City National Business Suite

®

Mobile Application

User Guide

September 2023

The information contained in this document is confidential and only for the intended recipient. It

may not be used, published or redistributed without the prior written consent of City National

Bank.

C

ity National Bank Member FDIC. City National Bank is a subsidiary of Royal Bank of Canada.

© 2023 City National Bank. All Rights Reserved.

September 2023 Business Suite Mobile App

2

Contents

Application or Web Experience ...................................................................................................................... 3

Security .......................................................................................................................................................... 3

Getting Started ............................................................................................................................................... 4

Important Notes:

........................................................................................................................................................................ 4

For Users with Personal Banking* and Business Suite:

............................................................................................ 4

Dashboard ...................................................................................................................................................... 6

Menu .............................................................................................................................................................. 8

Accounts…………………………………………………………………………………………………………….…..8

Balances and Activities………………………………………………………………………………………………..8

USD Accounts……………………………………………………………………………………………………………………………….……,8

Foreign Currency Deposit Accounts ................................................................................................................................................ 10

Deposit Accounts ........................................................................................................................................................................ 10

Time Deposit Accounts ............................................................................................................................................................... 11

Investment Sweep Accounts ........................................................................................................................................................... 11

Loan Accounts

............................................................................................................................................................................... 12

Stop Pay Requests.......................................................................................................................................................................... 13

Transfers ......................................................................................................................................................................... 14

Quick Transfers ............................................................................................................................................................................... 14

Approve Transfers ........................................................................................................................................................................... 15

Payments ........................................................................................................................................................................ 17

Bill Pay – Single Payment ............................................................................................................................................................... 17

Bill Pay – Approve Payments .......................................................................................................................................................... 18

Bill Pay – Activity (Scheduled Payments) and History ..................................................................................................................... 19

Canceling a Payment ...................................................................................................................................................................... 20

History ............................................................................................................................................................................. 20

Payments Requiring Approval ........................................................................................................................................ 20

Recurring Exceptions (Payments) .................................................................................................................................. 22

E-Deposit ........................................................................................................................................................................ 23

Create Deposit

........................................................................................................................................................................... 23

Add items

................................................................................................................................................................................... 24

Confirmation and Transmission

................................................................................................................................................ 25

Deposits

..................................................................................................................................................................................... 27

Fraud Control .................................................................................................................................................................. 28

Exceptions ....................................................................................................................................................................................... 28

Decision History .............................................................................................................................................................................. 29

Check Issue/Voids .......................................................................................................................................................... 30

Administration ................................................................................................................................................................. 32

About CNB ...................................................................................................................................................................... 34

September 2023 Business Suite Mobile App

3

Application or Web Experience

City National Bank provides City National Business Suite® Mobile in two ways:

the City National Bank App

®

(“Mobile App”) and the Mobile Web Experience.

Most users of Business Suite will do so through the Mobile App, which is

described in this User Guide.

If you prefer using the Mobile Web Experience instead of the Mobile App,

refer to the Mobile Web Experience User Guide.

Security

With City National Business Suite Mobile through the City National Bank App, you will enjoy the

same safety and security that you currently experience with web-based Business Suite on your

office computer. This includes:

•

Multi-user entitlement controls.

•

All users must first be entitled for Business Suite by your company’s System

A

dministrator.

•

Users access the Mobile App with the same user credentials as those used online for

the web-based system.

Secure Logon and Session Management features include:

•

Credentials are validated using our secure multi-factor authentication process.

•

No sensitive information is stored on the mobile device.

•

Automatic session timeout after 10 minutes of inactivity.

•

Users are given a unique session upon successful logging and can only be logged in

from one device/browser at a time.

•

Session is encrypted using device-specific information.

Enabling Users for Business Suite Mobile

Business Suite Mobile is automatically available to all Business Suite clients

and the designated System Administrators who download the Mobile App. In

other words, all users who have access to Business Suite will have access to

Business Suite Mobile.

September 2023 Business Suite Mobile App

4

Getting Started

Important Notes:

•

INITIAL USER SET UP: Before downloading the Mobile App and logging into the mobile

service, you must first be setup on Business Suite by your System Administrator and then

you must establish your login credentials and security information on your office computer,

before you activate the Mobile App.

•

EXPIRED PASSWORD: If your password has expired, you must first reset the password

on your office computer before attempting to use the Mobile App. It is not possible t

o

re

set your password on your mobile device.

•

USER ACCESS: The features you are entitled to access through the Mobile App are

determined by your online user entitlements and whether the feature is also available on

the mobile service. For example, if bill pay service is not available to you on your desktop

computer, it will not be available to you on the mobile service.

•

MOBILE PHONE OR OTHER DEVICE AND PAGE ORIENTATION: The site is designed

for viewing on a mobile phone using either portrait or landscape orientation.

•

HISTORICAL DATA: Available transaction history conforms to what is available on the

desktop.

•

SUPPORTED BROWSER/OPERATING SYSTEMS:

o

Safari 10+; iOS 10+

o

Chrome 49+; Android 7 Nougat

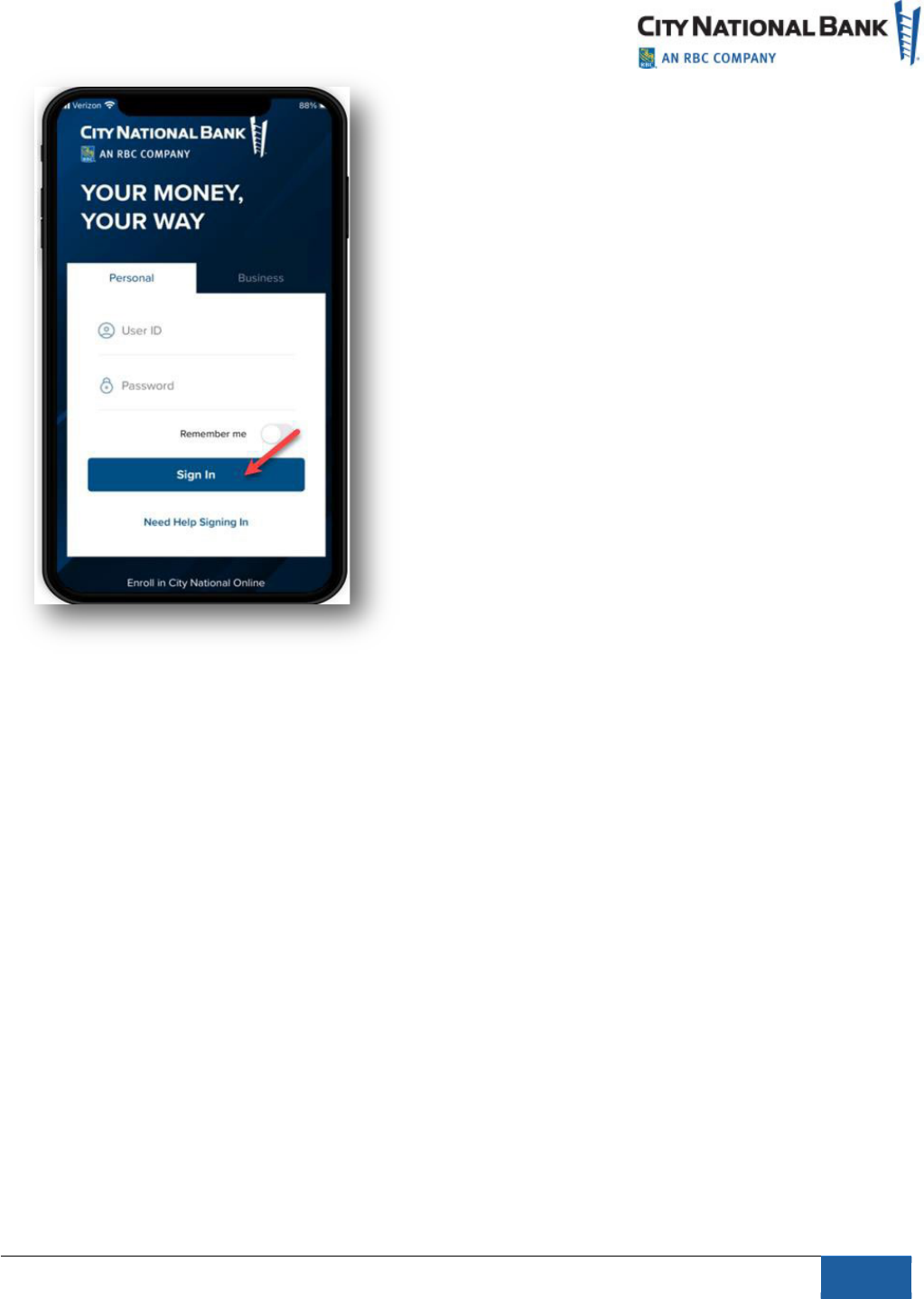

For Users with Personal Banking* and Business Suite:

1.

Download the Mobile App from your respective app store.

2.

After installing the Mobile App on your phone, select Get Started.

3.

Under the Personal tab, enter your Personal User ID and password,

when prompted.

*

Personal users have the ability to enroll in online banking via the Mobile App, by

selecting “Enroll in City National Online.” As a business user, please be sure you are

set up for City National Online and Business Suite before using mobile banking. Y

ou

w

ill be asked to read and consent to the terms and conditions for using the system

,

both on your computer and on the Mobile App, while setting up Business Suite on

y

our computer the first time.

4

September 2023 Business Suite Mobile App

5

The Mobile App provides personal users with the ability to access business

accounts in Business Suite, without having to re-enter a business ID each

time. You can set this up by following the instructions below.

1.

Go to

Settings

on the main navigation.

2.

Next, select

Business Suite Settings

.

3.

Follow the instructions to add your active business profile by

entering your Business Suite User ID and password information and

going through the validation process.

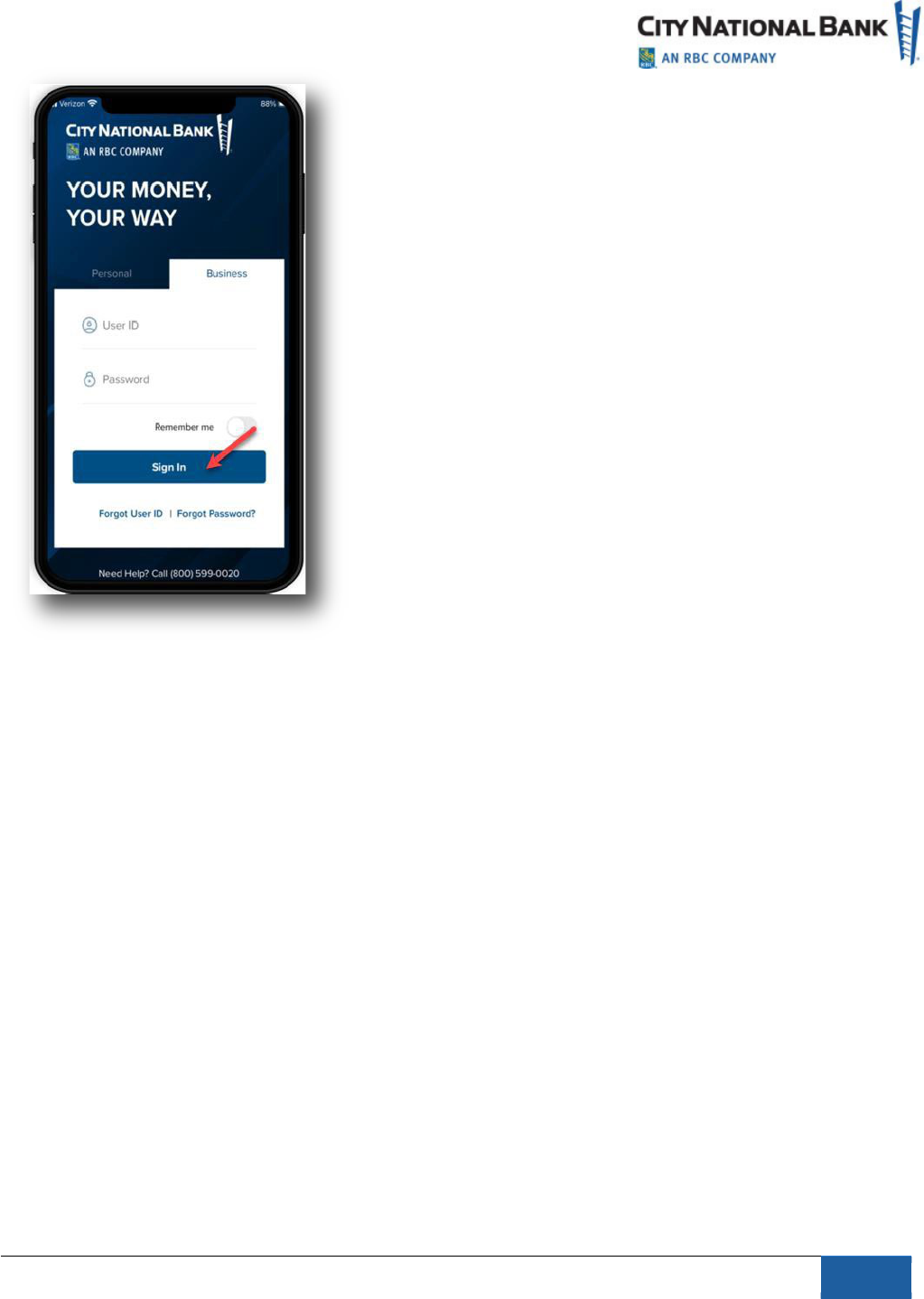

For users with Business Suite only:

1.

Download the Mobile App from your respective app store.

2.

After installing the Mobile App on your phone, select Get Started.

3.

Select the Business tab to access Business Banking.

4.

Enter your Business Suite User ID and password, when prompted.

September 2023 Business Suite Mobile App

6

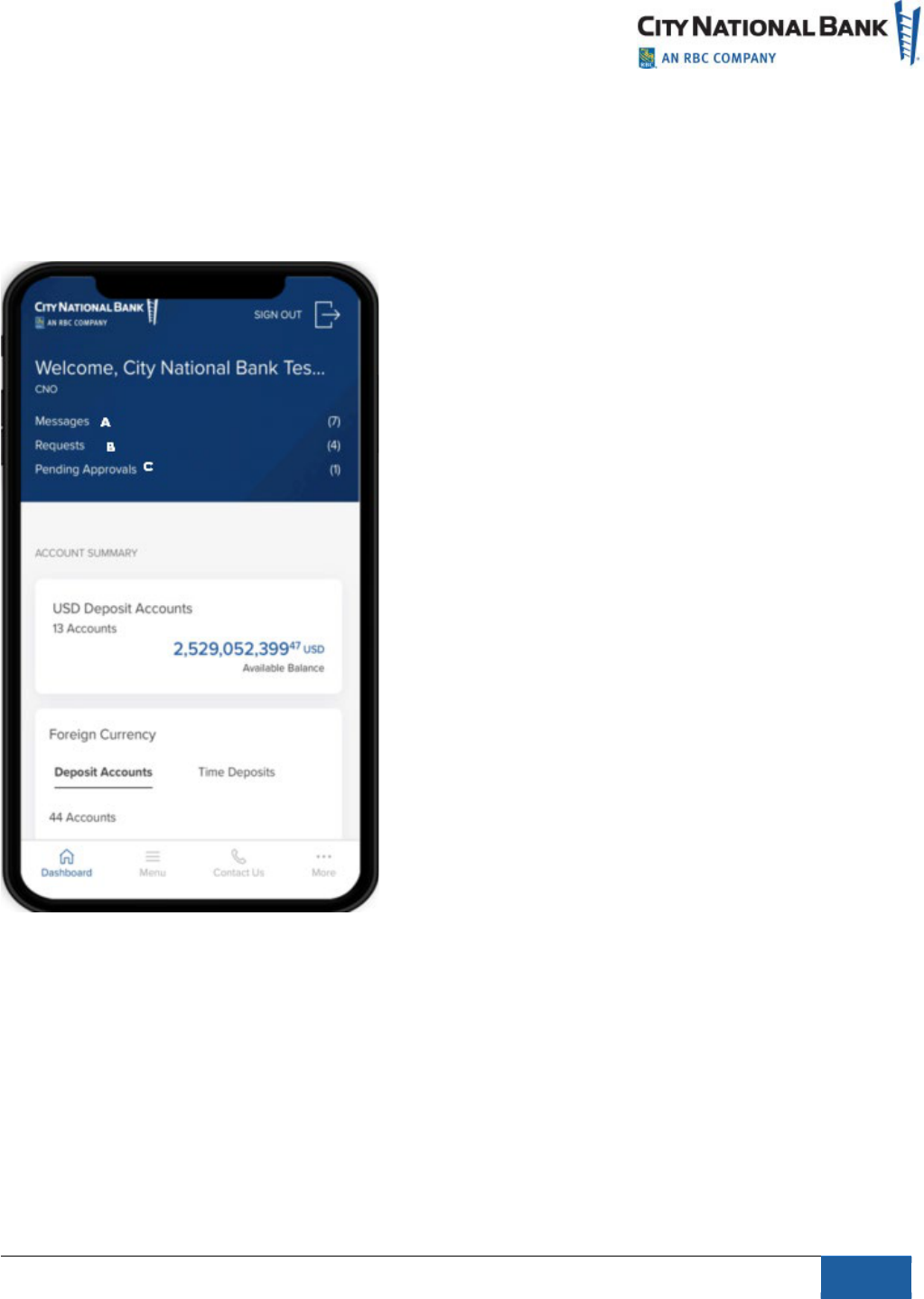

Dashboard

After signing in, the Dashboard page will display.

•

The Dashboard provides a summary of your accounts and corresponding

b

alances.

•

Get more details for each account by selecting the right arrow next to the account

type (e.g., US Dollar or Foreign Currency Deposits, Investment Sweeps or Loan).

Note:

When successfully signing into Business Suite on your computer for the first time, you

will have accepted the terms and conditions for using the Mobile App.

From the Dashboard, as shown below, you may choose to do the following:

•

See bank messages by going to the Message Center or by selecting

Messages

(A).

•

View the total number of user service-related

Requests

(B) you have submitted. (If link is

displayed)

•

Approve a request to unlock a user by selecting

Pending Approvals

(C). (If link is

displayed)

6

September 2023 Business Suite Mobile App

7

If links are displayed within Requests and Pending Approvals, you can filter and sort by:

•

User

•

Approver

•

Request Type

Note:

Search words are case-sensitive.

September 2023 Business Suite Mobile App

8

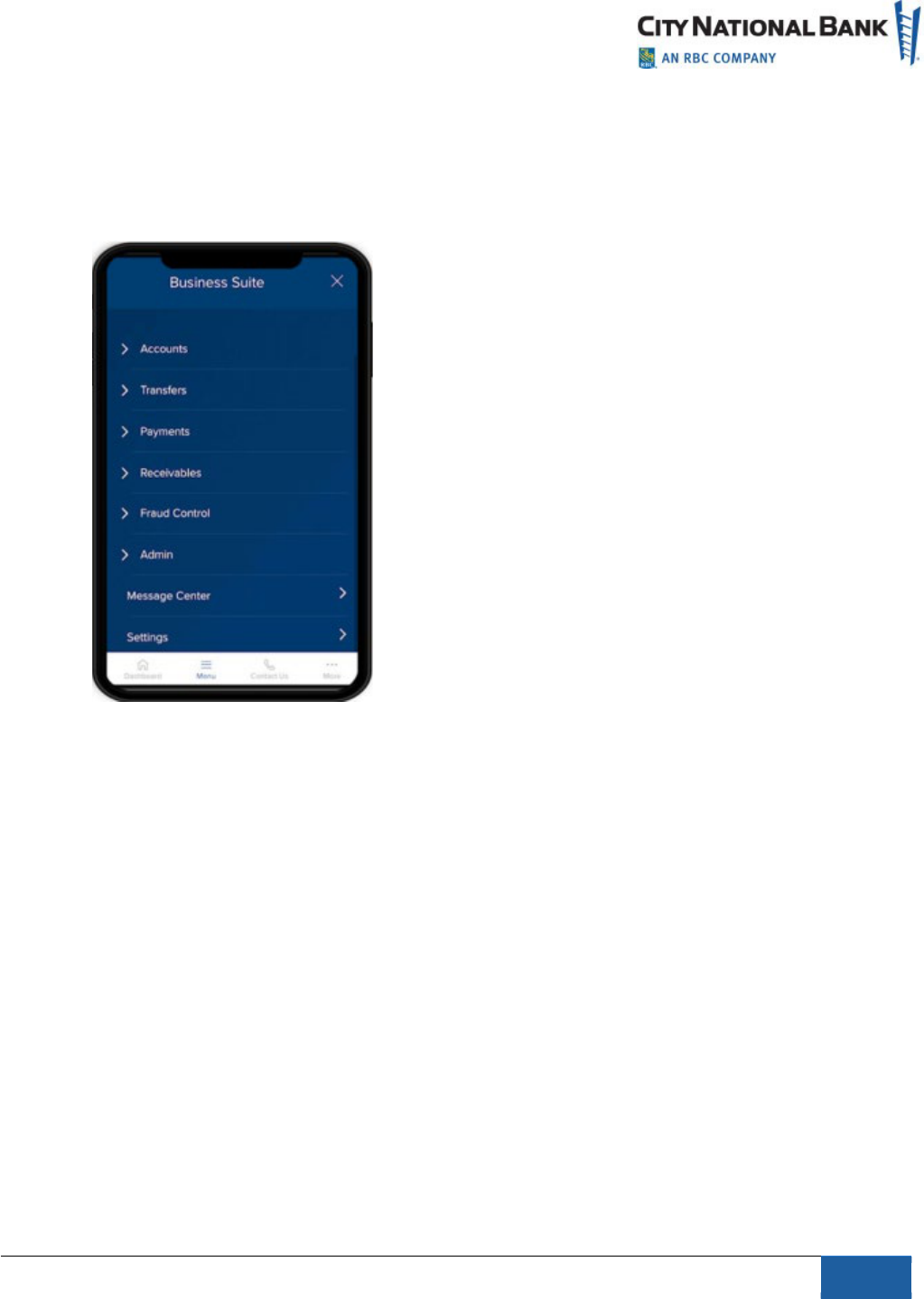

Menu

From the Menu, you will navigate to the different modules/types of service by selecting the

appropriate menu item.

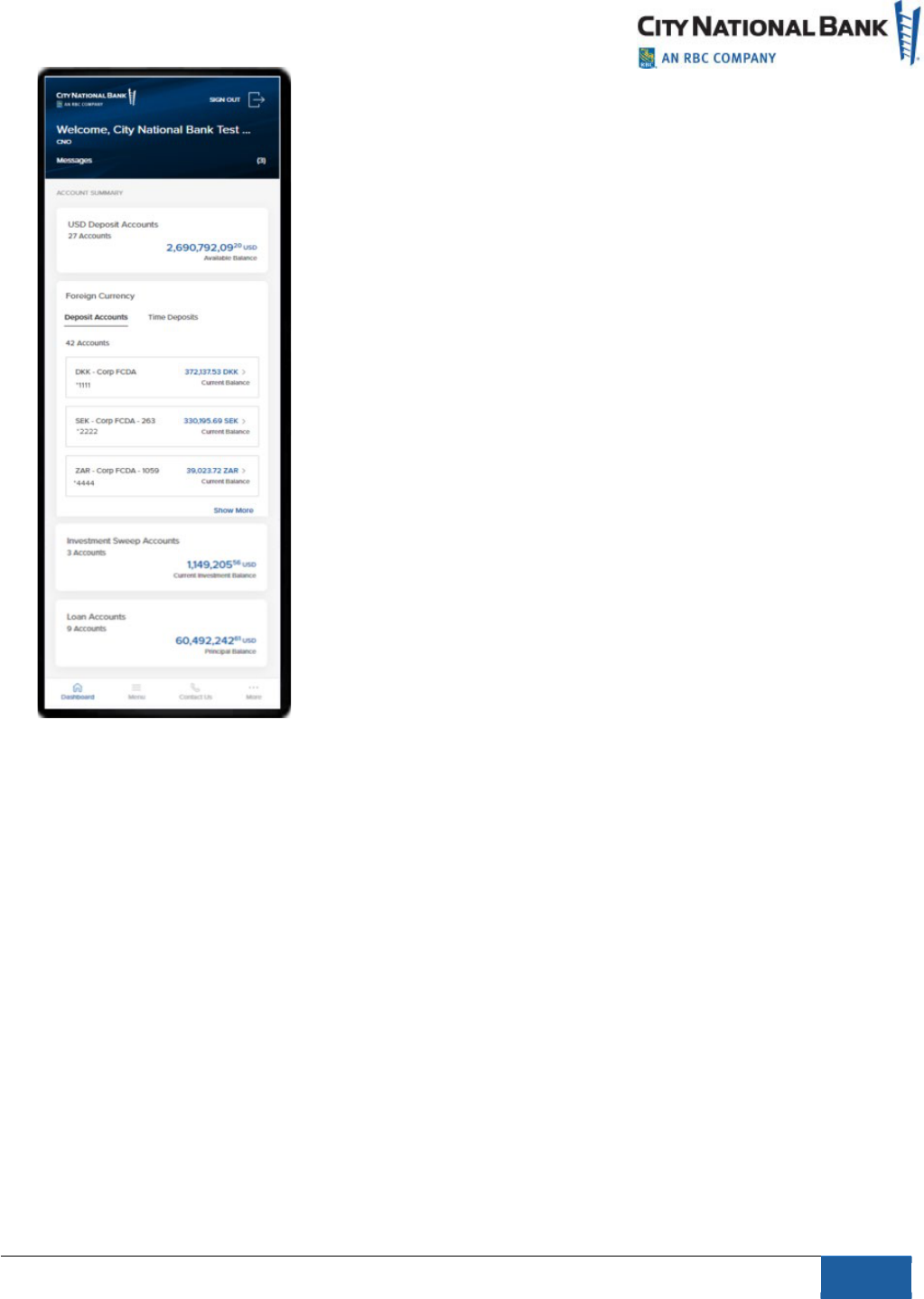

Accounts

Account Summary

Account Summary provides an overview of the different types of accounts you have (e.g., US

Dollar and Foreign Currency Deposit Accounts, Investment Sweeps and Loan Accounts) and the

accounts within each type. It also shows balance information and detailed account activities.

Balances and Activities

USD Deposit Accounts

1. From the Dashboard, select USD Deposit Accounts.

2. All your deposit accounts will be displayed.

3. Each account will include the following information:

•

Account name

•

Last 4 digits of the account number

8

8

September 2023 Business Suite Mobile App

9

•

Available Balance

•

Ledger

•

Related Available

•

Net Activity Today

•

Total Accessible

3.

You can search by Account Name or Number and f

ilter by:

•

Account Name

•

Account Number

•

Available

•

Ledger

•

Total Accessible

•

Net Activity Today

•

Related Available

Sort by: (ascending or descending order)

•

Account Name

•

Account Number

•

Available

4.

To view all transactions for an account, select View Transactions.

Yo

u can search Account Transactions by Description or by Serial Number.

You can also

filter Transactions by the following categories:

•

Check Paid

September 2023 Business Suite Mobile App

10

•

Debits

•

Credits

•

Select a date range: Today, Prior Day, Last 7 Days, Last 30 Days, Custom Range, Select

a Status, Pending Cleared, Search by Amount

Sort by: (ascending or descending order)

•

Date

•

Description

•

Serial #

•

Amount

5.

Select a transaction to view transaction details. Transaction Details include the following

information:

•

Date

•

Description

•

Image (if available for the item)

•

Serial Number (if applicable)

•

Status

•

Balance of the account

Foreign Currency Deposit Accounts

From the Dashboard, select Deposit Accounts or Time Deposits.

Deposit Accounts

1. Select by currency (when there is more than one account for that currency) or by a specific

account, to view details such as balance and transactions. Each account will include the

following information:

• Account name

• Last 4 digits of the Account Number

2. View balance information

3. Search by Account Name or Account Number

4. Filter by:

• Current Balance

• Ledger

• Available

• Search by Amount

• Sort by:

• Account Name

• Account Number

• Current Balance

5. View Transactions

6. Search Account Transactions

7. Filter by:

• Debi

t

• C

redit

September 2023 Business Suite Mobile App

11

• Date

:

• Last 30 days (default)

• Today

• Prior Day

• Last 7 Days

• Set a Custom Range

• Amount

8. Sort by:

• Date

• Description

• Amount

9. View Transaction Details for additional information such as Date, Description, and Status.

Time Deposit Accounts

• All your deposit accounts will be displayed.

• Select by currency (when there is more than one account for that currency) or by a specifi

c

ac

count, to view details such as balance and transactions.

• Each account will include the following information:

• Account name

• Last 4 digits of the Account Number

• Balanc

e

• Maturity Date

• As of Date/Time

Inv

estment Sweep Accounts

1.

From the Dashboard, select Investment Sweep Accounts.

2.

All accounts will display with the following information:

• Account name

• Last 4 digits of the Account Number

• Rate

• Available Balance

• Fund Name

• Current Investment Balance

• Pending Transactions

• Current 7-Day Yield

• Current 30-Day Yield

• As of Date/Time

September 2023 Business Suite Mobile App

12

Loan Accounts

1.

From the Dashboard, select

Loan Accounts

.

2.

All accounts will display with the following information:

•

Account name

•

Last 4 digits of the Account Number

•

Principal Balance

•

Interest Rate

•

Next Due Date

•

Maturity Date

3

.

Search by Account Name or Account Number.

• Filter by:

• Amount

• Interest Rates

• Next Due Date

• Maturity Dates

• Sort by:

• Account Name

• Account Number

• Principal Balance

• Interest Rate

• Next Due Date

• Maturity Date

September 2023 Business Suite Mobile App

13

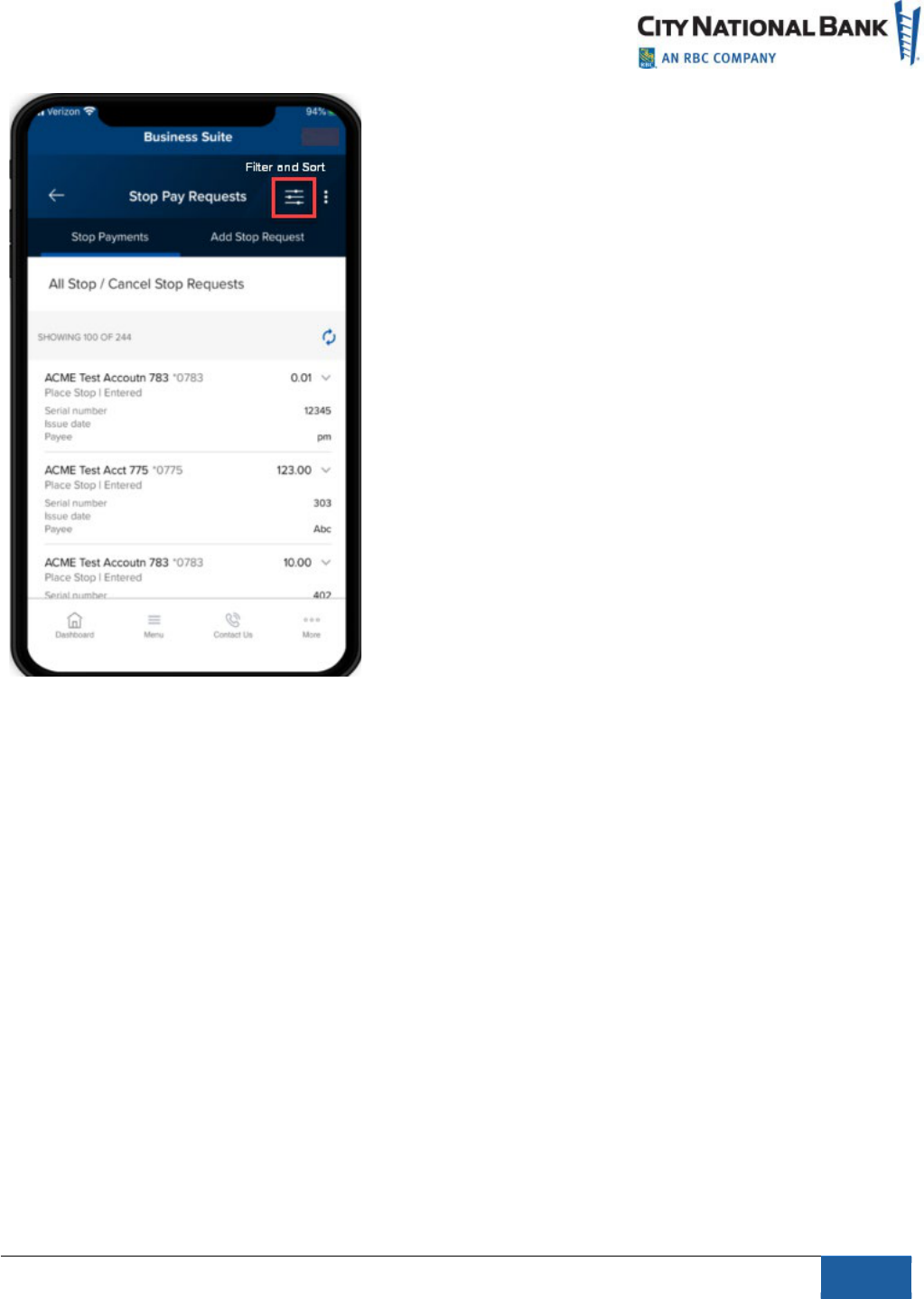

Stop Pay Requests

Approve a Stop Pay Request for a single check and for a range of checks. You may also cancel a

stop on a single check.

1.

Select

Accounts

from the Menu.

2.

Select

Stop Pay Requests.

A list of items will display.

3.

Select a check (or *multiple items) to

Approve for Stop Payment

or

Cancel Stop

P

ayment**

on a single check.

4.

A confirmation will display to show the status of your request.

Filter by:

•

Status

•

Request Type

•

Serial #

•

Range End

•

Amount

•

Payee

•

Account Name

•

Account Number

So

rt by (ascending or descending order):

•

Status

•

Request Type

•

Serial #

•

Range End

•

Amount

•

Payee

•

Account Name

•

Account Number

*To Approve a Stop Request for multiple single checks, select the three dots next to the filter

and sort icon. This will allow you to mark the items for Place Stop approval.

September 2023 Business Suite Mobile App

14

Transfers

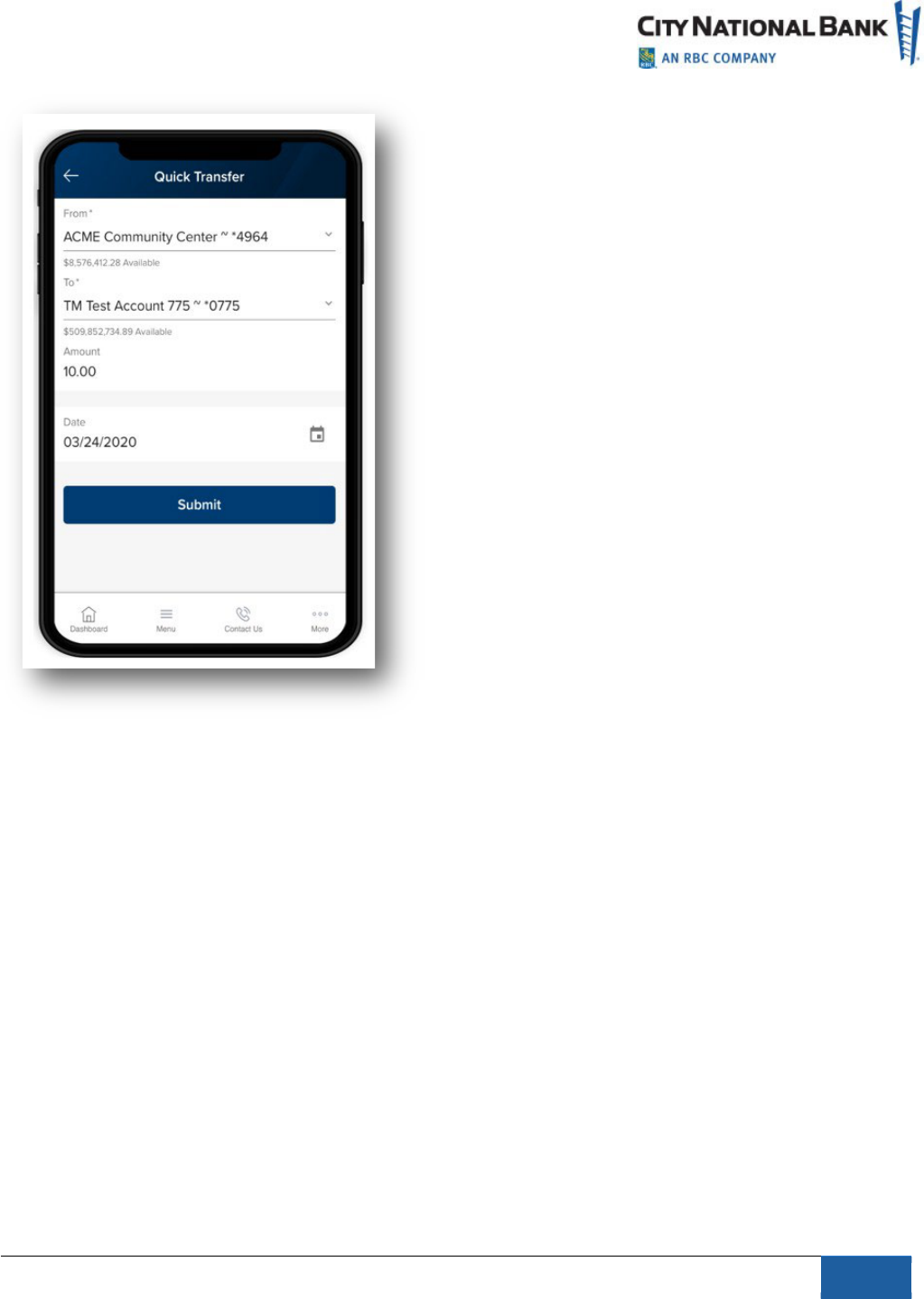

Quick Transfers

The Quick Transfer feature allows you to transfer funds between your City National Bank

accounts. Only accounts within the same Business Suite relationship are available for transfers.

If your company requires approvals for transfers, you can also approve transfers if entitled to do

so.

1.

Select

Quick Transfer

from the Menu. You can also access Quick Transfer from your

Dashboard if you have this widget displayed with your dashboard widgets.

2.

Select the

From

Account.

3.

Select the

To

Account

.

4.

Enter the

Amount

and

Date

and click

Continue.

5.

Review

and verify transfer details, then select

Submit

as shown below.

September 2023 Business Suite Mobile App

15

6.

A transfer submitted without errors will display “

Payment Submitted”

on the

confirmation page.

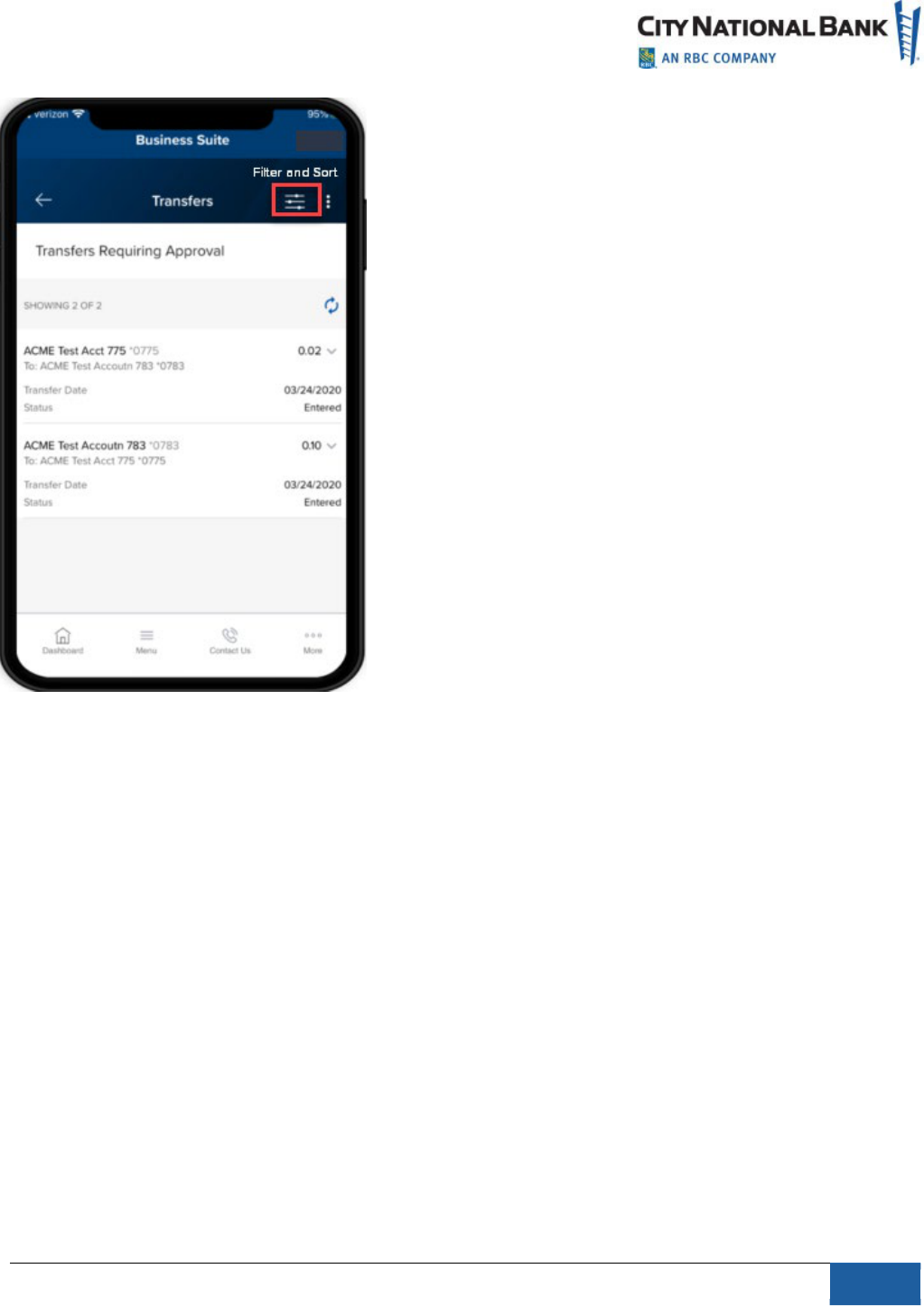

Approve Transfers

If your company requires approval of transfers, this feature allows the approvers to do so.

1.

Select

Transfers

from the Menu.

2.

Select Transfers Requiring Approval.

3.

Review the transfer details.

4.

Select

Approve

.

Note:

In order to Unapprove a transfer, please log into the full site on your computer.

Filter by:

•

From Account Name

•

From Account Number

•

Status

•

To Account Name

•

To Account Number

•

Transfer Date

September 2023 Business Suite Mobile App

16

Sort by: (ascending or descending order)

•

Amount

•

From Account Name

•

From Account Number

•

Status

•

To Account Name

•

To Account Number

•

Transfer Date

SINGLE APPROVAL

: Select the item to approve. It will open up to a page to a Transfer Details

page and an option to

Approve

.

MULTIPLE APPROVALS

: Select the three dots next to the filter and sort icon and select

Approve as shown below. You will be able to see the Transfer requests pending approval.

Select the items and select

Approve

.

September 2023 Business Suite Mobile App

17

Payments

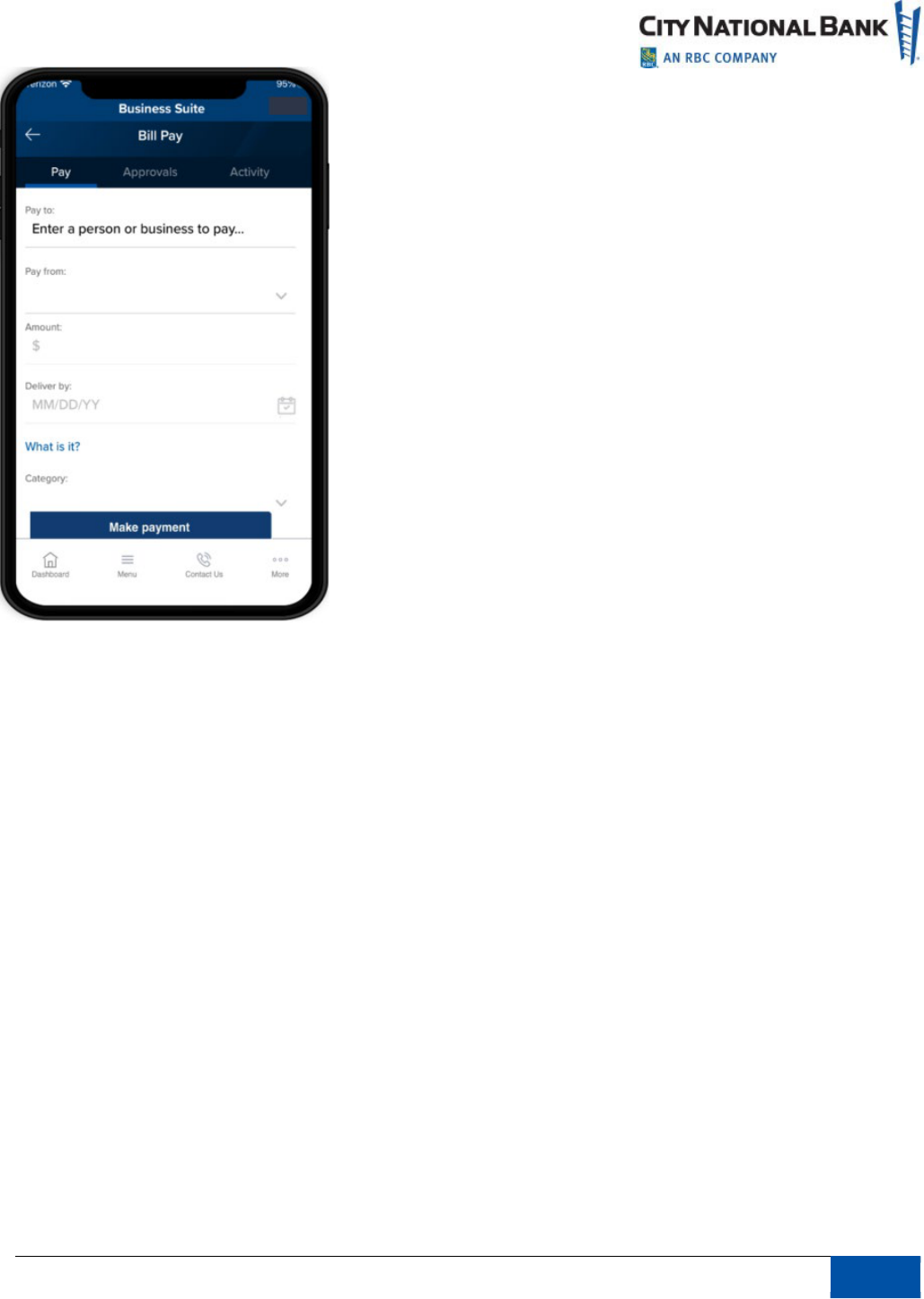

Bill Pay – Single Payment

The Bill Pay feature will allow you to make individual payments to existing payees, review

scheduled payments, approve payments, and view payment history.

1.

Select

Payments

from the Menu.

2.

Select

Bill Pay

.

3.

Pay to

: Type a payee name from an existing list of payees

.

4.

Pay From

: Select Funding Account.

5.

Category

: Select from drop down menu.

6.

Enter Amount.

7.

Enter Delivery by date.

8.

Select

Make Payment

.

9.

Preview and then click

Confirm.

Note:

In order to add new payees, make multiple payments, or edit scheduled payment, please

log into the full site on your computer.

September 2023 Business Suite Mobile App

17

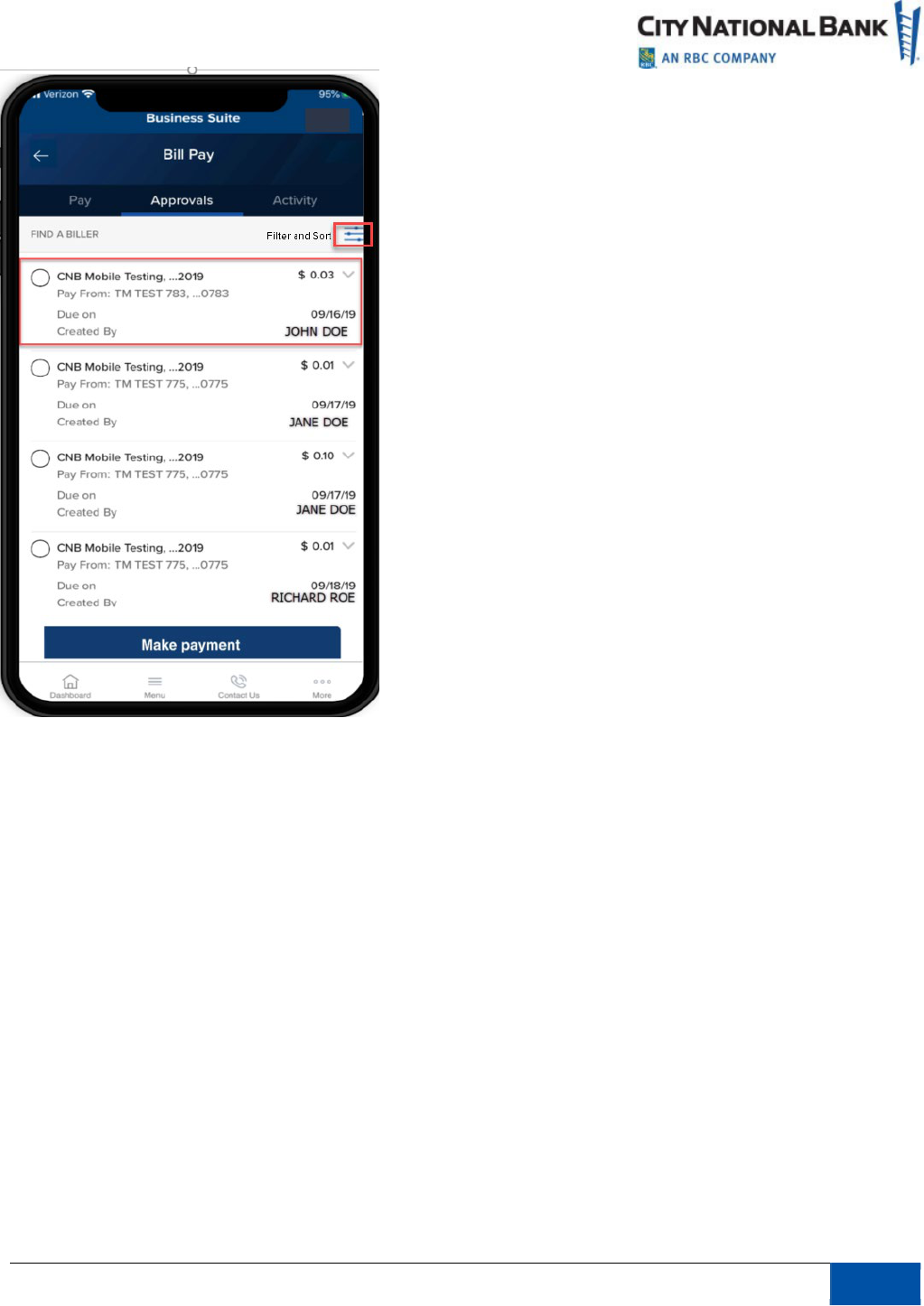

Bill Pay – Approve Payments

Individuals who are authorized to approve payments will be able to approve a single or several

single payments by going to the Approvals page on Bill Pay.

1.

Select the payment item(s) you want to approve.

2.

Select

Submit.

(If needed, you will have the option to cancel the payment prior to the

payment date).

18

September 2023 Business Suite Mobile App

17

Bill Pay – Activity (Scheduled Payments) and History

Activity

(Scheduled Payments) - Scheduled payments will allow you to review and cancel

scheduled payments.

1.

Select

Payments

from the Menu.

2.

Select

Bill Pay

.

3.

Go to Activity.

Activity provides you with a list of scheduled payments and the following information:

•

Deliver By

•

Paid To

•

Amount

•

Total Scheduled

4.

Select a scheduled payment to review the details. This will also be where you will find the

option to cancel the payment.

19

September 2023 Business Suite Mobile App

17

Canceling a Payment

1.

To cancel a scheduled payment, select the

Cancel

button.

2.

Review cancel payment details and select your choice of

Cancel Payment

or

Don’t

Cancel Payment

.

3.

If Cancel Payment is selected, a message will appear that states “Your payment to

for $ amount was canceled on MM/DD/YY”.

History

With the history function, you can view a list of paid items.

1.

Select

Payments

from the Menu.

2.

Select

Bill Pay

.

History lists all past payments with the following information:

•

Deliver By

•

Paid To

•

Amount and Status

•

Total Paid

3.

Select a paid item to view additional details.

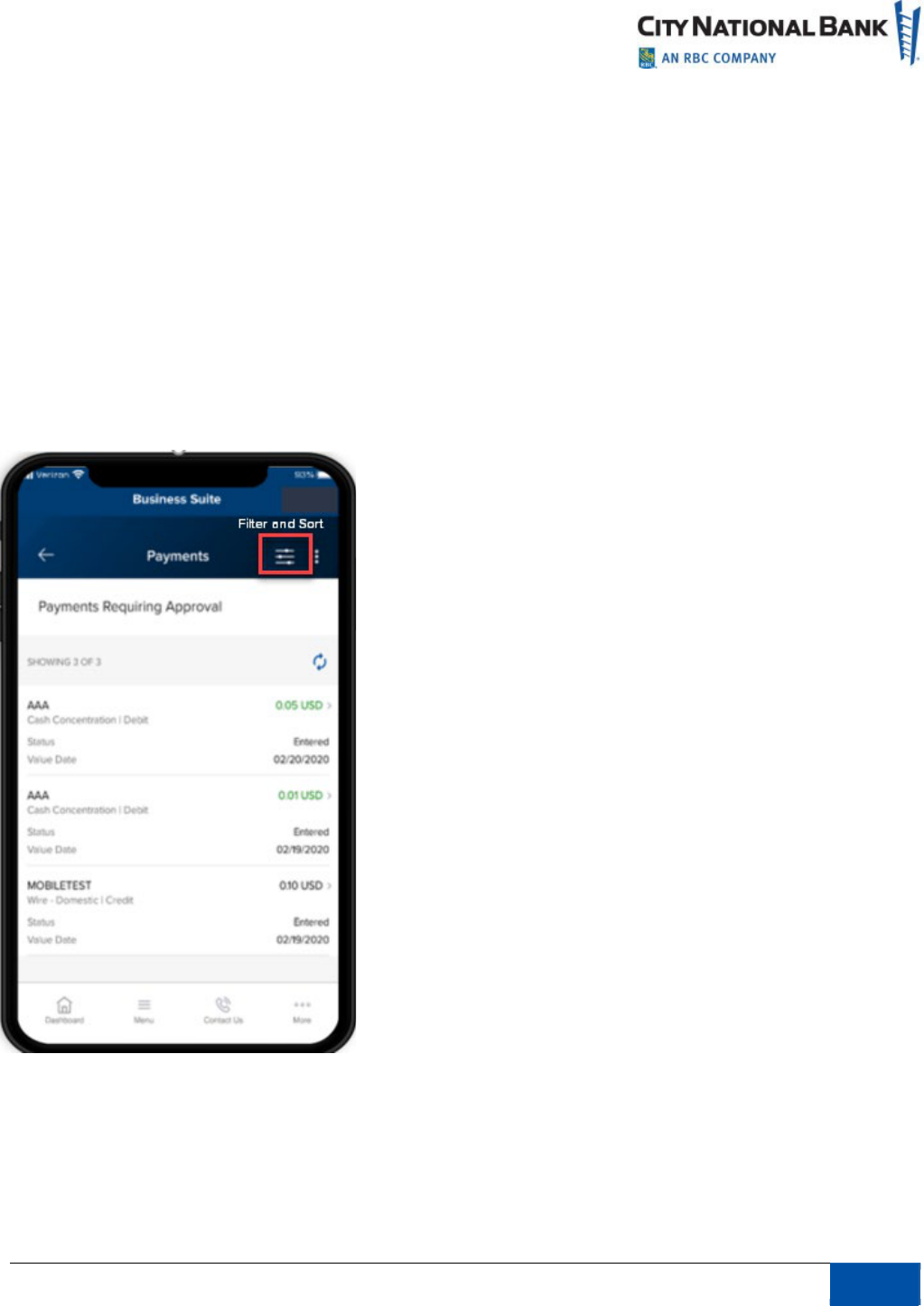

Payments Requiring Approval

Depending upon your permissions and roles at your firm, you may approve payment

requests that have been previously entered in the desktop application.

1.

Select

Payments

from the Menu (or, via the Payments widget on your Dashboard to go

directly to the Payments module).

2.

Select

Payments

to arrive at

Payments Requiring Approval

where you will see a list of

payments awaiting approval.

3.

Select the payment for approval. For multiple approvals, use the three dots next to the

Filter and Sort icon. This will allow you to mark the items for payment approval.

Filter by:

•

Amount

•

Beneficiary

•

CCY

•

Confirmation Number

•

Credit/Debit

•

Debit Account Name

•

Debit Account Number

•

Payment Type

•

Status

•

Value Date

20

September 2023 Business Suite Mobile App

17

Sort by (in ascending or descending order):

•

Amount

•

Beneficiary

•

CCY

•

Confirmation Number

•

Credit/Debit

•

Debit Account Name

•

Debit Account Number

•

Payment Type

•

Status

•

Value Date

21

September 2023 Business Suite Mobile App

17

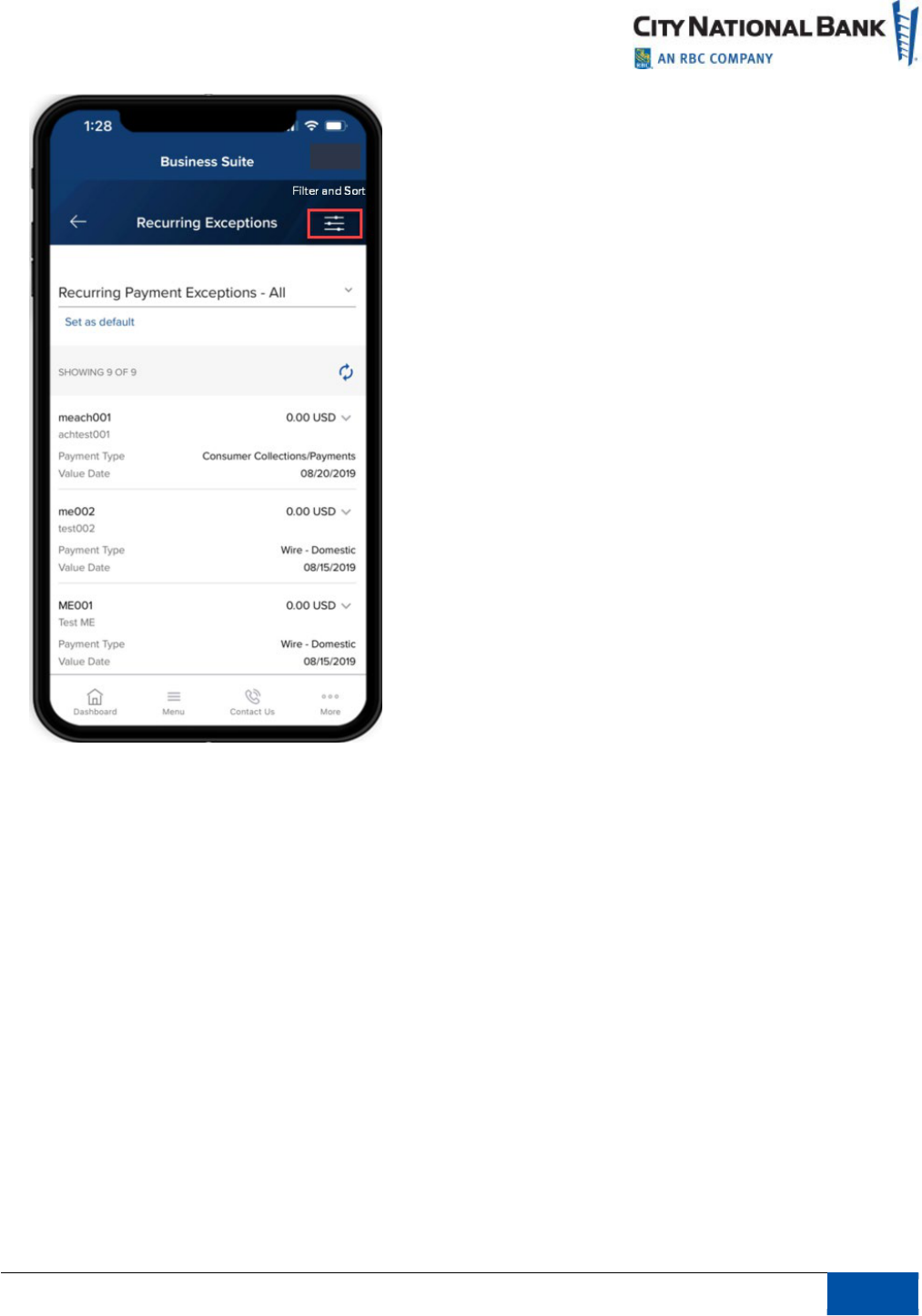

Recurring Exceptions (Payments)

This function provides notifications for scheduled payments exceptions.

1.

Select

Payments

from the Menu (or via the Notifications widget on your Dashboard,

select the

Recurring Payments that recently failed

link to go directly to the Payments

module).

2.

Select

Recurring Exceptions

to view the list of schedule payments exceptions.

3.

Customize your view by selecting the drop-down arrow next to Recurring Payment

Ex

ceptions and choose from the following options:

•

All

•

Last 30 days

•

Last 60 days

•

Last 7 days

Filter by:

•

Template ID

•

Description

•

Payment Type

•

Payment Account

•

CCY

•

Value Date

•

Occurred On

•

Reason

Sort by (ascending or descending order):

•

Template ID

•

Description

•

Payment Type

•

Payment Account

•

CCY

•

Value Date

•

Occurred On

•

Reason

22

September 2023 Business Suite Mobile App

17

E-Deposit

E-Deposit enables users to create a deposit by using a mobile device to capture the images of a

check and transmitting it to City National Bank for credit.

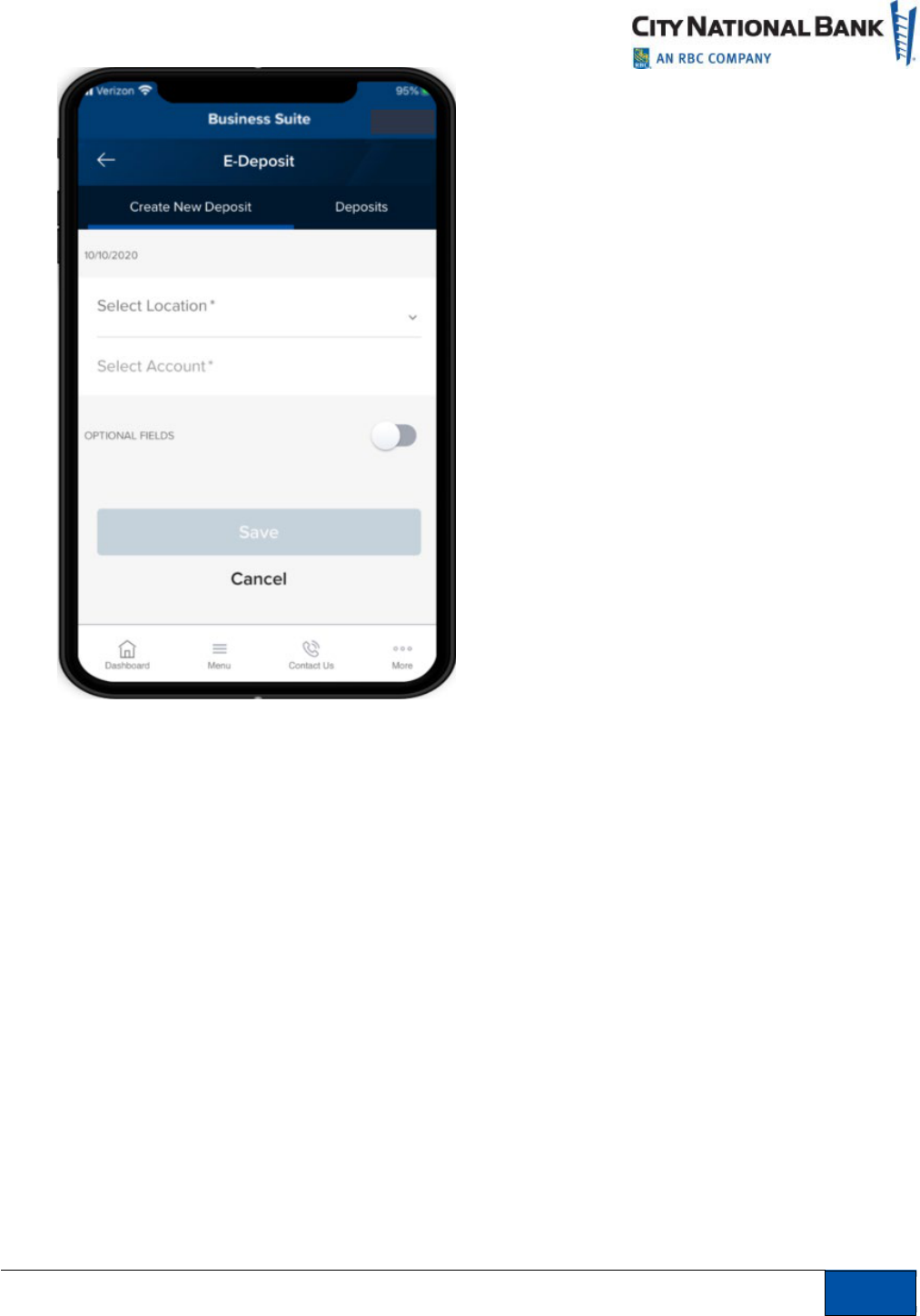

Create Deposit

To start the deposit, follow these steps:

1.

Select

Receivables

from the Navigation Menu.

2.

Select

E-Deposit

.

3.

Create New Deposit page displays.

4.

Create a new deposit by first selecting a location.

5.

Select an account number where the check will be deposited.

6.

Save the information by selecting

Next

.

23

September 2023 Business Suite Mobile App

17

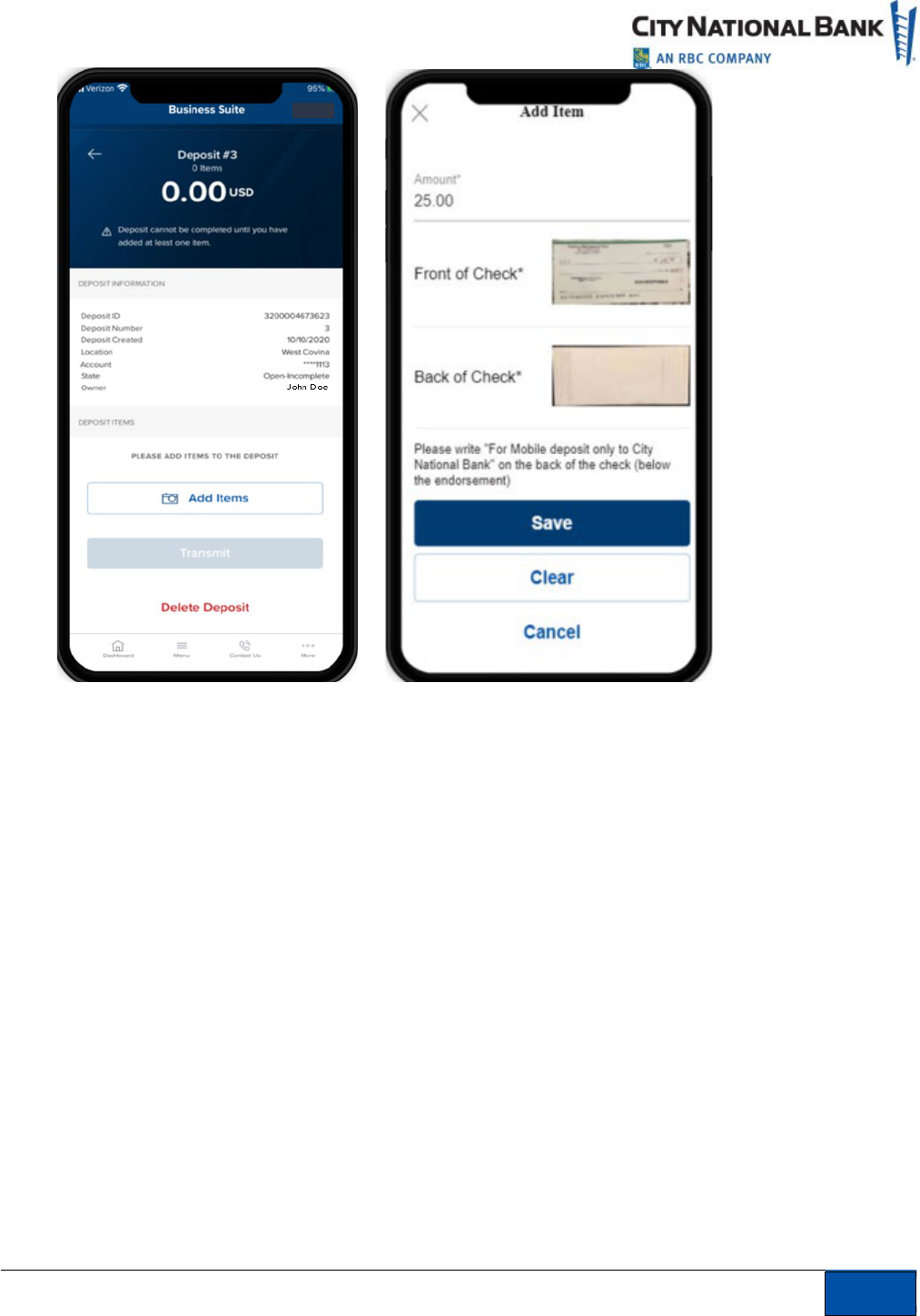

Add Items

1.

Add an item (check) to the deposit information you saved by selecting

Add Items

.

2.

Enter amount of check for deposit.

3.

Capture the image of the front of the check by selecting the camera icon in the field

labeled.

4.

Take a picture of the front of the check ensuring

that all four corners of the check are

captured

. If you would like to change the picture, simply tap the picture you just took--

this will allow you to retake an image and replace the previous picture.

5.

Capture image of the back of the check by selecting the camera icon in the field labeled:

Back of the check

. Follow the same procedures above for taking a picture of the check.

24

September 2023 Business Suite Mobile App

17

6.

Review your entry and select

Save

.

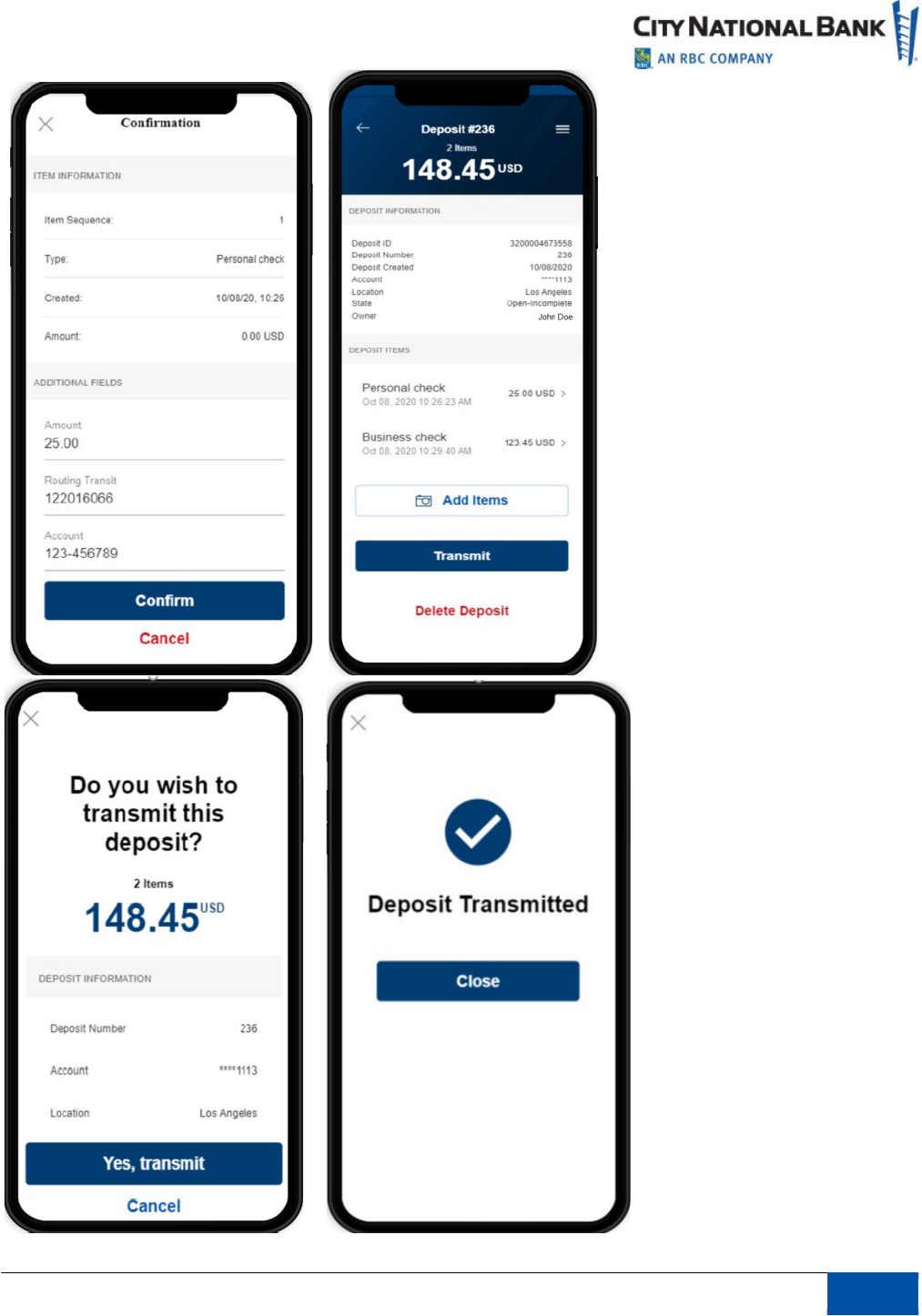

Con

firmation and Transmission

1.

After adding an item, the Confirmation page will display.

2.

Make any necessary corrections to

Amount

,

Routing Transit number

or

Account

number

.

3.

Confirm the deposit information.

4.

The Deposit information page will display which will show a list of the deposit items to be

transmitted.

5.

You can add checks to the Deposit by selecting

Add Items

.

6.

When finished adding items, select

Transmit

to send the deposit items to the bank.

7.

A Deposit Transmitted page will appear to indicate that the transmission was successful.

25

September 2023 Business Suite Mobile App

17

26

September 2023 Business Suite Mobile App

17

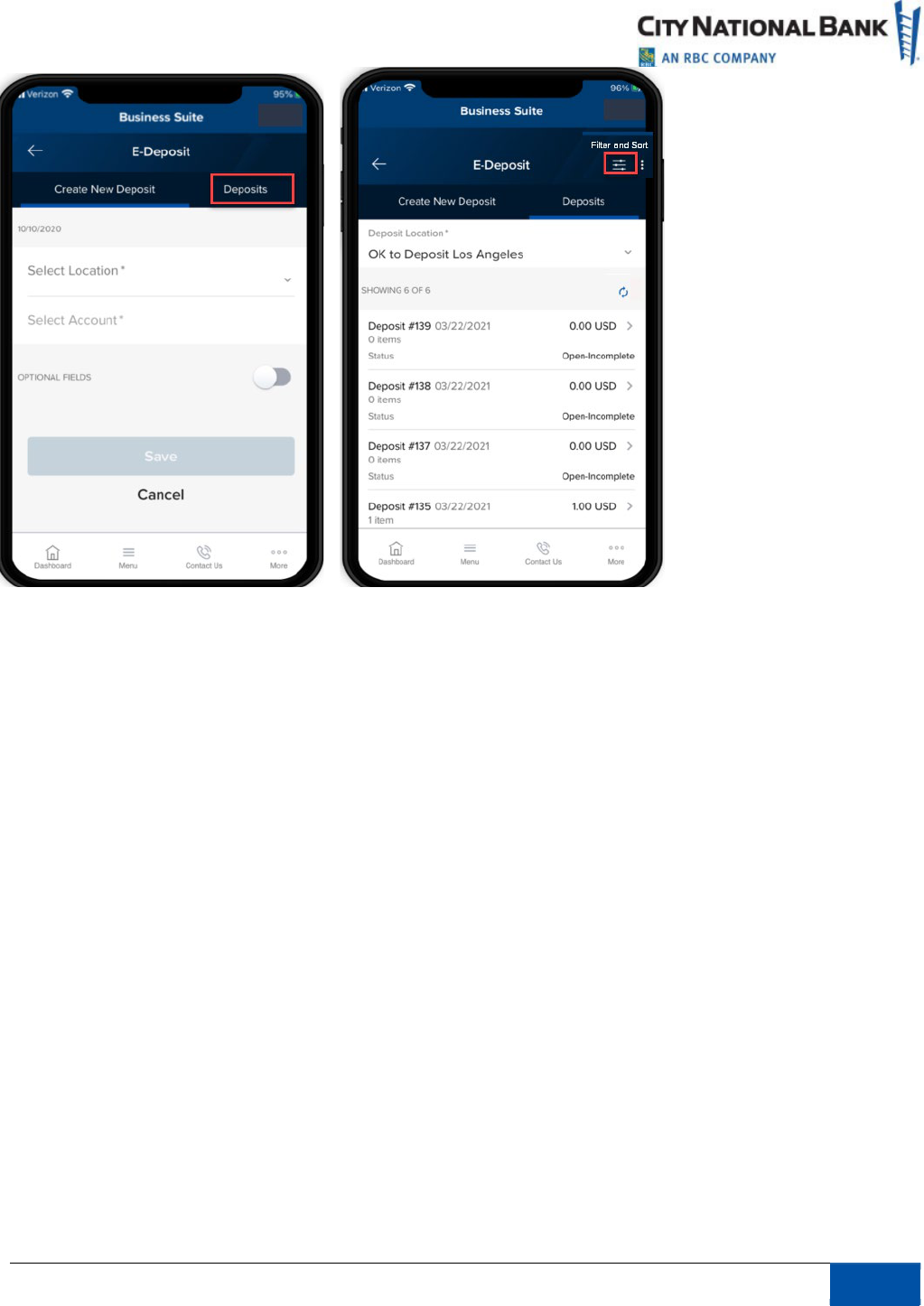

Deposits

The Deposit tab displays a list of deposits that have been created and their status. A status of

Received indicates the deposit has been successfully transmitted to City National Bank and the

status of Open-Incomplete shows it is waiting for further action including adding or removing

items or transmitting the deposit.

To view the list of Deposits, follow these steps:

1.

Select

Receivables

from the Navigation Menu.

2.

Select

E-Deposit

.

3.

Select Deposits tab.

4.

Select

Location

.

5.

Select

Account

.

6.

A list of deposit items will display with their status.

•

Received indicates a successful transmission to the bank.

•

Open-Incomplete indicates that the deposit item is pending further action.

Filter by:

•

All Open

•

Today (this is the default setting)

•

Last 7 days

•

Last 14 days

•

Last 30 days

•

Last 60 days

27

September 2023 Business Suite Mobile App

17

Fraud Control

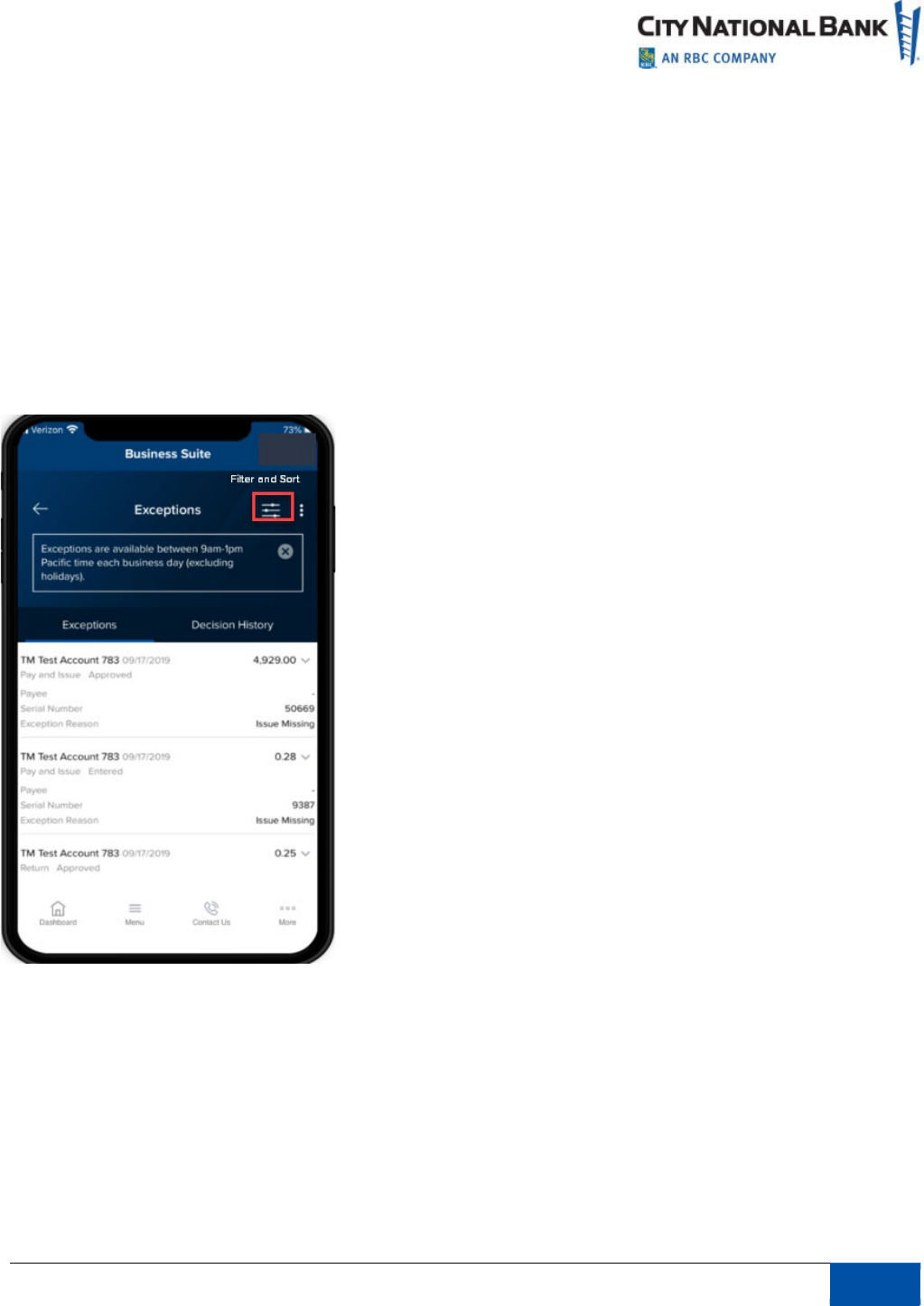

Exceptions

Pay, pay and issue, or return an exception item.

1.

Select

Fraud Control

from the Menu (or via the Exceptions widget on your Dashboard,

select

Exceptions Management

).

2.

A list of Exception items will display.

3.

Select the items for which you would like to make a decision.

Filter by:

•

Account Name

•

Account Number

•

Status

•

Serial Number

•

Paid Amount

•

Payee

•

Decision

•

Exception Reason

28

September 2023 Business Suite Mobile App

17

Sort by: (ascending or descending order)

•

Account Name

•

Account Number

•

Status

•

Serial Number

•

Paid Amount

•

Payee

•

Decision

•

Exception Reason

If required by your company, you also have the option to Approve/Unapprove the decisioned

item(s).

Decision History

The Decision History page provides a record of items that have been decisioned in the past.

1.

Select

Fraud Control

from the Menu (or via the Exceptions widget on your Dashboard,

select

Exceptions Management

).

2.

Select the

Decision History

tab.

3.

A record of previously decisioned items will display.

29

September 2023 Business Suite Mobile App

17

Filter by:

•

Account Name

•

Account Number

•

Approved By

•

Approved Date

•

Bank Reason

•

Decision Submitted

•

Issue Amount

•

Issue Date

•

Paid Amount

•

Paid Date

•

Payee

•

Return Reason

•

Serial Number

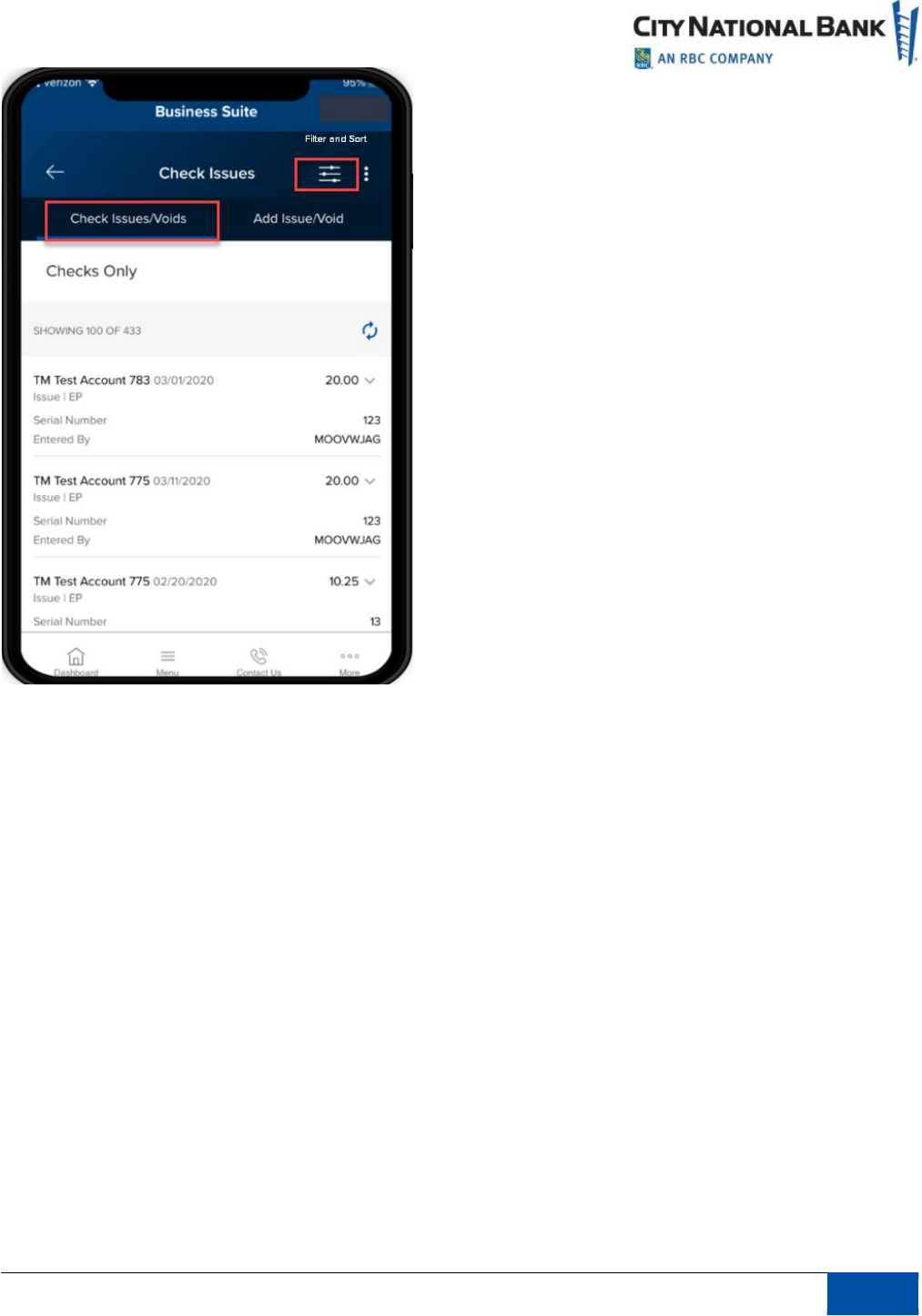

Check Issue/Voids

Approve or delete Checks Issue/Voids for Checks Only.

1.

Select

Fraud Control

from the Menu.

2.

Select Check Issues.

Filter by:

•

Account Name

•

Account Number

•

Status

•

Type

•

Serial Number

•

Date

•

Amount

30

September 2023 Business Suite Mobile App

17

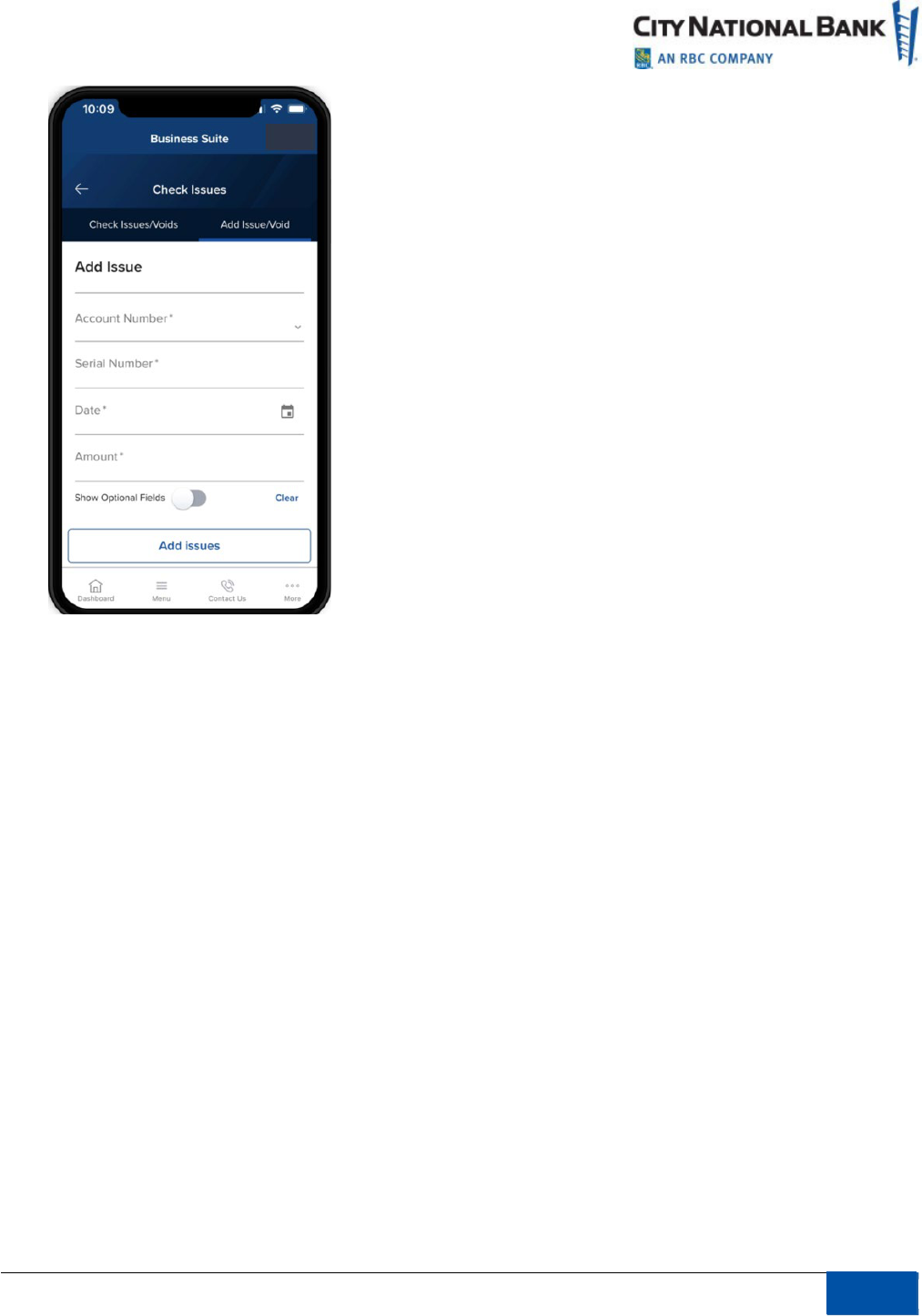

Add Check Issue/Voids as follows:

1.

Select

Fraud Control

from the Menu.

2.

Select

Check Issues

.

3.

Select

Enter Issues

.

4.

Enter

Issued Checks

, providing the following:

•

Account Name

•

Serial Number

•

Date

•

Amount

Opt

ional Fields (Payee and Memo) Add a new entry (limit to 5)

31

September 2023 Business Suite Mobile App

17

5.

Enter

Check Voids

, providing the following:

•

Account Name

•

Serial Number

•

Date

•

Amount

•

Optional Fields (Memo)

•

Add a new entry (limit to 5)

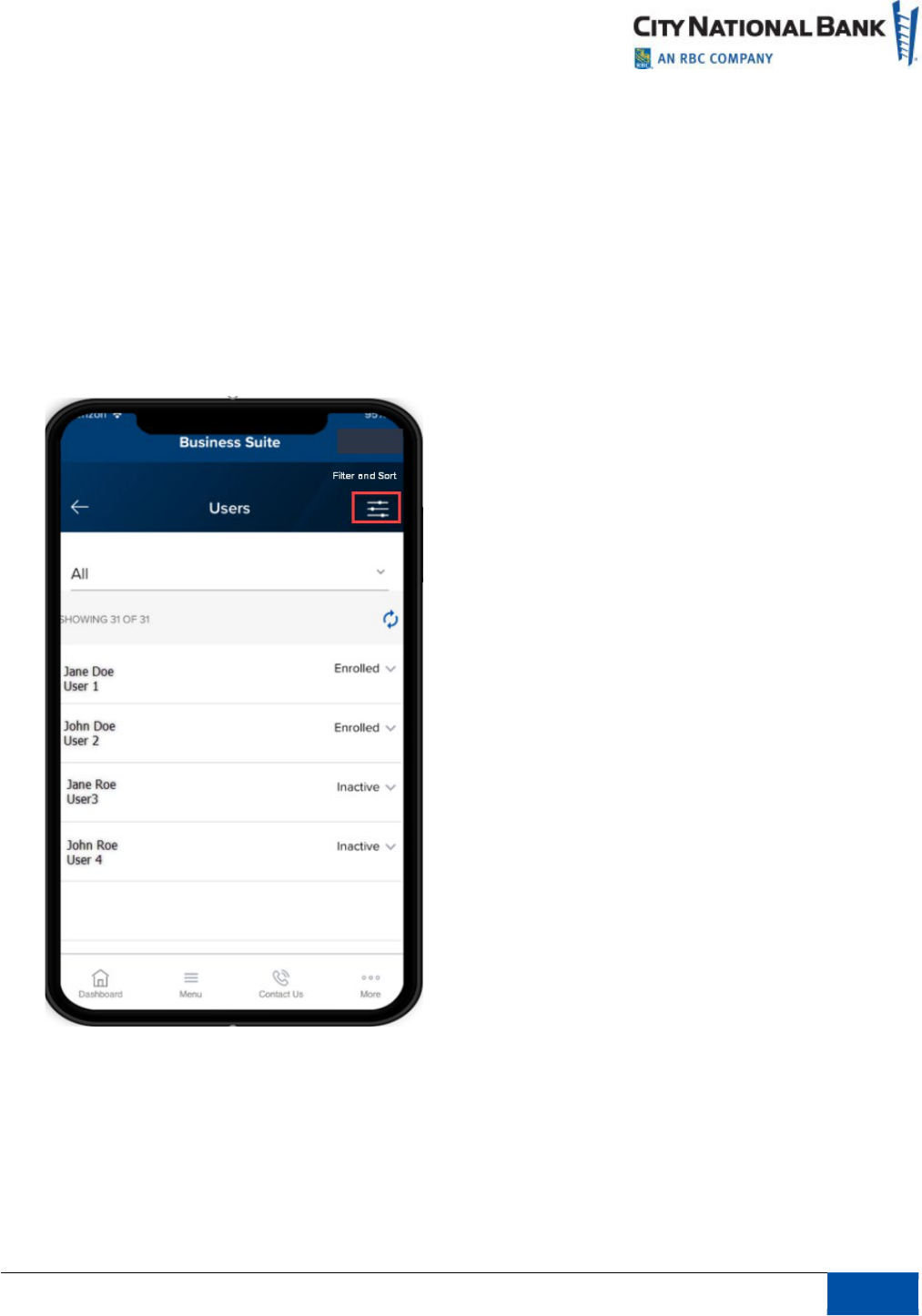

Administration

The Administration page displays a list of users. Users with Admin entitlements will be able

lock/unlock users or reset the password of another user.

Filter by:

•

Name

•

User ID

•

Address

•

Contact

•

Status

•

Service and Roles

32

September 2023 Business Suite Mobile App

17

Sort by: (ascending or descending order)

•

Account Name

•

Account Number

•

Status

•

Serial Number

•

Paid Amount

•

Payee

•

Decision

•

Exception Reason

33

September 2023 Business Suite Mobile App

17

About CNB

Learn more about City National Bank by selecting any of the following links on your mobile

phone:

•

About

•

Contact Us

•

Help

•

Locations

•

Terms & Conditions

•

Privacy & Security

•

Fraud Prevention Center

•

Secure Online Session

34