VAT Refunds

What is a

VAT refund?

When you visit the UK or an EU Country from overseas, you will pay

Value Added Tax (VAT) on most things you buy. The VAT Retail Export

Scheme allows you to claim a VAT refund on most goods you buy

when you leave the EU.

Not all retailers participate in the VAT refund scheme. When you purchase the goods, ask the

retailer if they participate as you will need to complete the form in the shop and the retailer will

need to verify the purchase.

You are eligible to claim a VAT refund if?

• You live outside the EU.

• You are an overseas resident but have been working/studying in the UK. However, you will

need to prove that you are leaving the EU for more than 12 months.

What goods can I buy under the scheme?

You can buy any goods under the scheme on which you pay VAT if the retailer participates in the

scheme except for the following:

• Services e.g. hotel bills and car hire.

• Goods bought online or by mail order.

• Consumable goods you have already started using.

• Goods which require an export licence (except antiques).

• Goods to be exported as freight.

The goods on which VAT is being claimed must be exported within your hold or hand luggage

and should be available for inspection.

VAT Refunds at

London Gatwick

Don’t forget to claim your VAT refund at London Gatwick Airport if you are

visiting the UK from a non- EU country.

How does a VAT refund work?

Visitors from non- EU countries can reclaim the VAT paid on purchases made in Britain or other EU countries.

With regards to claiming back your VAT, look out for the tax free shopping sign displayed in stores.

Ask the retailer directly for a VAT refund form. Please be advised that you may need to fill in multiple tax free forms as

not all stores are associated with the same tax company.

Not all retailers oer tax-free shopping and you can only get VAT refunds on goods purchased within the last 3

months.

When you arrive at London Gatwick Airport, take your completed VAT forms and receipts to the VAT Customs Desk

for validation before you check-in

How does the process work at London Gatwick Airport?

Firstly you will need to visit the Customs oce to have your forms validated. This is done by the Customs ocial

inspecting your forms and stamping them to show they have been validated. You may be required to show the

Customs ocer the goods you are exporting

Once the forms have been stamped by Customs, please make your way to the moneycorp desk located in both

North and South terminals next to the Customs oce (download Airport map). moneycorp will provide you with

refund options or will assist you to claim your refund directly as may be the case. The refunded VAT amount can be

issued to you in cash for use at your destination, or for some refunds credited to a nominated card account

What Tax agents do moneycorp London Gatwick Airport support?

moneycorp London Gatwick Airport are proud to partner with the below tax agents:

• Global Blue

• Planet Tax Free (Premier Tax Free and GB Tax Free)

• Innova Tax Free

• UShop

• WeVAT

• Travel Tax Free

For any more information regarding these tax agents, please feel free to enquire at the moneycorp desk.

What do I need to fill in on the VAT form?

Please note that the following information is mandatory and has to be completed before handing the forms in:

• Passport Number

• Full Name of Claimant

• Permanent address (outside the E.U)

• Arrival and Departure dates

• Final destination country

• Signatures on forms as required

Where can I find a moneycorp VAT branch at London Gatwick Airport?

• North Terminal – Landside level 2 (Adjacent to the Customs desk)

• South Terminal – Landside level 2 (Opposite the Customs desk)

If you cannot find the VAT branch, please ask a member of the moneycorp team at any of our other branches in the

airport who will direct you to the appropriate VAT branch.

VAT Refunds at

London Stansted

Don’t forget to claim your VAT refund at London Stansted Airport if you are

visiting the UK from a non- EU country.

How does a VAT refund work?

When you purchase goods, inform the retailer immediately that you wish to reclaim the VAT. You will be given a VAT

refund form to complete and sign.

Please note VAT refund forms should be completed prior to visiting a moneycorp VAT branch at London Stansted

Airport. Not all retailers participate in the VAT refund scheme.

How does the process work at London Stansted Airport?

You must present your passport, visa and travel documents as requested to do so by a member of the Moneycorp

team.

A check will be made to confirm your identity and for evidence of same day travel outside the EU. The goods on

which refunds are being claimed must be available for inspection by moneycorp, which may necessitate completing

the process prior to check in (landside), unless the goods are being carried as hand luggage.

The refunded VAT amount can be issued to you in cash for use at your destination, or for some refunds credited to a

nominated card account.

Please check with the moneycorp team for options.

What Tax agents do moneycorp London Stansted Airport support?

moneycorp London Stansted Airport are proud to partner with the below tax agents:

• Global Blue

• Planet Tax Free (Premier Tax Free and GB Tax Free)

• Innova Tax Free

For any more information regarding these tax agents, please feel free to enquire at the moneycorp desk.

What do I need to fill in on the VAT form?

Please note that the following information is mandatory and has to be completed before handing the forms in:

• Passport Number

• Full Name of Claimant

• Permanent address (outside the E.U)

• Arrival and Departure dates

• Final destination country

• Signatures on forms as required

Where can I find a moneycorp VAT branch at London Stansted Airport?

• • Landside (Before Security) - Zone A

• • Airside (after Security) - opposite Joe and the Juice

If you cannot find the VAT branch, please ask a member of the moneycorp team at any of our other branches in the

airport who will direct you to the appropriate VAT branch.

Example forms

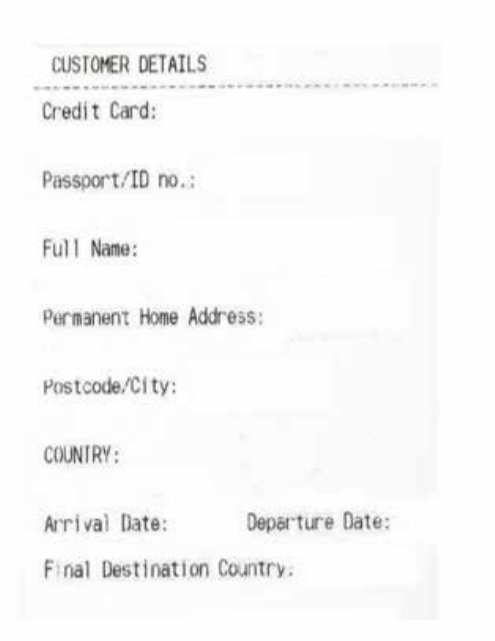

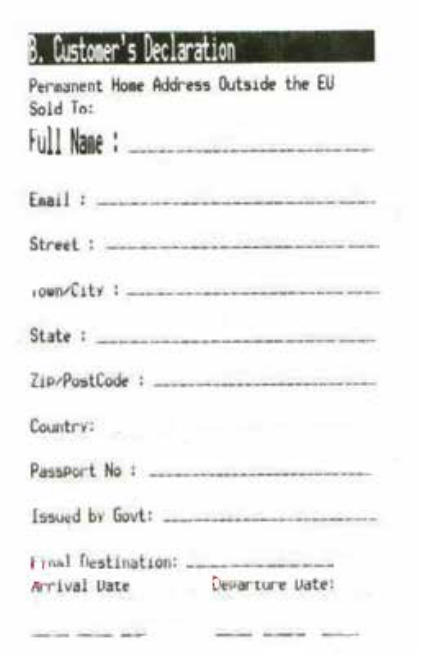

Global Blue Sample form 1

How to fill out Global Blue form sample 1:

Passport/ID Number – Please fill in your current Passport/Identification Card Number here

Full Name – Please fill in your First and Family name here

Permanent Address – Please fill in your permanent home address including your house number, street name,

city and post code here. Alternatively, please enter your PO Box number if applicable.

Country – Please fill in the country that you permanently reside in (Outside the EU)

Arrival Date – Please fill in the date that you arrived in the EU on this trip

Departure Date – Please fill in the date that you are leaving the EU on

Country of Final Destination – Please enter the final (residence) country that you are travelling to

Please ensure that all forms are filled in accurately as crossing out any information may invalidate them

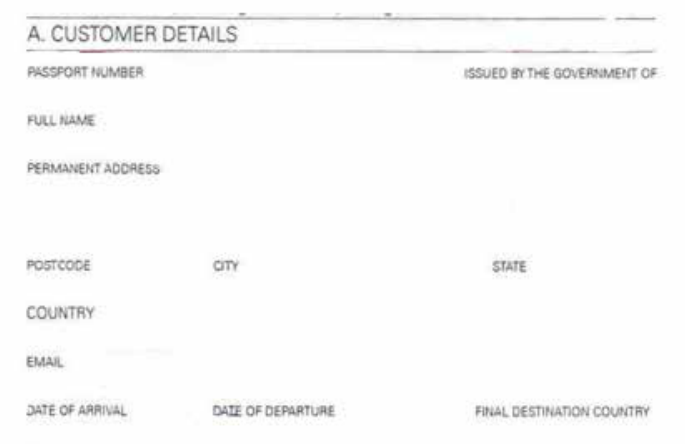

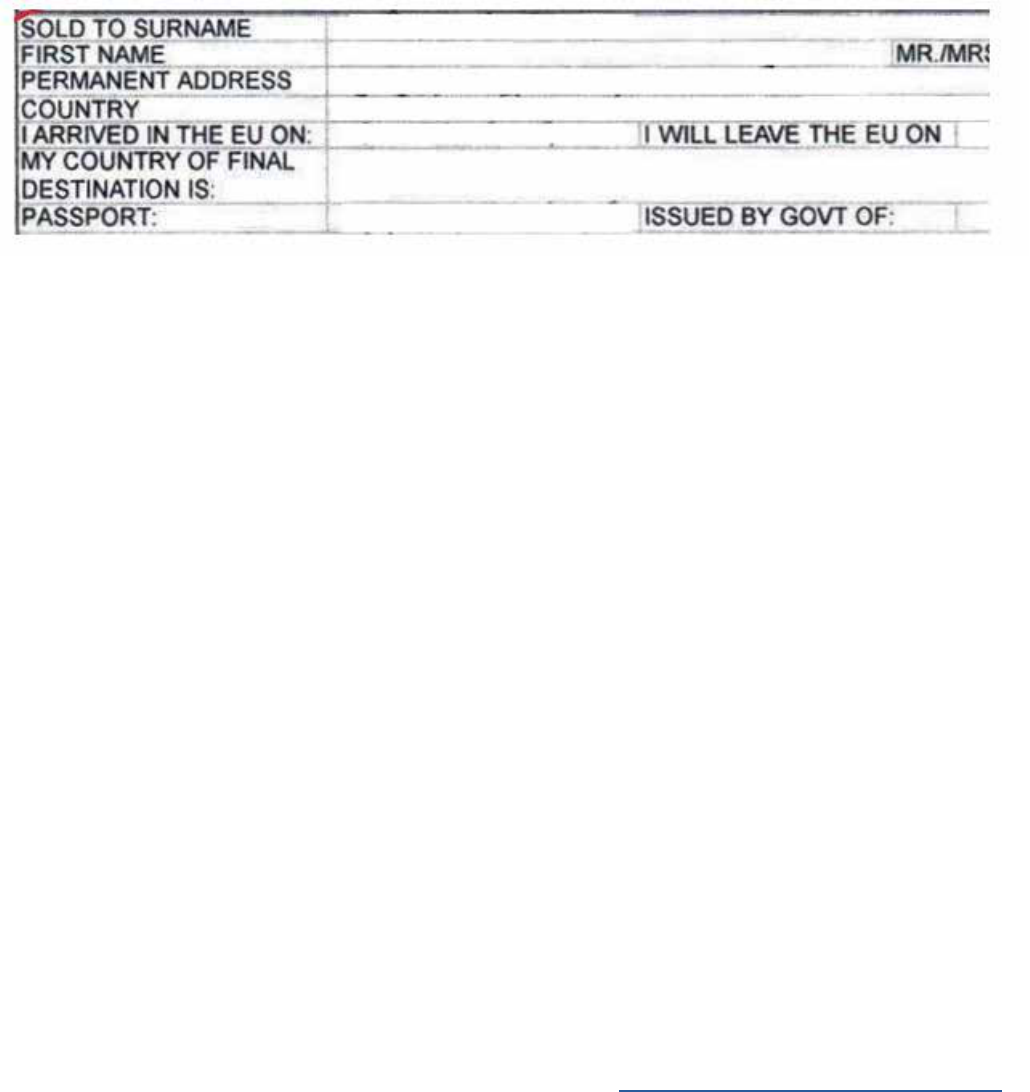

Global Blue Sample form 2

How to fill out Global Blue Sample form 2:

Passport/ID Number – Please fill in your current Passport/Identification Card Number here

Full Name – Please fill in your First and Family name here

Permanent Address – Please fill in your permanent home address including your house number, street name,

city and post code here. Alternatively, please enter your PO Box number if applicable.

Country – Please fill in the country that you permanently reside in (Outside the EU)

Arrival Date – Please fill in the date that you arrived in the EU on this trip

Departure Date – Please fill in the date that you are leaving the EU on

Country of Final Destination – Please enter the final (residence) country that you are travelling to

Issued by Government of – Please enter the country that your passport/Identification Card is issued by

Please ensure that all forms are filled in accurately as crossing out any information may invalidate them

Planet Tax Free Sample form 1

How to fill out Planet Tax Free Sample form 1:

Passport/ID Number – Please fill in your current Passport/Identification Card Number here

Full Name – Please fill in your First and Family name here

Permanent Address – Please fill in your permanent home address including your house number, street name,

city and post code here. Alternatively, please enter your PO Box number if applicable.

Country – Please fill in the country that you permanently reside in (Outside the EU)

Issued by Government of – Please enter the country that your passport/Identification Card is issued by

Final Destination – Please enter the final (residence) country that you are travelling to

Arrival Date – Please fill in the date that you arrived in the EU on this trip

Departure Date – Please fill in the date that you are leaving the EU on

Please ensure that all forms are filled in accurately as crossing out any information may invalidate them

For more information on VAT Refunds please visit the HM Revenue and Customs website.

Planet Tax Free Sample form 2

How to fill out Planet Tax Free Sample form 2:

Sold to Surname: Please enter your family name here

First Name: Please enter your first name here

Permanent Address – Please fill in your permanent home address including your house number, street name,

city and post code here. Alternatively, please enter your PO Box number if applicable.

Country – Please fill in the country that you permanently reside in (Outside the EU)

Arrival Date – Please fill in the date that you arrived in the EU on this trip

Departure Date – Please fill in the date that you are leaving the EU on

Country of Final Destination – Please enter the final (residence) country that you are travelling to

Passport/ID Number – Please fill in your current Passport/Identification Card Number here

Issued by Government of – Please enter the country that your passport/Identification Card is issued by

Please ensure that all forms are filled in accurately as crossing out any information may invalidate them’

Travel money services are provided by Moneycorp CFX Limited. Moneycorp CFX Limited is a company registered in England

under registration number 4780562. Its registered oce address is at Floor 5, Zig Zag Building, 70 Victoria Street, London, SWE1

6SQ and its VAT registration number is 897 393434