

to full case details and requiring borrowers to constantly re-explain sensitive circumstances

or provide information on multiple occasions

Poor systems and processes can make it difcult for staff to deliver good

customer outcomes

One firm had no electronic system based functionality to capture information about

income and expenditure. Each customer had to complete a manual budget planner and

send this to the firm. The firm had not made sufficient allowance for the limitations

in this process when validating and challenging affordability or updating income and

expenditure information.

One firm only permitted borrowers to pay direct debits on one day in the month.

Others provided only three or four options. This meant that customers were unable

to make payments easily on a day of their choice and made it more likely that

arrangements would break, for example, due to unsecured lenders’ more flexible

collection arrangements.

One firm would only confirm and put in place forbearance options such as arrangements

to pay on receipt of certain customer documentation such as bank statements. The

firm did not permit customers to submit this information electronically and did not

prioritise its incoming post in an efficient or timely way.

The standard of customer records maintained in file and diary notes was insufficiently

detailed in more than one firm. This often hampered subsequent call handlers’ ability

to deal with borrowers in a professional and consistent manner. In some cases this

appeared to be due to pressure on agents to move on to the next call before they were

able to complete notes of typically complicated and in-depth discussions.

Financial Conduct Authority 13

TR14/3

February 2014

Mortgage lender

s’ arrears management and forbearance

Staff are likely to need additional support when dealing with complex, or non-

standard cases such as shared ownership

Some firms had not considered the particular features of shared ownership loans when

developing training and competence schemes and had not provided sufficient guidance to

staff. Staff did not always understand the distinctive features of these arrangements, including

the rights of the landlord or the risks to both borrowers and lenders if rental payments are not

maintained. We found examples of staff:

• not including rent due to the landlord in income and expenditure assessments

• not taking rent arrears into account when assessing the customer’s circumstances or

determining the collections strategy

• failing to consider the impact of rent arrears and ongoing rent commitments paid by the

lender (to protect their security) on the customer’s longer term ability to repay their arrears,

and

• failing to consider whether the customer could sell all or part of their owned share back

to the landlord to reduce the overall mortgage balance or level of arrears (‘downward

staircasing’)

This led to an increased risk that staff deployed strategies which were not appropriate for

borrowers’ circumstances, leading to a risk of poor customer outcomes.

Application of fees and charges

Many firms had improved their charging practices since our previous review. However, we

found isolated examples of charging policies which inappropriately applied costs to borrowers’

accounts, for example where the firm was not actively administering the account or proactively

seeking resolution of residual arrears.

Unfair charging practices

One firm levied multiple arrears charges where more than one mortgage ‘account’

existed on the same property. These charges did not reflect the additional resources

required to administer the cases, on which such charges should be based. This resulted

in significant increases in overall charges and levels of arrears in some cases.

Another firm charged customers for failing to keep to their arrangement to pay despite

the customer making the payment within days of the agreed date and within the

month that the regular monthly commitment fell due.

One firm charged customers a fee where the firm elected to cancel a field agent

visit, due to no fault of the customer. The relevant fee doubled when the customer

cancelled the visit and exceeded the costs incurred by the firm.

14 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

Firms need to control risks when incentivising collections agents

We warned firms that incentive schemes could encourage inappropriate behaviours and lead

to the unfair treatment of customers following our 2013 review of ‘Risks to customers from

financial incentives’.

4

We provided guidance on managing the risks and governance of incentive

schemes and gave examples of what effective controls and governance may look like in practice.

Many firms had taken steps to remove inappropriate incentive schemes or had taken steps to

make them more customer-focused. However, we identified one scheme which risked driving

negative behaviours in front-line staff.

Incentive schemes can encourage inappropriate behaviour

In one firm, staff were incentivised by the amount of cash collected from borrowers.

This created a risk that staff placed an overriding focus on agreeing short-term

arrangements to pay, rather than considering other options that might be more suited

to individual customer needs.

4 FSA finalised guidance: FG13/01: Risks to customers from financial incentives (page 23)

www.fsa.gov.uk/static/pubs/guidance/fg13-01.pdf

Financial Conduct Authority 15

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

3.

Economic context

This chapter provides context to our thematic review and considers underlying factors that firms

should consider when deploying their strategies for managing customers in financial difficulty.

There are 11.2 million mortgages in the UK, with loans worth more than £1.2 trillion. A total

of 144,700 mortgages, representing 1.29% of all mortgages, had arrears equivalent to more

than 2.5% of their mortgage balance at the end of 2013.

5

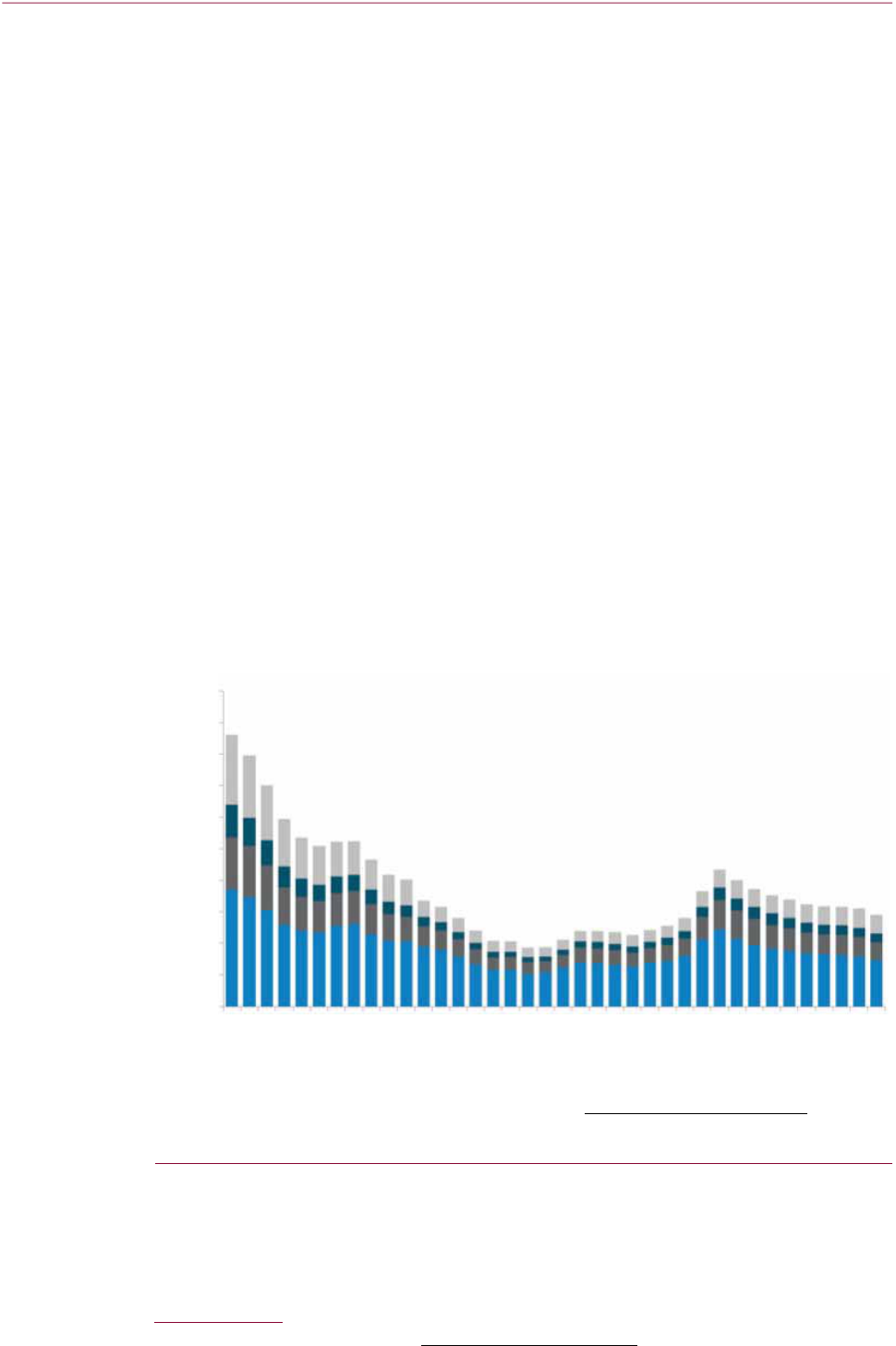

The total number of first charge mortgages in arrears has trended downwards since the

beginning of 2009. The downward trend has been evident across all arrears bands, with the

exception of accounts more than 10% in arrears, which have remained broadly stable.

Arrears on mortgages by percentage of total balance in arrears

The economic outlook – forward-looking observations

Although all firms in our review support the principle of treating customers in financial difficulty

fairly, we found that firms did not always have robust strategies which fully consider the

impact of potential interest rate increases on existing borrowers in arrears, or those borrowers

susceptible to arrears.

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

1995

H1

1996

H1

1997

H1

1998

H1

1999

H1

2000

H1

2001

H1

2002

H1

2003

H1

2004

H1

2005

H1

2006

H1

2007

H1

2008

H1

2009

H1

2010

H1

2011

H1

2012

H1

2013

H1

2.5%<5%

5%<7.5%

7.5%<10%

>10%

5 Source: Council of Mortgage Lenders Q4 2013: www.cml.org.uk/cml/media/press/3817

Source: Council of Mortgage Lenders Q4 2013: www.cml.org.uk/cml/media/press/3817

16 Financial Conduct AuthorityFebruary 2014

TR14/3 Mortgage lenders’ arrears management and forbearance

The impact of over-indebtedness

Despite an extended period of low bank base rates, household debt-to-income remains high

and unsustainable levels of debt remain a key driver of financial distress for UK borrowers. This,

and the possibility of further debt accumulation, leaves some households exposed to potential

interest rate increases, income and expenditure shocks and changes to credit conditions. Lower

income and ‘credit-hungry’ borrower groups are likely to be particularly exposed in a changing

interest rate environment. These borrower groups have a higher than average concentration of

negative equity and are at risk of falling into arrears on their mortgage regardless of changes

in macro-economic conditions.

The impact of life events and the importance of considering borrowers’ specic

individual nancial and personal circumstances

Other drivers of financial difficulty can be exacerbated by over-indebtedness.

Borrowers who fall into arrears as a result of life events can also be particularly sensitive to lender

collection strategies. It is important that lenders understand a borrower’s specific individual

financial and personal circumstances before making decisions on the most appropriate action

to take.

The impact of any future interest rate increases

The current low interest-rate environment is likely to have reduced debt servicing costs and

supported indebted households through the post-crisis period - in part off-setting the impact

of inflation on living costs and negative real wage growth. Low rates and improvements in

funding conditions for lenders are likely to have supported firms’ forbearance strategies, for

example by reducing the financial costs of non-performing loans to firms.

The overall costs of forbearance to borrowers, where the ability to repay their arrears is absent,

can be high once you include fees, charges and interest costs as well as any loss on sale.

Lenders need to be alert to this risk.

Interest rates can be expected to increase as the economy improves. The impact of higher

rates on both firms and borrowers, and their response to this, will to some extent be impacted

by the environment against which rates start to rise (including house prices, wage inflation,

employment and household expenses). These risks may impact both borrowers currently in

arrears and those borrowers who are susceptible, for example, due to over-indebtedness.

Actions for rms

Firms should consider which borrowers are most likely to be affected by potential rate rises, for

example, those who have experienced payment problems in the past or those with a high loan-

to-income ratio, and consider deploying proactive strategies to engage them early.

Firms need to ensure their cultures, policies and practices are well placed to treat their customers

fairly. Firms must ensure that decisions around forbearance or repossession are suitable given the

Financial Conduct Authority 17

TR14/3

February 2014

Mortgage lenders’ arrears management and forbearance

specific personal and financial circumstances of borrowers - dealing sensitively with borrowers

who may have particular vulnerabilities. Decisions should take account of a borrower’s likely

long-term ability to repay their arrears.

Lenders should take action now to identify customers susceptible to falling into arrears and

have appropriate strategies to treat these customers fairly.

Financial Conduct Authority

© Financial Conduct Authority 2014

25 The North Colonnade Canary Wharf

London E14 5HS

Telephone: +44 (0)20 7066 1000

Website: www.fca.org.uk

All rights reserved

PUB REF: 004863