J.P.Morgan

2023 AFP®

PAYMENTS FRAUD AND

CONTROL SURVEY REPORT

KEY HIGHLIGHTS

This summary report includes highlights from the comprehensive 2023

AFP® Payments Fraud and Control Survey Report. The complete report

comprising all ndings and detailed analysis is exclusively available to

AFP members.

Learn more about AFP membership.

Underwritten by:

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 3

J.P.Morgan

We’re proud to share the results from the 2023 AFP Payments Fraud and Control survey. As a

sponsor of the survey for the last 15 years, J.P. Morgan is committed to helping organizations

protect themselves from payments fraud.

The latest survey shows that payments fraud is still a serious threat for every organization.

Instances of digital fraud are frequent across various fronts, with multiple schemes aimed at

relaxed controls.

Here are some highlights from the survey:

• The share of businesses that reported commercial card fraud has increased by 10

percentage points since 2021.

• The share of businesses that reported ACH Credit fraud has increased by six percentage

points over the same time frame.

• Fraudsters continue to impersonate employees and vendors through sophisticated business

email compromise schemes that are the root cause of most reported fraud cases.

• Checks are the payment method most vulnerable to fraud—a trend that has remained

consistent since the rst AFP survey.

• Still, three out of four organizations that use checks plan to keep using checks.

J.P. Morgan oers products and services that can help you manage your fraud risk in connection

with checks, wires, and ACH. We hope this report keeps you informed on the latest challenges

and encourages you to remain vigilant as ever.

With best regards,

Sue Dean

Max Neukirchen Alec Grant

Ryan Schmiedl

Head of Solutions,

Global Head of Head of Client Fraud

Global Head of

Commercial Banking

Payments & Commerce Prevention, & Recoveries,

Trust & Safety,

Solutions Commercial Banking,

Payments,

J.P. Morgan

J.P. Morgan

J.P. Morgan

J.P. Morgan

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 4

TOPICS COVERED IN THE COMPREHENSIVE 2023 AFP® PAYMENTS

FRAUD AND CONTROL SURVEY REPORT

PAYMENTS FRAUD ACTIVITY

— Payments Fraud Trends

— Payment Methods Impacted by Payments Fraud

— Corporate/Commercial Card Fraud

— Losses Incurred Due to Payments Fraud Attempts/Attacks

— Detecting Payments Fraud Activity

— Recouping of Funds

— Origination of Attempted/Actual Payments Fraud

BUSINESS EMAIL COMPROMISE (BEC)

— About Business Email Compromise

— Business Email Compromise Trends

— Financial Impact of Business Email Compromise

— Financial Losses Incurred Due to Business Email Compromise

— Targets of Business Email Compromise Scams

— Departments Most Susceptible to Business Email

Compromise Fraud

PAYMENTS FRAUD CONTROLS

— Business Email Compromise Controls

— Check Fraud Controls

— ACH Fraud Controls

— Implementing Risks to curb Fraud via Faster Payments

— Beneciary Validation

— Fraud Review

— Measures to Improve Controls

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 5

INTRODUCTION

As 2021 came to a close, organizations were

slowly returning to some level of normalcy as

the severity of the impact of COVID-19 began

to diminish. However, the spread of the highly

contagious Omicron variant upended those

plans during the rst few months of 2022. Once

that threat subsided, business leaders were

quick to focus on ramping up operations. But

there were challenges, including a sudden and

severe shortage of personnel in the workforce

and a tight job market. Organizations found it

dicult to ll open positions. Employees had

the upper hand, and they were being swayed

by higher compensation and benets from

other employers. A consequence was that

people were resigning from their jobs in droves,

resulting in a global phenomenon known as the

“Great Resignation.”

In February of 2022, Russia attacked Ukraine.

Sanctions imposed on Russia by many western

countries resulted in a very tense global

situation. This created instability and fuel

prices rose precipitously. Ination rates rose

to the highest levels in decades, and the cost

of groceries, rent, fuel and other household

items were skyrocketing. As a consequence,

the Federal Reserve took action to control

the rising ination by increasing interest rates

7 times in 2022; it is anticipated there will be

more rate increases in 2023.

With rising interest rates, the fear of a recession

loomed over the economy. Tech companies

began mass layos creating a sense of

uncertainty and fear that organizations in

other industries might follow suit. To address

challenges in the work environment, many

companies oered employees hybrid work

arrangements, requiring that employees come

into their oces only a few times a week or

month. Some organizations mandated that

employees return to oces, but that was –

and continues to be – met with resistance.

Other organizations chose to remain “virtual”

permanently.

With the major threat of COVID-19 now

abated, many businesses are functioning

at pre-pandemic levels. During COVID-19,

payment systems were put to the test of

operating in an all-virtual environment. With

minimal preparation, companies had to make

and receive payments while operating in an

environment drastically dierent from the usual

norm. 2022 saw a large increase in brazen and

successful attempts at stealing mail from post

oce boxes: i.e., the blue boxes typically found

on street corners. Perpetrators of these crimes

replicated keys to mailboxes and stole mail. Mail

was then opened, and payments containing

checks (government, business, personal, etc.)

were washed and check amounts and names

of payees altered. These checks were then

endorsed and deposited into accounts with a

short life. FinCen recently issued a warning to

nancial institutions about this type of fraud

1

.

This type of fraud is low-tech (being paper

based) and low cost, and so is an attractive

method for fraudsters. Postal Inspectors are

overworked with cases of this type of fraud,

and perpetrators are able to get away with few

repercussions. To address this trend, treasury

and nance professionals worked on equipping

their organizations to tackle the risk of fraud

in this new scenario. Stringent controls were

put in place to curb fraud attacks on payment

systems. This appears to have been eective

in curbing instances of widespread payments

1

FinCEN Alert on Nationwide Surge in Mail Theft-Related Check Fraud Schemes Targeting the U.S. Mail | FinCEN.gov

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 6

INTRODUCTION (Continued)

fraud. Additionally, the use of checks, a

common target of perpetrators, has declined

considerably, preventing fraudsters from doing

further harm using checks as a means to

perpetrate fraud.

Every year since 2005, the Association

for Financial Professionals® (AFP) has

conducted its Payments Fraud Survey. The

surveys examine the nature of fraud attacks

on business-to-business transactions,

the payment methods impacted, and the

strategies organizations are adopting to

protect themselves from those committing

payments fraud. Continuing this research, AFP

conducted the 19th Annual Payments Fraud

and Control Survey in January 2023. The

survey generated 471 responses from corporate

practitioners from organizations of varying

sizes representing a broad range of industries.

Results presented in this report reect data for

2022. Survey respondent demographics are

available at the end of this report.

AFP thanks J.P. Morgan for its continued

underwriting support of the AFP Payments

Fraud and Control Survey series. Both

questionnaire design and the nal report, along

with its content and conclusions, are the sole

responsibility of AFP’s Research Department.

“Attempted fraud

was discovered by

our supplier setup

team calling an

established vendor

and conrming they

had not changed

banks, as per the

email we received.”

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 7

KEY FINDINGS

Overall, attempted or actual payments fraud

in 2022 was lower compared to that in recent years.

Sixty-ve percent of respondents indicate that their organizations were

victims of either attempted or actual fraud

activity in 2022 – the smallest percentage since 2014.

Instances of fraud via digital

payment methods have risen

since 2021.

Commercial card fraud increased

by 10 percentage points in 2022,

fraud via ACH credits was up by

6 percentage points and fraud

via virtual cards also increased

by 6 percentage points during

the same time frame.

Twenty-seven percent

of organizations were

able to successfully

recover at least 75 percent

of funds lost due to

payments fraud in 2022,

while 44 percent were

unsuccessful in doing so.

Over half of organizations

with annual revenue of less

than $1 billion were unable

to recover funds lost due to

payments fraud attacks.

Business Email Compromise (BEC) scams

are still highly prevalent and are the root

cause of payments fraud at a majority

of organizations. Seventy-one percent of

companies were victims of payments

fraud via email in 2022.

Larger organizations with annual revenue of at least $1 billion were

more susceptible to BEC scams, while those companies with less

than $1 billion in annual revenue were more susceptible to fraud

committed by individuals outside their organizations.

Payment methods used during BEC attempts included

wires, cited by 45 percent of respondents (the highest

percentage in the past five years) and ACH debits.

Fraudsters are increasingly targeting ACH debits when

attempting scams via email.

Nearly 80 percent of organizations are most likely

to seek assistance from their banking partners for

guidance regarding the steps to take to minimize

the impact of payments fraud.

Sixty-nine percent inform the security/compliance team

at their organizations.

Checks continue to be the payment method most vulnerable to fraud.

Sixty-three percent of respondents report that their organizations faced fraud

activity via checks. Three-fourths of organizations currently using checks do not plan

to discontinue issuing checks.

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 8

•

PAYMENTS FRAUD ACTIVITY IN 2022

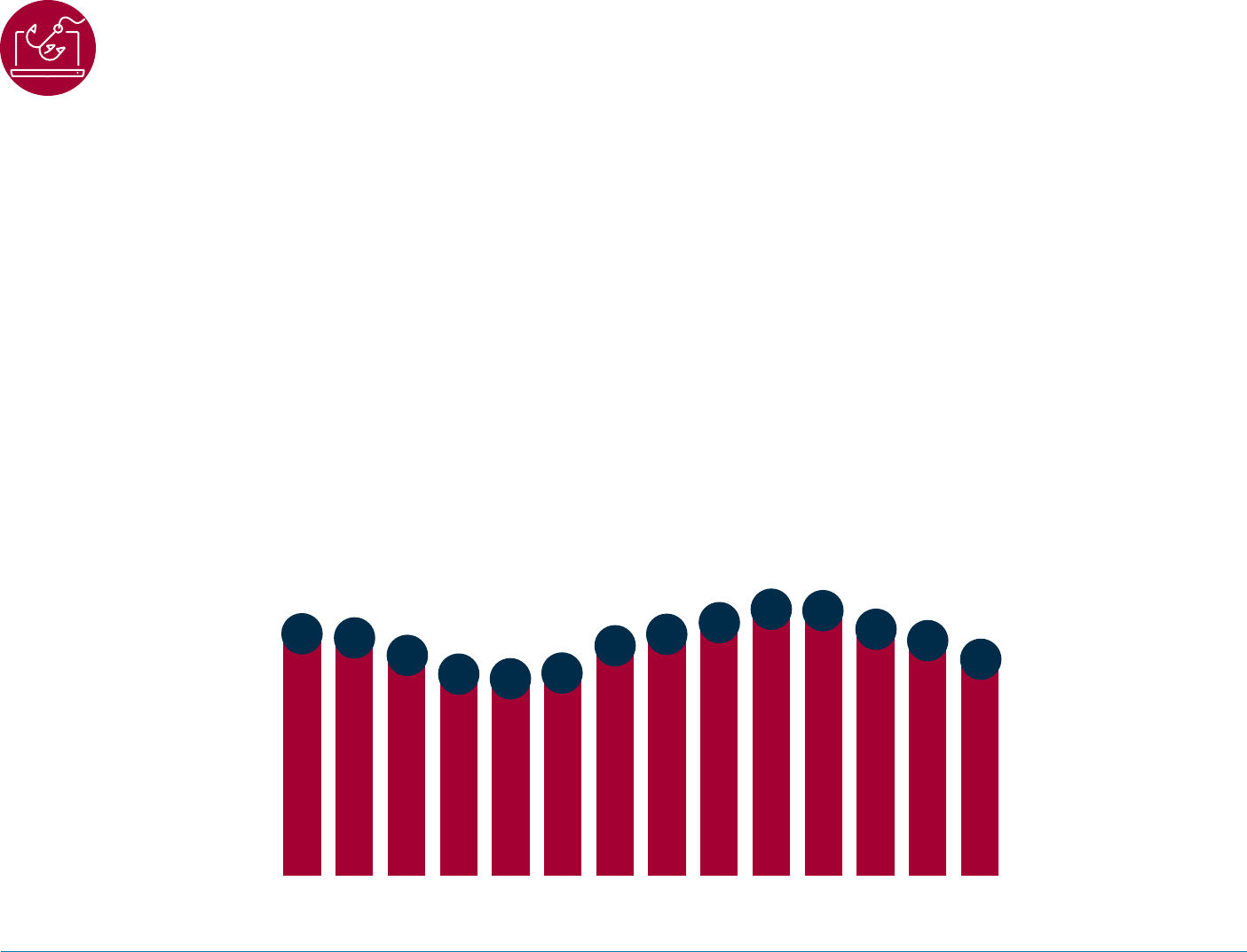

Fewer Organizations Report Being Targets of a Payments Fraud Attack in 2022

From 2009-2013, organizations experienced a

decline in payments fraud activity. Sixty percent

of respondents reported instances of fraud at

their organizations in 2013. Then the pendulum

swung the other way and there was an uptick in

fraud activity between 2014-2018. In 2018 and

2019 payments fraud activity was widespread

with over 80 percent of organizations falling

prey to the tactics of fraudsters.

Since then, there has been a decrease in

the percentage of treasury professionals

reporting that their organizations had been

targets of a fraud attack. Fortunately, this

downward trend activity continued in 2022;

65 percent of organizations were victims of

either attempted or actual fraud activity – the

smallest percentage since 2014. Although this

gure is lower than fraud reported in recent

years, it is still a signicant share with two out

of three companies continuing to be victims of

fraud attacks.

A greater share of survey respondents from

larger organizations and those with more

payment accounts – i.e., those with annual

revenue of at least $1 billion and with more

than 100 payment accounts – reports their

rms experienced payments fraud in 2022

compared with the share of respondents from

other organizations. Eighty-four percent of

these organizations were targets of payments

fraud. Fewer smaller organizations – those

with annual revenue less than $1 billion – were

targets of payments fraud in 2022 than were

larger organizations (with annual revenue

of at least $1 billion): 60 percent compared

to 78 percent, respectively. Fraudsters were

more inclined to target larger organizations,

exposing deciencies around process controls

using social engineering.

Percent of Organizations That Were Victims of Payments Fraud Attacks/Attempts

73%

71%

68%

61%

60%

62%

73%

74%

78%

82%

81%

74%

71%

65%

2009

2010

2011 2012

2013

2014

2015

2016

2017

2018

2019 2020

2021 2022

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 9

•

• •••

•

PAYMENTS FRAUD ACTIVITY IN 2022

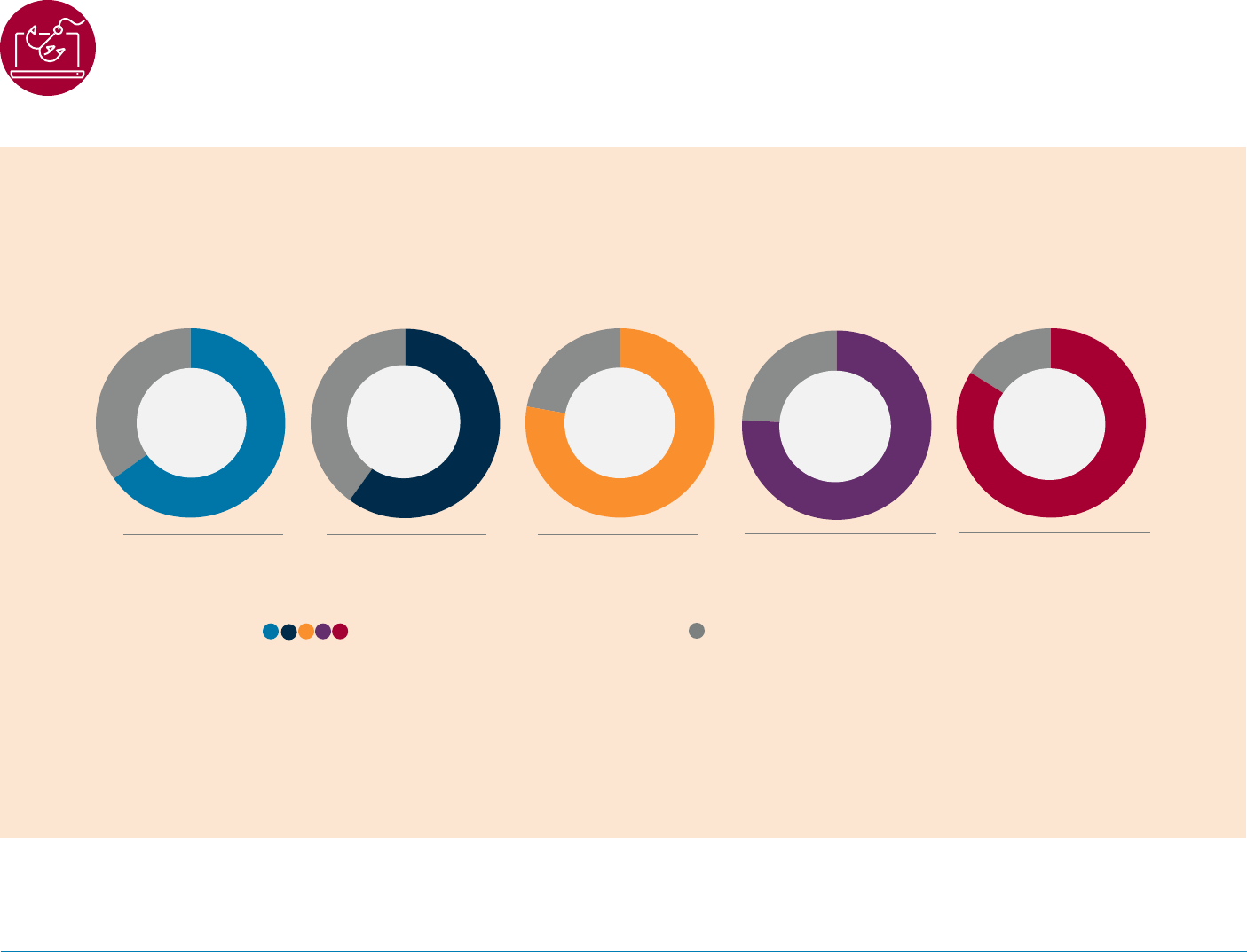

Prevalence of Attempted/Actual Payments Fraud in 2022

(Percentage Distribution of Organizations)

65% 60%

78%

84%

76%

All

Annual Revenue Less

Than $1 Billion

Annual Revenue

At Least $1 Billion

Annual Revenue At Least

$1 Billion and Fewer Than 26

Payment Accounts

Annual Revenue At Least

$1 Billion and More Than

100 Payment Accounts

Yes, my organization was a victim

of attempted or actual payments fraud

No, my organization was not a victim of

attempted or actual payments fraud

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 10

•

-

-

-

■

• •

PAYMENT METHODS MOST VULNERABLE TO FRAUD

Checks Continue to be Most

Vulnerable to Payments Fraud

In 2022, checks continued to be the payment

method impacted most often by fraud activity;

63 percent of respondents report that their

organizations faced some kind of check fraud

activity, attempted or actual. Payments fraud

via checks had been on the decline since 2010,

with some intermittent upticks in between.

Seventy percent of nancial professionals

reported that their organizations’ check

payments were subject to fraud attempts/attacks

in 2018, while 74 percent reported the same for

2019. We then saw a decrease to 66 percent in

2020 and it remained unchanged in 2021.

“We had a washed

check and relied on our

bank to track down the

errant payee.

”

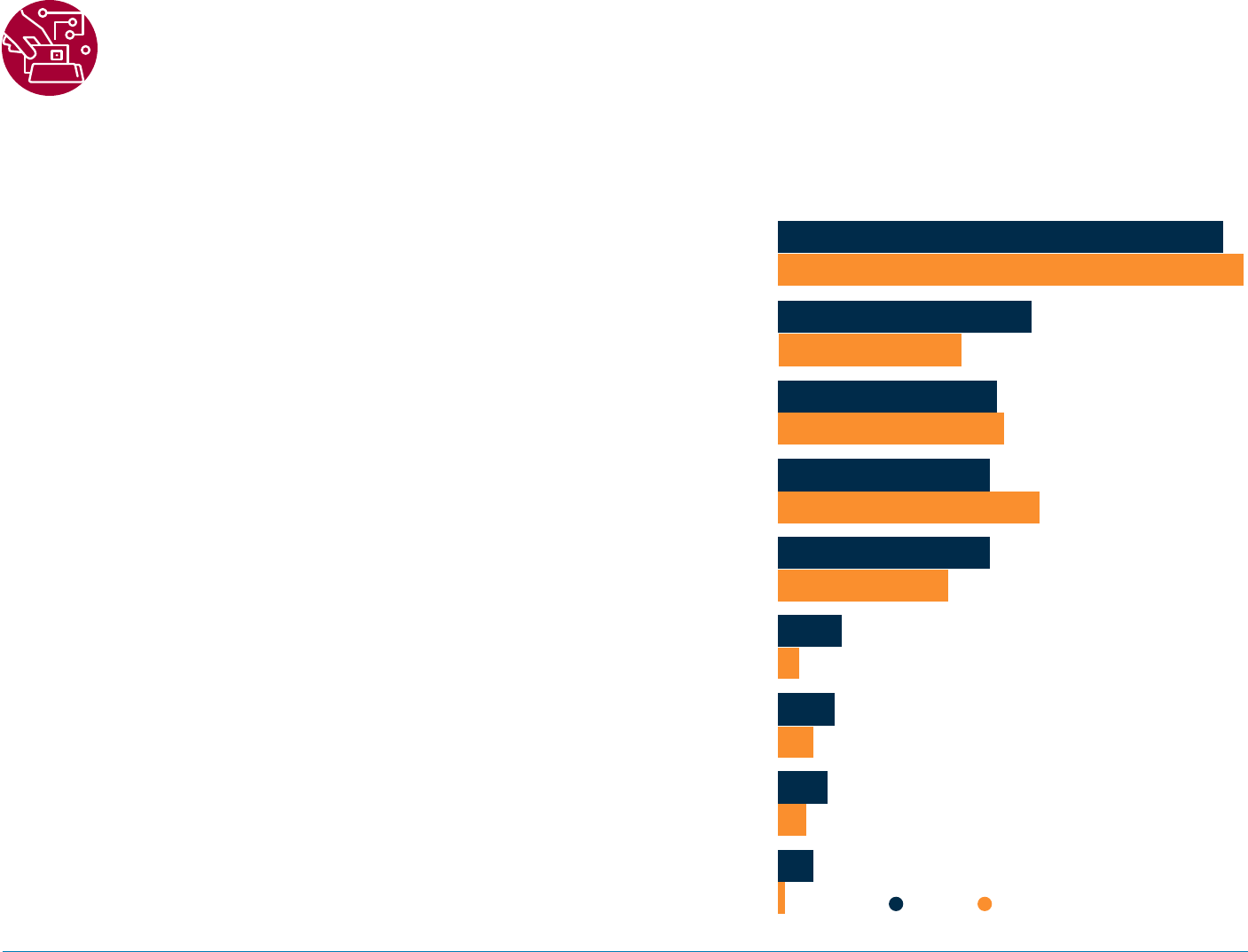

Payment Methods Subject to Fraud by Type

(Percent of Organizations)

Checks

63%

66%

Corporate/commercial credit cards

26%

36%

Wire transfers

31%

32%

ACH debits

30%

37%

ACH credits

30%

24%

Virtual cards

3%

9%

Faster payments

8%

5%

Mobile wallets

7%

4%

Cryptocurrency (Bitcoin, Ethereum, etc.)

5%

1%

2022 2021

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 11

•

••

•

~

PAYMENT METHODS MOST VULNERABLE TO FRAUD

Contributing to the decline in check fraud is the

fact that organizations are using fewer checks

in their business-to-business (B2B) transactions

and an increase in digital payments. According

to the 2022 AFP® Electronic Payments Report,

33 percent of organizations used checks for

B2B payments in 2022, while in 2004 over

80 percent of companies used checks for

similar transactions.

The share of organizations that were victims

of fraud attacks via wire transfers has also

been decreasing – from 48 percent in 2017

to 32 percent in 2021 and 31 percent in 2022.

Companies are more ecient in detecting

potential fraud and mitigating it appropriately.

Results suggest a clear downward trend in

wire fraud activity, indicating that the controls

companies are putting in place to prevent

wire fraud are eective. Fraudsters often use

wires to inltrate an organization’s payment

systems using email, and because in recent

years companies have bolstered their eorts

to control fraud via email – i.e., Business Email

Compromise (BEC) – those eorts have

contributed to a decrease in instances of

wire fraud.

The share of respondents reporting fraud via

ACH debits decreased from 37 percent in 2021

to 30 percent in 2022. The percentage of fraud

activity via ACH debits had been increasing

gradually – from 33 percent in 2019 to 34

percent in 2020 and to 37 percent in 2021.

Time will tell whether the recent decline is the

beginning of a trend or not. Potential reasons

for the decline possibly include businesses

having stronger procedures and tools in place,

including the use of debit lters, debit blocks,

etc. Also, as more payments move to digital

channels, the stronger processes around

ACH debits might have helped to reduce the

incidence of fraud.

Fraud via ACH credits rose 6 percentage points

from 2021 to 30 percent in 2022. In 2019 fraud

via ACH credits accounted for 22 percent

of fraud activity, then decreased slightly to

19 percent in 2020 before rising again to 24

percent in 2021 and to 30 percent in 2022.

As companies move from paper to digital

payment methods, the origination point of ACH

credits needs further review around processes,

controls and procedures. Dual approvals and

proper payment backup/detail protocols should

parallel those for other payment channels

such as wires, Real Time Payments and Same

Day ACH. In addition, organizations should

continually educate their employees on how to

protect their payment systems from fraudsters.

Apart from fraud via checks, wire transfers and

ACH credits, attacks via corporate/commercial

credit cards, faster payments, virtual cards,

cryptocurrency and mobile wallets have

increased from 2021 to 2022. The percentage

of organization that were victims of fraud

attacks via corporate/commercial credit cards

rose from 26 percent to 36 percent in 2022,

fraud attacks via faster payments increased

from 5 percent to 8 percent and fraud attacks

via cryptocurrency rose from one percent to

ve percent.

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 12

ASSISTANCE SOUGHT WHEN REPORTING PAYMENTS FRAUD

Banking Partners Often Sought Out for Assistance in Process to Report

Payments Fraud

When looking to report payments fraud,

79 percent of respondents indicate their

organizations are most likely to seek

assistance from their banking partners to

receive guidance about the steps to take to

minimize the impact from such fraud. Since

banking partners are increasingly being

sought out for guidance, practitioners should

ensure that when selecting banking partners

those partners have experience in dealing

with payments fraud and so will be able to

help organizations when the need arises. If

changing banks, it is a good practice for a

company to incorporate a “fraud checkup” into

the RFP as a requirement including requesting

demos of fraud solutions for each payment

type, how exceptions are handled, timing to

action exceptions, and setting defaults to

”not pay” if deadlines are missed. Sixty-nine

percent of respondents report they would

inform the security/compliance team at

their organizations; this action is taken more

frequently at larger organizations with annual

revenue of at least $1 billion (74 percent) than

at those rms with annual revenue of less than

$1 billion (59 percent). Other steps being taken

when reporting fraud are:

— File report with police (local, state,

or federal) (cited by 38 percent of

respondents)

— Inform law enforcement agencies (e.g.,

FBI) (35 percent)

— Inform the Federal Trade Commission

(FTC) (6 percent)

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 13

ASSISTANCE SOUGHT WHEN REPORTING PAYMENTS FRAUD

Process Used to Report Payments Fraud in 2022

(Percent of Organizations)

All

Annual Revenue

Less Than $1 Billion

Annual Revenue

At Least $1 Billion

Annual Revenue At

Least $1 Billion

and Fewer Than 26

Payment Accounts

Annual Revenue At

Least $1 Billion

and More Than 100

Payment Accounts

Seek assistance from our banking partner 79% 73% 84% 87% 78%

Inform internal security/compliance team 69% 59% 74% 72% 78%

File report with police (local, state or federal) 38% 30% 45% 44% 41%

Inform law enforcement agencies (e.g., FBI) 35% 30% 43% 44% 41%

Inform the Federal Trade Commission (FTC) 6% 6% 6% 7% 7%

Other

• File police report in targeted country

(when outside of the U.S.)

• File a claim with Postmaster General’s oce

• Depends on the fraud

• File a Suspicious Activity Report (SAR)

4% 6% 3% 1% 4%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 14

•

I 1

RECOUPING OF FUNDS

A Majority of Organizations Recoup

Less than 10 percent of Funds Stolen

Due to Fraud

Forty-four percent of respondents indicate

that after a successful fraud attempt, their

organizations were unable to recover the funds

lost due to the fraud. At the other end of the

spectrum, 27 percent were able to recoup 75

percent of the funds lost. Larger organizations

with annual revenue of at least $1 billion and

more than 100 payment accounts have greater

success in recovering funds lost; 41 percent of

these companies were successful in regaining

more than 75 percent of the funds lost due

to a fraud attack and only 19 percent were

unsuccessful in recouping funds. Organizations

with greater revenue and with a larger volume of

payment accounts are better equipped to detect

fraud early. They implement systems that allow

for uncovering the origins of the fraud and thus

minimize the nancial impact of a fraud attack.

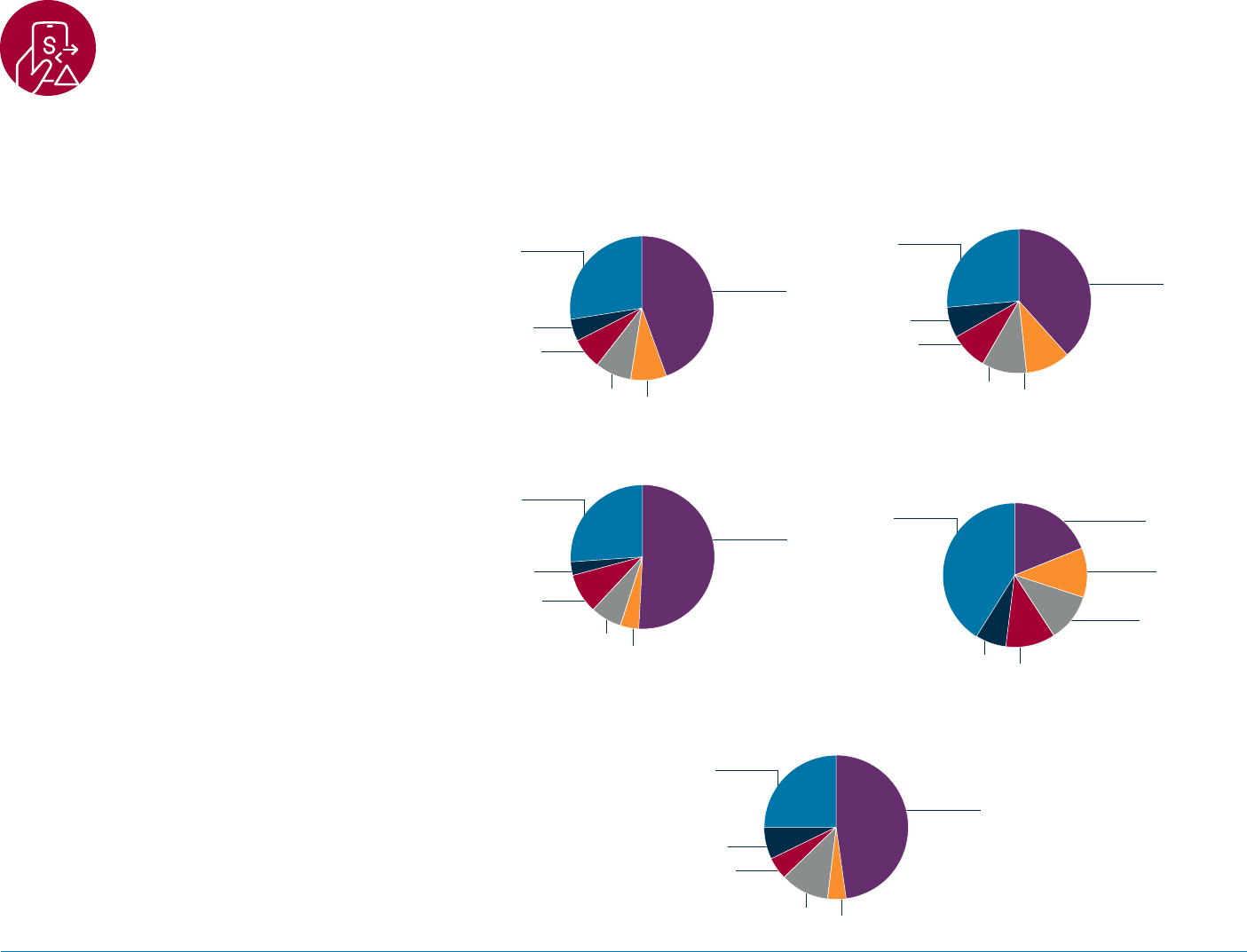

Recoup of Funds After a Successful Fraud Attempt

(Percentage Distribution of Organizations that Experienced Fraud)

All

Annual Revenue At Least $1 Billion

26%

27%

More than 75%

More than 75%

38%

44%

None

None

51-75%

7%

51-75%

5%

26-50%

26-50%

8%

7%

11-25%

11-25%

Less than 10%

Less than 10%

10%

8%

10%

8%

Annual Revenue Less than $1 Billion

Annual Revenue At Least $1 Billion

and Fewer Than 26 Payment Accounts

26%

41%

19%

None

More than 75%

More than 75%

51%

None

11%

Less than 10%

51-75%

3%

26-50%

9%

11%

11-25%

11-25%

Less than 10%

7%

51-75%

26-50%

4%

7%

11%

Annual Revenue At Least $1 Billion

and Fewer Than 26 Payment Accounts

25%

More than 75%

48%

None

51-75%

7%

26-50%

5%

11-25%

Less than 10%

11%

4%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 15

•

ORIGINATION OF PAYMENTS FRAUD

Majority of Payments Fraud Originate from an Individual (External to Organization) and Business Email Compromise

The most-common source of payments

fraud in 2022 was an external source or

individual (e.g., forged check, stolen card); 54

percent of nancial professionals report that

payments fraud at their companies was the

result of actions by an individual outside the

organization. This is a slight uptick from the 51

percent reported last year (for 2021).

Fifty-three percent of fraud was a result of

Business Email Compromise (BEC). In 2019, 61

percent of respondents cited BEC as a source

of fraud; in 2020 the share inched upward to

62 percent. Although BEC continued to be the

chief reason organizations were experiencing

fraud in 2021, the share of respondents that

cited BEC as a reason for payments fraud

at their companies that year decreased

slightly from previous years (55 percent).

The percentage also decreased slightly to

53 percent in 2022, and BEC was the second

most cited source of payments fraud. Larger

organizations with annual revenue of at least

$1 billion and with more than 100 payments

accounts were more susceptible to BEC scams

in 2022, while companies with less than $1

billion in annual revenue were more susceptible

to fraud committed by outside individuals.

Other sources of payments fraud included

vendor imposter (37 percent) and bad actor

who takes over an account (20 percent) – i.e.,

account takeovers via hacked system, phishing,

spyware or malware.

A larger share of companies with annual

Those respondents indicating that note that an

revenue of less than $1 billion were targeted by

insider committed fraud at their organizations

an outside individual (58 percent) than were

(3 percent) suggest that these individuals

those organizations with annual revenue of at

worked in Accounts Payable, Retail, Sales or

least $1 billion (52 percent).

Bookkeeping departments.

Sources of Attempted/Actual Payments Fraud Attempts in 2022

(Percent of Organizations)

Annual Annual Revenue Annual Revenue

Revenue Annual At Least $1 Billion At Least $1 Billion

Less Revenue and Fewer Than and More Than

2022

Than $1

Billion

At Least

$1 Billion

26 Payment

Accounts

100 Payment

Accounts

2021

Outside individual (e.g., check forged,

54% 58% 52% 49% 44% 51%

stolen card, fraudster)

Business Email Compromise (BEC Fraud) 53% 48% 58% 62% 63% 55%

Vendor imposter 37% 29% 46% 49% 48% _

Bad actor takes over an account, i.e., Account

takeover (e.g., hacking a system, adding malicious 20% 19% 23% 17% 30% 16%

code – spyware or malware from social network)

Invoice fraud 15% 9% 13% 14% 33% _

Imposter to client posing as representative from

14% 6% 3% 1% _ _

our company

Third-party or outsourcer (e.g., vendor, professional

13% 12% 15% 17% 11% 18%

services provider, business trading partner)

U.S. Postal Service Oce interference 11% 7% 13% 9% 22% _

Organized crime ring (e.g., crime spree that targets

other organizations in addition to your own, either in 8% 2% 12% 12% 11% 10%

a single city or across the country)

Ransomware 5% 1% 9% 8% 7% _

Internal party (e.g., malicious insider) 3% 2% 3% _ 7% 2%

Compromised mobile device 3% 2% 2% 3% 4% 3%

Deepfake attempt (e.g., voice and/or video

1% _ _ _ _ _

swapping, “deep voice” technology, vishing)

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 16

•

ABOUT BUSINESS EMAIL COMPROMISE

Business Email Compromise (BEC)

Events Increase Slightly

Seventy-one percent of organizations

experienced attempted or actual BEC in 2022.

This is a three-percentage point increase from

2021, but still a signicant drop from the 80

percent reported in 2018. As has been the

trend, fewer smaller organizations (with annual

revenue less than $1 billion) were targets of

BEC fraud than were larger organizations (with

annual revenue of at least $1 billion): 63 percent

compared to 82 percent. This gap has widened

since 2020 when those gures were 67 percent

and 78 percent, respectively.

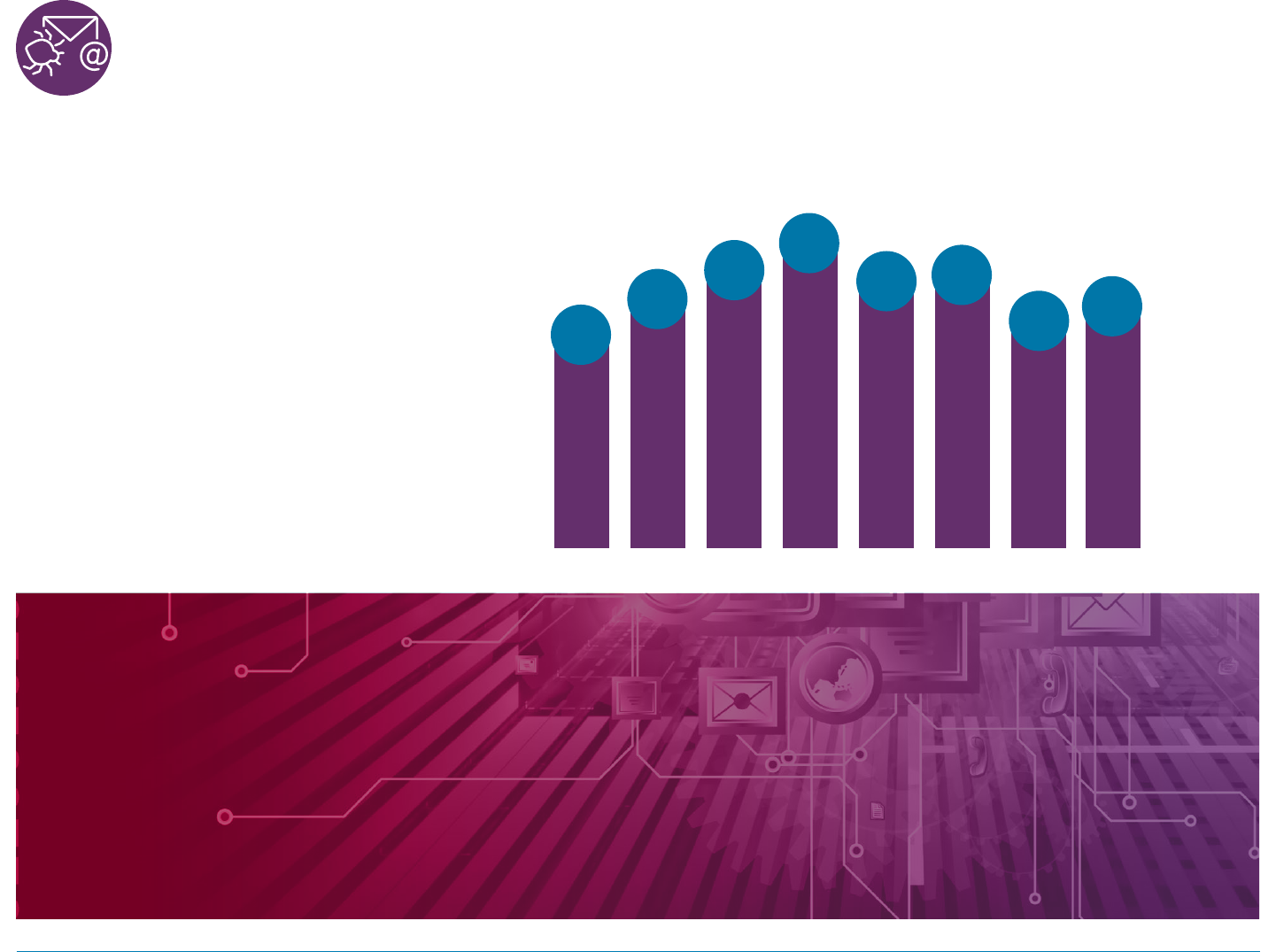

Percent of Organizations that Experienced Business Email Compromise (2015-2022)

64%

74%

77%

80%

75%

76%

68%

71%

2015

2016

2017 2018

2019 2020 2021 2022

“We received a fraudulent

email impersonating an

executive ocer of the

company.

”

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 17

•

HOW CRIMINALS CARRY OUT BUSINESS EMAIL COMPROMISE SCAMS

“Fictitious email

was sent by an

imposter pretending

to be a vendor

requesting change in

Banking information.

Procurement sta

changed the banking

information not

realizing it was fraud.

The fraud was quickly

detected and our

Bank, the local Police

and the FBI were

notied. Funds were

recovered.

”

BEC Methods

Fraudsters’ approaches to BEC in 2022 were similar to those observed in previous

years. Criminals carry out BEC scams in the following ways.

— Spoof an email account or website (experienced by 73 percent of organizations).

Senders forge email header elements to trick users into thinking they are

interacting with a trusted source.

— Use a domain lookalike (experienced by 57 percent of organizations). Bad actors

register look-alike domains to confuse users into believing that they have reached

a legitimate site. Visiting these sites may lead to web trac diversion and/or

malware delivery.

— Access a compromised email account (experienced by 54 percent of

organizations). Fraudsters will sometimes use compromised email accounts to

send fraudulent “change of payment” instructions to potential victims.

Fraudulent emails may contain attachments or links that send users to illegitimate

websites or payment portals. Respondents report their rms receive these messages

through texts as well as apps, including WhatsApp.

Most Prevalent Types of Business Email Compromise Fraud in 2022

(Percent of Organizations)

73% 57%

54%

Legitimate email that was

Spoof email

Domain lookalike

taken over by a fraudster

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 18

•

71

BENEFICIARY VALIDATION

Beneciary Validation a Common

Practice at Most Organizations

Beneciary payment validation is an important

step in ensuring accurate and secure payments.

When asked about the validation process for

their organizations, 53 percent of respondents

report that their organizations validate

payments verbally. Some organizations choose

to outsource validation:

— Rely on nancial vendor/bank (cited by

17 percent of respondents)

— Use of an external service to validate

payment information (16 percent)

Nine percent of organizations do not validate

beneciary payment. Some organizations rely

on a combination of validation procedures.

Verbal validation is often used in conjunction

with bank letters and/or written instructions.

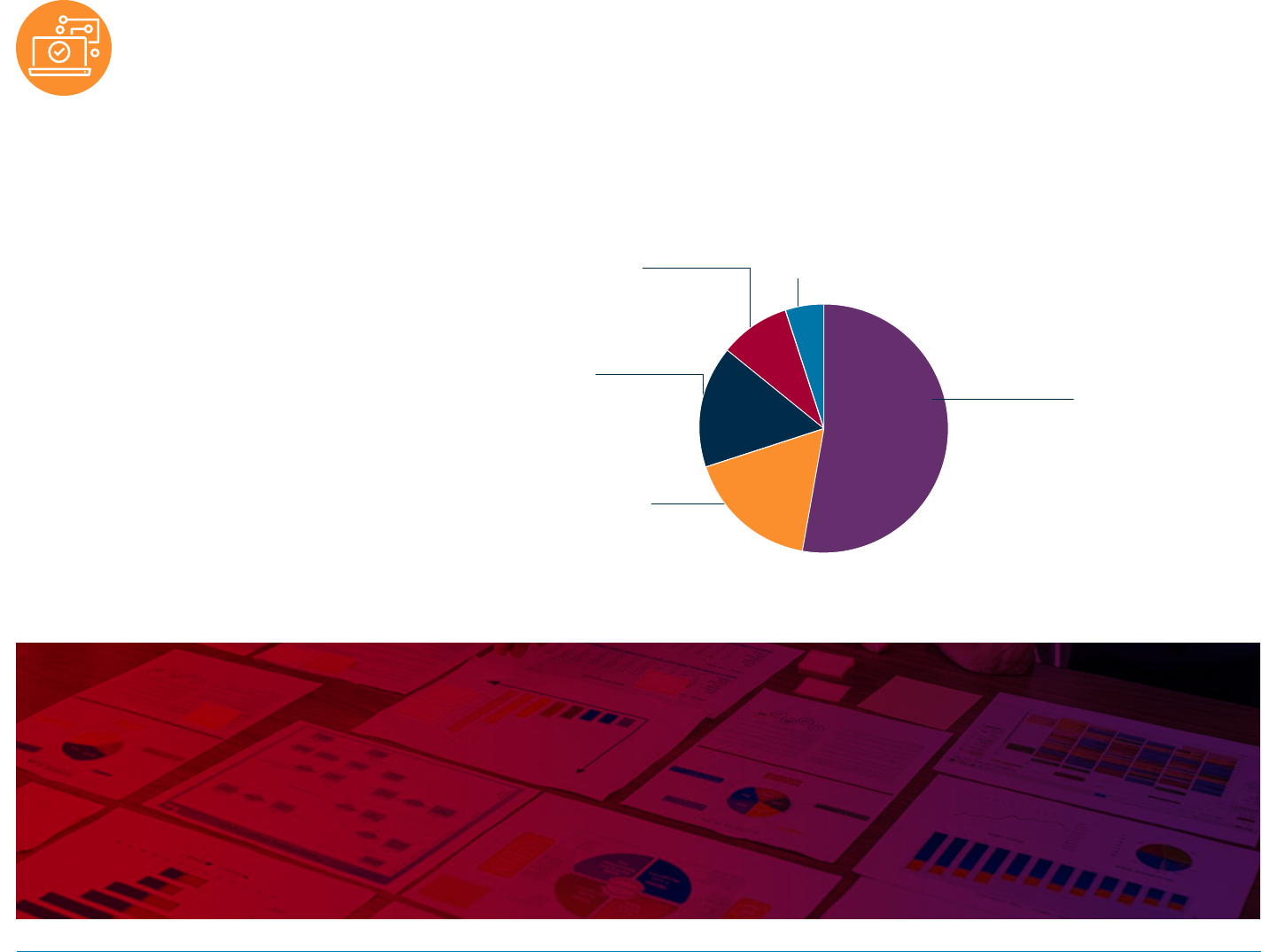

Validating Benefciary Payment Details

(Percentage Distribution of Organizations)

5%

Other

No, we do not validate

beneficiary payment

information

9%

16%

53%

Yes, organization uses

Yes, verbal

an external service

validation

to validate payment

information

17%

We rely on our financial

vendor/bank to do so

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 19

•

•

FRAUD REVIEW

Fraud Review Process

Over 60 percent of organizations conduct

fraud reviews: 36 percent conduct reviews

internally while 25 percent seek the assistance

of their bank/vendor. Another 12 percent have

plans to conduct a review within the next year.

Organizations with annual revenue of less than

$1 billion are more prone to conduct reviews

internally (42 percent) than are organizations

with annual revenue of at least $1 billion

(33 percent). In comparison, organizations

with annual revenue of at least $1 billion (30

percent) are more likely to seek the assistance

of their bank/vendor than are organizations

with less annual revenue (21 percent).

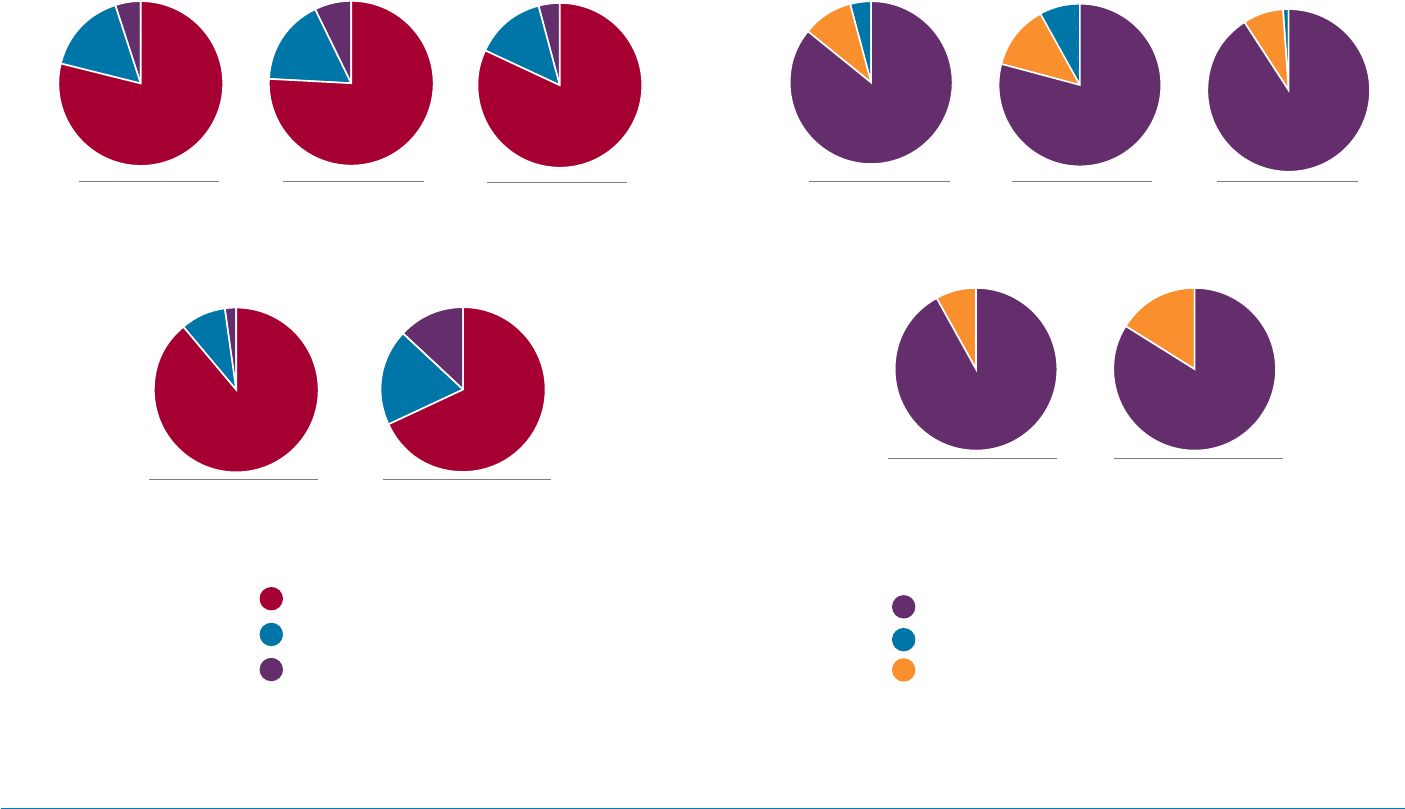

Fraud Review Process

(Percentage Distribution of Organizations)

Conduct an internal independent review

Conduct review with the assistance of bank/vendor

Planning to conduct a review within the next year

Do not conduct fraud reviews

At a majority of organizations, Treasury is

responsible for the oversight of the fraud

review process (cited by 56 percent of

respondents). Other departments that have

oversight of the fraud review process are:

— Risk (cited by 42 percent of respondents)

— Accounts Payable (37 percent)

— IT (35 percent)

A greater percentage of Risk departments at

organizations with annual revenue of at least

$1 billion and more than 100 payment accounts

are responsible for fraud review than are similar

sized companies with fewer payment accounts

(64 percent versus 42 percent).

Annual Revenue Annual Revenue

All Less Than $1 Billion At Least $1 Billion

36% 42% 33%

25% 21% 30%

12% 10% 14%

27% 27% 24%

“Attempted fraud

was discovered by our

supplier setup team

calling an established

vendor and conrming

they had not changed

banks, per the email

we received.

”

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 20

•

•

FRAUD REVIEW

Fraud review is conducted annually at 39

percent of organizations and conducted more

frequently at 21 percent of organizations,

either once a quarter or twice a year. Some

respondents indicate that these reviews

are conducted on an ad-hoc basis at their

organizations, and 19 percent are unsure about

the frequency that fraud reviews are conducted

at their companies.

Frequency of Fraud Review

(Percentage Distribution of Organizations)

Other: • Monthly • Daily

6%

Ad-Hoc

15%

Annually

39%

Unsure

19%

Bi-annually

7%

Quarterly

14%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 21

CONCLUSION

There are clear signs that payments fraud

is abating. After record levels of fraud in

both 2018 and 2019 – peaking at over 80

percent – the share of organizations that

were targets of attempted/actual payments

fraud has been on the decline since. Checks

continue to be a prime target for criminals, but

with the declining use of checks – and very

eective tools to stop check fraud – fraudsters

have been having less success. According to

the 2022 AFP® Electronic Payments Report,

33 percent of organizations used checks

for business-to-business payments in 2022,

while in 2019, 43 percent of companies did

so. Because many organizations are unable

to eliminate the use of checks completely,

fraudsters continue to be able to use checks

to target organizations, although perhaps to a

lesser extent. Unfortunately, criminals are not

easily discouraged; advanced software and

social engineering enables them to attempt

payments fraud through other payment

methods such as wires and ACH payments.

Emails are frequently used to inltrate

company networks. In the current business

environment, employees are likely physically

distanced; consequently, verbal verication of

payment requests become more challenging.

Unless formal systems are in place and

ingrained in employees, fraud can often

occur. Business leaders have made training

and education focused on detecting phishing

attempts a priority for employees. Indeed,

many organizations do not restrict training to

just the nance teams, but instead require that

employees throughout the entire organization

be cognizant about fraud attempts via email

and be able to identify them. Employees who

inadvertently open emails multiple times which

are either actual fraud attacks or simulated

phishing attempts are reprimanded, and

in some extreme cases may be terminated

from their jobs. Despite extensive measures

implemented to prevent Business Email

Compromise, it continues to be one of the

primary sources of fraud at organizations.

The share of organizations experiencing

corporate/commercial credit card fraud

increased 10 percentage points, from 26 percent

in 2021 to 36 percent in 2022. This uptick is

similar to the incidence of credit card fraud

reported prior to the COVID-19 pandemic in

2019 – 34 percent. As a consequence of the

pandemic, organizations reduced workforce,

furloughed employees and trimmed

discretionary spending by restricting travel. The

use of corporate/commercial credit cards also

decreased, resulting in fewer card transactions

and, therefore, less fraud via that payment

method than was reported in 2020 and 2021. As

employers are recruiting again and organizations

have eased restrictions on travel and other

discretionary spending, corporate/commercial

credit cards are being used more extensively,

resulting in greater incidence of fraud being

reported via those payment methods.

Call backs, daily reconciliations and verbal

verications are methods many organizations

are using in their eorts to minimize the

occurrence of fraud via payment methods.

Treasury and nance leaders are increasingly

reaching out to banking partners for guidance

in reporting and managing fraud. Depending

on the extent of the fraud, practitioners are

also reporting fraud to police and other law

enforcement agencies.

In the past, actual nancial losses from

payments fraud attacks were not damaging;

that continued to be the case in 2022. However,

this is not a reason for companies to lose focus

on preventing fraud. While loss of condential

and personnel information does not directly

impact an organization’s bottom line, extensive

eort and resources are required to resolve

such situations.

It is evident that the steps business leaders

are taking to prevent fraud are having success.

However, historical payments fraud survey data

show dierent types of fraud emerge in the

wake of such success. Fraudsters are relentless

and will continue to target organizations and

any vulnerable payment networks. Therefore,

treasury leaders will want to ensure that they

are prepared for the next type of fraud that is

in the works. It is vital that treasury and nance

professionals stay ahead of the perpetrators

so that fraud attacks do not interrupt business

operations and organizations’ nancial losses

remain at a minimum.

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 22

ABOUT SURVEY RESPONDENTS

In January 2023, the Research Department of

the Association for Financial Professionals®

(AFP) surveyed treasury practitioner members

and prospects. The survey was sent to treasury

professionals with the following job titles: Vice

President of Treasury, Treasurer, Assistant

Treasurer, Director of Treasury, Treasury Manager,

Type of Organization’s Payment Transactions

(Percentage Distribution of Organizations)

Primarily consumers

When making payments 9%

When receiving payments 21%

Number of Payment Accounts Maintained

(Percentage Distribution of Organizations)

Director of Treasury and Finance, Senior Treasury

Analyst, and Cash Manager. A total of 471

responses were received from practitioners, which

form the basis of the report.

AFP thanks J.P. Morgan for underwriting the

2023 AFP® Payments Fraud and Control Survey.

Split between

consumers and businesses Primarily businesses

27% 64%

29% 50%

Both the questionnaire design and the nal

report, along with its content and conclusions,

are the sole responsibilities of the AFP Research

Department. The following tables provide a prole

of the survey respondents, including payment

types used and accepted.

Annual Revenue At Least $1 Annual Revenue At Least

Annual Revenue Less Than Annual Revenue At Least Billion and Fewer Than 26 $1 Billion and More Than 100

All $1 Billion $1 Billion Payment Accounts PaymentAccounts

Fewer than 5 24% 32% 17% 28% _

5-9 23% 24% 23% 38% _

10-25 19% 18% 21% 34% _

2

6-50 9% 10% 8% _ _

5

1-100 10% 6% 12% _ _

More than 100 15% 9% 19% _ 100%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 23

•

•

•

•

•

•

ABOUT SURVEY RESPONDENTS

Methods to Maintain Payments Accounts Application of Accounts Controls

(Percentage Distribution of Organizations) (Percentage Distribution of Organizations)

79%

76%

82%

17%

14%

5%

7%

4%

85%

5%

80%

7%

2%

16%

10% 13%

All

Annual Revenue

Annual Revenue

All

Annual Revenue

Less Than $1 Billion

At Least $1 Billion

Less Than $1 Billion

8%

16%

2%

13%

92%

Annual Revenue

At Least $1 Billion

and Fewer Than 26

Payment Accounts

Centralized

Yes, applied to all accounts in all areas

Decentralized

Not applied to all accounts

Other

Yes, applied to all accounts but in select areas

90%

8%

Annual Revenue

At Least $1 Billion

89%

9%

Annual Revenue At Least

$1 Billion and Fewer Than

26 Payment Accounts

69%

19%

Annual Revenue At Least

$1 Billion and More Than

100 Payment Accounts

84%

Annual Revenue At

Least $1 Billion and

More Than 100 Pay-

ment Accounts

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 24

ABOUT SURVEY RESPONDENTS

Annual Revenue (USD)

(Percentage Distribution of Organizations)

Under $50 million

11%

$50-99.9 million

5%

6%

$100-249.9 million

$250-499.9 million

11%

$500-999.9 million

13%

$1-4.9 billion

30%

$5-9.9 billion

8%

$10-20 billion

6%

Over $20 billion

9%

Organization’s Ownership Type

(Percentage Distribution of Organizations)

Annual Revenue At Least Annual Revenue At Least

Annual Revenue Less Annual Revenue $1 Billion and Fewer Than $1 Billion and More Than

All Than $1 Billion At Least $1 Billion 26 Payment Accounts 100 PaymentAccounts

Publicly owned 35% 15% 51% 49% 59%

Privately held 41% 53% 30% 33% 28%

Non-profit (not-for-profit) 16% 22% 11% 8% 6%

Government (or government owned entity) 9% 10% 8% 10% 6%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 25

ABOUT SURVEY RESPONDENTS

Industry Classifcation

(Percentage Distribution of Organizations)

ALL

Agricultural, Forestry, Fishing & Hunting _

Administrative Support/Business

services/Consulting

1%

Banking/Financial services 14%

Construction 4%

E-Commerce 2%

Education (K-12, public or private institution) 2%

University or other Higher Education 4%

Energy 5%

Government 6%

Health Care and Social Assistance 9%

Hospitality/Travel/Food Services 2%

Insurance 5%

Manufacturing 17%

Mining _

Non-profit 5%

Petroleum 1%

Professional/Scientific/Technical Services 3%

Real estate/Rental/Leasing 4%

Retail Trade 4%

Wholesale Distribution 5%

Software/Technology 2%

Telecommunications/Media 1%

Transportation and Warehousing 3%

Utilities 2%

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 26

AFP® 2023 Payments Fraud and Control Report

Copyright © 2023 by the Association for Financial Professionals (AFP).

All Rights Reserved.

This work is intended solely for the personal and noncommercial use of the reader. All other uses of this work, or

the information included therein, is strictly prohibited absent prior express written consent of the Association for

Financial Professionals. The AFP 2023 Payments Fraud and Control Report the information included therein, may

not be reproduced, publicly displayed, or transmitted in any form or by any means, electronic or mechanical,

including but not limited to photocopy, recording, dissemination through online networks or through any other

information storage or retrieval system known now or in the future, without the express written permission

of the Association for Financial Professionals. In addition, this work may not be embedded in or distributed

through commercial software or applications without appropriate licensing agreements with the Association for

Financial Professionals.

Each violation of this copyright notice or the copyright owner’s other rights, may result in legal action by the

copyright owner and enforcement of the owner’s rights to the full extent permitted by law, which may include

nancial penalties of up to $150,000 per violation.

This publication is not intended to oer or provide accounting, legal or other professional advice. The

Association for Financial Professionals recommends that you seek accounting, legal or other professional advice

as may be necessary based on your knowledge of the subject matter.

All inquiries should be addressed to:

Association for Financial Professionals

4520 East West Highway, Suite 800

Bethesda, MD 20814

Web: www.AFPonline.org

ASSOCIATION FOR

FINANCIAL

PROFESSIONALS

AFP Research

AFP Research provides nancial professionals with proprietary and timely research that

drives business performance. AFP Research draws on the knowledge of the Association’s

members and its subject matter experts in areas that include bank relationship

management, risk management, payments, FP&A and nancial accounting and reporting.

Studies report on a variety of topics, including AFP’s annual compensation survey, are

available online at www.AFPonline.org/research.

About AFP®

Headquartered outside of Washington, D.C. and located regionally in Singapore, the

Association for Financial Professionals (AFP) is the professional society committed to

advancing the success of treasury and nance members and their organizations. AFP

established and administers the Certied Treasury Professional® and Certied Corporate

FP&A Professional® credentials, which set standards of excellence in treasury and nance.

Each year, AFP hosts the largest networking conference worldwide for more than 7,000

corporate nancial professionals.

4520 East-West Highway, Suite 800

Bethesda, MD 20814

+1 301.907.2862

www.AFPonline.org

2023 AFP

®

Payments Fraud and Control Report | www.AFPonline.org 28

The threat of

fraud is real

The question is, are you ready?

As fraud becomes more sophisticated, so

does our approach to security. Get the

critical information and advanced tools

you need to safeguard your organization.

LEARN MORE

or contact your J.P. Morgan

representative today.

© 2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for full

disclosures and disclaimers related to this content. 1216486