CAF Cash Account

Safe and secure day-to-day banking, designed

exclusively for charitable organisations.

Our interest-bearing CAF Cash Account provides

transactional banking for your everyday requirements.

So whether you need to send money electronically within

the UK, send money outside the UK, make everyday card

payments or set up standing orders to third parties,

this account aims to satisfy your day-to-day banking

needs, including:

n earn interest on account balances in credit

n online banking with dual authorisation for

added security

n access to a branch network for paying in at

UK counter-service branches of HSBC or

Royal Bank of Scotland

n standing order, cheque and paying-in book facilities

n access to Post Office deposit services

Receiving money

You can receive money into your CAF Cash Account by

online or electronic transfer, or by cash or cheque at

any counter-service HSBC Branch in the UK if your sort

code begins with 40, or at any counter-service

RBS Branch in the UK if your sort code begins with 83.

You can also pay in at any Post Office in the UK.

Sending money

You can use a variety of methods to send money:

n card payments with a CAF Bank Mastercard

®

Business card

n Online Service

n outside the UK by completing our Sending money

outside the UK form

n Bacs bureau and sponsorship for payments and

collection of Direct Debits

n CHAPS bank transfer

n Direct Debit

n standing order

n Faster Payments

n cash withdrawal from an international network of

cash machines wherever you see the Mastercard

symbol

n cheque

Find out more at www.cafonline.org/banking

Fees

The CAF Cash Account monthly fee of £5.00 and other

transaction fees are detailed in the CAF Bank Tariff of

Charges, which you can view at www.cafonline.org/

cafbank-tariff-terms

Arranged Overdrafts

A secured, arranged overdraft by prior agreement

as part of your CAF Cash Account may meet your

borrowing needs.

1

Find out more about our secured loans at

cafonline.org/loans

1 Overdraft applications are subject to credit assessment and

security is required.

CAF Bank online

You can manage your account with our Online Banking

service, a safe and secure way to manage your day-to-

day transactions over the internet.

Dual authorisation

Managing your account online gives you the benefit of

additional security and fraud prevention measures using

dual authorisation. Once a transaction has been initiated

to a third party, it requires another online user, authorised

by your organisation, to approve it before any money

leaves your account.

CAF Cash features and benets

2

You can:

n view transaction history and balances for all your

accounts

n pay variable amounts to your staff and suppliers

n view statements online

n send and receive money between your

CAF Cash and Gold Accounts

n send money to other UK bank accounts

n set up additional users with various

Administration Rights

n view Direct Debits

n set up, amend and cancel standing orders

n change your passwords

n order cheque or paying-in books

CAF Cash Online QuickPay

This is a free online service that lets you pay variable

amounts to your staff and suppliers from your CAF

Cash Account. Unlike a standing order, QuickPay allows

you to transfer irregular amounts. You can control your

payments online and they are sent electronically at no

cost to your organisation.

Interest

You can view our current interest rates at:

CAF Cash Account – cafonline.org/banking

Deposit Accounts – cafonline.org/bankrates

Our friendly team

You can, of course, choose to manage your account

transactions by telephone, or by sending written

instructions, signed in accordance with your existing

mandate held with CAF Bank.

Our UK-based Customer Service team is available to help

you Monday to Friday 9am to 5pm on 03000 123 456

(excluding English bank holidays). Alternatively, you can

email us at cafbank@cafonline.org

Staying secure

We’re here to help you protect your money. Visit our

Security Centre at www.cafonline.org/security-centre

for updates on the latest scams and tips on how to

prevent fraud.

CDT-2160/0724

We’re here to help

Explore our Help and Support Hub at

www.cafonline.org/caf-bank-help to find

answers to questions you may have about

opening a CAF Bank Account.

T: 03000 123 456

E: cafbank@cafonline.org

W: cafonline.org/caf-bank

Telephone calls may be monitored or recorded for security/training purposes.

Lines are open Monday to Friday 9am - 5pm (excluding English bank holidays).

CAF Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204451).

CAF Bank Limited Registered oce is 25 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4JQ.

Registered in England and Wales under number 1837656

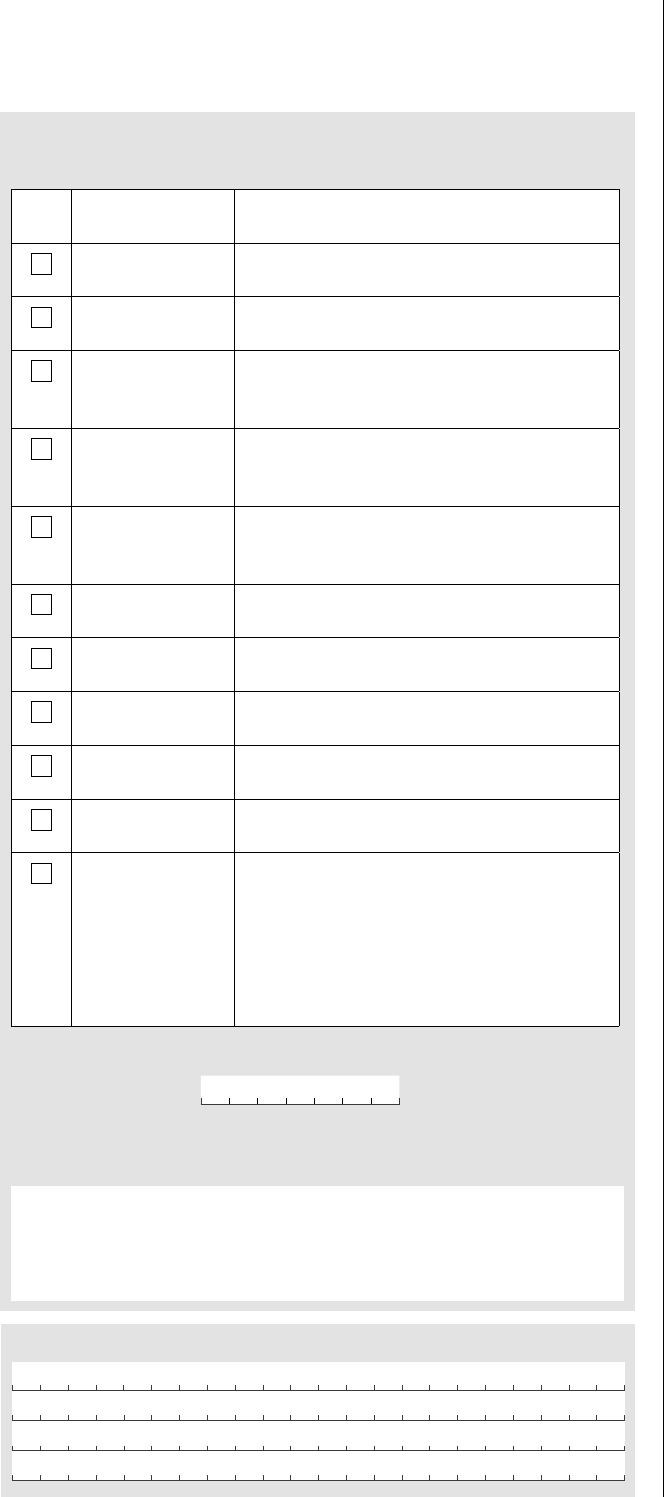

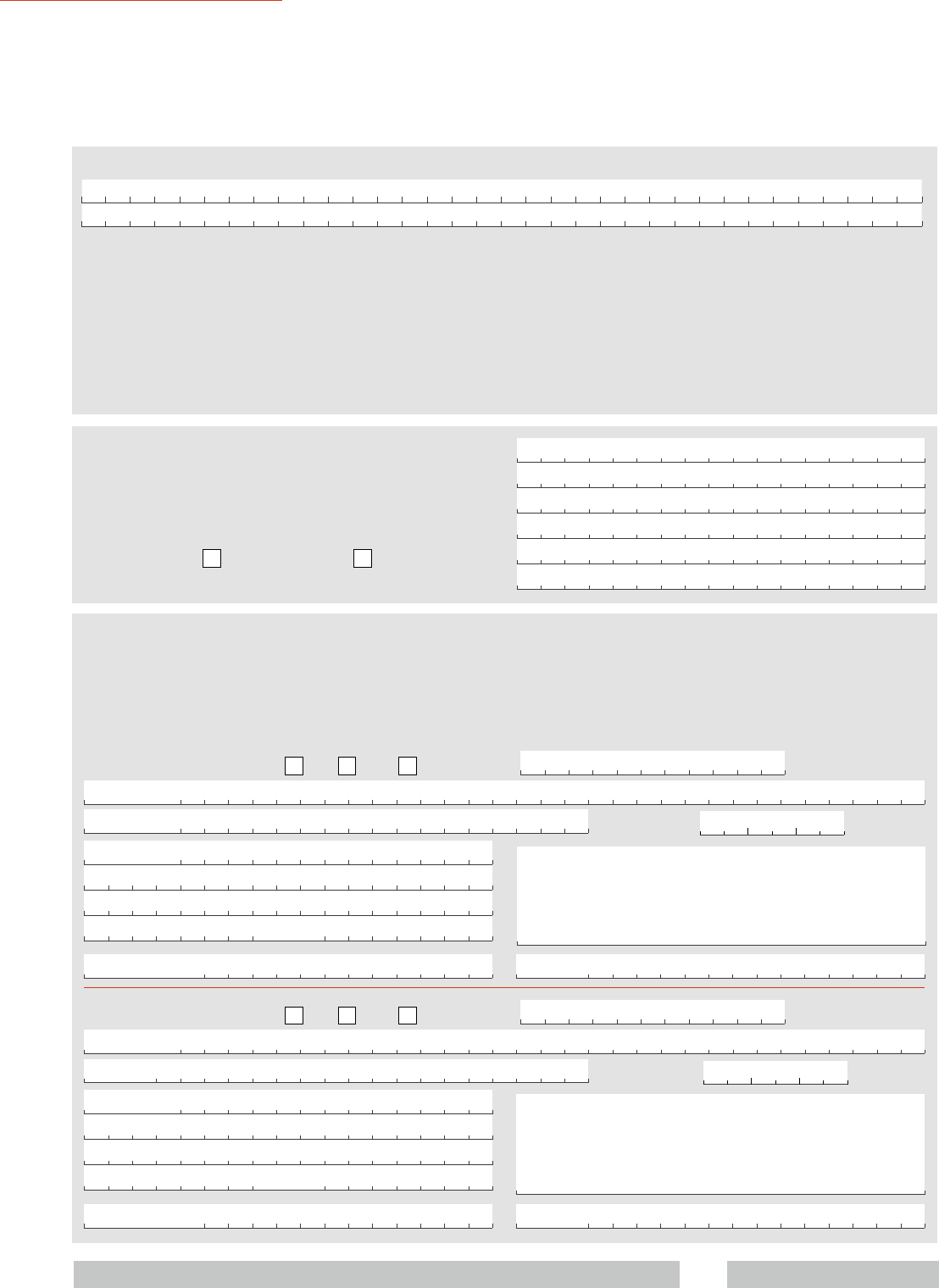

Summary box

CAF GOLD ACCOUNT

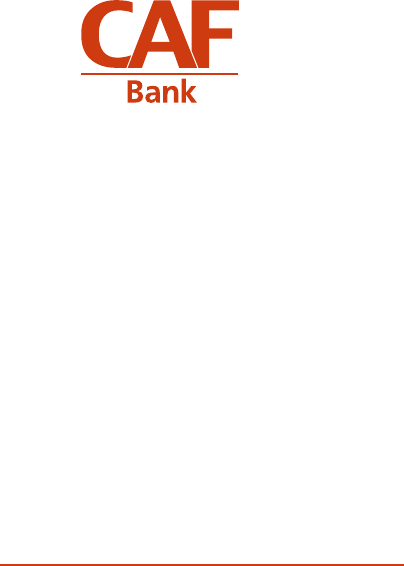

Account name CAF Gold Account

What is the interest rate? Your interest rate is variable. The current annual rate is shown in the table

below.

Balance Quarterly Interest

(variable)

£0+ Gross* AER**

2.50% 2.52%

n

Interest is calculated on your daily balance.

n

Interest is paid quarterly to this account.

Can CAF Bank change the

interest rate?

Yes, we can change the interest rate at any time. We will notify you of any

change that does not benet you 60 days before the change is made. For more

information, please see section 20 of our General Terms and Conditions.

What would the estimated

balance be after 12 months

based on a £1,000 balance?

An illustration of the future balance is shown below.

Balance Gross

*

Rate/AER

**

Balance at 12 months

£1,000.00 2.50%/2.52% £1,025.24

This is an illustrative example assuming that:

n

You don’t withdraw or deposit any additional money.

n

The interest rate stays the same and is paid quarterly.

n

Interest is calculated on a cleared deposit for a full 12 months.

How do I open and manage

my account?

n

You can open an account by printing the online application form and posting

it to CAF Bank Limited, 25 Kings Hill Avenue, Kings Hill, West Malling, Kent

ME19 4JQ.

n

There is no minimum deposit.

n

There is no minimum account balance.

n

You can manage the account by telephone, online or by post.

Can I withdraw money?

n

Yes, you can make withdrawals from this account to your CAF Cash account.

Additional information

n

You can close this account any time without charge.

n

If your sort code starts with 40, you can deposit cash or cheques through

any counter-service branch of HSBC in the UK. If your sort code starts with

83, you can deposit cash or cheques through any counter-service branch

of RBS in the UK. For both HSBC and RBS sort codes, you can use the Post

Office counter-service to deposit cash or cheques in the UK.

n

Interest is paid Gross

*

.

n

Please read this summary in conjunction with the CAF Bank General Terms

and Conditions and the CAF Gold Account – Account Terms.

CDT-1955/0224

Telephone calls may be monitored or recorded for security/training purposes.

Lines are open Monday to Friday 9am - 5pm (excluding English bank holidays).

CAF Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204451).

CAF Bank Limited Registered oce is 25 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4JQ.

Registered in England and Wales under number 1837656.

*

Gross means that all interest will be paid without any deduction of tax. You are responsible for paying any tax due

to HMRC.

**

AER stands for the Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and

compounded over a year.

Financial Services Compensation Scheme (FSCS)

This product is covered by the Financial Services Compensation Scheme (FSCS).

For further information about the compensation provided by the FSCS (including amounts covered and eligibility

to claim), refer to the FSCS website www.FSCS.org.uk or call the FSCS on 0800 678 1100.

Details correct as at 13/02/2024

Application form

CAF BANK

2

CAF Cash current account

If you require easy access to your money but also need

every penny to work for you, then our CAF Cash Account

may be the answer. Your account needs to be funded in

the first 30 days. Failure to do so may result in your account

becoming overdrawn. To find out more about possible

charges, please see our Tariff of Charges, located at

cafonline.org/cafbank-tariff-terms.

With a CAF Cash Account you can:

n Send money within the UK

n Send money outside the UK

n Receive money from outside the UK

n Receive money from within the UK.

CAF Bank Business card

With a CAF Bank MasterCard

®

Business card you can make

card payments for goods and services from your CAF Cash

Account in a safe and secure way and online, in the UK and

overseas. You can make a cash withdrawal at ATMs where

the MasterCard acceptance mark is displayed.

With a CAF Bank Business card your cardholder can:

n make card payments in pounds 24/7

n make card payments in a foreign currency

n securely undertake online payments using the

MasterCard® SecureCode™ service

n make cash withdrawals in pounds in the UK and in

a foreign currency outside the UK up to £300 per

transaction. This is subject to a daily limits which covers

all cardholder cash withdrawals from ATMs.

CAF Bank Bacs bureau service

A secure, efficient way to collect Direct Debits in to your

CAF Cash Account and send money within the UK.

Loans

Finding a loan tailored to meet the needs and circumstances

of your organisation is not always easy. As a trusted provider

that understands the requirements of charities we can

help take the hassle out of the process, enabling you to

concentrate more on your cause. Whether you’re looking

to undertake a project, refinance an existing agreement,

purchase or refurbish a property or need working capital to

expand your services, our experienced relationship managers

will work with you to develop the right financial solution.

We assess each application on its own merit. We are

committed to being a responsible lender and all loans are

subject to a comprehensive assessment process.

Please note that we do not provide loans where 40% or

more of the secured assets would be a residential dwelling,

or loans other than for business purposes or which would

be a regulated consumer credit agreement.

Arranged overdrafts

If a loan is not suitable for your organisation, a business

arranged overdraft as part of your CAF Cash Account may

better meet your shorter-term needs.

CAF Gold deposit account

This account provides your charity with easy access to your

savings. You can open an account and send money to your

CAF Cash Account or a nominated account as long as your

account remains in credit.

To operate a CAF Gold Account, you must open a linked

CAF Cash Account.

Savings

We can give you access to savings accounts with variable

notice periods from 60 days to 1 year. Helping you to meet

your current needs and improve your future sustainability.

About our services

3

The meaning of the words and phrases used in this

document are detailed in the Words and Terms we use

section of the CAF Bank General Terms and Conditions. In

addition, the Financial Conduct Authority has published a

set of standardised terms and definitions that all banks use

in relation to the services it provides per payment account.

A glossary of the terms and definitions is available to view at

cafonline.org/glossaryofterms which will apply to these

terms unless a contrary intention is expressed. We set out

the cost of these services in our Tariff of Charges which are

designed to make it easier for you to compare the cost of

banking services. Our Tariff of Charges can be found at

cafonline.org/cafbank-tariff-terms.

You should carefully read the accompanying product

information and General Terms and Conditions and retain

them for future reference. If there is anything that you do

not fully understand, please ask for further information or

seek professional advice or guidance before sending your

application to CAF Bank. Failure to complete this form fully

may delay your application.

Below is a list of information you will need to supply when

completing this application. For ease, you may wish to have

this information to hand before starting your application.

Details about your organisation’s:

n activities

n income

n charity registration number (charities registered with the

Charity Commission (CC), Office of the Scottish Charity

Regulator (OSCR) or Charity Commission for Northern Ireland

(CCNI)

n registered company number (for organisations

registered with Companies House)

n registered address and correspondence address

n an extract of the minutes of a meeting attended by your

board of directors/trustees or equivalent, where it shows

authority to open a new bank account. This should be

signed by your chairman and certified by them as a true

extract of the minute (the signature must be an original)

n country(ies) of tax residence – normally the country

or countries in which you are established but if the

organisation has connections with any other country

you will need to check the rules in that country –

see www.oecd.org/about/members-and-partners

n classification for AEOI (Automatic Exchange of Information)

purposes.

Please ensure your application and mandate complies

with your governing document and matches with

information held by the Charity Commission.

Please do not send original governing documents. Please

only send copies of original documents.

Data protection and confidentiality

We take data protection and privacy very seriously. Our Privacy

Notice, which can be viewed at cafonline.org/privacy,

describes the way in which we collect, retain and use personal

data. We aim to ensure that we only hold personal data for as

long as it is needed and that it is held securely.

The personal information we collect from you in this

application will be shared with fraud prevention agencies, who

will use it to prevent fraud and money laundering and to verify

your identity. If fraud is detected, you could be refused certain

services, finance or employment.

For further details of how your information will be used by us

and these fraud prevention agencies, and your data protection

rights, view our privacy notice at cafonline.org/privacy

Information about the people connected to your organisation:

n Contact person: This individual will have verbal authority

to send money between your CAF Bank accounts and to

the other bank accounts stated in this application, and

obtain information about your account.

n Signatories: These individuals will have authority to sign

cheques or written instructions, verbal authority to send

money between your CAF Bank accounts and to the

other bank accounts stated in this application, and obtain

information about your account.

We recommend you have at least two nominated

signatories to approve requests to send money in writing.

When nominating signatories it is best to consider practical

issues of obtaining signatures whenever required.

The contact and all signatories will be required to provide:

• full name

• personal address and any previous address(es) (if

moved in the last three years)

• contact email (where requested)

• phone numbers

• date of birth

• nationality.

This information will be used when carrying out electronic

verification checks and may be used to identify the individuals

as part of our telephone security procedures.

n Business card holders: These individuals have been

given authority to have a business card on behalf of the

organisation.

n Trustees, directors or equivalent and beneficial owners

(such as your governors or equivalent if you are a

state-supported school, college, university or an

independent school or college or the committee members

responsible for running your organisation or group such

as Parent Teacher Association or Parochial Church Council).

Information needed for your application

4

n Trustees, directors or equivalent and beneficial owners

are required to provide:

• full legal name

• personal address and any previous address(es) (if

moved in the last three years)

• phone numbers

• date of birth

• nationality.

This information will be used when carrying out

electronic verification checks.

Important information

All banks face an increasingly stringent regulatory environment,

from regulators here and around the world, which requires

them to put in place close monitoring of all accounts to

ensure they comply with rules for financial transactions. We

are required to know our customers and where they send

their money, the nature of any partner organisations and the

countries and regions in which they operate.

At CAF Bank, we take our obligations very seriously,

and review all our accounts carefully and individually

to ensure we have the necessary understanding of our

customers. In order for CAF Bank to fulfil its account

opening administrative requirements and to comply with

UK anti-money laundering legislation, before your account

can be opened we are required to complete checks on

your organisation and on individuals that are involved with

your organisation. Wherever possible these checks are

performed electronically, minimising the time it takes to

open your account. If we are required to contact you for

further information this may delay your application.

In certain circumstances, however, it may be necessary to

request additional identification documentation which may need

to be certified and may delay your application. Before continuing

please ensure that each person named on this application

form is aware of how we will process the data. If you are aware

of any individuals who may already be associated with other

CAF Bank accounts please notify us in a covering letter to avoid

us undertaking our electronic checks again.

In order to improve international tax compliance, the UK has

enacted legislation to implement various intergovernmental

agreements (including to give effect to relevant European

directives and the US provisions commonly known as FATCA).

We are required by UK law to obtain information to verify

the identity and tax status of account holders together with

the country or countries in which they are tax-resident and,

in some cases, also to verify the identity, tax status and

residence of the ‘Controlling Person(s)’ (as defined under the

various intergovernmental agreements) of the organisation

that is the account holder.

Where the information we hold or collect indicates that

you are, or may be, tax-resident in another country, we

are required to pass that information and details about

your account to HM Revenue & Customs (HMRC) who

will, in turn, pass it to relevant foreign tax authorities

where intergovernmental agreements to which the UK is

a party require the automatic exchange of information for

international tax compliance purposes.

If you do not supply sufficient information to determine

your tax residence (or the tax residence of your ‘Controlling

Person(s)’) we will also have to report that to HMRC, together

with details of your account. HMRC will, in turn pass on

details of such account holders and their accounts to the tax

authorities of the US and Crown Dependencies.

Where you apply for any product with us, we may perform

a credit search in order to check the details of your credit

history with certain credit reference agencies. These agencies

will keep a record of that search (including details of your

application for a product with us, and whether or not that

application is successful) and, for a short period of time, this

can therefore affect your ability to get credit elsewhere. If the

results indicate that the product that you are seeking would

not be suitable, your application may be declined. If your

application is accepted we will file information with these

agencies about how you manage your product on an

ongoing basis.

The Organisation’s directors, trustees (through a resolution

of the board of trustees), committee, or equivalent must

have resolved that CAF Bank is to be appointed as bankers

to the organisation, in writing, and have nominated the

individual completing this application to act on their behalf.

Please make sure all personal details provided as part of your

application are up-to-date and correct. The information you

submit for anyone attached to your organisation may affect

any personal information we already hold.

Your organisation and account contact must be resident in

the UK.

Please ensure you complete each section clearly, in full

and in black ink using capitals. Should you make a mistake,

please cross out the incorrect entry, write in the correct

details above the box and initial the changes.

5

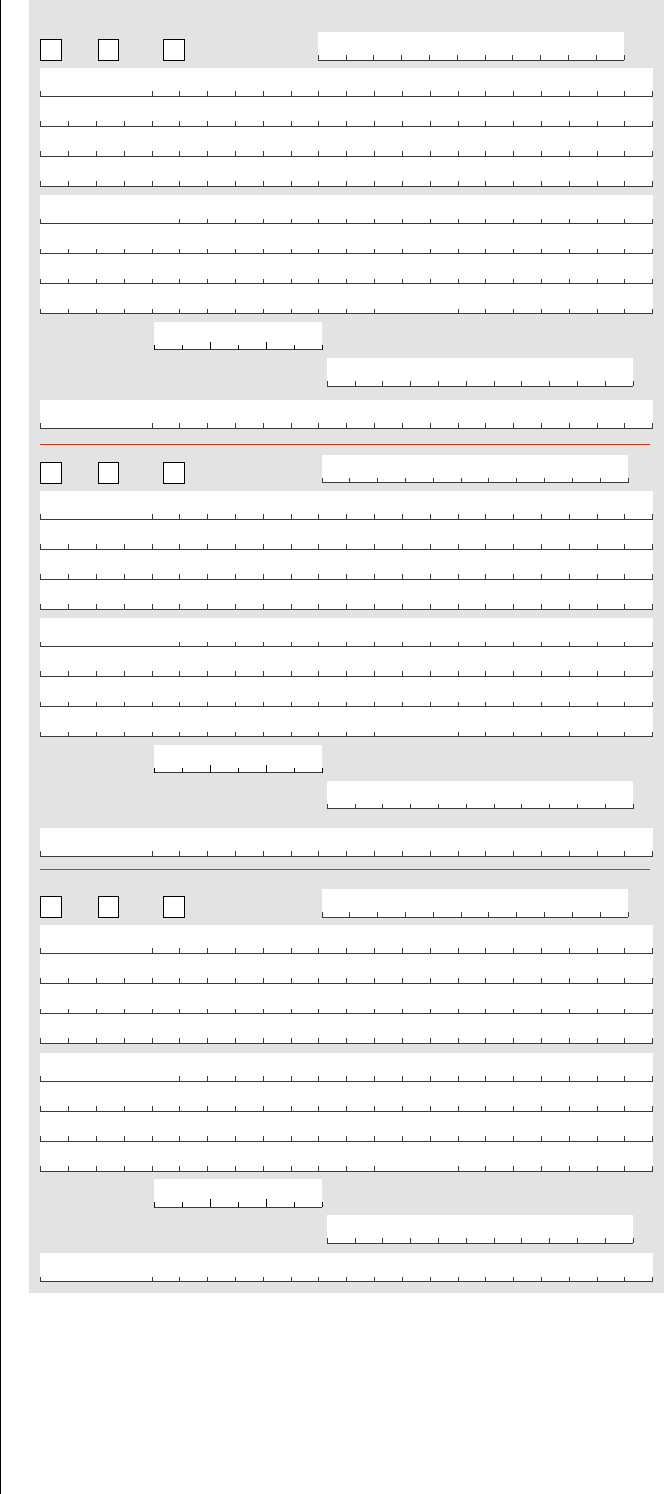

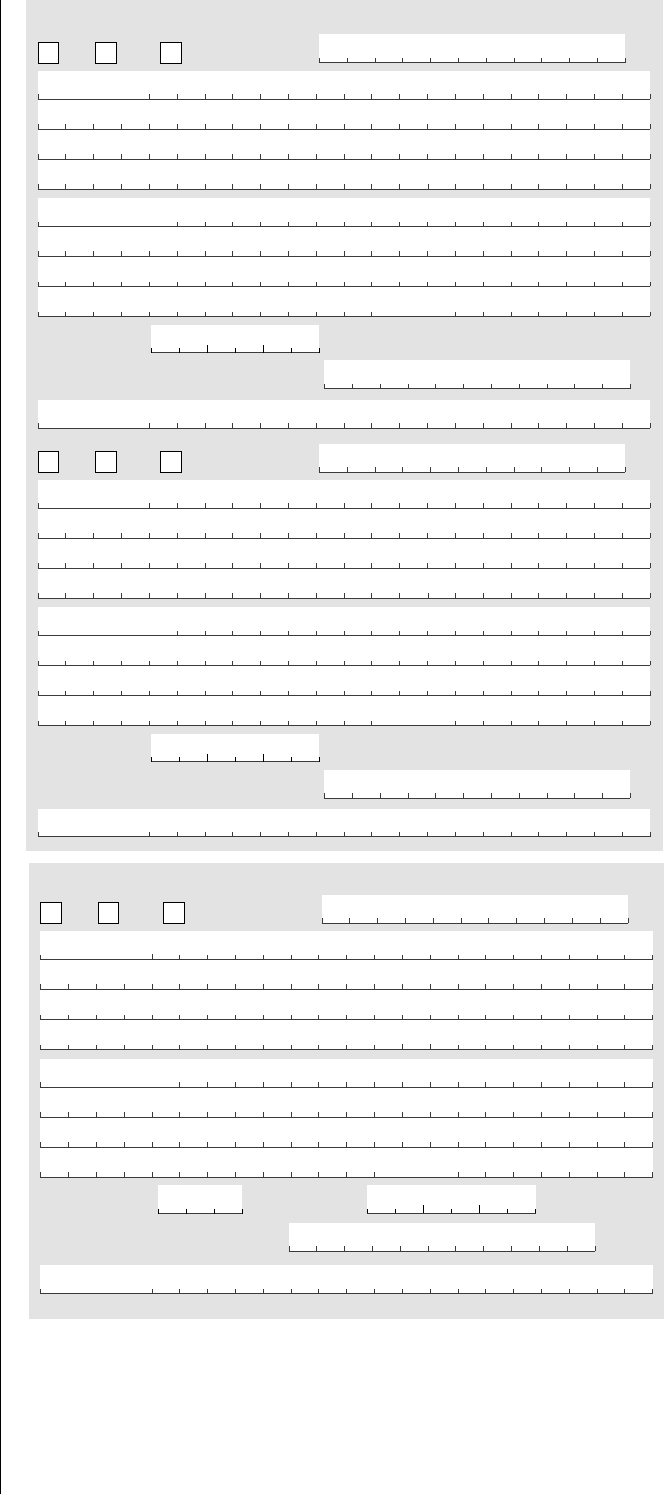

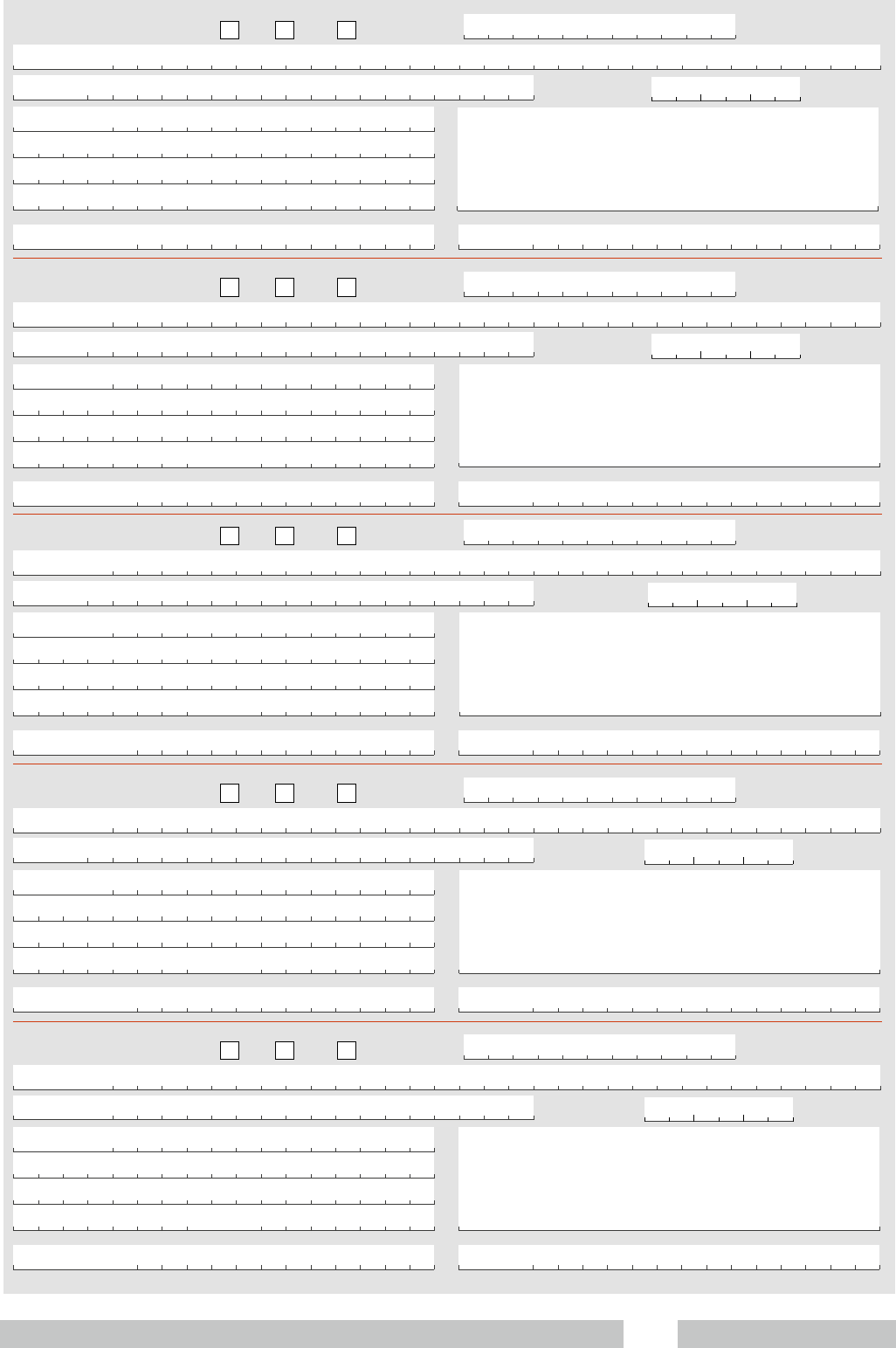

Section 1

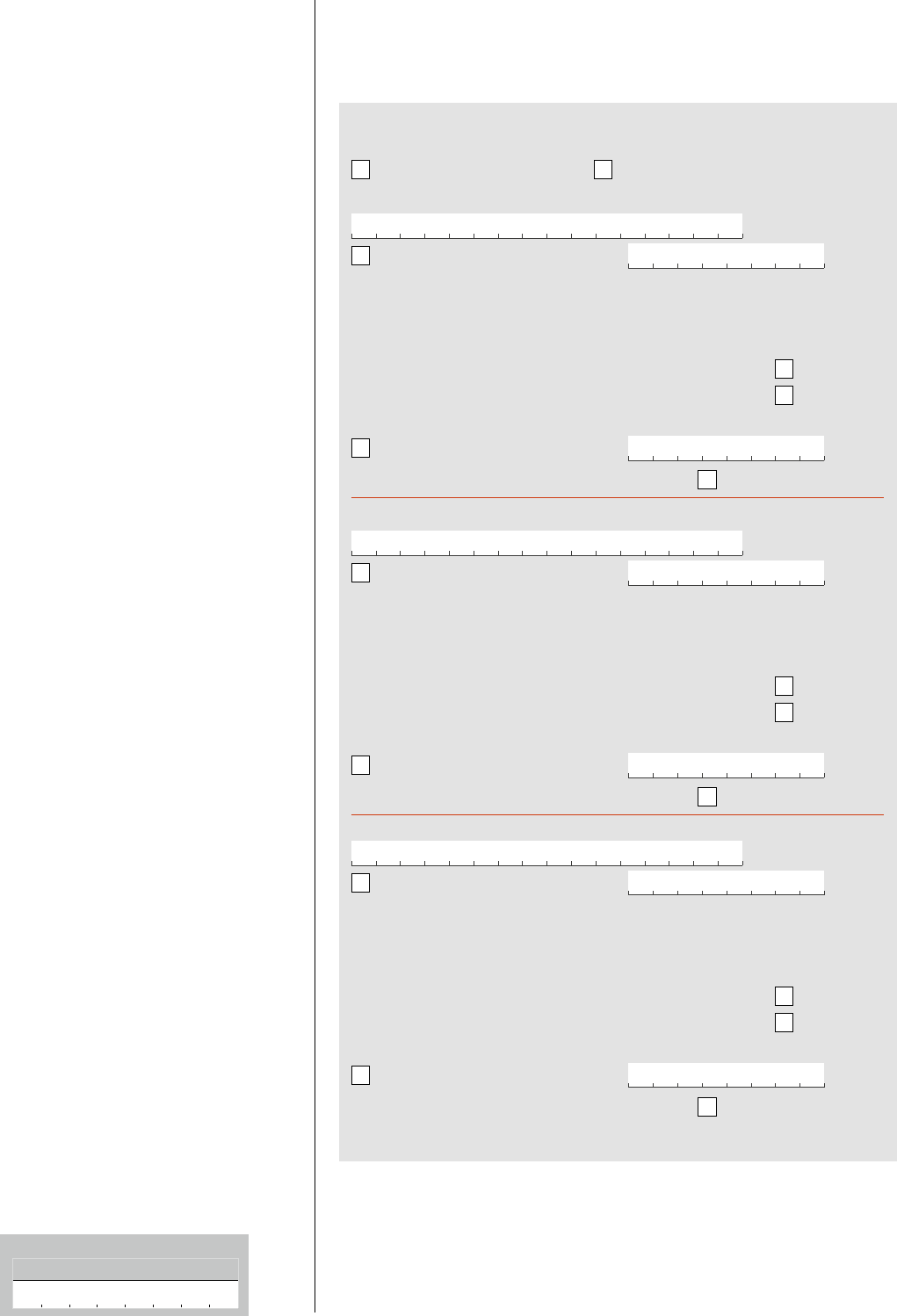

New accounts

1.1 Your new account(s)

I would like to open the following accounts paying in at:

HSBC branch counters OR

RBS branch counters

New account(s) 1 – Designation name (leave blank if not required)

CAF Cash Account Deposit £

If you require a Business card, please download an application form from

our website at cafonline.org/businesscard and submit the application

alongside your account application.

If you would like a chequebook, please tick here

If you require a paying-in book, please tick here

and/or

CAF Gold Account Deposit £

If you require a paying-in book, please tick here

New account(s) 2 – Designation name (leave blank if not required)

CAF Cash Account Deposit £

If you require a Business card, please download an application form from

our website at cafonline.org/businesscard and submit the application

alongside your account application.

If you would like a chequebook, please tick here

If you require a paying-in book, please tick here

and/or

CAF Gold Account Deposit £

If you require a paying-in book, please tick here

New account(s) 3 – Designation name (leave blank if not required)

CAF Cash Account Deposit £

If you require a Business card, please download an application form from

our website at cafonline.org/businesscard and submit the application

alongside your account application.

If you would like a chequebook, please tick here

If you require a paying-in book, please tick here

and/or

CAF Gold Account Deposit £

If you require a paying-in book, please tick here

Section 1

New accounts

1.1 Your new account(s)

If your sort code starts with "40", you can carry

out your banking at HSBC counter-service

branches. If your sort code starts with "83",

you can carry out your banking at Royal Bank

of Scotland counter-service branches. You can

also pay in cash and cheques at any Post Office

in the UK.

Each account will be opened using your exact

organisation name which you will be asked

to provide in section 2.2, but you can also

choose a ‘designation name’ for each

account, to differentiate between them,

eg Number 1 account.

The CAF Cash Account is subject to a

monthly fee. Please fund your account

within 30 days to avoid any unexpected

costs. Please see the CAF Bank Tariff of

Charges for further information.

Please note: account designations must not

exceed 16 characters including spaces and are

not an alternative account name – all cheques

and monies received must be payable to your

organisation name or your designation name.

Your Business card application will need to be

submitted with your new account application.

Business cards are issued to the cardholder

on behalf of the organisation. Please note,

cardholders cannot contact CAF Bank directly,

unless the cardholder is also a signatory or the

named contact person for the account.

Section 1 continued overleaf

For office use only:

CAF Bank Account number

6

1.2 Other services

We will send the information to the account

contact using the details set out in section 6.

1.2 Other services

Would you like us to send you information about the other services we

can offer? (subject to a separate application)

Bacs bureau

CAF Bank loan

Arranged overdraft

How would you like us to send this information to you?

Email

Post

1.3 Where did you hear about CAF Bank?

7

Section 2

About your organisation

2.1 Existing CAF Bank accounts

Please indicate if your organisation already holds

a bank account with CAF Bank and insert the

main account number in the box provided.

2.2 Organisation name

Where relevant, you must use the organisation

name or working name registered with the

HMRC or your regulator. If you have more

than one working name, you can choose one

of these.

Please ensure that the organisation name

you enter here is identical to your registered

working name in your governing document.

2.3 Operating or registered address

The operating address or registered address

is required for identification purposes.

Registered charities – this must be identical

to the details held by the CC, OSCR or CCNI.

Non-registered organisations – this must

be identical to the details provided on

your website, or on the accompanying

HMRC exemption certificate and governing

document.

Please note, we cannot open accounts for

organisations whose principal operating

address is outside the UK.

2.4 Country of incorporation (if relevant)

of organisation

Please provide the country where your

organisation is incorporated or legally registered.

2.5 Organisation web address

Please provide the web address for your

organisation.

2.6 Other bank accounts

If you hold a bank account with another

financial institution, including accounts that

you are transferring to CAF Bank, please

provide copies of the last six months'

statements for all such accounts.

2.7 Estimated annual turnover in the next

12 months

Please put the figure that is closest to your

organisation's likely turnover for the next 12

months.

Section 2

About your organisation

2.2 Organisation name

2.3 Operating or registered address

Postcode

2.4 Country of incorporation (if relevant) of organisation

2.1 Existing CAF Bank account

Does your organisation already hold a CAF Bank account?

Yes

No (go to section 2.2)

If your organisation holds an existing account with CAF Bank then a link will be

formed with the new account, unless the new account is for a separate legal entity

that is financially distinct from the existing organisation.

Main CAF Bank account number

Reason for additional account

2.5 Organisation web address

2.6 Other bank accounts

Does your organisation hold an account with another financial institution?

This includes accounts that you are transferring to CAF Bank.

Yes

No

If 'Yes' please provide copies of your last six months' statements for each

account you hold.

2.7 Estimated annual turnover in the next 12 months

Section 2 continued overleaf

8

2.8 Country(ies) of tax residence (including the UK)

Please complete the information in the boxes below indicating:

i) where the Account Holder is tax-resident; and

ii) the Account Holder’s TIN for each country indicated.

If the Account Holder is not resident in any jurisdiction (eg because it is fiscally

transparent), please indicate that in the boxes below and provide its place of

effective management or country in which its principal office is located.

If a TIN is unavailable, please provide the appropriate reason A, B or C

where appropriate:

Reason A – The country where the Account Holder is liable to pay tax

does not issue TINs to its residents.

Reason B – The Account Holder is otherwise unable to obtain a TIN or

equivalent number. Please explain why the Account Holder is unable to

obtain a TIN in the below boxes if you have selected this reason.

Reason C – No TIN is required. Note: only select this reason if the authorities of the

country of tax residence entered below do not require the TIN to be disclosed

1. Countries of tax residence

Tax number, eg UTR, TIN

If no TIN is available (including the UK), enter reason A, B or C

2. Countries of tax residence

Tax number, eg UTR, TIN

If no TIN is available (including the UK), enter reason A, B or C

3. Countries of tax residence

Tax number, eg UTR, TIN

If no TIN is available (including the UK), enter reason A, B or C

If you selected Reason B above, please explain in the following boxes why

you are unable to obtain a TIN.

1.

2.

3.

Section 2 continued overleaf

2.8 Country(ies) of tax residence (including

the UK)

You must list all countries in which the

Account Holder is tax-resident and provide

the Taxpayer Identification Number or

national equivalent. A Charity registered with

the CC, OSCR or CCNI will be UK tax-resident.

In the UK, charities registered with HMRC

will have a TIN (also known as a Unique Tax

Reference (UTR)).

If the Account Holder is tax-resident in

more than three countries, please use a

separate sheet.

9

2.9 Trustees or equivalent

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

2.9 Trustees or equivalent

Please complete full details for all your trustees,

directors or equivalent (this is anybody who

votes in your meetings) such as:

n your governors or equivalent if you are a

state-supported school, college, university

or an independent school or college

n the committee members responsible for

running your organisation or group, such

as Parent Teacher Association or Parochial

Church Council - if you are a branch of a

main charity please provide your branch’s

committee member details.

Please ensure the details of the trustees or

equivalent are those stated on the Charity

Commission website or at Companies House.

If the details are different, please provide an

extract from the minutes of a meeting where

you confirm the trustees differ. This should be

signed by your chairman (the signature must

be an original signature).

Where your Beneficial owners are not your

trustees please complete section 5.4

If you have more than four trustees,

directors or equivalent, please use a

separate sheet, setting out for each person

the same information requested here.

Please provide the full legal name for each

Trustee. We need this information in order

to identify your Trustees. We are not able to

accept shortened versions of names.

Section 2 continued overleaf

10

3.1 Charity registration number

3.2 Company Registration Number (if applicable)

Registered charities (other than those which are dual tax registered), please go to

section 6 (Operating your new account).

If your organisation is dual registered for tax purposes, please complete section 4

(Entity classification).

If you are not a registered charity, please complete sections 4 (Entity

classification) and 5 (Non-registered organisations).

Section 3

Registered charities

Registered charity

An organisation that is registered with the

CC, OSCR or CCNI.

Non-registered organisation

An organisation that is not registered

with the CC, OSCR or CCNI.

3.1 Charity registration number

Please insert either your CC registration

number (up to seven characters),

CCNI registration number (up to eight

characters), or your OSCR registration

number (eight characters starting with SC).

3.2 Company Registration Number

If your organisation is a limited company,

please enter your company registration

number.

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Section 3

Registered charities

11

Section 4

Entity (organisation)

classification for AEOI

Purposes

AEOI Entity classification

Active Non-Financial Entity (Active NFE)

A charity, church or other non-profit

organisation will usually be considered an

Active NFE and should tick "Yes", unless it falls

within the definition of a 'Managed Investment

Entity and is located in a non-Participating

Jurisdiction'. The definition on the OECD's list

of Participating Jurisdictions can be found at

www.oecd.org/about/members-and-partners.

If unsure of your organisation's tax status,

please consult your tax adviser.

Managed Investment Entity and is located in

a non-Participating Jurisdiction

Investment Entity located in a Non-

Participating Jurisdiction and managed by

another Financial Institution' means any

Entity the gross income of which is primarily

attributable to investing, reinvesting, or

trading in Financial Assets if the Entity is (i)

managed by a Financial Institution and (ii) not

a Participating Jurisdiction Financial Institution.

Such an Entity is treated in the same way as a

Passive NFE for AEOI reporting.

Section 4

Entity (organisation) classification

for AEOI Purposes

Was your organisation established or is it resident for tax outside the UK?

Yes

No

If yes, please contact our Customer Services Team on: 03000 123 456.

Is your organisation an Active NFE?

Yes

No

If no, please contact our Customer Services Team on: 03000 123 456.

12

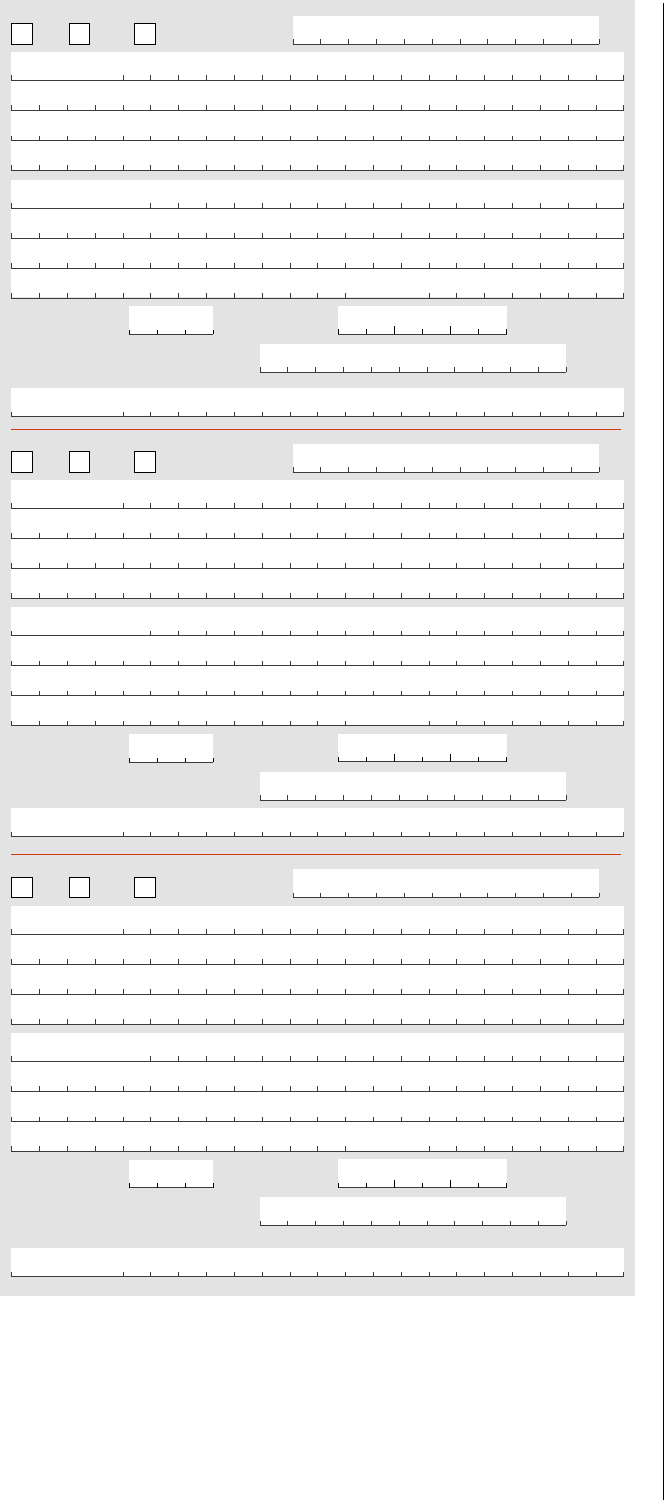

5.1 Organisation type

Please tick the relevant box(es) to confirm the legal structure of your organisation.

Tick

box

Organisation

type

Supporting document needed

Limited Company Company registration number and provide a copy

of your HMRC exemption certificate, if applicable.

Limited Liability

Partnership (LLP)

Relevant Registration Number and provide a copy

of your HMRC exemption certificate, if applicable.

Community

Interest Company

(CIC)

Relevant Registration Number and provide a copy

of your HMRC exemption certificate, if applicable.

Co-operative and

Community Benefit

Societies

Relevant Registration Number and provide a copy

of your HMRC exemption certificate, if applicable.

Community

Amateur Sports

Club

Relevant Registration Number and provide a copy

of your HMRC exemption certificate, if applicable.

Social Enterprise Relevant Registration Number and provide a copy

of your HMRC exemption certificate, if applicable.

Educational

establishment

Further documentation may be required once

your application has been assessed.

Religious

establishment

Please provide details of your diocese, if

appropriate.

Girlguiding or

Scout Group

Further documentation may be required once

your application has been assessed.

Armed Forces Further documentation may be required once

your application has been assessed.

Other (for example,

an unincorporated

Trust, exempt

charity, partnership,

association, club,

social housing

providers)

For Trusts, that need to be registered with the

Trust Registration Service (TRS), please provide

a copy of your TRS certificate. If you are a Trust

but do not need to register with the TRS, please

explain why you do not need to register. We may

require confirmation from a professional advisor.

If applicable to your organisation type, please provide:

Your registration number

Further details if you are a Religious Establishment or a Trust but do not need to

register with the TRS.

Section 5

Non-registered organisations

5.2 Organisation beneficiaries

Section 5

Non-registered

organisations

Section 5 continued overleaf

5.1 Non-registered organisations

If supporting documents are needed, please

provide a copy when sending us your

application form.

5.2 Organisation beneficiaries

Please state who or what are the main

beneficiaries of your charitable activity.

Beneficiaries could be people, groups

of people or organisations that your

organisation is set up to help. This may be

found in your governing document.

13

5.3 Founders, protectors and settlors or equivalent (for trusts only)

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

5.3 Founders, protectors and settlors or

equivalent

Please complete full details for any founders,

protectors or settlors the trust may have.

These are found in your trust deed.

Please provide the full legal name for each

founder, protector or settlor. We need this

information in order to identify them. We

are not able to accept shortened versions of

names.

5.4 Beneficial owners

Please complete full details for any

beneficial owners you may have.

A beneficial owner is an individual who

ultimately owns or controls 20% or more of

the organisation in relation to share of the

capital, profits, voting rights, capital of the

trust property or who operates or has control

over a trust, meaning having the power to:

n dispose of, advance, lend, invest, pay or

apply trust property;

n vary the trust;

n add or remove persons as a beneficiary

or to or from a class of beneficiaries;

n appoint or remove trustees; or

n direct, withhold consent to or veto the

exercise of any of the above powers.

5.4 Beneficial owners

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Percentage held Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Section 5 continued overleaf

14

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Percentage held Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Percentage held Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

Mr

Mrs

Miss Other

Full legal name

Home address

Postcode

Percentage held Date of birth

dd/mm/yy

Home telephone number (incl std)

Nationality

15

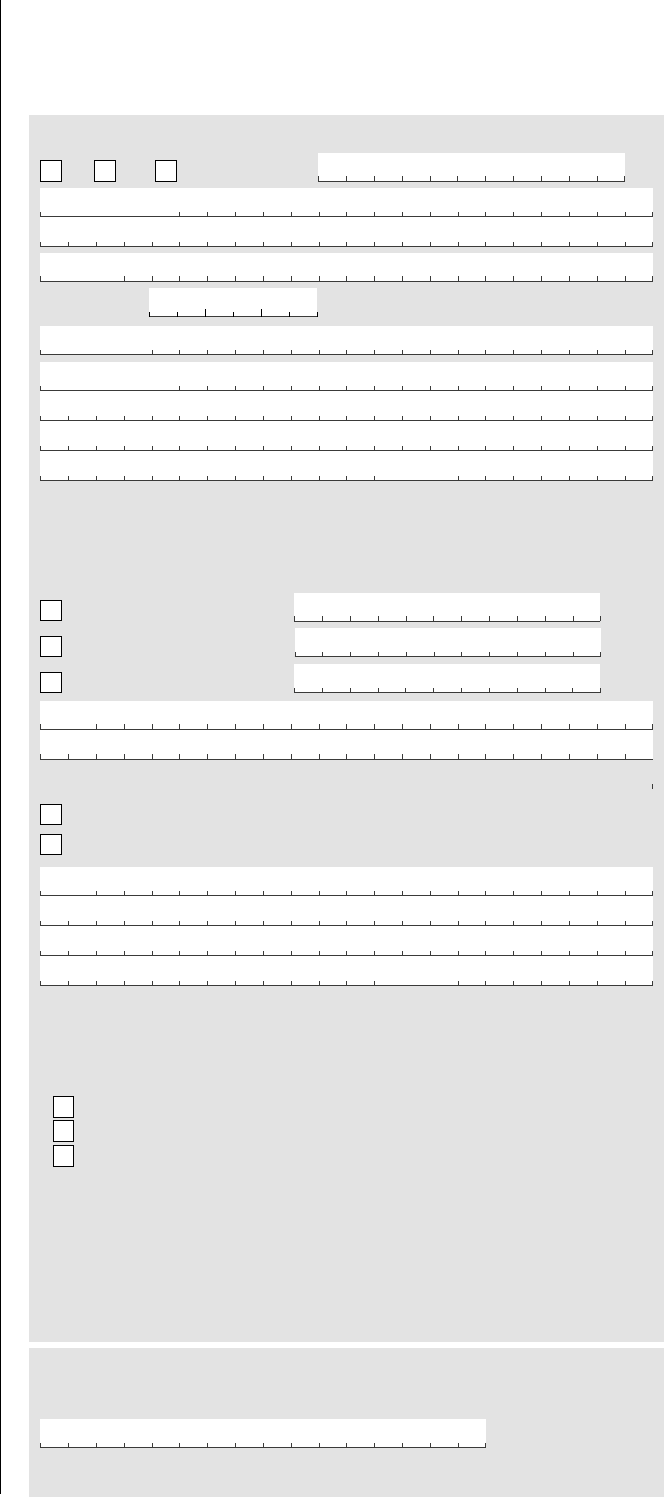

6.1 Account contact

Mr

Mrs

Miss Other

Full legal name

Position

Date of birth

dd/mm/yy

Nationality

Home address

Postcode

If you have lived at this address for less than three years, please complete a previous

address(es) form. This can be found at cafonline.org/applicationforms

Please complete all telephone numbers below and tick your preferred

option for us to contact you on.

Home telephone (landline)

Daytime contact number

Mobile telephone number

Email

Which address should we use to write to you?

Operating or registered address (as stated in 2.3)

Account contact's home address

Other

Postcode

As well as contacting you about this product or service, we would like to

send you information about other related products and services from the

CAF Group that we believe will be of interest to you.

I DO NOT want to receive this information by (tick all that apply):

Email

Phone

Post

Please note: if you tick a box, we will not be able to tell you about these products

and services in this way.

For information about how CAF handles your information, see our Privacy

Notice which you can nd at cafonline.org/privacy

CAF and the companies in which it has a majority stake, or their subsidiaries (defined

here as the CAF Group) will not share your information with any outside organisation

except as part of providing a product/service or when legally obliged to do so.

Section 6

Operating your new account

6.2 Telephone banking

Mandatory telephone password

Please refer to the guidance notes on the left hand side

Section 6 continued overleaf

Section 6

Operating your new account

Please ensure you fully complete all parts of

section 6.

6.1 Account contact

The account contact does not have to be a

signatory. The account contact does have to be

UK based.

The account contact will have authority to:

n act as the main CAF Bank Online

user which means they have full user

responsibility for administration of the

CAF Bank Online service and are able to:

– initiate money to be sent within the UK

online in accordance with the terms

and conditions

– set up additional users including

allocation of their user ID and password

– access day-to-day account information

n authorise money to be sent between

your organisation’s accounts by speaking to

us over the telephone

n act as the main user for CAF Bank

Online statements, being able to view

statements for all linked accounts.

The account contact should be someone

who is readily available and familiar with the

requirements of the account.

For identification purposes, the account

contact must provide their full name. If

they have a preferred/familiar name, please

include this in brackets after their full name.

If the account contact has lived at more

than one address in the previous three years

please complete their previous address details

on a Previous addresses form. This can be found

at cafonline.org/applicationforms or complete

a blank sheet listing name, address, postcode

and dates for each previous address.

We may need to call the account contact

Monday – Friday (9am-5pm) on the preferred

number chosen but we will use the other

numbers if necessary.

6.2 Telephone banking

Telephone banking is another easy way to access

and manage your accounts:

n access information about transactions

n cancel standing orders and Direct Debits

n get support with internet banking

Setting up a password is mandatory to use

our telephone banking service. The account

contact, along with any signatories detailed on

your Bank mandate, will require access to the

password. We recommend using a password

that is both secure, including alpha and

numerical characters, and easy to remember.

This will be used as part of our security

procedures. We will never ask for your full

password during the identification process.

If you do not provide a telephone password

here, your account will not be opened until

this is received.

16

6.3 CAF Bank Online

Would you like to register for CAF Bank Online?

Yes

No (go to section 6.4)

We will use the mobile telephone number provided in section 6.1 to

register the primary user for CAF Bank Online, including Text Alerts. This

registered device will be needed each time the account contact wishes

to log in, view or change their details, manage online users or authorise

money to be sent within the UK

Statements

Opt for online statements and we will use the email address of the

account contact provided in section 6.1 to make contact as part of

registration. Up to 36 months of statements can be viewed, downloaded,

saved and printed.

If you would prefer to receive your statements in paper format, please

tick here

How often would you like to receive statements for your CAF Bank account(s)?

CAF Cash Monthly Quarterly Yearly (online only)

CAF Gold Quarterly Yearly (online only)

Date of statement

6.4 Audit and Account Authority

Do you want us to provide your auditor or account authority with

information on your account?

Yes

No

If 'Yes' please complete this section.

Name of auditor/accountant

Address

Postcode

Section 6 continued overleaf

6.3 CAF Bank Online

CAF Bank Online is a quick and easy way to

access and manage your accounts.

If you choose to register for CAF Bank Online the

account contact will become the primary user,

meaning they will have full user administration

rights and will be able to:

ninitiate money to be sent within the UK

nauthorise money to be sent within the UK

nset up secondary online users with various

permissions, including allocation of their

User ID and Password

norder cheque and paying-in books

naccess all account information that is

available online.

For more information about CAF Bank Online,

read Section 11 of the CAF Bank General Terms

and Conditions which can be found at

cafonline.org/everydaybanking or the

CAF Bank Online User Guide which can be found

at cafonline.org/onlinebanking

If you choose online statements, the primary

user will have access to view all accounts that are

linked. Once your online banking is active they

will receive an email with further instructions.

If you do not select an option, we will

automatically send you paper statements.

By selecting the online statements option, you

can help us to reduce our paper usage.

6.4 Audit authority or accountant

Please complete the name and address of

your auditors or accountants to allow them to

request information on your account(s).

17

Section 6 continued overleaf

All banks face an increasingly stringent regulatory environment, from regulators here and around the world, which requires

them to put in place close monitoring of all accounts to ensure they comply with rules for financial transactions. We are

required to know our customers and where they send their money, the nature of any partner organisations and the

countries and regions in which they operate.

At CAF Bank, we take our obligations very seriously, and review all our accounts carefully and individually to ensure we

have the necessary understanding of our customers.

6.5 What is your reason for choosing a CAF Bank Account?

6.6 Will CAF Bank be your primary bankers?

6.7 What transactions do you expect to make on your proposed new account?

Please confirm the nature, size and frequency of transactions and describe the likely sources (i.e. remitting parties) of the

incoming payments and the likely destination of outgoing payments (i.e. beneficiary parties).

6.8 Where will the initial funding of the account come from?

Please indicate if cash or investments, the institution name and location, and the value of this initial funding. If the

funding is not from an account in your organisation's name, please provide the reason why.

18

6.9 Please confirm how your charity raises funds.

E.g. donations or grants, and the expected value of these.

6.10 How was the organisation originally funded, where did those funds come from, and what where they used for?

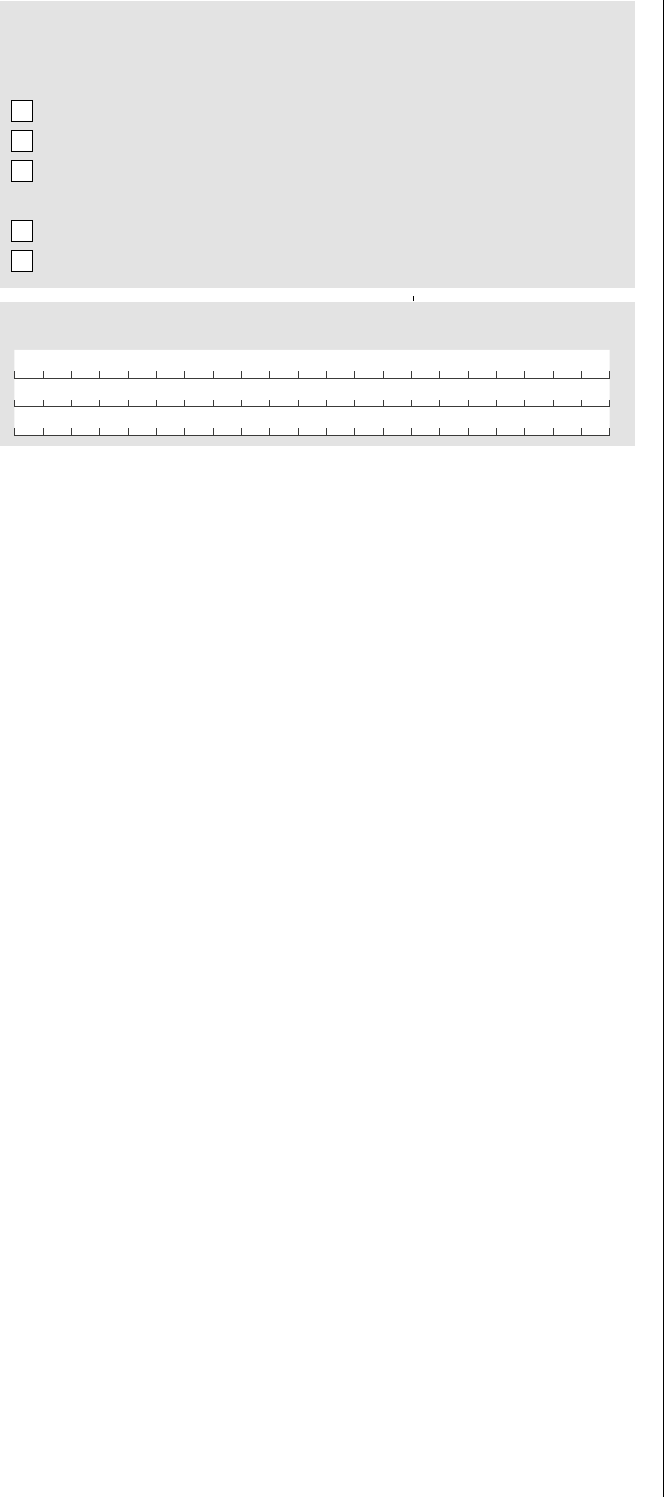

6.11 Do you have any of the following outside the UK? (Please tick)

Operations / activities / receive money from outside the UK/send money outside the UK/cash withdrawal outside the UK

Associated organisations

Partners (organisations you work with)

None of the above is relevant to our organisation.

If you have ticked any of the first three options above, please provide further details below:

6.12 Please give details of your organisation's activities in relation to sending money or receiving money.

n If you intend to send money outside the UK, please list the countries below and confirm the purpose, frequency and

indicate the type of beneficiaries.

n If you receive money from countries outside the UK, please list the countries below and confirm the sources,

purpose, frequency and indicate the type of donor.

n If you operate cash programmes (where you use cash in the UK or outside the UK rather than sending money

electronically), please state any procedures you have in place to protect the diversion of funds.

Section 6 continued overleaf

19

6.13 Please describe your policies and procedures in connection with your operations or money sent to individuals or

organisations outside the UK.

Include how you identify and know the true nature of your beneficiaries.

6.14 Please provide us with a copy of your organisation's governing document. Make sure you include a copy of any

amendments or additions that have been made since the inception of your charity and its original governing document.

Tick this box to indicate that you have included a copy of your governing document with your application.

PAGE 1 of 2

Bank Mandate

Please complete this section with the personal details of all

authorised signatories.

This form will only be used for the account(s) being opened

in this application. If you are an existing customer and wish

to update signatories on your existing account(s), please ask

for a separate Bank Mandate form.

We will hold this Bank Mandate on our files as proof of the

individuals who are authorised to manage your CAF Bank account.

Please retain a copy of the Bank Mandate for your future

reference. It is important to keep your signatories up-to-date to

ensure your banking facilities are not compromised at any time.

Instruction format

Please tell us how you would like your account to run, eg, a minimum

of two signatures for cheques, three signatures for other instructions

etc. Please ensure you meet any signing stipulations as stated in your

most up-to-date governing document.

Please accept:

Two signatures

Other*

*Please indicate briefly how you wish us to accept instructions.

Your organisation name

authorises any individual named below in ‘Signatories’ (an ‘authorised person’) either individually or, if relevant, with other authorised

person(s) in accordance with the information contained in ‘Instruction format’ below to:

Signatories

Please note: CAF Bank would advise a minimum of two signatories.

Ensure that all sample signatures are exactly as your signatories would normally sign as any discrepancy may result in

requests for money to be sent being returned.

In some rare circumstances we may be required to contact the signatories using the contact details provided on this form.

Account signatory 1

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account signatory 2

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account number(s)

Sample signature

Sample signature

(a) vary the terms of their Bank Mandate and vary or enter into

any other agreements with the Bank which they consider to

be in our interests from time to time; and

(b) give instructions concerning the operation of our bank

accounts and otherwise communicate with the Bank in

accordance with the Bank’s applicable terms and conditions

and this mandate; and

(c) give other instructions or request information to the Bank in

relation to the Accounts; opening accounts with the same

signing rules and authorised signatories; closing accounts; or

other banking services or products.

This Bank Mandate will continue until you give the Bank a replacement

instruction by completing and returning an updated Bank Mandate

signed in accordance with this Bank Mandate.

PAGE 2 of 2

Account signatory 3

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account signatory 4

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account signatory 5

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Sample signature

Home telephone

Position

Account signatory 6

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account signatory 7

Mr

Mrs

Miss Other

Full legal name

Nationality

Date of birth

dd/mm/yy

Home address

Postcode

Home telephone

Position

Account number(s)

Sample signature

Sample signature

Sample signature

Sample signature

This form is for authorised signatories or account contact who have lived at their current address for less than three years.

Please supply further address details to complete the process.

Please complete your full name, house name or number, road name, and the postcode. To find out how we handle your

personal information, you can view our Privacy Notice here: www.cafonline.org/privacy

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Previous address (es)

Previous addresses

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

Full legal name

House name/number, road name

Postcode

Date from

d d m m y y

to

d d m m y y

CDT-2099/0524

Telephone calls may be monitored or recorded for security/training purposes.

Lines are open Monday to Friday 9am - 5pm (excluding English bank holidays).

CAF Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204451).

CAF Bank Limited Registered oce is 25 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4JQ.

Registered in England and Wales under number 1837656.

1

To complete our application for a CAF Bank account, we confirm that we:

n have submitted an extract of the minutes of a meeting attended by our board of directors/trustees or equivalent, where it

shows authority to open a new bank account. This has been signed by our chairperson (the signature must be an original).

n have obtained the correct number of signatures to authorise this application in line with the signing guidance below, and

have clearly stated their positions.

n agree that we will operate the account in line with our governing document.

n have read the CAF Bank Terms and Conditions. We acknowledge and accept by signing and submitting this application that

all parties to the account are agreeing to be bound by the CAF Bank Terms and Conditions as they apply to our account.

n have read and understood the CAF Gold Account Summary Box information, if we are opening a CAF Gold Account.

n have sought professional advice and guidance before submitting our application, if there was anything we did not fully

understand.

n have received the FSCS Information sheet provided with this application.

n have obtained authorisation from the persons detailed on this application and that they have authorised the disclosure of

their personal details to CAF Bank and are aware of how their data may be used and if further information is required they

are aware that CAF Bank may contact them directly.

n understand that the personal information we have provided to CAF Bank will be shared with fraud prevention agencies,

who will use it to prevent fraud and money laundering and to verify identities. If fraud is detected, we could be refused

certain services. We understand that further details of how our information will be used by CAF Bank and these fraud

prevention agencies, and our data protection rights, can be found at www.cafonline.org/privacy

n have provided correct and complete information in this application.

n understand that our application may be delayed if we do not provide any additional information should it be requested by

CAF Bank and accept the account application may not proceed. CAF Bank will keep us informed if this is the case.

n approve our account contact to also be our administrator for online banking who will have responsibility for managing

secondary users. We understand that by assigning any user of online banking with administrator permissions we are

granting them the same level of access, authority and control as the administrator.

n acknowledge that the information contained in this application form and the information regarding the Account Holder and

any Reportable Account(s) (as defined in the Notes and definitions for information relevant to AEOI) may be reported to HM

Revenue & Customs and exchanged with tax authorities of another country or countries in which the Account Holder or

its Controlling Person(s) may be tax-resident pursuant to intergovernmental agreements to exchange account information

with the UK, existing currently or in the future.

n must inform CAF Bank as soon as we know of any change in circumstances, and any event within 30 days, which affects

tax responsibilities of the Account Holder identified in this form or causes the information contained herein to become

incorrect or incomplete. We must provide CAF Bank with updated information and a replacement Declaration as soon as

we know of such change in circumstances.

n understand that all persons who provide personal data to CAF Bank must familiarise themselves with the CAF group

Privacy Notice, which can be found at www.cafonline.org/privacy

Certi fication

Certification signing guidance

Authorised signatories

Girlguiding groups, Scout groups, community amateur sports clubs, educational establishments and armed forces.

Please ensure that at least two of the trustees who you have listed in your application have signed this form.

Companies, LLPs and CICs

Please ensure that at least two directors (as registered with Companies House) or one director and the Company Secretary

have signed the certication page.

Charitable Incorporated Organisations (CIOs)

Please ensure that at least two of the trustees who you have listed in your application have signed this form.

Unincorporated trusts, associations, clubs, societies, religious establishments, mutual societies and other charitable organisations

Please ensure the certication page has been signed by the number of people required by your trust deed, rules of

association or similar.

Telephone calls may be monitored or recorded for security/training purposes.

Lines are open Monday to Friday 9am - 5pm (excluding English bank holidays).

CAF Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204451).

CAF Bank Limited Registered oce is 25 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4JQ.

Registered in England and Wales under number 1837656.

CDT-2086/0524

Full legal name

Position

Authorised signature

Date

d d m m y y y y

Full legal name

Position

Authorised signature

Date

d d m m y y y y

The position stated should represent the required title for the signing authority stated above and for that which is stated in

your governing document.

Eective from 13 February 2024

GENERAL TERMS AND CONDITIONS

2

Contents

Words and Terms we use 3

1 Introduction 6

General Terms and Conditions 7

2 These Terms and Conditions 7

3 Opening an Account 7

4 Deposits, Withdrawals

and Payments 7

5 When might we refuse to make a Payment,

accept an instruction or apply restrictions

on your Account? 10

6 Account closure or transfer 11

7 Interest 11

8 Charges 11

9 When do you need to contact us? 11

10 Statements 12

11 Our Online Service 12

12 Telephone Banking Service 14

13 CAF Bank Mastercard

®

Business card 14

14 Using and safeguarding

Security Details 16

15 Using, processing and sharing your information 17

16 Tax reporting 17

17 Arranged Overdraft services 17

18 Set-off 17

19 Liabilities 18

20 Amendments to the Terms and

Conditions relating to your Account 19

21 Miscellaneous 19

22 How you can make a complaint 19

23 Regulatory protection 19

About CAF Bank 20

3

Access code: A code, made up of numbers, given by us to

the Cardholder to allow the Cardholder to activate the Card

and access the PIN.

Account: Any Bank Account that you hold with us.

Account Contact: The person assigned by you to be the

first point of contact between you and us. The Account

Contact does not have to be a signatory on the Account.

This person will also be your Primary User. See also

Primary User.

Account Terms: The Terms and Conditions (that are

additional and separate to these Term and Conditions)

relating to your Account.

Agency Bank: A bank that does not process payments itself

and uses another bank to process the clearing of payments.

See also Clearing Bank.

Application Documentation: The application form and any

other documents requested by us for the opening of an

Account.

Arranged Overdraft: An agreed limit that lets you spend

more money than you have in your current Account.

The maximum amount is determined by us and there is

normally a charge to use this service as set out in our

Tariff of Charges.

Bacs Transfer: An electronic money transfer between

banks which normally takes three working days.

CAF Bank UniqueCode: Passcode generated on the CAF

Bank App or sent to you by text message to use as two-

factor authentication for the Online Service.

CAF Group: Our parent organisation, Charities Aid

Foundation (registered charity number 268369) or any of its

subsidiaries, associated and affiliated companies.

Card: A CAF Bank Mastercard

®

Business card which is linked

to your CAF Cash Account.

Cardholder: A person nominated by you to receive and use

a Card to make Transactions on behalf of the organisation.

Card Transactions: Purchases, Payments and cash

Withdrawals made using the Card.

CHAPS Transfer: A same-day transfer between banks that

can be used for large amounts of money. There is normally

a charge for a CHAPS payment as set out in our Tariff of

Charges.

Clearing Bank: A bank which we use to process all our

payments for us. See also Agency Bank.

Controlling Persons: The natural person exercising control

over the corporation, organisation, partnership, trust,

foundation, or other entity. This includes anyone exercising

ultimate effective control over the entity (including any

Words and Terms we use

natural person holding directly or indirectly (solely or in

connection with others) 25% or more of the voting rights

or shares. If no such person(s) exist(s), then it includes any

natural person who exercises control over the management

of the entity (e.g., the senior management official). In the

case of a trust, controlling persons could include the settlor,

the trustees, or the beneficiaries, including persons holding

equivalent roles irrespective of title.

Credits: Payments into your Account.

Data Protection Legislation: The United Kingdom laws and

regulations that aim to safeguard the privacy and security

of personal data.

Deposit: A sum of money paid into the bank Account.

Direct Debit: An instruction you give to us that authorises

a company to take payments from your account when they

are due. The amount may vary but the organisation must let

you know if the amount changes.

Direct Debit Scheme Guarantee: A guarantee which

protects you in the event of an error with your Direct Debit

payment. This is normally used when the organisation you

are trying to pay changes the date, amount or frequency

without notifying you before the funds come out of your

Account. We may need to review the transaction before

activating the guarantee.

European Economic Area (EEA): All member states of the

European Union, plus Iceland, Liechtenstein, and Norway.

Faster Payments: A payment system that banks use to

transfer money within the UK. The timescales for these

Payments are set out in Condition 4.29.

These can be requested using the Online Service and are

sent as electronic transfers.

Group Payment: A list of payees can be created to make

payments using the Online Service, for example payroll.

High Volume Cash Transactions: Refer to the Tariff of

Charges.

High Volume Cheque Transactions: Refer to the Tariff of

Charges.

HSBC: HSBC Bank plc, a company incorporated in England

and Wales under number 14259. HSBC is authorised and

regulated by the Financial Conduct Authority and the

Prudential Regulation Authority under number 114216.

Individuals: Signatories, trustees, Account Contact, online

users and Cardholders or any other persons who are

authorised by you to operate the bank Account.

Insolvency Events: Any event where:

n You stop or delay payment of your debts or are

regarded as being unable to pay your debts; or

n Any step, application or proceeding is taken by or

against you for:

4

n The dissolution, winding up or bankruptcy of your

organisation; or

n The appointment of a receiver, administrative

receiver, administrator, or similar officer to you or

over all or any part of your assets or undertaking.

n You are a partnership, and this partnership is dissolved

or joins or merges with another partnership;

n You negotiate with any of your creditors to readjust

or reschedule your debts, ask to enter a voluntary

arrangement, or enter an arrangement which benefits

any of your creditors;

n You stop or delay or threaten to stop or delay all or a

substantial part of your operations as a business.

n Any event occurs which, under the applicable law of

any jurisdiction, has an equivalent to any of the events

mentioned above.

In Writing: We will contact you by email, text message,

letter, secure e-messages, or any other method of written

communication. This includes messages on our website,

www.cafonline.org, or with the Statements for your

Account.

Mandate: This tells us who you would like to give access to

your Account and who has the right to operate it.

Nominated Account: An account in your organisation’s

name, held with another bank. You provide us with the

details of this account to allow for Payments to be made

without providing these details every time.

Online Service: Accessing information and services

relating to your Account by logging in to our website

(https://secure.cafbank.org/). You need to be registered

for this service and we will provide you with your Security

Details.

One Time Passcode (OTP): A number which is normally sent

to you by text message to authorise Payments.

Payee: The person or firm you would like to pay.

Payments: Sending money to another account in or outside

of the UK and making Card Transactions in pound sterling or

foreign currency using the Card.

Payment Device: A Card, an electronic wallet or any other

device or software that you can use on its own or with your

Security Details to access your Account or give instructions.

Primary User: The main user who has access to your

Account using the Online Service. This person is responsible

for letting us know of changes which may affect other users

of the Online Service and includes removing user(s) who are

no longer authorised to access the Online Service.

Post Office: A company registered in England and Wales

under number 2154540. Registered address: 100 Wood

Street, London, EC2V 7ER.

RBS: The Royal Bank of Scotland plc, a company

incorporated in Scotland under number 90312.

RBS is authorised and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority under

number 121882.

Secondary User: Any additional user you have authorised

to have access to your Account using the Online Service.

Security Details: Details that are unique to you which we

have provided you, or those you have chosen, to allow you

to use your Account in a secure way. Some examples are:

n The User ID, password, unique word, and CAF Bank

UniqueCode used for our Online Service;

n The telephone password and/or additional security

information we may request from you to process any

transactions on your Account;

n The signatures on any written instruction, including

cheques, you provide to us;

n The use of a Card, Access Code, personal identification

number (PIN), and One Time Passcode; and

n Any other security requirements we may notify you of

from time to time.

Single Immediate Payment: Payments which are credited

more quickly to the payee’s account than other forms of

Faster Payments. The charge for this type of Payment is set

out in our Tariff of Charges.

Statement: A document showing all the Payments into

and out of the Account, including the date of transactions;

details of the sender/recipient and any references where

these are given. Additional information such as opening

balances, closing balances, charges, and interest is also

shown on your statement.

Standing Order: A regular Payment of an exact amount that

you set up and is paid on a specified date. You can change

or stop a Standing Order at any time by contacting us in

writing.

SWIF T: A way of making a Payment using pound sterling

from the UK to another country or Payments in a currency

other than pound sterling.

Tariff of Charges: A list of charges which are payable and

can be found at www.cafonline.org/cafbank-tariff-terms,

as amended from time to time.

Telephone Banking Service: Accessing information and

certain services relating to your Account by telephone. You

need to be registered for this service which includes setting

up Security Details. The Account Contact will be the Primary

User for this.

Text Alert: The feature of our Online Service which sends an

SMS message to a UK mobile number registered with us.

Transactions: Credits and Withdrawals from your Account.

Value Date: The date a Payment is posted to your Account.

5

Withdrawals: These can be made from your Account in the

following ways:

n Cash withdrawals at ATMs (both in and out of the UK);

n Card Transactions;

n Writing a cheque;

n Payments using our Online Service; Telephone Banking

Services or sending a request to us in writing, and

n Electronic payments such as standing orders and direct

debits

Working Day: Any day which is not a Saturday, Sunday or

English public or bank holiday.

6

1 Introduction

1.1 This document will provide important information to

consider before opening an Account with CAF Bank.

It is important that you read this information

and keep a copy for your reference. Copies of all

documents can also be found on our website at