(over)

Agreement Between The United States And Italy

Agreement Between The United States

And Italy

Contents

Introduction 1

Coverage and Social Security taxes 2

Certificate of coverage 3

Monthly benefits 5

An Italian pension may affect your U.S. benefit 7

What you need to know about Medicare 8

Claims for benefits 8

Authority to collect information for a certificate coverage

(see pages 3-4) 9

Contacting Social Security 9

Introduction

An agreement effective November 1, 1978,

between the United States and Italy improves

Social Security protection for people who work

or have worked in both countries. It helps many

people who, without the agreement, would not

be eligible for monthly retirement, disability or

survivors benets under the Social Security

system of one or both countries. It also helps

people who would otherwise have to pay

Social Security taxes to both countries on the

same earnings.

For the United States, the agreement

covers Social Security taxes (including the

U.S. Medicare portion) and Social Security

retirement, disability and survivors insurance

benets. It does not cover benets under the

U.S. Medicare program or the Supplemental

Security Income program. For Italy, it also

includes family allowances.

This booklet covers highlights of the agreement

and explains how it may help you while you

work and when you apply for benets.

The agreement may help you, your

family and your employer

• While you work—If your work is covered

by both the U.S. and Italian Social Security

systems, you (and your employer, if you are

employed) would normally have to pay Social

Security taxes to both countries for the same

work. However, the agreement eliminates

this double coverage so you pay taxes to

only one system (see pages 2-3).

SocialSecurity.gov

2

(over)

Agreement Between The United States And Italy

• When you apply for benets—You may

have some Social Security credits in both

the U.S. and Italy but not have enough to

be eligible for benets in one country or

the other. The agreement makes it easier

to qualify for benets by letting you add

together your Social Security credits in

both countries. For more details, see the

section on “Monthly benets” beginning on

page 5.

Coverage and Social Security taxes

Before the agreement, employees, employers

and self-employed people could, under certain

circumstances, be required to pay Social

Security taxes to both the United States and

Italy for the same work.

Under the agreement, a U.S. national who

would otherwise be covered by both countries

is only covered by the United States. An

Italian national or dual U.S./Italian national

who would otherwise be covered by both

countries generally may choose the country

to which Social Security taxes will be paid

(see pages 3-4).

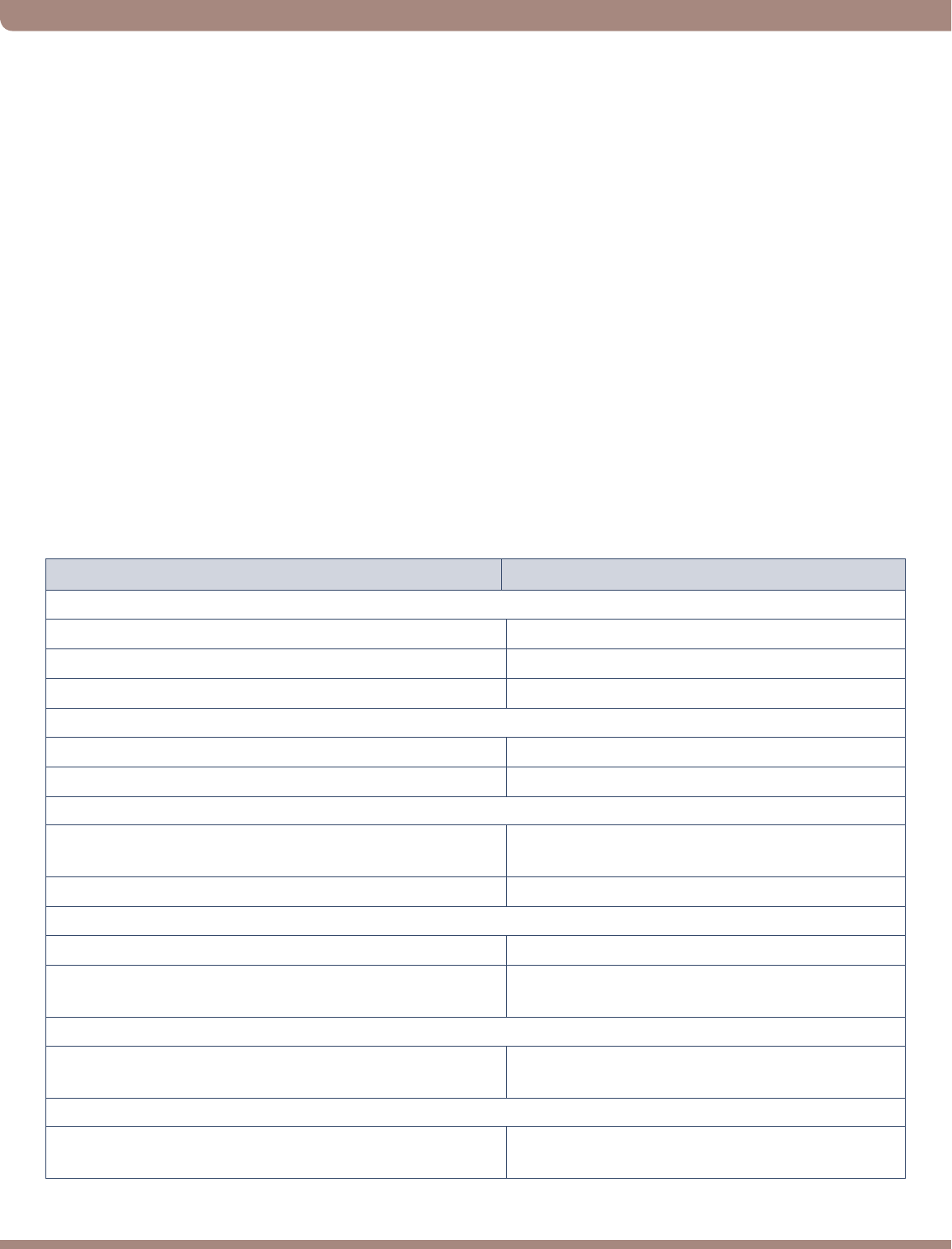

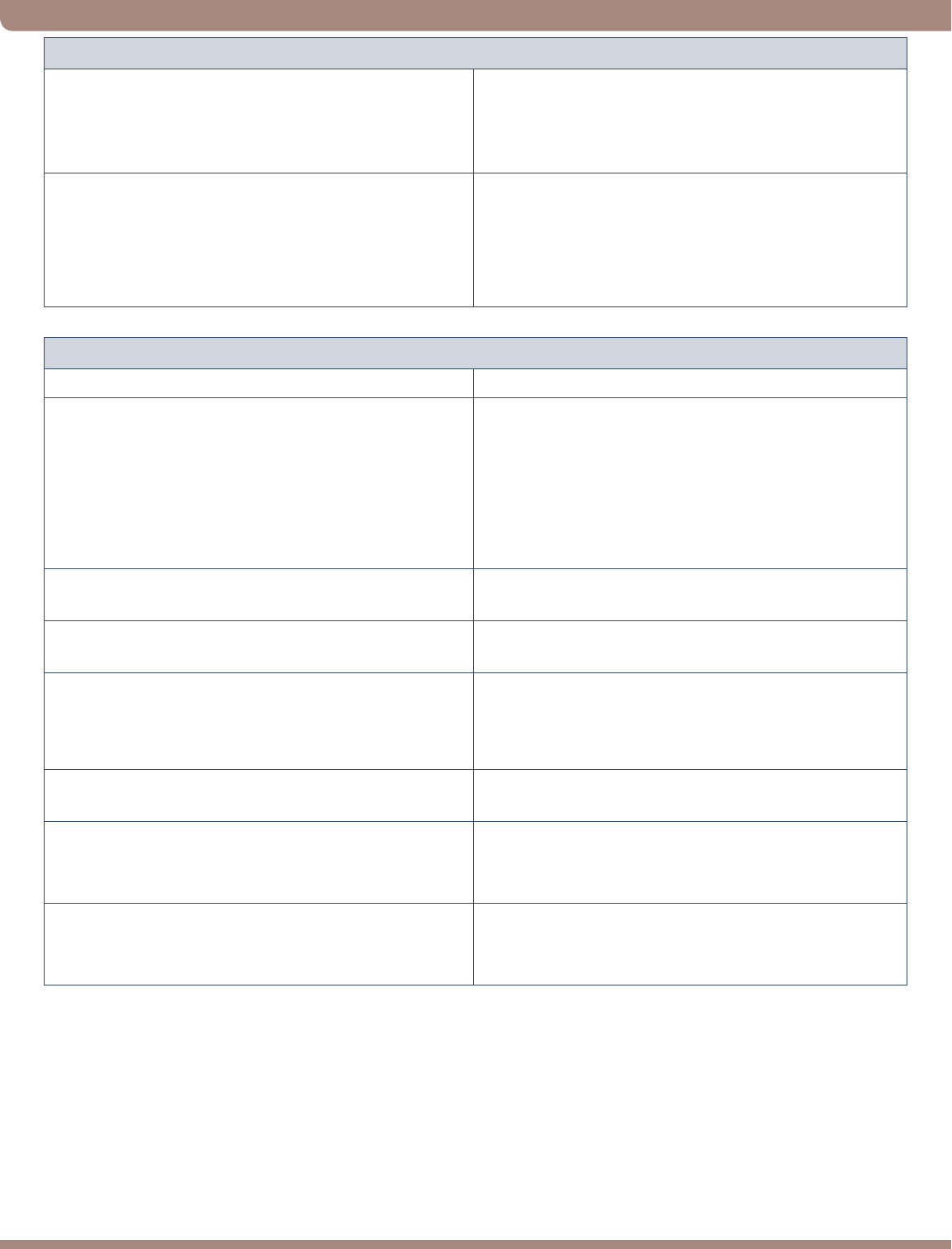

Summary of agreement rules

The following table shows whether your work is

covered under the U.S. or Italian Social Security

system. If you are covered under U.S. Social

Security, you and your employer (if you are an

employee) must pay U.S. Social Security taxes.

If you are covered under the Italian system, you

and your employer (if you are an employee)

must pay Italian Social Security taxes. The next

section explains how to get a form from the

country where you are covered that will prove

you are exempt in the other country.

Your work status Coverage and taxes

You are a U.S. national working in Italy:

• For a U.S. employer U.S.

• For an Italian (or other non-U.S.) employer Italy

• As a self-employed person U.S.

You are a U.S. national working in the U.S.

• For an Italian employer U.S.

• As a self-employed person U.S.

You are an Italian national working in the U.S.:

• For an Italian employer

(or Italian-controlled business)

You may elect either U.S. or Italian coverage

(see page 3).

• For a U.S. (or other non-Italian) employer U.S.

You are an Italian national working in Italy:

• For an Italian employer Italy

• For a U.S. employer or as a self-employed person

and you are a resident of the U.S.

You may elect either U.S. or Italian coverage

(see page 3).

You are a dual U.S./Italian national working in Italy:

• In employment or self-employment covered under

both systems

You may elect either

You are a dual U.S./Italian national working in the U.S.:

• In employment covered under both systems You may elect either U.S. or Italian coverage

(see page 3).

3

(over)

Agreement Between The United States And Italy

Your work status Coverage and taxes

• As a self-employed person U.S.

You are third country national regardless of the employer:

• Working in the U.S. U.S.

• Working in Italy Italy

NOTE: As the table indicates, a U.S. national employed in Italy can be covered by U.S. Social Security

only if he or she works for a U.S. employer. A U.S. employer includes a corporation organized under the

laws of the United States or any state, a partnership if at least two-thirds of the partners are U.S. residents,

a person who is a resident of the U.S. or a trust if all the trustees are U.S. residents. The term also includes

a foreign afliate of a U.S. employer if the U.S. employer has entered into an agreement with the Internal

Revenue Service (IRS) under section 3121(l) of the Internal Revenue Code to pay Social Security taxes for

U.S. citizens and residents employed by the afliate.

Election of coverage

Under the terms of the agreement, a national of

the United States or Italy who would otherwise

be covered by both countries, will generally

remain covered only by the country of which he

or she is a national and is exempt in the other.

However, Italian nationals and dual nationals

(nationals of both the U.S. and Italy) who are

working in employment or self-employment

covered by both systems must elect to be

exempt from coverage and taxation under one

system and to pay Social Security taxes to the

other. This election must be made within three

months from the date the work begins. If you

are an Italian national, you may subsequently

change your election of coverage. However, you

may change your election only:

• During the second year after the year you

begin your work; or, if later,

• When you acquire or lose permanent U.S.

residence status.

If you are a dual U.S/Italian national working

in employment or self-employment covered

by the United States and Italy, your election

for that particular job is nal and may not

be changed. However, you may change your

election if you begin a new job that is covered

by both countries.

To make an election, you or your employer

should write to the Social Security system of

the country where you want to continue your

coverage and request a certicate of coverage

from that country. You should send the request

to the appropriate address shown in the

following section of this booklet.

Certicate of coverage

A certicate of coverage issued by one

country serves as proof of exemption from

Social Security taxes on the same earnings in

the other country.

Certicates for employees

To establish an exemption from compulsory

coverage and taxes under the Italian system,

your employer must request a certicate

of coverage (form USA/IT 4) from the U.S.

at this address:

Social Security Administration

Ofce of International Programs

P.O. Box 17741

Baltimore, MD 21235-7741

USA

If preferred, the request may be sent by FAX to

(410) 966-1861. Please note this FAX number

should only be used to request certicates

of coverage.

No special form is required to request a

certicate but the request must be in writing and

provide the following information:

• Full name of worker;

• Date and place of birth;

• Citizenship;

4

(over)

Agreement Between The United States And Italy

• Country of worker’s permanent residence;

• U.S. Social Security number;

• Name and address of the employer in the

U.S. and Italy; and

• Date the employment began.

In addition, your employer must indicate if you

remain an employee of the U.S. company while

working in Italy or if you become an employee

of the U.S. company’s afliate in Italy. If you

become an employee of an afliate, your

employer must indicate if the U.S. company

has an agreement with the IRS under section

3121(l) of the Internal Revenue Code to pay

U.S. Social Security taxes for U.S. citizens and

residents employed by the afliate and, if yes,

the effective date of the agreement.

Your employer can also request a certicate

of U.S. coverage for you over the Internet

using a special online request form available

at www.socialsecurity.gov/coc. Only an

employer can use the online form to request a

certicate of coverage. A self-employed person

must submit a request by mail or fax.

To establish your exemption from coverage

under the U.S. Social Security system, your

employer in Italy must request a certicate of

coverage (form IT/USA 4) from Italy by writing

to the provincial ofce of the Istituto Nazionale

della Previdenza Sociale in the province where

the Italian employer is located.

The same information required for a certicate

of coverage from the United States is needed to

get a certicate from Italy except that you must

show your Italian Social Security number rather

than your U.S. Social Security number.

Certicates for self-employed people

If you are self-employed and would normally

have to pay Social Security taxes to both the

U.S. and Italian systems, you can establish your

exemption from one of the taxes.

• If you are a U.S. national or you are

a U.S. resident, write to the Social

Security Administration at the address

on page 10; or

• If you are an Italian national or dual U.S./

Italian national and wish to elect Italian

coverage, write to the provincial ofce of the

Istituto Nazionale della Previdenza Sociale in

the province where you work.

Be sure to provide the following information in

your letter:

• Full name;

• Date and place of birth;

• Citizenship;

• Country of permanent residence;

• U.S. and/or Italian Social Security number;

• Nature of self-employment activity;

• Dates the activity was or will be

performed; and

• Name and address of your trade or business

in both countries.

Eective date of coverage exemption

The certicate of coverage you receive from

one country will show the effective date of your

exemption from paying Social Security taxes in

the other country. Generally, this will be the date

you began working in the other country.

Certicates of coverage issued by Italy should

be retained by the employer in the United States

in case of an audit by the IRS. No copies should

be sent to IRS unless specically requested by

IRS. However, a self-employed person must

attach a photocopy of the certicate to his or

her income tax return each year as proof of the

U.S. exemption.

Copies of certicates of coverage issued by

the United States will be provided for both the

employee and the employer. It will be their

responsibility to present the certicate to the

Italian authorities when requested to do so. To

avoid any difculties, your employer (or you,

if you are self-employed) should request a

certicate as early as possible, preferably before

your work in the other country begins.

If you or your employer request a certicate of

coverage, you should read the Privacy Act and

Paperwork Reduction Act statements at the end

of this booklet.

5

(over)

Agreement Between The United States And Italy

Monthly benets

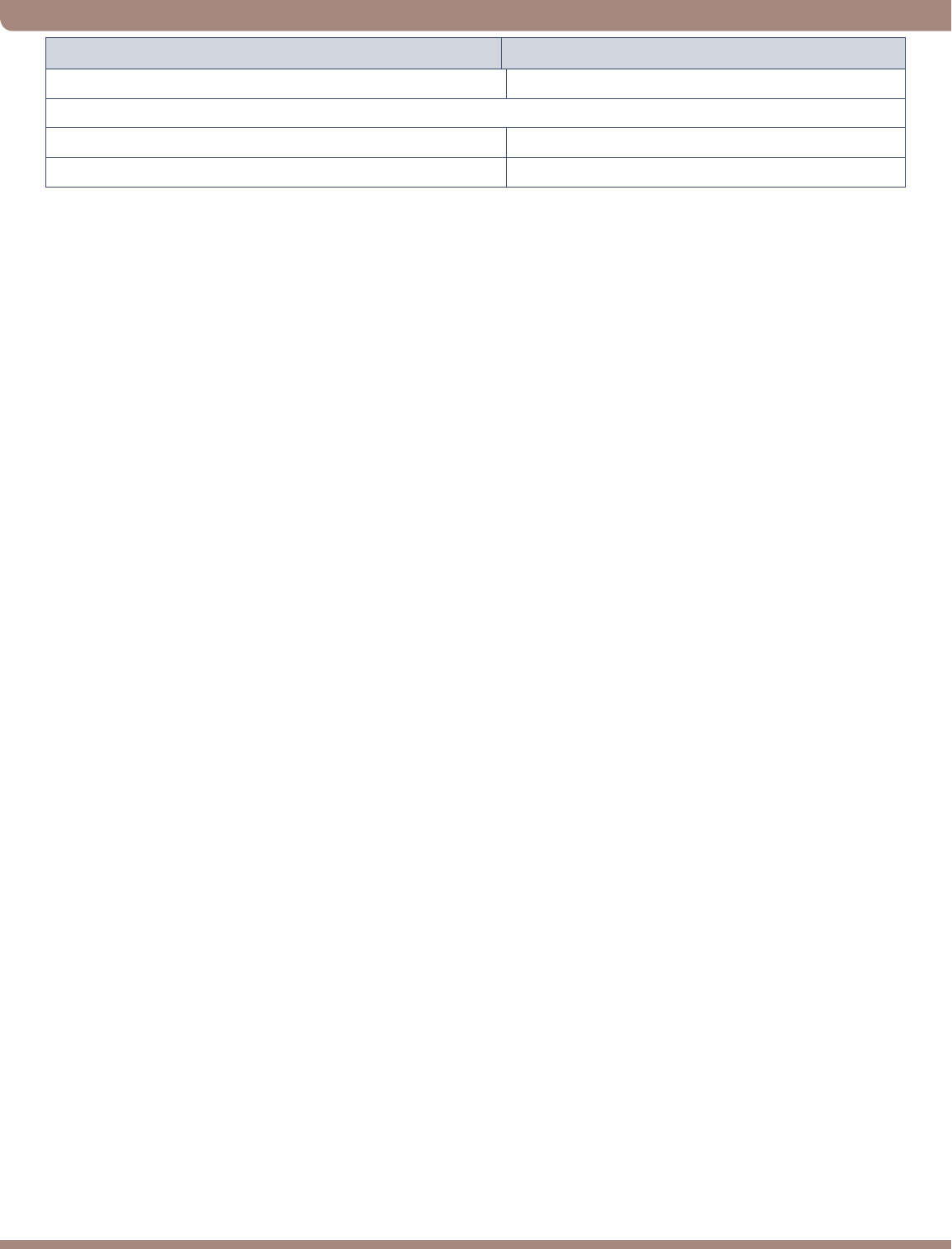

The following table shows the various types

of Social Security benets payable under the

U.S. and Italian Social Security systems and

briey describes the eligibility requirements that

normally apply for each type of benet. If you

do not meet the normal requirements for these

benets, the agreement may help you to qualify

(see “How benets can be paid” on page 7).

This table is only a general guide. You can

get more specic information about U.S.

benets at any U.S. Social Security ofce or by

calling our toll-free number at 1-800-772-1213

or by visiting Social Security’s website at

www.socialsecurity.gov. You can get more

detailed information about the Italian system

by writing to the Italian address on page 10

or by visiting the Italian Social Security system

website at www.inps.it.

Under U.S. Social Security, you may earn up to

four credits each year depending on the amount

of your covered earnings. The amount needed

to earn a work credit goes up slightly each

year. For more information, see How You Earn

Credits (SSA Publication No. 05-10072).

Under the Italian system, credits are measured

in weeks. To simplify the information in the table,

requirements are shown in years of credits.

Retirement or old-age benets

United States Italy

Worker—Full benet at full retirement age.*

Reduced benet as early as age62. Required work

credits range from one and one-half to 10 years

(10 years if age 62 in 1991 or later).

Worker—Benet payable at age 65 for men and age

60 for women with 20 years of credit or at any age

with 35 years of credit.

Disability benets

United States Italy

Worker—Under full retirement age* can get

benet if unable to do any substantial gainful work

for at least a year. One and one-half to 10 years

credit needed, depending on age at date of onset.

Some recent work credits also needed unless

worker is blind.

Worker—Full disability benet if under pensionable

age and permanently and totally disabled. Total

of ve years of coverage with three years in the

last ve years. Partial disability benet if two-thirds

reduction in working capacity.

*Full retirement age for people born in 1938 is age 65 and 2 months. The full retirement age increases

gradually until it reaches age 67 for people born in 1960 or later.

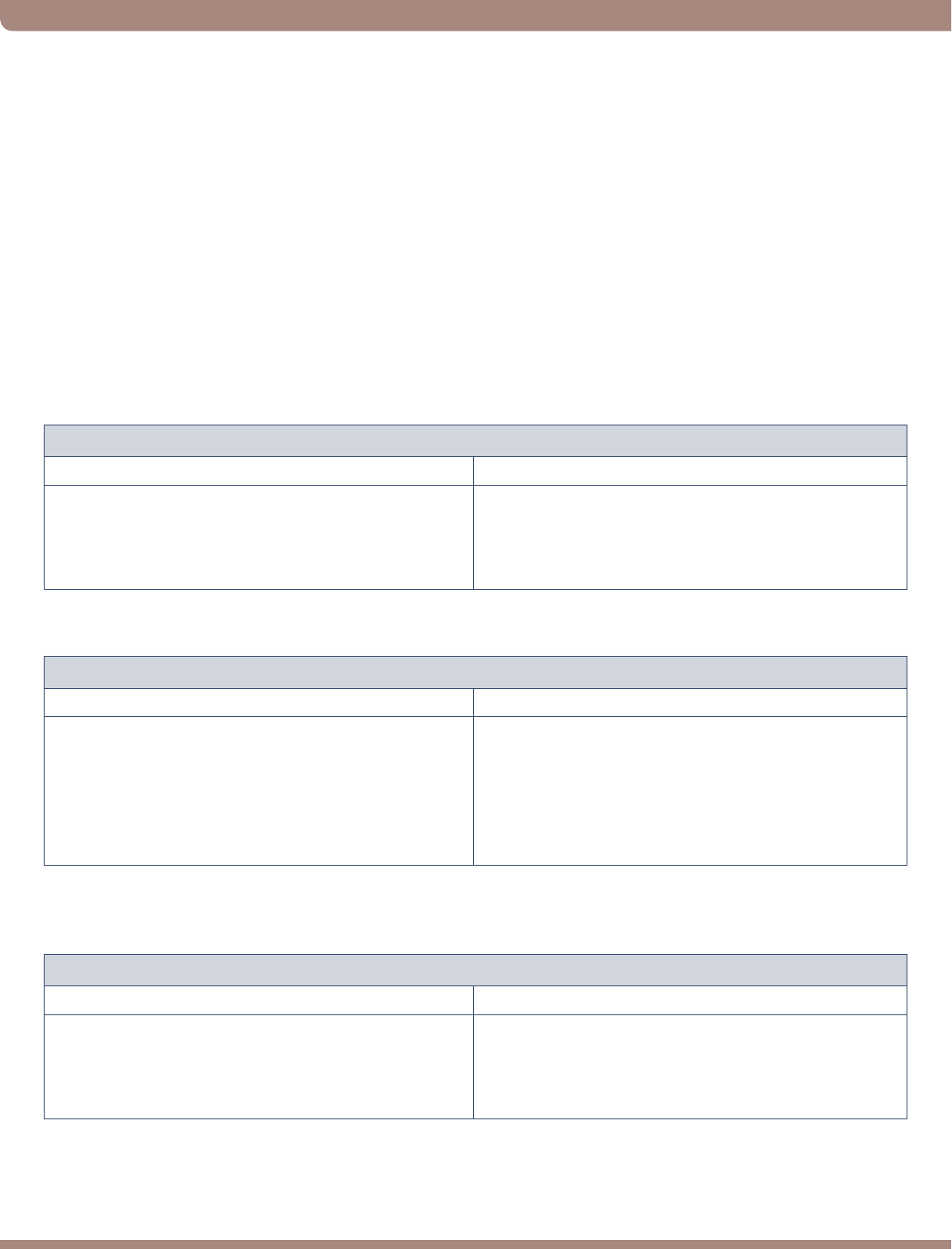

Family benets to dependents of retired or disabled people

United States Italy

Spouse—Full benet at full retirement age* or at

any age if caring for the worker’s entitled child under

age 16 (or disabled before age 22). Reduced benet

as early as age 62 if not caring for a child.

Spouse—No provision. However, a supplement

is payable to the worker for a dependent wife or

disabled husband regardless of age.

6

(over)

Agreement Between The United States And Italy

Family benets to dependents of retired or disabled people

Divorced spouse—Full benet at full retirement

age.* Reduced benet as early as age 62. Must be

unmarried and have been married to worker for at

least 10 years.

Divorced spouse—No provision.

Children—If unmarried, up to age 18 (age 19 if in

an elementary or secondary school full time) or any

age if disabled before age 22.

Children—No provision. However, a supplement

is payable to the worker for a dependent child who

is under age 18, age 18-21 and attending middle

or vocational school, under age 26 and attending a

university or disabled regardless of age.

Survivors benets

United States Italy**

Widow—Full benet at full retirement age* or

at any age if caring for the deceased’s entitled

child under age 16 (or disabled before age 22).

Reduced benet as early as age 60 (or age 50

if disabled) if not caring for child. Benets may

be continued if remarriage occurs after age 60

(or age 50 if disabled).

Widow—Any age if dependent on the worker.

Worker must have been entitled to benets or have

ve years of credit.

Widower—Same as for widow. Widower—Must be disabled. Other requirements

same as widow.

Divorced widow(er)—Same as widow(er) if

marriage lasted at least 10 years.

Divorced widow(er)—No provision.

Children—Same as for children of retired or

disabled worker.

Children—Up to age 18 (or age 22 if attending

middle or vocational school; or age 26 if attending

university) or any age if disabled before age 18 or

the death of the worker.

Dependent parent—Age 62 or older

(even if others eligible).

Dependent parent—Age 65 and no surviving

spouse or child.

Dependent brother or sister—No provision. Dependent brother or sister—Any age if disabled,

unmarried and there is no surviving spouse, child

or parent.

Lump-sum death benet—A one-time payment

not to exceed $255 payable on the death of an

insured worker.

Lump-sum death benet—No provision.

*Full retirement age for people born in 1938 is age 65 and 2 months. The full retirement age increases

gradually until it reaches age 67 for people born in 1960 or later.

**In Italy, family members must be dependent on the worker and are presumed to be if they are living in the

same household.

7

(over)

Agreement Between The United States And Italy

How benets can be paid

If you have Social Security credits in both the

United States and Italy, you may be eligible

for benets from one or both countries. If you

meet all the basic requirements under one

country’s system, you will get a regular benet

from that country. If you do not meet the basic

requirements, the agreement may help you

qualify for a benet as explained below.

• Benets from the U.S.—If you do not have

enough work credits under the U.S. system

to qualify for regular benets, you may be

able to qualify for a partial benet from the

United States based on both U.S. and Italian

credits. Only Italian credits earned after 1936

may be counted. However, to be eligible to

have your Italian credits counted, you must

have earned at least six credits (generally

one and one-half years of work) under the

U.S. system. If you already have enough

credits under the U.S. system to qualify for a

benet, the United States cannot count your

Italian credits.

• Benets from Italy—Social Security credits

from both countries can also be counted,

when necessary, to meet the eligibility

requirements for Italian benets. To be

eligible to have your U.S. and Italian credits

counted, you must have at least one year

of coverage since 1920 under any of the

programs administered by the following four

Italian Social Security Agencies:

1. Istituto Nazionale della

Previdenza Sociale;

2. Ente Nazionale di Previdenza e Assistenza

per i Lavoratori dello Spettacolo;

3. Istituto Nazionale di Previdenza per i

Dirigenti di Aziende Industriali; or

4. Istituto Nazionale di Previdenza per i

Giornalisti Italiani.

How credits get counted

You do not have to do anything to have your

credits in one country counted by the other

country. If we need to count your credits under

the Italian system to help you qualify for a U.S.

benet, we will get a copy of your Italian record

directly from Italy when you apply for benets.

If Italian ofcials need to count your U.S. credits

to help you qualify for an Italian benet, they will

get a copy of your U.S. record directly from the

Social Security Administration when you apply

for the Italian benet.

Although each country may count your credits

in the other country, your credits are not actually

transferred from one country to the other. They

remain on your record in the country where you

earned them and can also be used to qualify for

benets there.

Computation of U.S. benet under

the agreement

When a U.S. benet becomes payable as a

result of counting both U.S. and Italian Social

Security credits, an initial benet is determined

based on your U.S. earnings as if your entire

career had been completed under the U.S.

system. This initial benet is then reduced to

reect the fact that Italian credits helped to make

the benet payable. The amount of the reduction

will depend on the number of U.S. credits: the

more U.S. credits, the smaller the reduction; the

fewer U.S. credits, the larger the reduction.

An Italian pension may aect your

U.S. benet

If you qualify for Social Security benets from

both the United States and Italy and you did

not need the agreement to qualify for either

benet, the amount of your U.S. benet may

be reduced. This is a result of a provision

in U.S. law which can affect the way your

benet is gured if you also receive a pension

based on work that was not covered by U.S.

Social Security. For more information, call

our toll-free number, 1-800-772-1213, or visit

our website, www.socialsecurity.gov, and

get a copy of Windfall Elimination Provision

(Publication No. 05-10045). If you are outside

the United States, you may write to us at the

address on page 10.

8

(over)

Agreement Between The United States And Italy

What you need to know

about Medicare

Medicare is the U.S. national health insurance

program for people age 65 or older or who are

disabled. Medicare has four parts:

• Hospital insurance (Part A) helps pay

for inpatient hospital care and certain

follow-up services.

• Medical insurance (Part B) helps pay for

doctors’ services, outpatient hospital care

and other medical services.

• Medicare Advantage plans (Part C) are

available in many areas. People with

Medicare Parts A and B can choose to

receive all of their health care services

through a provider organization under Part C.

• Prescription drug coverage (Part D) helps

pay for medications doctors prescribe for

medical treatment.

You are eligible for free hospital insurance at

age 65 if you have worked long enough under

U.S. Social Security to qualify for a retirement

benet. People born in 1929 or later need 40

credits (about 10 years of covered work) to

qualify for retirement benets.

Although the agreement between the United

States and Italy allows the Social Security

Administration to count your Italian credits to

help you qualify for U.S. retirement, disability

or survivors benets, the agreement does

not cover Medicare benets. As a result, we

cannot count your credits in Italy to establish

entitlement to free Medicare hospital insurance.

For more information about Medicare,

call our toll-free number, 1-800-772-1213,

and ask for the publication, Medicare

(Publication No. 05-10043) or visit Medicare’s

website at www.medicare.gov.

Claims for benets

If you live in the United States and wish to apply

for U.S. or Italian benets:

• Visit or write any U.S. Social Security

ofce; or

• Phone our toll-free number, 1-800-772-1213,

7 a.m. to 7 p.m. any business day. People

who are deaf or hard of hearing may call our

toll-free TTY number, 1-800-325-0778.

You can apply for Italian benets at any

U.S. Social Security ofce by completing an

application form SSA-2490.

If you live in Italy and wish to apply for U.S. or

Italian benets, contact:

• The U.S. Embassy in Rome (phone

6-4674-2326) or the U.S. Consulate in

Naples (phone 81-5838-235) to le for U.S.

benets; or

• The nearest ofce of the Istituto Nazionale

della Previdenza Sociale to le for

Italian benets.

You can apply with one country and ask to

have your application considered as a claim for

benets from the other country. Information from

your application will then be sent to the other

country. Each country will process the claim

under its own laws—counting credits from the

other country when appropriate—and notify you

of its decision.

If you have not applied for benets before, you

may need to provide certain information and

documents when you apply. These include

the worker’s U.S. and Italian Social Security

numbers, proof of age for all claimants,

evidence of the worker’s U.S. earnings in the

past 24 months and information about the

worker’s coverage under the Italian system.

You may wish to call the Social Security

ofce before you go there to see if any other

information is needed.

Payment of benets

Each country pays its own benet. U.S.

payments are made by the U.S. Department

of Treasury each month and cover benets for

the preceding month. Italian benets are paid

through the Banca Commerciale Italiana in New

York for beneciaries living in the United States.

If you live outside Italy, payments are made

every four months for the two previous months

and the two succeeding ones.

9

(over)

Agreement Between The United States And Italy

Absence from U.S. territory

Normally, people who are not U.S. citizens

may receive U.S. Social Security benets

while outside the U.S. only if they meet certain

requirements. Under the agreement, however,

you may receive benets as long as you

reside in Italy regardless of your nationality. If

you are not a U.S. citizen and live in another

country, you may not be able to receive

benets. The restrictions on U.S. benets are

explained in the publication, Your Payments

While You Are Outside The United States

(Publication No. 05-10137).

Appeals

If you disagree with the decision made on your

claim for benets under the agreement, contact

any U.S. or Italian Social Security ofce. The

people there can tell you what you need to do to

appeal the decision.

The Italian Social Security authorities will

review your appeal if it affects your rights under

the Italian system, while U.S. Social Security

authorities will review your appeal if it affects

your rights under the U.S. system. Since each

country’s decisions are made independently

of the other, a decision by one country on a

particular issue may not always conform with

the decision made by the other country on the

same issue.

Authority to collect information

for a certicate coverage

(see pages 3-4)

Privacy Act

The Privacy Act requires us to notify you that

we are authorized to collect this information by

section 233 of the Social Security Act. While it is

not mandatory for you to furnish the information

to the Social Security Administration, a

certicate of coverage cannot be issued unless

a request has been received. The information is

needed to enable Social Security to determine

if work should be covered only under the U.S.

Social Security system in accordance with an

international agreement. Without the certicate,

work may be subject to taxation under both the

U.S. and the foreign Social Security systems.

Paperwork Reduction Act Notice

This information collection meets the clearance

requirements of 44 U.S.C. section 3507,

as amended by section 2 of the Paperwork

Reduction Act of 1995. You are not required

to answer these questions unless we display a

valid Ofce of Management and Budget control

number. We estimate that it will take you about

30 minutes to read the instructions, gather the

necessary facts, and write down the information

to request a certicate of coverage.

Contacting Social Security

Visit our website

The most convenient way to conduct Social

Security business from anywhere at any

time, is to visit www.socialsecurity.gov.

There, you can:

• Apply for retirement, disability, and

Medicare benets;

• Find copies of our publications;

• Get answers to frequently asked

questions; and

• So much more!

Call us

If you don’t have access to the internet, we

offer many automated services by telephone,

24 hours a day, 7 days a week. If you’re in the

United States, call us toll-free at 1-800-772-1213

or at our TTY number, 1-800-325-0778, if you’re

deaf or hard of hearing.

If you need to speak to a person, we can answer

your calls from 7 a.m. to 7 p.m., Monday through

Friday. We ask for your patience during busy

periods since you may experience a higher than

usual rate of busy signals and longer hold times

to speak to us. We look forward to serving you.

10

For more information

To le a claim for U.S. or Italian benets under

the agreement, follow the instructions on

pages 8-9.

To nd out more about U.S. Social Security

benets or for information about a claim for

benets, contact any U.S. Social Security ofce

or call our toll-free number at 1-800-772-1213.

If you live outside the United States, write to:

Social Security Administration

OIO—Totalization

P.O. Box 17049

Baltimore, MD 21235-7049

USA

For more information about Italy’s Social

Security programs, visit any Social Security

ofce in Italy. If you do not live in Italy, write to:

I.N.P.S.-Direzione Generale

Servizio Rapporti e Convenzioni

Internazionali

via della Frezza 17

00186 Roma

ITALY

If you do not wish to le a claim for benets

but would like more information about the

agreement, write to:

Social Security Administration

Ofce of International Programs

P.O. Box 17741

Baltimore, Maryland 21235-7741

USA

For additional information visit our website:

www.socialsecurity.gov/international

Social Security Administration

Publication No. 05-10171

August 2017

Agreement Between The United States And Italy

Produced and published at U.S. taxpayer expense