Table of Contents

Page

Report of Independent Auditors 1

Consolidated Financial Statements

Consolidated Balance Sheets 4

Consolidated Statements of Operations and Change in Net Deficit 5

Consolidated Statements of Cash Flows 6

Notes to Consolidated Financial Statements 8

Supplementary Information

Consolidating Balance Sheet 28

Consolidating Statement of Operations 30

1

Report of Independent Auditors

The Board of Trustees

Astria Health and Subsidiaries

Report on the Audit of the Financial Statements

Disclaimer of Opinion

We were engaged to audit the consolidated financial statements of Astria Health and Subsidiaries

(the Organization), which comprise the consolidated balance sheets as of December 31, 2022 and

2021, and the related consolidated statements of operations and change in net deficit and cash flows

for the years then ended, and the related notes to the consolidated financial statements.

We do not express an opinion on the accompanying consolidated financial statements of the

Organization. Because of the significance of the matters described in the Basis for Disclaimer of

Opinion section of our report, we have not been able to obtain sufficient appropriate audit evidence to

provide a basis for an audit opinion on these consolidated financial statements.

Basis for Disclaimer of Opinion

Management informed us that the Organization had not been audited since 2017. Management was

unable to obtain support to complete necessary reconciliations between 2018 and 2020 for certain

accounts. In addition, during that same period, the Organization had entered and emerged from

bankruptcy and the Organization had also experienced challenges associated with implementing a

new revenue system.

As of the date of our audit report, with respect to accounts on December 31, 2022, management was

still in the process of reconciling property and equipment, net; and deferred other grant income

(recorded in other accrued liabilities).

As a result of these matters, we were unable to determine whether any adjustments might have been

found necessary with respect to recorded or unrecorded net deficit without donor restrictions;

property and equipment, net; and other accrued liabilities; and the elements included in the

consolidated statements of operations and change in net deficit and cash flows for the year ended

December 31, 2022.

As of the date of our audit report, with respect to accounts on December 31, 2021, management was

still in the process of reconciling some accounts including property and equipment, net; accrued paid

time off (recorded in accrued compensation and benefits); and deferred other grant income (recorded

in other accrued liabilities).

In addition, we were not engaged as the Organization’s auditor until after December 31, 2020, and,

therefore, did not observe the counting of physical inventories at the beginning of the year. We were

unable to satisfy ourselves by other auditing procedures concerning the activity related to changes in

inventory for the year ended December 31, 2021.

As a result of these matters, we were unable to determine whether any adjustments might have been

found necessary with respect to recorded or unrecorded net deficit without donor restrictions;

property and equipment, net; accrued compensation and benefits; other accrued liabilities; and the

elements making up the statements of operations and change in net deficit and cash flows for the

year ended December 31, 2021.

2

Emphasis of Matter - Change in Accounting Principle

As discussed in Note 2 to the consolidated financial statements, in 2022, the Organization adopted

new accounting guidance Accounting Standards Codification Topic 842, Leases. Our opinion is not

modified with respect to this matter.

Substantial Doubt about the Organization’s Ability to Continue as a Going Concern

The accompanying consolidated financial statements have been prepared assuming that the

Organization will continue as a going concern. As discussed in Note 3 to the consolidated financial

statements, the Organization had 10 days of cash on hand and a net deficit of $30,766,757 as of

December 31, 2022. The Organization has stated that substantial doubt exists about the

Organization’s ability to continue as a going concern. Management’s evaluation of the events and

conditions and management’s plans regarding these matters are also described in Note 3. The

consolidated financial statements do not include any adjustments that might result from the outcome

of this uncertainty. Our audit opinion is not modified with respect to that matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of

America, and for the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there

are conditions or events, considered in the aggregate, that raise substantial doubt about the

Organization’s ability to continue as a going concern within one year after the date that the financial

statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our responsibility is to conduct an audit of the Organization’s consolidated financial statements in

accordance with auditing standards generally accepted in the United States of America and to issue

an auditor’s report. However, because of the matters described in the Basis for Disclaimer of Opinion

section of our report, we were not able to obtain sufficient appropriate audit evidence to provide a

basis for an audit opinion on these consolidated financial statements.

We are required to be independent of the Organization and to meet our other ethical responsibilities,

in accordance with the relevant ethical requirements relating to our audit.

Supplementary Information

We were engaged for the purpose of forming an opinion on the financial statements as a whole. The

consolidating balance sheet – December 31, 2022, consolidating balance sheet – December 31,

2021, consolidating statement of operations – year ended December 31, 2022, and consolidating

statement of operations – year ended December 31, 2021, are presented for the purposes of

additional analysis and are not a required part of the financial statements. Because of the significance

of the matter described above in the Basis for Disclaimer of Opinion section, it is inappropriate to and

we do not express an opinion on the supplementary information referred to above.

Seattle, Washington

April 30, 2023

Consolidated Financial Statements

Astria Health and Subsidiaries

See accompanying notes.

4

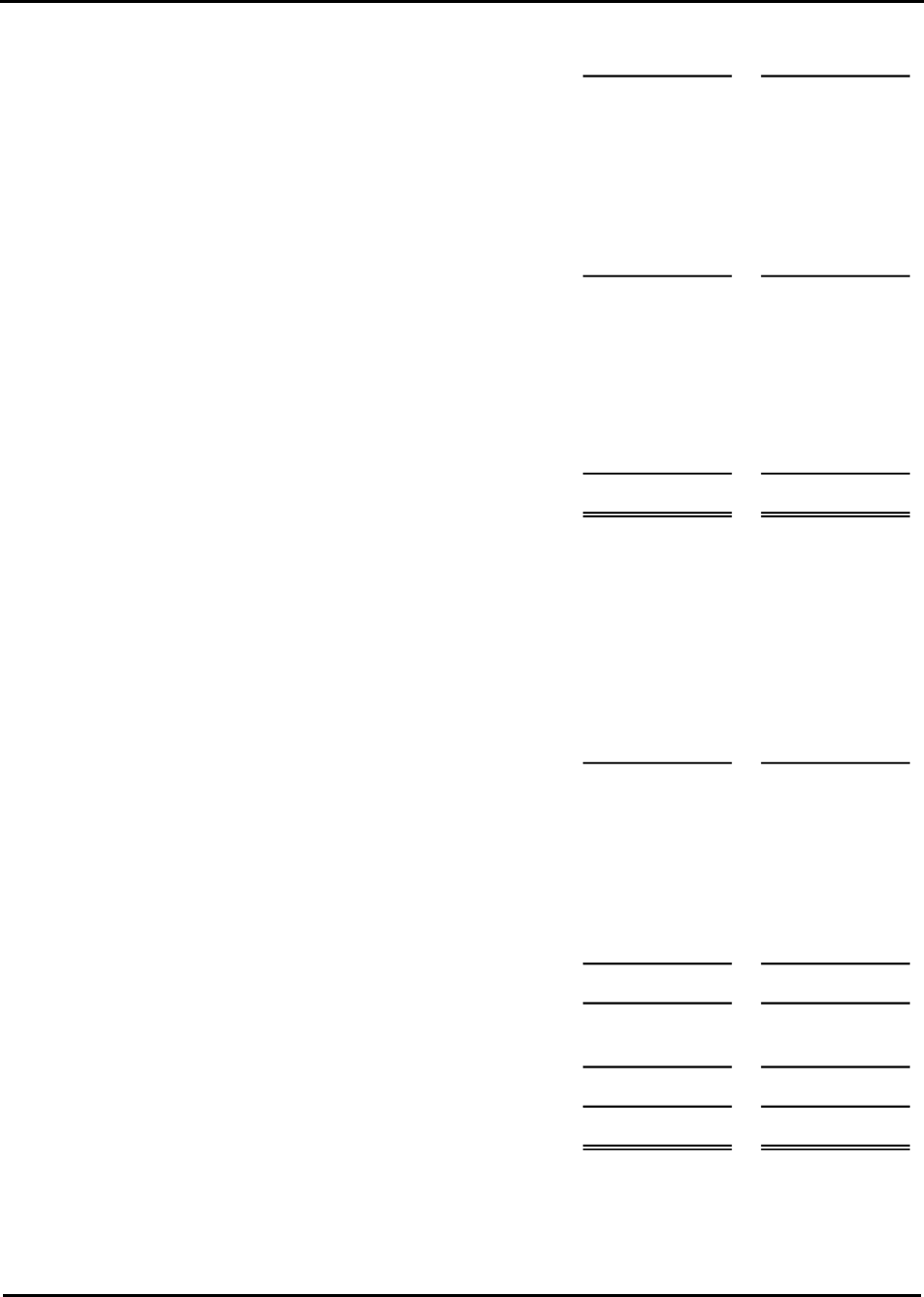

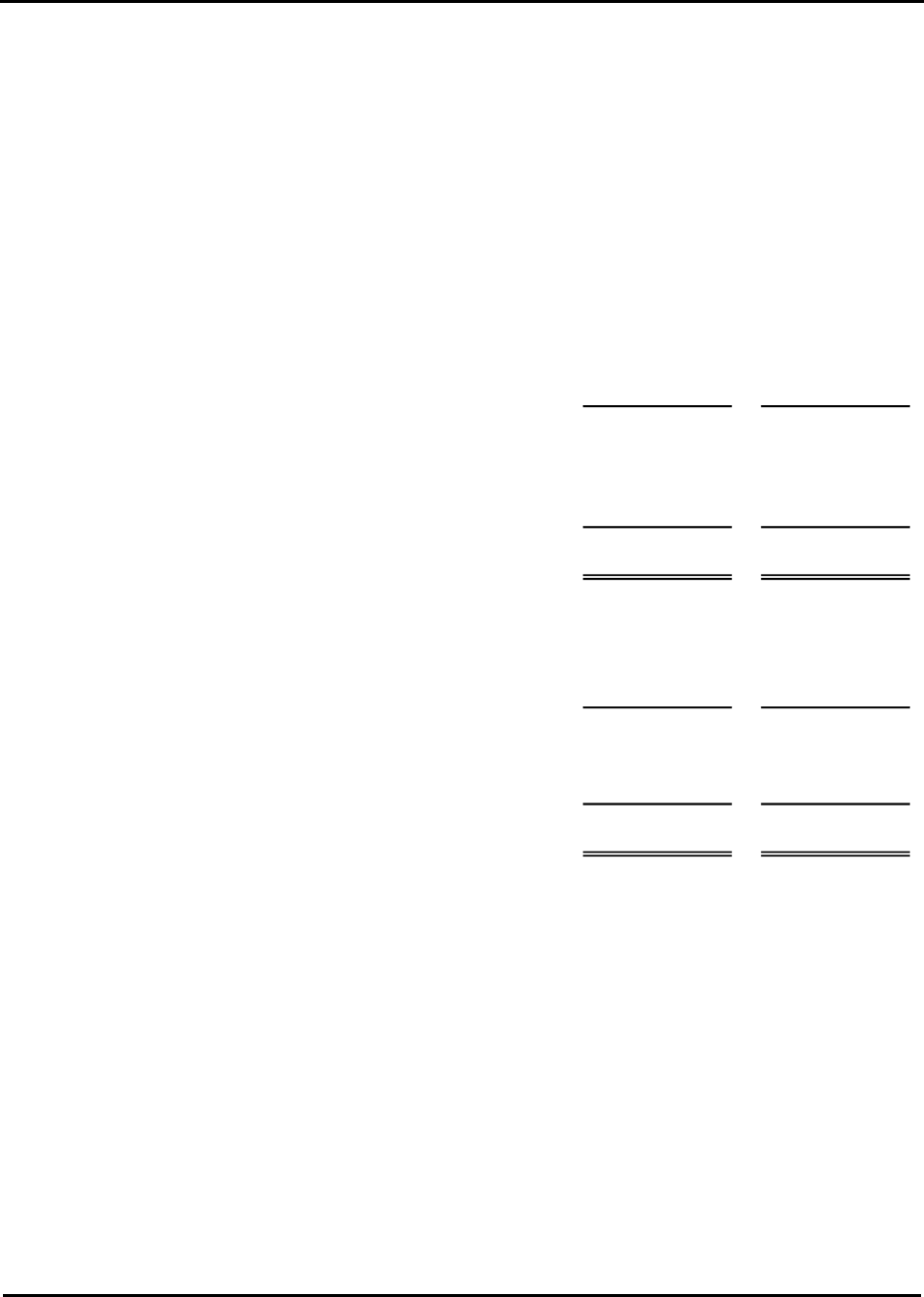

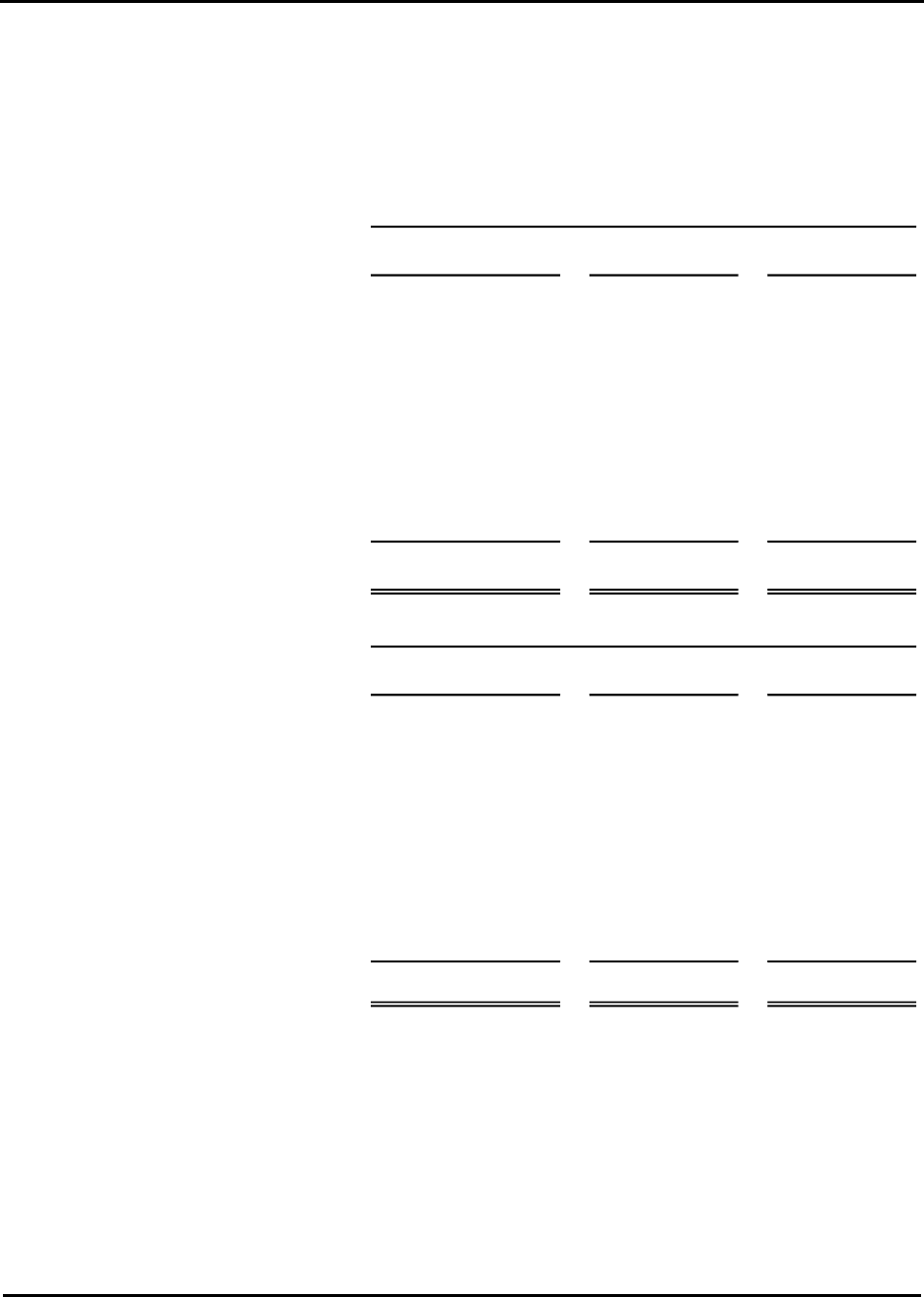

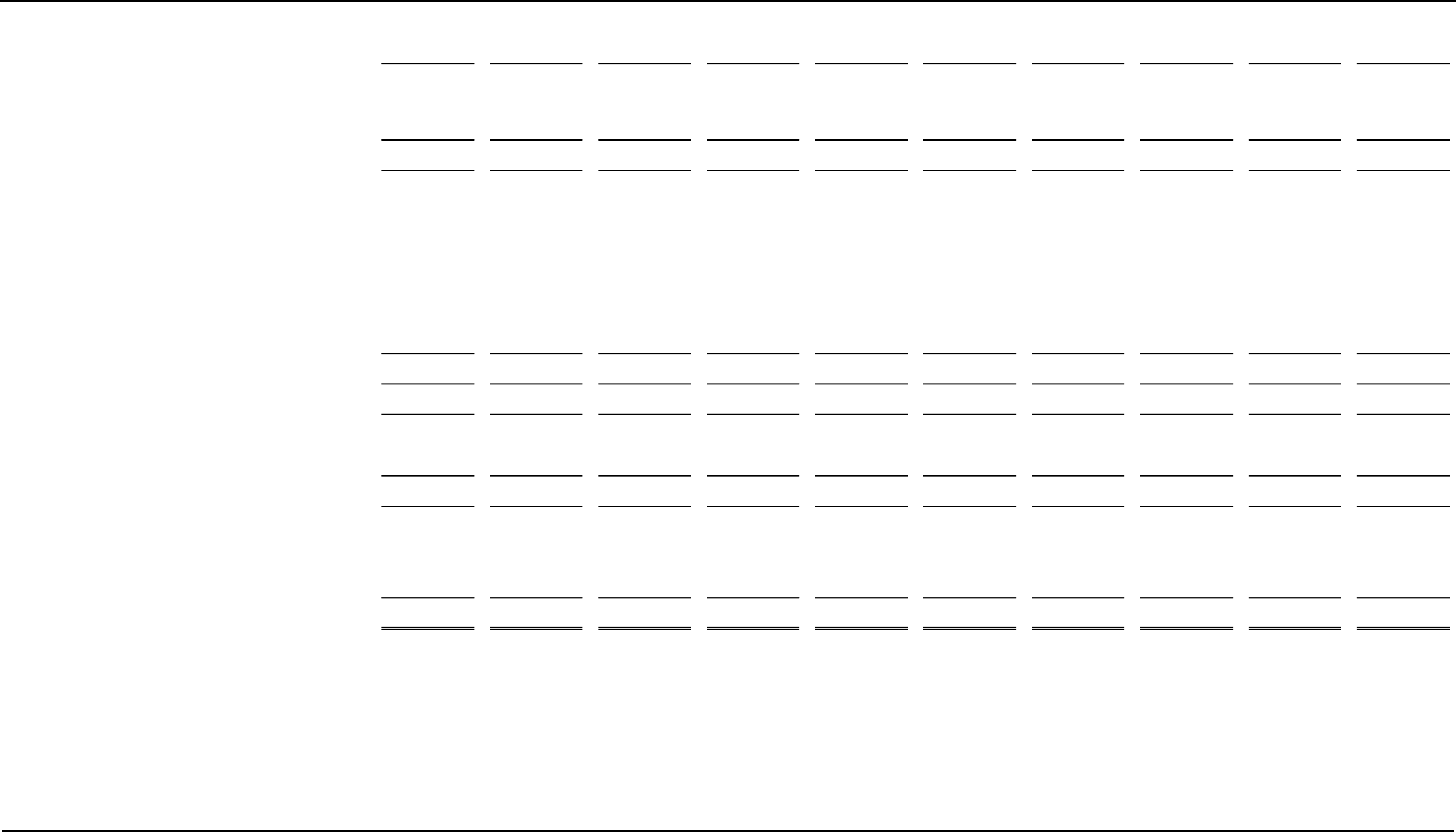

Consolidated Balance Sheets

December 31, 2022 and 2021

2022 2021

ASSETS

CURRENT ASSETS

Cash and cash equivalents 4,499,315$ 4,612,077$

Patient accounts receivable 28,141,842 24,148,323

Other receivables 26,003 -

Inventory 5,559,088 5,339,991

Prepaid expenses and other assets 1,706,069 1,571,810

Total current assets 39,932,317 35,672,201

PROPERTY AND EQUIPMENT, net 25,995,950 27,695,625

OPERATING LEASE RIGHT-OF-USE ASSETS, net 6,777,185 -

FINANCE LEASE RIGHT-OF-USE ASSETS, net 314,434 -

OTHER ASSETS 858,022 1,252,851

Total assets 73,877,908$ 64,620,677$

LIABILITIES AND NET DEFICIT

CURRENT LIABILITIES

Accounts payable and accrued expenses 12,454,864$ 14,452,207$

Accrued compensation and benefits 5,968,581 5,978,505

Estimated third-party payor settlements 1,376,815 1,407,995

Other accrued liabilities 2,228,888 1,068,298

Current portion of long-term debt 10,998 1,024,756

Current portion of operating lease liabilities 1,110,709 -

Current portion of finance lease liabilities 50,573 -

Total current liabilities 23,201,428 23,931,761

LONG-TERM DEBT, net of current portion 75,147,867 77,007,294

OPERATING LEASE LIABILITIES, less current portion 5,628,798 -

FINANCE LEASE LIABILITIES, less current portion 266,572 -

OTHER LONG-TERM LIABILITIES 400,000 235,114

Total liabilities 104,644,665 101,174,169

NET DEFICIT

Without donor restrictions (30,766,757) (36,553,492)

Total net deficit (30,766,757) (36,553,492)

Total liabilities and net deficit 73,877,908$ 64,620,677$

Astria Health and Subsidiaries

See accompanying notes.

5

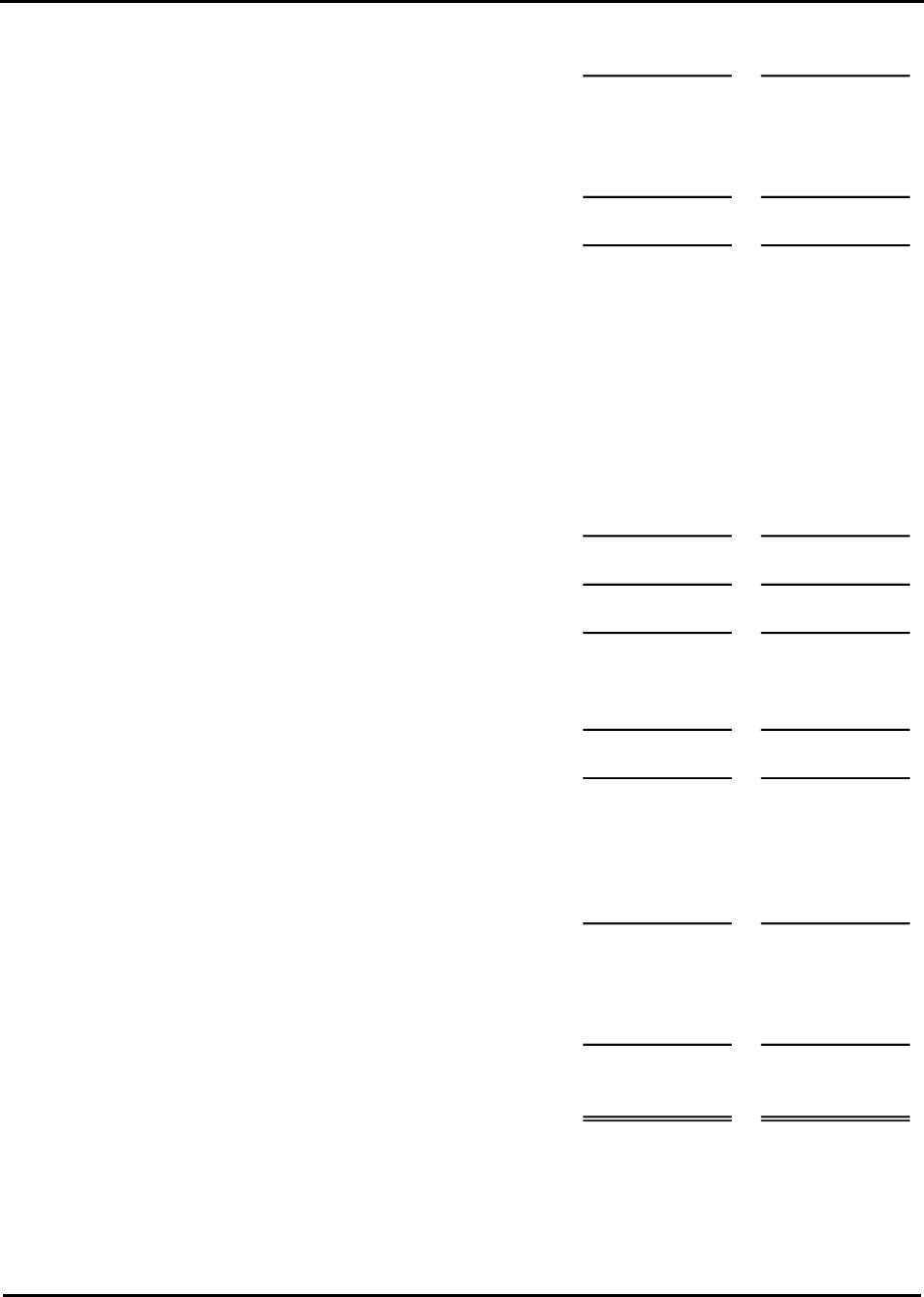

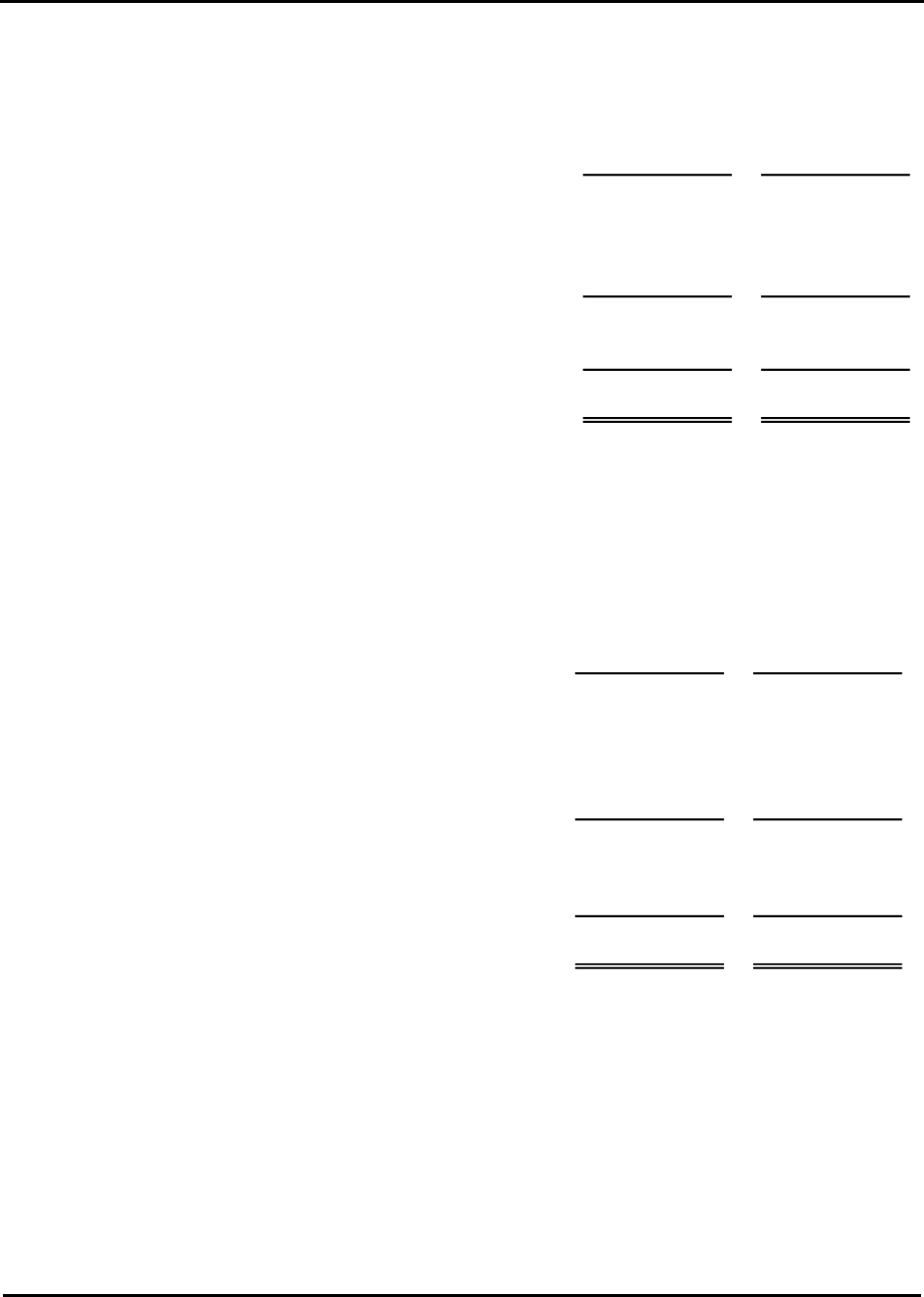

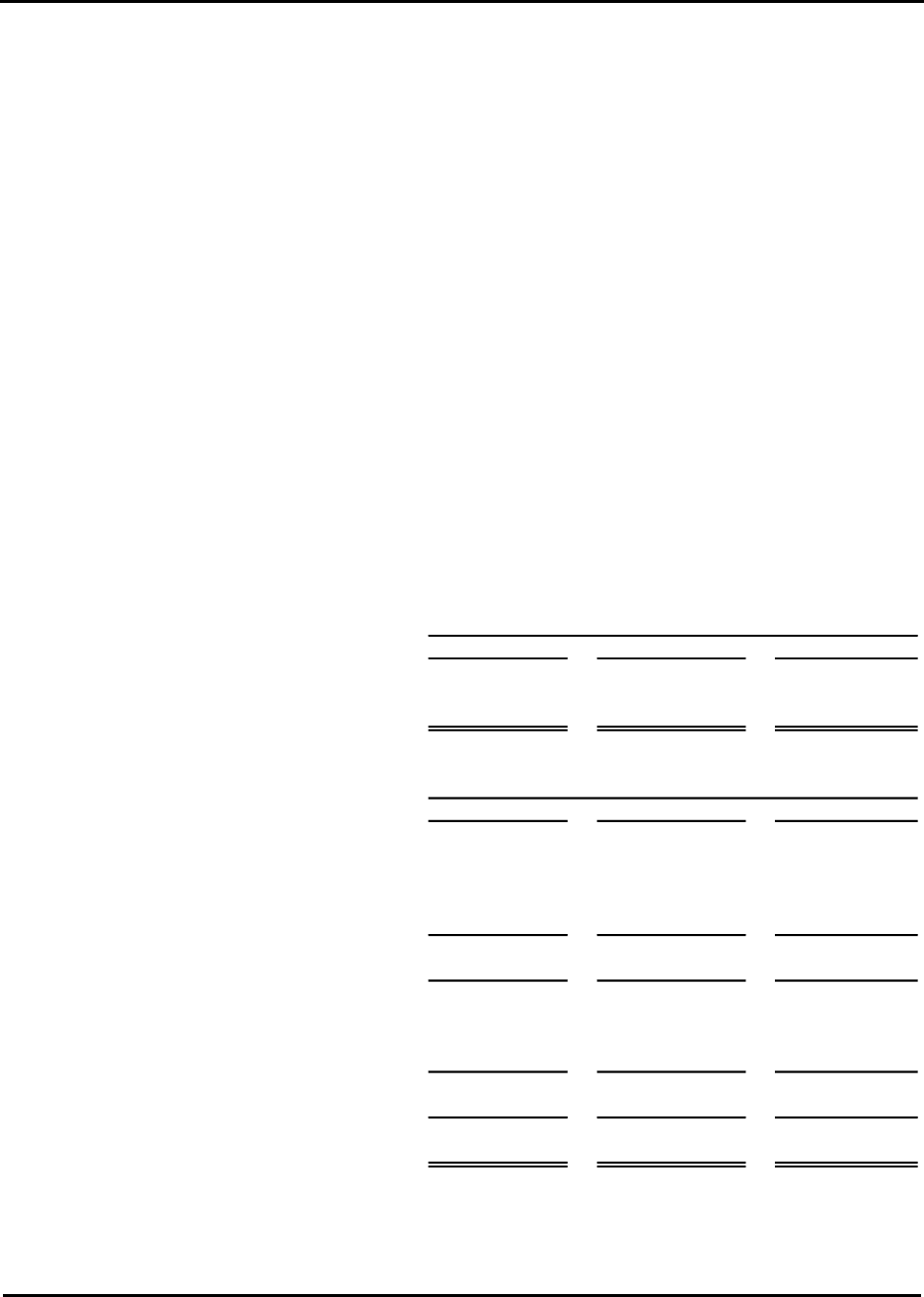

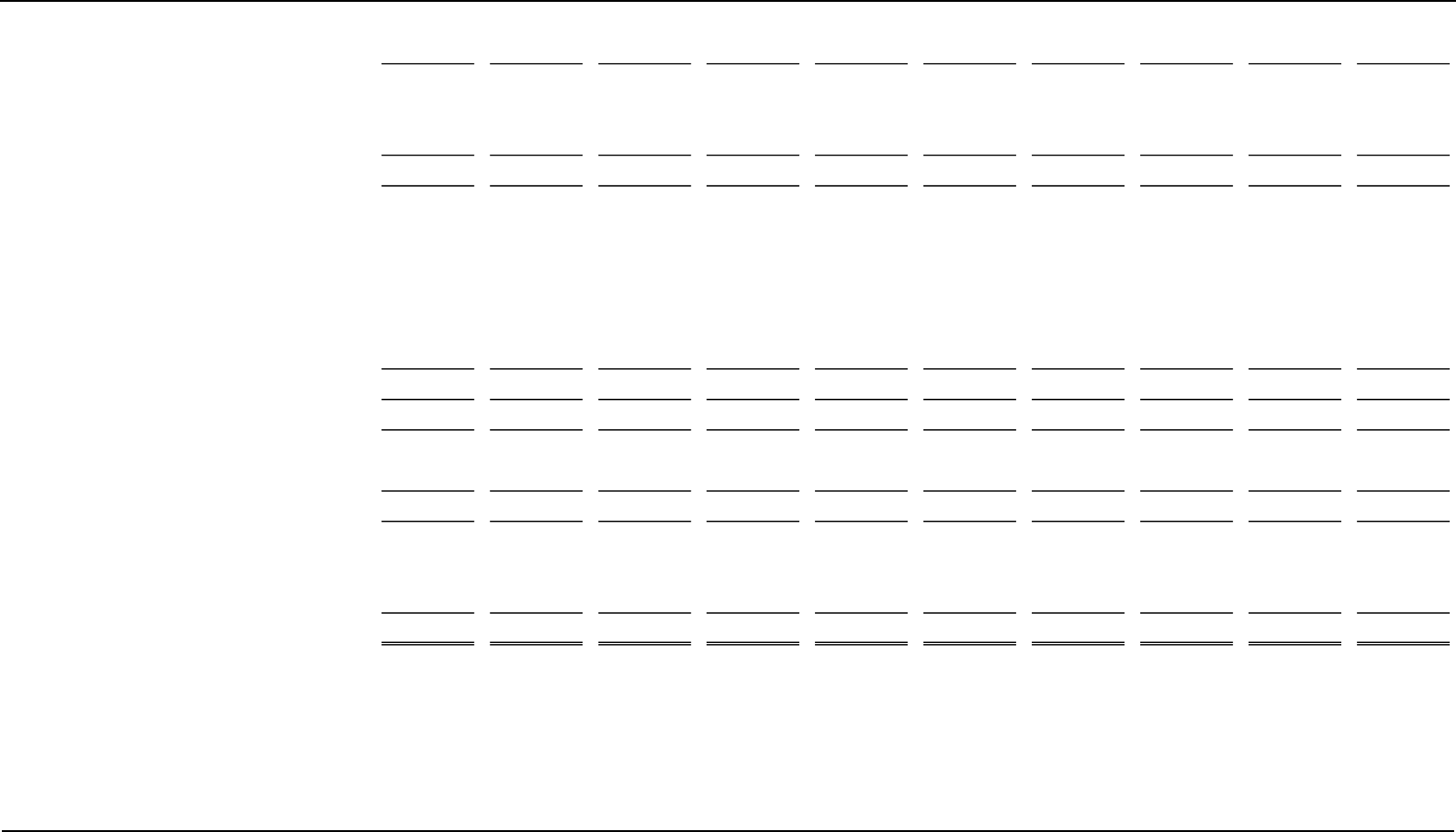

Consolidated Statements of Operations and Change in Net Deficit

Years Ended December 31, 2022 and 2021

2022 2021

REVENUES, GAINS, AND OTHER SUPPORT

Net patient service revenue 160,268,604$ 128,828,544$

Other operating revenue 12,225,566 2,751,890

Grant income 1,626,376 11,051,099

Contributions in-kind - 347,070

Total revenues, gains, and other support 174,120,546 142,978,603

OPERATING EXPENSES

Salaries and wages 60,753,059 53,855,513

Employee benefits 13,226,561 9,491,838

Professional fees 19,390,100 15,692,362

Supplies 19,934,690 19,260,763

Purchased services 28,060,229 26,021,621

Depreciation and amortization 3,320,345 3,495,065

Interest expenses 7,179,293 7,221,966

Facility expenses 4,089,843 3,613,996

Insurance 3,213,426 2,937,625

Other expenses 8,070,698 5,074,438

Total operating expenses 167,238,244 146,665,187

OPERATING INCOME 6,882,302 (3,686,584)

OTHER INCOME (LOSS)

(Loss) gain on bankruptcy settlements, net (730,373) 1,161,662

Other loss, net (59,807) (85,920)

Total other income (loss), net (790,180) 1,075,742

EXCESS OF REVENUES OVER EXPENSES

FROM CONTINUING OPERATIONS 6,092,122 (2,610,842)

DISCONTINUED OPERATIONS

Loss on discontinued operations (see Note 14) (305,387) (2,642,072)

Change in net deficit 5,786,735 (5,252,914)

NET DEFICIT WITHOUT DONOR RESTRICTIONS,

beginning of year (36,553,492) (31,300,578)

NET DEFICIT WITHOUT DONOR RESTRICTIONS,

end of year (30,766,757)$ (36,553,492)$

Astria Health and Subsidiaries

See accompanying notes.

6

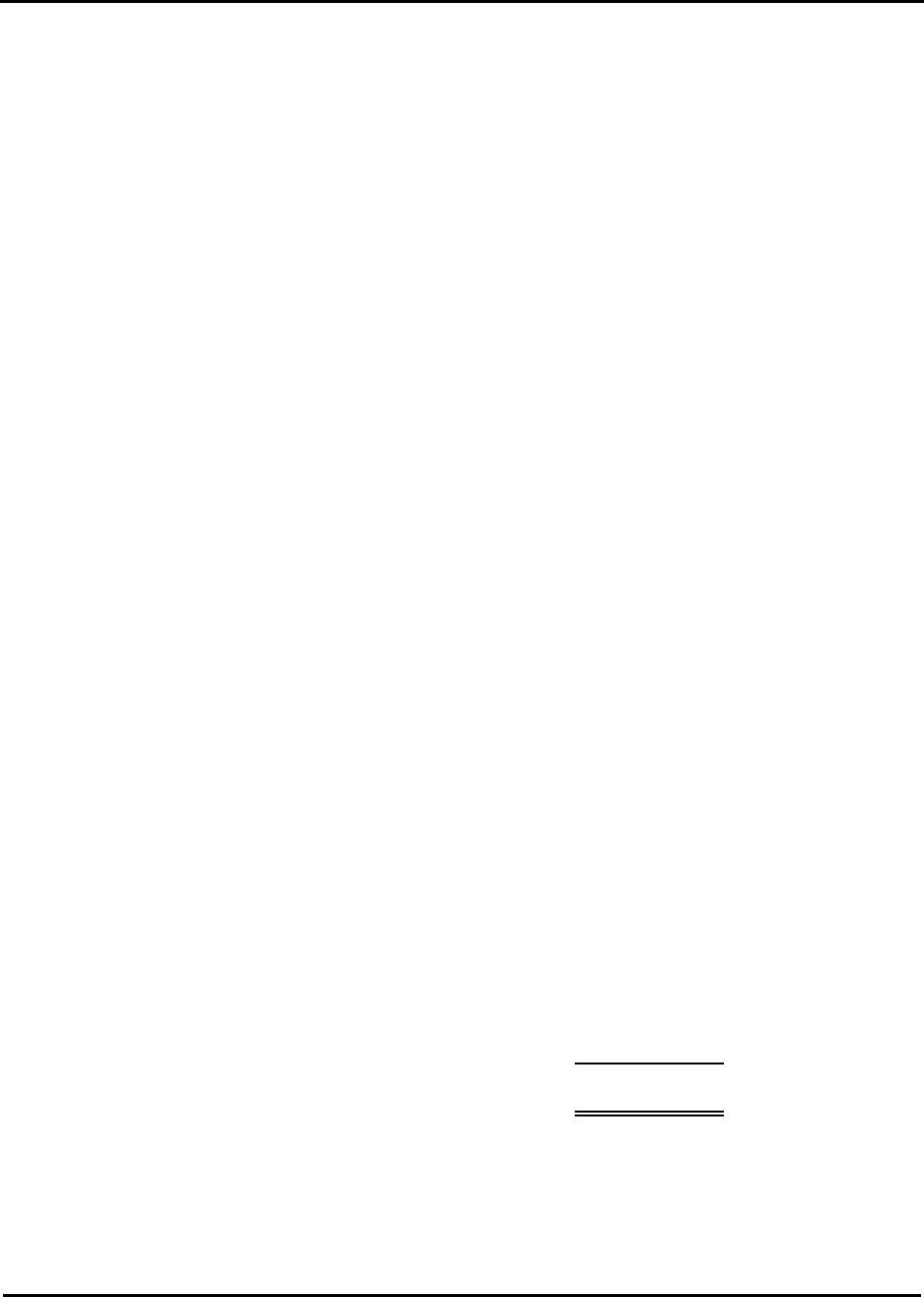

Consolidated Statements of Cash Flows

Years Ended December 31, 2022 and 2021

2022 2021

CASH FLOWS FROM OPERATING ACTIVITIES

Change in net deficit 5,786,735$ (5,252,914)$

Adjustments to reconcile change in net assets to net cash

used in operating activities

Depreciation and amortization of property and equipment 3,320,345 3,495,065

Non-cash lease expense 1,399,167 -

Gain on forgiveness of PPP Loans (2,743,300) -

Loss on disposal of property and equipment 93,339 685,524

Loss on discontinued operations (see Note 14) 305,387 2,642,072

Changes in operating assets and liabilities

Patient accounts receivable (3,993,519) (508,321)

Other receivables (161,317) 153,357

Inventory (219,097) (1,619,308)

Prepaid expenses and other assets 260,570 (218,208)

Due from (to) intercompany

for discontinued operations (see Note 13) 1,247,681 (243,665)

Accounts payable and accrued expenses (1,955,855) (983,301)

Accrued compensation and benefits (9,924) (2,405,040)

Estimated third-party payor settlements (31,180) (1,776,505)

Other accrued liabilities 950,867 (32,911,134)

Operating lease liabilities (1,385,314) -

Net cash provided by (used in) operating activities 2,864,585 (38,942,378)

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from sale of property and equipment - 314,176

Purchase and construction of property and equipment (2,798,642) (1,845,210)

Net cash used in investing activities (2,798,642) (1,531,034)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from long-term debt 160,000 76,215,000

Repayment of long-term debt (289,885) (58,239,529)

Repayment on finance lease liabilities (48,820) -

Net cash (used in) provided by financing activities (178,705) 17,975,471

NET CHANGE IN CASH AND CASH EQUIVALENTS (112,762) (22,497,941)

CASH AND CASH EQUIVALENTS, beginning of year 4,612,077 27,110,018

CASH AND CASH EQUIVALENTS, end of year 4,499,315$ 4,612,077$

Astria Health and Subsidiaries

Consolidated Statements of Cash Flows

Years Ended December 31, 2022 and 2021

See accompanying notes.

7

2022 2021

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION

Cash paid during the year for interest 7,218,833$ 7,887,963$

SUPPLEMENTAL DISCLOSURE OF NONCASH

INVESTING AND FINANCING ACTIVITIES

Noncash impact of the implementation of ASC 842

Operating lease right-of-use assets obtained

in exchange for operating lease liabilities 8,009,319$ -$

Finance lease right-of-use assets obtained

in exchange for new finance lease liabilities 365,875$ -$

Astria Health and Subsidiaries

8

Notes to Consolidated Financial Statements

Note 1 – Organization and Principles of Consolidation

Astria Health (the Organization) is a nonprofit corporation operating hospitals, health clinics, home health

services, and other healthcare services in Yakima, Toppenish, and Sunnyside, Washington, and the

surrounding areas. The Organization is exempt under Section 501(c)(3) of the Internal Revenue Code

from federal income taxes except for unrelated business income.

Astria Sunnyside Hospital consists of the following entities:

Astria Sunnyside Hospital (Sunnyside) is a critical access hospital with 25 set-up beds. Services

offered at the hospital include medical, surgical, labor/delivery and nursery care, 24-hour emergency,

laboratory, imaging services, physical therapy, cardiac rehabilitation, urgent care, oncology,

cardiology, and clinics. Members of the medical staff include specialists in emergency medicine, family

practice, internal medicine, general surgery, pediatrics, obstetrics/gynecology, orthopedics,

otolaryngology, radiology, and inpatient hospitalization. Astria Health is the sole member of Sunnyside.

A wholly owned subsidiary of Sunnyside, Sunnyside Professional Services, LLC (SPS), a for-profit

limited liability corporation, has an investment in a corporation that owns two medical office buildings.

It manages these buildings for Sunnyside.

Sunnyside Hospital Foundation (the Foundation) is a nonprofit organization that provides contributions

to Sunnyside. The Foundation is exempt under Section 501(c)(3) of the Internal Revenue Code from

federal income taxes except for unrelated business income. The Foundation is an affiliated

organization, and its activity is consolidated with the Organization.

Astria Home Health is a nonprofit organization working toward establishing home health services in

Sunnyside and does not currently provide patient care services. Astria Home Health is exempt under

Section 501(c)(3) of the Internal Revenue Code from federal income taxes except for unrelated

business income. Astria Home Health is a wholly owned subsidiary of Sunnyside.

Astria Home Medical Supply is a for-profit organization providing durable medical equipment and

supplies to the community the Organization serves.

SHC Holdco, LLC, whose sole member is Astria Health, consists of the following entities:

Astria Toppenish Hospital (Toppenish) is a 78-bed facility located in Toppenish, Washington.

Toppenish has an expanded surgery capability, pediatrics area, and a Family Maternity Center.

A wholly owned subsidiary, Yakima Home Care Holdings, LLC (YHCH), a for-profit limited liability

corporation, owns and operates Yakima HMA Home Health, LLC, (YHHH), which provides home

health and hospice services throughout Yakima County, Washington.

Astria Regional Medical Center (ARMC) was closed in January 2020 (see Note 14).

The consolidated financial statements reflect the consolidated operations of Astria Health, Sunnyside,

and SHC Holdco, LLC, collectively referred herein as the “Organization.” All significant intercompany

transactions and balances have been eliminated.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

9

Note 2 – Significant Accounting Policies

Use of estimates – The preparation of the consolidated financial statements in accordance with

accounting principles generally accepted in the United States of America (GAAP) requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from

those estimates.

Cash and cash equivalents – Cash and cash equivalents include highly liquid investments with an

original maturity of three months or less, excluding assets limited as to use.

Patient accounts receivables – Patient receivables are uncollateralized patient, customer, and third-

party payor obligations. Payments of patient receivables are allocated to the specific claims identified on

the remittance advice or, if unspecified, are applied to the earliest unpaid claim. The carrying amount of

patient receivables is reduced by implicit and explicit price concessions that reflects management’s

estimate of amounts that will not be collected from patients, residents, and third-party payors.

Management reviews patient receivables by payor class and applies percentages to determine estimated

amounts that will not be collected from third parties under contractual agreements and amounts that will

not be collected from patients due to implicit price concessions. Management considers historical write-off

and recovery information in determining the estimated implicit price concession.

Inventory – Inventory, consisting principally of surgical, medical, and pharmaceutical supplies, are stated

at the lower of cost (first-in, first-out) or market.

Prepaid expenses – Prepaid expenses are expenses paid during the fiscal year relating to expenses to

be incurred in future periods.

Property and equipment – Property and equipment acquisitions equal to or greater than $5,000 and

having more than a one-year useful life are capitalized and recorded at cost. The cost of property and

equipment, and the related accumulated depreciation, are removed from the accounts when sold or

retired, and any resulting gain or loss is recognized. Depreciation is provided over the estimated useful

life of each depreciable asset and is computed using the straight-line method. The estimated useful lives

of property and equipment are as follows:

Buildings and improvements 3 to 40 years

Equipment 1 to 15 years

The Organization assesses potential impairment to its long-lived assets when there is evidence that

events or changes in circumstances have made recovery of the carrying value of the assets unlikely.

Leases – For the year ended December 31, 2021, the Company followed Financial Accounting

Standards Board (FASB) Accounting Standards Codification (ASC) 840, Leases. Under that guidance,

the Company classified leases as either operating or capital. Capital leases resulted in the recognition of

the assets and liabilities, whereas operating leases did not.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

10

As of January 1, 2022, the Company adopted FASB ASC 842, Leases. The Company implemented this

standard utilizing the modified retrospective transition approach and electing to not adjust comparative

periods. As a result, the consolidated financial statements for the year ended December 31, 2021, were

not changed related to this implementation.

The following lease accounting policies were followed for year ended December 31, 2022:

At lease inception, the Company determines whether an arrangement is or contains a lease. Operating

leases and Finance leases are included in property and equipment, current portion of long-term lease

obligation, and lease obligation, net of current under long-term liabilities in the consolidated balance

sheets. Right-of-use (ROU) assets represent the Company’s right to use leased assets over the term of

the lease. Lease liabilities represent the Company’s contractual obligation to make lease payments

arising from the lease.

For operating leases, ROU assets and lease liabilities are recognized at the commencement date. The

lease liability is measured as the present value of the lease payments over the lease term. The Company

uses the rate implicit in the lease if it is determinable. When the rate implicit in the lease is not

determinable, the Company uses its incremental borrowing rate to determine the present value of the

lease payments. Operating ROU assets are calculated as the present value of the lease payments plus

initial direct costs, plus any repayments less any lease incentives received. Lease terms may include

renewal or extension options to the extent they are reasonably certain to be exercised. Factors

considered in determining whether an option is reasonably certain of exercise include, but are not limited

to, the value of leasehold improvements, the value of renewal rates, and the presence of factors that

would cause a significant economic penalty to the Company if the option were not exercised. Lease

expenses are recognized on a straight-line basis over the lease term. The Company has elected not to

recognize an ROU asset and obligation for leases with an initial term of 12 months or less. The expense

associated with short-term leases is included in rent expense in the consolidated statements of

operations.

For finance leases, upon lease commencement, the lease liability is measured on an amortized cost

basis and increased to reflect interest on the liability and decreased to reflect the lease payment made

during the period. Interest on the lease liability is determined each period during the lease term as the

amount that results in a constant period discount rate on the remaining balance of the liability. The ROU

asset is subsequently measured at cost, less any accumulated amortization and any accumulated

impairment losses. Amortization on the ROU asset is recognized over the period from the

commencement date to the earlier of the end of the useful life of the ROU asset or the end of the lease

term. The Company uses the rate implicit in the lease if it is determinable. When the rate implicit in the

lease is not determinable, the Company uses its incremental borrowing rate to determine the present

value of the lease payments.

Self-insurance reserves – The provisions for the reserves in the self-insured health plan and the

workers’ compensation trust include estimates of the ultimate costs for both the reported claims and the

claims incurred but not reported.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

11

Basis of presentation – The Organization’s consolidated financial statements are presented in

accordance with GAAP, as codified by the Financial Accounting Standards Board (FASB). Net assets,

revenues, gains, and losses are classified based on the existence or absence of donor-imposed

restrictions. Accordingly, net assets and changes therein are classified and reported as follows:

Net (deficit) assets without donor restrictions – Net (deficit) assets available for use in general operations

and not subject to donor restrictions.

Net assets with donor restrictions – Net assets subject to donor-imposed restrictions. Some donor-

imposed restrictions are temporary in nature, such as those that will be met by the passage of time or

other events specified by the donor. Other donor-imposed restrictions are perpetual in nature, where the

donor stipulates that resources be maintained in perpetuity. Donor-imposed restrictions are released

when a restriction expires; that is, when the stipulated time has elapsed, when the stipulated purpose for

which the resource was restricted has been fulfilled, or both. These are reported as reclassifications

between the applicable classes of net assets. There were no net assets with donor restrictions for the

years ended December 31, 2022 and 2021.

Net patient service revenue – Patient care service revenue is reported at the amount that reflects the

consideration to which the Organization expects to be entitled in exchange for providing patient care.

These amounts are due from patients, third-party payors (including health insurers and government

programs), and others and includes variable consideration for retroactive revenue adjustments due to

settlement of audits, reviews, and investigations. Generally, the Organization bills the patients and third-

party payors several days after the services are performed or the patient is discharged from the facility.

Revenue is recognized as performance obligations are satisfied.

Charity care – Patients who meet the Organization’s criteria for charity care are provided care without

charge or at amounts less than established rates. Such amounts determined to qualify as charity care are

not reported as revenue. The costs the Organization incurred to provide charity care were approximately

$1,441,732 and $982,000 for the year ended December 31, 2022 and 2021, respectively. The

Organization has estimated these costs by multiplying its ratio of costs to gross charges to the gross

uncompensated charges associated with providing charity care.

Grant income – Grant income primarily includes revenues generated primarily from U.S. Department of

Health and Human Services’ Provider Relief Fund (PRF) (see Note 4).

Other operating revenue – Other operating revenue primarily includes revenues generated from

cafeteria, rentals, vendor rebates, other ancillary services, and joint venture gains and losses.

Other operating expenses – Other operating expenses primarily include expenses related to taxes,

repairs and maintenance, travel, education, professional dues, subscriptions, recruiting, and licenses.

Performance indicator – Deficiency/excess of revenues over expenses from continuing operations, as

reflected in the accompanying consolidated statement of operations and change in net deficit, is the

performance indicator. Deficiency/excess of revenues over expenses from continuing operations includes

all changes in net deficit except for activity of discontinued operations.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

12

Hospital safety net assessment – The state of Washington has a safety net assessment program

involving Washington State hospitals to increase funding from other sources and obtain additional federal

funds to support increased payments to providers for Medicaid services. In connection with this program,

the Organization recorded increases in patient service revenue of $1,724,381 and $1,284,932 for 2022

and 2021, respectively and incurred assessments of $1,196,012 and $776,628, respectively, which were

recorded in other operating expenses in the accompanying consolidated statement of operations and

change in net deficit. The Organization has outstanding receivables of $524,646 and $99,935 associated

with this program as of December 31, 2022 and 2021, respectively, which are included with patient

accounts receivable on the consolidated balance sheet.

Federal income tax – The Organization comprises several corporations that are exempt from federal

income tax under Section 501(c)(3) of the IRC (see Note 1), except to the extent of unrelated business

taxable income as defined under IRC Sections 511 through 515, and several limited liability companies.

The Organization has adopted accounting for uncertain tax positions, which is an accounting standard

that prescribes a recognition threshold and measurement process for uncertain tax positions. The

Organization had no uncertain tax positions as of December 31, 2022.

Subsequent events – Subsequent events are events or transactions that occur after the consolidated

balance sheet date but before the consolidated financial statements are issued. The Organization

recognizes in the consolidated financial statements the effects of all subsequent events that provide

additional evidence about conditions that existed at the date of the consolidated balance sheet, including

the estimates inherent in the process of preparing the consolidated financial statements. The

Organization’s consolidated financial statements do not recognize subsequent events that provide

evidence about conditions that did not exist at the date of the consolidated balance sheets but arose after

the consolidated balance sheet date and before the consolidated financial statements are available to be

issued.

The Organization has evaluated subsequent events through April 30, 2023, which is the date the

consolidated financial statements are available to be issued, and concluded that there were no events or

transactions that need to be disclosed.

Note 3 – Going Concern

The Organization, in accordance with FASB ASC Subtopic 205-40, Presentation of Financial

Statements—Going Concern, has identified conditions that raise substantial doubt about the ability of the

Organization to continue as a going concern in the near future. The following is the evaluation of this

condition and management’s plan: The principal conditions that raised substantial doubt about the

Organization’s ability to continue as a going concern is the days cash on hand ratio of 10 days and 12

days, negative operating cash flows, and a net deficit of $30,766,757 and $36,553,492 as of and for the

years ended December 31, 2022 and 2021, respectively. The Organization’s $75,000,000 note payable

matures in December 2025 and the Organization was not in compliance with its financial covenants and

received a waiver (see Note 7) as of and for the years ended December 31, 2022 and 2021. The

Organization is actively working to improve cash flows to provide adequate liquidity for operations and

prevent an event of default on the long-term debt obligations.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

13

Note 4 – Coronavirus (COVID-19) Impact

The Organization received funds under the PRF, administered by the U.S. Department of Health &

Human Services (HHS), of $221,916 and $3,926,219 in 2022 and 2021, of which the Organization has

recognized grant income of $221,916 and $3,926,219 and deferred revenue, which is included in other

accrued liabilities, of $0and $0, as of and for the years ended December 31, 2022 and 2021, respectively.

The Organization was required to agree to the terms and conditions of payments. Those terms and

conditions include measures to help prevent fraud and misuse. Documentation is required to ensure that

these funds are to be used for expenses or lost revenue attributable to coronavirus. Also, anti-fraud

monitoring and auditing will be done by HHS and the Office of the Inspector General.

The Organization received funds under the Payroll Protection Program (PPP or Program) loans (see Note

7), administered by the Small Business Administration (SBA), The PPP loans may be fully forgiven if (i)

proceeds are used to pay eligible payroll costs or other eligible costs and (ii) full-time employee

headcount and salaries are either maintained during the eight-week period following disbursement or

restored by December 31, 2020. If not maintained or restored, any forgiveness of the PPP loan would be

reduced in accordance with the regulations. All the proceeds of the PPP loans were used by the

Organization to pay eligible payroll costs and the Organization maintained its headcount and otherwise

complied with the terms of the PPP loans.

PPP loan payments were deferred during the Deferral Period. The Deferral Period is the period beginning

on the date of the loans and ending 10 months after the last day of the covered period (Deferral

Expiration Date). Any amounts not forgiven under the Program will be payable in equal installments of

principal plus any interest owed on the payment date from the Deferral Expiration Date through the

Maturity Date. Additionally, any accrued interest that is not forgiven under the Program will be due on the

First Payment Date.

While the Organization believes that it has acted in compliance with the program and did seek

forgiveness of the PPP loans, no assurance can be provided that the Organization will obtain forgiveness

of the PPP loans in whole or in part. As a result, the funding provided under the PPP program was

recorded as a liability rather than grant revenue as of and for the year ended December 31, 2021. The

PPP loans were forgiven in 2022 and gain on forgiveness has been recognized as is included in other

operating revenue.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

14

Note 5 – Net Patient Service Revenue

Revenue is recognized as performance obligations are satisfied. Performance obligations are determined

based on the nature of the services provided by the Organization. Revenue for performance obligations

satisfied over time is recognized based on actual charges incurred in relation to total expected (or actual)

charges. The Organization believes that this method provides a faithful depiction of the transfer of

services over the term of the performance obligation based on the inputs needed to satisfy the obligation.

Generally, performance obligations satisfied over time relate to patients in the hospitals receiving

inpatient acute care services or patients receiving services in the outpatient centers or in their homes

(home care). The Organization measures the performance obligation from admission into the hospital, or

the commencement of an outpatient service, to the point when it is no longer required to provide services

to that patient, which is generally at the time of discharge or completion of the outpatient services.

Revenue for performance obligations satisfied at a point in time is generally recognized when goods are

provided to the patients and customers in a retail setting (for example, pharmaceuticals and medical

equipment) and the Organization does not believe it is required to provide additional goods or services

related to that sale.

Because all of its performance obligations relate to contracts with a duration of less than one year, the

Organization has elected to apply the optional exemption provided in FASB ASC 606-10-50-14(a);

therefore, is not required to disclose the aggregate amount of the transaction price allocated to

performance obligations that are unsatisfied or partially unsatisfied at the end of the reporting period. The

unsatisfied or partially unsatisfied performance obligations referred to above are primarily related to

inpatient acute care services at the end of the reporting period. The performance obligations for these

contracts are generally completed when the patients are discharged, which generally occurs within days

or weeks of the end of the reporting period.

The Organization determines the transaction price based on standard charges for goods and services

provided, reduced by contractual adjustments provided to third-party payors, discounts provided to

uninsured patients in accordance with the Organization’s policy, and implicit price concessions provided

to uninsured patients. The Organization determines its estimates of contractual adjustments and

discounts based on contractual agreements, its discount policies, and historical experience. The

Organization determines its estimate of implicit price concessions based on its historical collection

experience with this class of patients.

Contractual agreements with third-party payors provide for payments at amounts less than the

Organization’s established charges. A summary of the payment arrangements with major third-party

payors is as follows:

Medicare – Inpatient acute care services rendered to Medicare program beneficiaries are paid at

prospectively determined rates per discharge, which provides for reimbursement based on Medicare

Severity Diagnosis-Related Groups (MS-DRGs). These rates vary according to a patient classification

system that is based on clinical diagnosis, acuity, and expected use of hospital resources. The majority of

Medicare outpatient services is reimbursed under a prospective payment methodology, the Ambulatory

Payment Classification System (APCs), or fees schedules.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

15

Medicaid – Inpatient services rendered to Medicaid program beneficiaries are reimbursed under a

prospective payment system similar to Medicare; however, Medicaid utilizes All Payor Refined Diagnosis-

Related Groups (APR-DRGs) as opposed to Medicare’s MS-DRGs. The Majority of Medicaid outpatient

services are reimbursed under a prospective payment methodology, the Enhanced Ambulatory Patient

Groups (EAPG), or fee schedules.

Other – The Organization has entered into payment agreements with certain commercial insurance

carriers, health maintenance organizations, and preferred provider organizations. The basis for payment

to the Organization under these agreements includes prospectively determined rates per discharge,

discounts form established charges, and prospectively determined daily rates and fee schedules.

Laws and regulations concerning government programs, including Medicare and Medicaid, are complex

and subject to varying interpretation. As a result of investigations and notices regarding alleged

noncompliance with those laws and regulations, which, in some instances, have resulted in organizations

entering into significant settlement agreements with the government. Compliance with such laws and

regulations may also be subject to future government exclusion from the related programs. There can be

no assurance that regulatory or government authorities will not challenge the Organization’s compliance

with these laws and regulations, and it is not possible to determine the impact, if any, that such claims or

penalties would have upon the Organization. In addition, the contracts with commercial payors also

provide for retroactive audit and review of claims that can reduce the amount of revenue ultimately

received.

Settlements with third-party payors for retroactive adjustments due to audits, reviews, or investigations

are considered variable consideration and are included in the determination of the estimated transaction

price for providing patient care. These settlements are estimated based on the terms of the payment

agreement with the payor, correspondence from the payor, and the Organization’s historical settlement

activity, including an assessment to ensure that it is probable that a significant reversal in the amount of

cumulative revenue recognized will not occur when the uncertainty associated with the retroactive

adjustment is subsequently resolved. Estimated settlements are adjusted in future periods as adjustments

become known (that is, new information becomes available), or as years are settled or are no longer

subject to such audits, reviews, and investigations. Adjustments arising from a change in the transaction

price were not significant in 2022 or 2021.

Generally, patients who are covered by third-party payors are responsible for related deductibles and

coinsurance, which vary in amount. The Organization also provides services to uninsured patients and

offers those uninsured patients a discount, either by policy or law, from standard charges. The

Organization estimates the transaction price for patients with deductibles and coinsurance and from those

who are uninsured based on historical experience and current market conditions. The initial estimate of

the transaction price is determined by reducing the standard charge by any contractual adjustments,

discounts, and implicit price concessions. Subsequent changes to the estimate of the transaction price

are generally recorded as adjustments to patient service revenue in the period of the change. For the

years ended December 31, 2022 and 2021, no significant additional revenue was recognized due to

changes in the Organization’s estimates of implicit price concessions, discounts, and contractual

adjustments for performance obligations satisfied in prior years. Subsequent changes that are determined

to be the result of an adverse change in the patient’s ability to pay are recorded as changes in the

Organization’s estimates of implicit price concessions.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

16

Consistent with the Organization’s mission, care is provided to patients regardless of their ability to pay.

Therefore, the Organization has determined that it has provided implicit price concessions to uninsured

patients and patients with other uninsured balances (for example, copays and deductibles). The implicit

price concessions included in estimating the transaction price represent the difference between amounts

billed to patients and the amounts the Organization expects to collect based on its collection history with

those patients.

The Organization has determined that the best depiction of its revenue is by mix of payors as this shows

the amount of revenue recognized from each portfolio and by lines of business.

Patient service revenue disaggregated by payor for the years ended December 31, 2022 and 2021, is as

follows:

2022 2021

Medicare 50,288,489$ 35,338,693$

Medicaid 39,983,368 37,551,399

Commercial 61,350,279 55,682,127

Self-pay 8,646,468 256,325

160,268,604$ 128,828,544$

Patient service revenue disaggregated by line of business for the years ended December 31, 2022 and

2021, is as follows:

2022 2021

Hospital 138,625,161$ 112,529,394$

Clinics 17,895,586 13,282,046

Home Health 3,747,857 3,017,104

160,268,604$ 128,828,544$

The Organization has elected to apply the practical expedient under ASC 340-40-25-4 and therefore, all

incremental customer contract acquisition costs are expenses as incurred, as the amortization period of

the asset that the Organization would have otherwise recognized is one year or less in duration.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

17

Note 6 – Property and Equipment

A summary of property and equipment at December 31, 2022 and 2021, follows:

2022 2021

Land and improvements 7,080,212$ 8,174,095$

Buildings and improvements 33,559,474 32,194,317

Fixed, major movable, and minor equipment 34,602,580 34,173,224

Construction in progress 1,174,571 325,899

76,416,837 74,867,535

Less accumulated depreciation (50,420,887) (47,171,910)

Net property and equipment 25,995,950$ 27,695,625$

Depreciation expense on property and equipment was $3,320,345 and $3,495,065 for the years ended

December 31, 2022 and 2021, respectively.

Note 7 – Long-Term Debt

Long-term debt consists of the following at December 31, 2022 and 2021:

2022

2021

MultiCare note payable (a)

75,000,000$

75,000,000$

PPP loan payable - Toppenish (b)

- 2,358,900

PPP loan payable - YHHH (c)

- 384,400

Other notes payable (d)

- 288,750

Note payable (e)

158,865 -

75,158,865 78,032,050

Net of current portion

(10,998) (1,024,756)

75,147,867$ 77,007,294$

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

18

(a) MultiCare note payable – In January 2021, the Organization entered into a $75,000,000 note

payable to MultiCare, a Washington nonprofit corporation, which was amended in December 2022

to extend the maturity date (MultiCare Note). The MultiCare Note bears a fixed interest rate of 9.5%

with payments due on June 30 and December 31 of each year, secured by all assets of the

Organization, and matures in December 2025. MultiCare has an option to acquire all of the assets

and operations and assume the liabilities arising after the effective date of the note payable

(Purchase Option). The Purchase Option may be exercised at any time up to the later of (i) the

maturity date, and (ii) the date on which the MultiCare Note is satisfied in full (Option Period). The

Purchase Option can be exercised by MultiCare providing written notice to the Organization prior to

the expiration of the Option Period. MultiCare has not exercised the Purchase Option as of April 30,

2023, which is the date the consolidated financial statements are available to be issued.

(b) PPP loan payable – Toppenish – In July 2020, Toppenish entered into a PPP loan totaling

$2,358,900 with a financial institution. The loan included interest at 1.0% and had an original

maturity date of five years in June 2025. Monthly payments of $57,534 were scheduled to

commence in February 2022 but were deferred pending outcome of application for forgiveness.

This PPP loan was forgiven in 2022.

(c) PPP loan payable – YHHH – In July 2020, YHHH entered into a PPP loan totaling $384,400 with a

financial institution. The loan included interest at 1.0% and had an original maturity date of five

years in June 2025. Monthly payments of $9,376 were scheduled to commence in February 2022

but were deferred pending outcome of application for forgiveness. This PPP loan was forgiven in

2022.

(d) Other notes payable – In 2021, the Organization entered into two notes payable totaling

$1,215,000 with third parties. The unsecured notes payable included fixed interest ranging from

3.0% to 7.5% with monthly payments that totaled $101,250 and matured in 2022.

(e) Note payable – In 2022, the Organization entered into a note payable totaling $160,000 with third

parties. The note is secured by real property and bears interest at 8.0% with monthly payments of

$1,941 and matures in November 2032.

Long-term debt maturities are as follows:

2023

10,998$

2024

75,011,895

2025

12,883

2026

13,952

2027

15,110

Thereafter

94,027

75,158,865$

The note payable to MultiCare is subject to certain covenants regarding certain financial statement

amounts, ratios, and activities of the Organization. The Organization received a waiver for minimum days

in accounts payable, minimum earnings before interest, tax, depreciation, and amortization, minimum

days cash on hand, and 120-day deadline for audited consolidated financial statements covenants as of

December 31, 2022, and through March 31, 2023.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

19

Note 8 – Leases

The Company is in engaged in leases for portions of the Company’s hospital space, office space, and

hospital equipment. These leases have been evaluated and are accounted for under ASC 840 for the

year ended December 31, 2021, and under ASC 842 for the year ended December 31, 2022.

Pre-adoption of ASC 842 for the year ended December 31, 2021:

Operating leases – The Organization leased certain equipment under noncancelable long-term operating

lease agreements. Total lease expense for the year ended December 31, 2021, for all operating leases,

was $2,031,469.

The following is a maturity analysis of the annual undiscounted cash flows of operating lease liabilities as

of December 31, 2021:

2022 1,834,633$

2023 1,229,459

2024 917,531

2025 918,858

2026 803,507

Thereafter 2,821,253

8,525,241$

Post-adoption of ASC 842 for the year ended December 31, 2022:

The Organization leased certain equipment under noncancelable long-term operating lease agreements.

The Organization recognized the following non-cash expense associated with leases for the year ended

December 31, 2022:

Operating leases

Amortization of ROU assets 1,341,717$

Short-term lease expense

1,000,086

Finance leases

Amortization of ROU assets 51,441

interest on lease liabilities 6,009

Total lease cost 2,399,253$

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

20

During the year ended December 31, 2022, the Organization had the following cash, noncash activities,

and other information associated with leases:

Cash paid for amounts included in the

measurement of lease liabilities

Operating cash flows from operating leases 1,379,395$

Operating cash flows from finance leases 5,919$

Financing cash flows from finance leases 48,820$

Supplemental disclosures on cash flow information

Noncash impact of the implementation of ASC 842

Operating lease ROU assets and liabilities recognized 8,009,319$

Finance lease ROU assets obtained in exchange for

new finance lease liabilities 365,875$

Weighted-average remaining lease term (years)

Operating leases 6.8

Finance leases 6.8

Weighted-average discount rate

Operating leases 1.5%

Finance leases 1.8%

The undiscounted future payments due under operating and finance leases as of December 31, 2022,

were as follows:

Total

2023 1,204,185$ 55,705$ 1,259,890$

2024 1,104,320 55,705 1,160,025

2025 1,076,302 55,705 1,132,007

2026 937,711 55,705 993,416

2027 732,797 55,705 788,502

Thereafter 2,051,580 55,705 2,107,285

Total lease payments 7,106,895 334,230 7,441,125

Less imputed interest (367,388) (17,085) (384,473)

Less current obligations (1,110,709) (50,573) (1,161,282)

Long-term lease obligations 5,628,798$ 266,572$ 5,895,370$

Operating

leases

Finance leases

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

21

Note 9 – Retirement Plan

The Organization sponsors the Regional Health 401(k) Plan (the 401(k) Plan), a defined contribution plan

that covers all employees with a minimum of three months’ service. Employees are 100 percent vested

upon entering the 401(k) Plan. The Organization makes matching contributions to the 401(k) Plan up to

3% of employee compensation plus additional matching of 50%of employee contributions between 3%

and 5% of compensation. Total expenses for the years ended December 31, 2022 and 2021, were

$1,739,573 and $1,586,093, respectively.

Note 10 – Concentrations of Credit Risk

Patient accounts receivable – The Organization grants credit without collateral to its patients, most of

whom are insured under third-party payor agreements. The mix of receivables from third-party payors and

patients at December 31, 2022 and 2021, were as follows:

2022 2021

Medicare

31% 31%

Medicaid

27% 25%

Commercial insurance

36% 37%

Self-pay

6% 7%

100% 100%

Physicians – The Organization is dependent on local physicians practicing in its service area to provide

admissions and utilize hospital services on an outpatient basis. A decrease in the number of physicians

providing these services or change in their utilization patterns may have an adverse effect on hospital

operations.

Cash and cash equivalents – At times, deposits with financial institutions exceed Federal Deposit

Insurance Corporation insured limits.

Collective bargaining units – Sunnyside and Toppenish both have agreements with Washington State

Nurses Association (WSNA). The nurses assigned to YHHH are covered by the Toppenish WSNA

agreement. At December 31, 2022, there were 129 nurses of the 689 total employees of the Organization

covered by WSNA agreements. At December 31, 2021, there were 193 nurses of the 847 total

employees of the Organization covered by WSNA agreements.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

22

At December 31, 2022, the following status for both contracts with WSNA is as follows:

WSNA agreement with Sunnyside has been negotiated and ratified for an effective date of January 1,

2022. The Sunnyside agreement calls for a 7.5% increase in beginning scale rate for registered

nurses and keeps in place the existing scale for Sunnyside with a 3% increase in year two and year

three scale rates. WSNA agreement with Toppenish has been negotiated and ratified for an effective

date of August 1, 2022. The Toppenish agreement calls for a 22% increase in beginning scale rate for

registered nurses and keeps in place the existing scale for Sunnyside with a 3% increase in year two

and year three scale rates. In August 2022, the Sunnyside agreement was amended with an effective

date of October 1, 2022, to increase the beginning scale rate an additional 15%, with no additional

changes to year two and year three.

Note 11 – Liquidity and Availability

Financial assets available for general expenditure that are without donor or other restrictions limiting their

use within one year of December 31, 2022 and 2021, comprise the following:

2022 2021

Cash and cash equivalents 4,499,315$ 4,612,077$

Patient accounts receivable 28,141,842 24,148,323

32,641,157$ 28,760,400$

The Organization has $4,499,315 and $4,612,077 of cash and equivalents available within one year of

the balance sheet date at December 31, 2022 and 2021, respectively, to meet cash needs for general

expenditures. Those financial assets represent 10 days and 12 days of normal operating expenses, which

are, on average, approximately $449,000 and $393,000 per day for the years ended December 31, 2022

and 2021, respectively. The Organization is actively working to improve cash flows (see Note 3). There

are certain debt covenant compliances that the Organization must adhere to per its debt agreements, and

as of December 31, 2022 and 2021, the Organization was not in compliance with its debt covenants and

received a waiver (see Note 7).

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

23

Note 12 – Functional Expenses

The Organization provides health care services to patients within its geographic location. Expenses

related to providing these services by functional class for the years ended December 31, 2022 and 2021,

were as follows:

Patient Health Care General and

and Program Administrative Total

Salaries and wages 44,955,655$ 15,797,404$ 60,753,059$

Employee benefits 4,748,875 8,477,686 13,226,561

Professional fees 20,016,253 (626,153) 19,390,100

Supplies 18,483,187 1,451,503 19,934,690

Purchased services 16,050,199 12,010,030 28,060,229

Depreciation and amortization - 3,320,345 3,320,345

Interest expense 99,319 7,079,974 7,179,293

Facility expenses 1,613,740 2,476,103 4,089,843

Insurance 51,917 3,161,509 3,213,426

Other expenses 483,897 7,586,801 8,070,698

106,503,042$ 60,735,202$ 167,238,244$

Year Ended December 31, 2022

Patient Health Care General and

and Program Administrative Total

Salaries and wages $42,071,725 $11,783,788 53,855,513$

Employee benefits 7,414,988 2,076,850 9,491,838

Professional fees 12,676,667 3,015,695 15,692,362

Supplies 17,898,021 1,362,742 19,260,763

Purchased services 12,247,116 13,774,505 26,021,621

Depreciation and amortization 559 3,494,506 3,495,065

Interest expense 87,659 7,134,307 7,221,966

Facility expenses 1,683,098 1,930,898 3,613,996

Insurance 34,820 2,902,805 2,937,625

Other expenses 1,719,644 3,354,794 5,074,438

95,834,297$ 50,830,890$ 146,665,187$

Year Ended December 31, 2021

No significant allocations of expenses are made from general and administrative expenses to patient

health care and program services.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

24

Note 13 – Commitments and Contingencies

Professional liability – The Organization has professional liability insurance coverage with Physicians

Insurance Mutual Group. The policy provides coverage on a claims-made basis. Claims filed in the

current year are covered by the current policy. If there are unreported incidents that result in a

malpractice claim for the current year, these will only be covered in the year the claim is reported to the

insurance carrier if the Organization purchases claims-made coverage in that year or if the Organization

purchases insurance to cover prior acts.

Physicians Insurance Mutual Group (PIMG) malpractice insurance provides $1,000,000 per claim of

primary coverage with an annual aggregate limit of $5,000,000 to the Organization. The annual aggregate

limit of was reduced to $3,000,000 during 2021. The Organization’s policy has no deductible per claim or

in the aggregate except for Toppenish, which changed the policy to include a deductible of $250,000 per

claim with no aggregate effective June 15, 2021. Sunnyside also maintained excess liability coverage

with limits of $10,000,000 per claim and $10,000,000 aggregate with PIMG, which expired June 15, 2021.

Toppenish also maintained excess liability coverage with limits of $5,000,000 per claim and $5,000,000

aggregate with PIMG, which expired June 15, 2021. Management is not aware of any pending claims that

exceed the coverage limitations provided by their policy. Management is of the opinion that the impact, if

any, is immaterial, and any settlement would not have a material adverse effect on the Organization’s

consolidated balance sheets.

Workers’ compensation – The Organization, except for Sunnyside, participates in the Washington State

Department of Labor & Industries Workers’ Compensation Trust (Trust). Sunnyside participates in a group

purchasing pool with Washing State Hospital Association (WHSA) for workers’ compensation. The

Organization pays monthly premiums to the Trust and WHSA based the number of employee hours by

risk class of as defined by the Trust and WHSA. Management is not aware of any pending claims that

exceed the coverage limitations provided by their policy. Management is of the opinion that the impact, if

any, is immaterial, and any settlement would not have a material adverse effect on the Organization’s

consolidated balance sheets.

Employee health plan – The Organization partially self-insures the cost of employee healthcare benefits

as it purchases annual stop-loss insurance coverage for all claims in excess of $150,000 per claim.

Liabilities on the consolidated balance sheet include an accrual for claims that have been incurred but not

reported of approximately $1,292,700 and $925,000 at December 31, 2022 and 2021, which are included

in accrued compensation and benefits in the consolidated balance sheet. Claims liabilities are

reevaluated periodically to take into consideration recently settled claims, frequency of claims, and other

economic and social factors.

Litigation, claims, and disputes – The Organization is subject to the usual contingencies in the normal

course of operations relating to the performance of its tasks under its various programs. In the opinion of

management, the ultimate settlement of litigation, claims, and disputes in process will not be material to

the consolidated balance sheet of the Organization.

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

25

Industry regulations – The health care industry is subject to numerous laws and regulations of federal,

state, and local governments. Laws and regulations concerning government programs, including

Medicare and Medicaid, are complex and subject to varying interpretation. As a result of investigations by

governmental agencies, various health care organizations have received requests for information and

notices regarding alleged noncompliance with those laws and regulations, which, in some instances, have

resulted in organizations entering into significant settlement agreements. Compliance with such laws and

regulations may also be subject to future government review and interpretation, as well as significant

regulatory action, including fines, penalties, and potential exclusion from the related programs. There can

be no assurance that regulatory authorities will not challenge the Organization’s compliance with these

laws and regulations, and it is not possible to determine the impact (if any) such claims or penalties would

have upon the Organization. In addition, the contracts the Organization has with commercial payors also

provide for retroactive audit and review of claims. Management believes that the Organization is in

substantial compliance with current laws and regulations.

Note 14 – Discontinued Operations

In January 2020, the Organization ceased providing patient services at ARMC. In August 2022, the

Organization ceased providing durable medical equipment and supplies at Medical Supply. The assets

and liabilities of the discontinued operation included in the consolidated balance sheet as of the years

ended December 31, 2022 and 2021, were as follows:

ARMC Medical Supply 2021

ASSETS

Due from (to) intercompany 1,004,016$ -$ 1,004,016$

ARMC Medical Supply 2021

ASSETS

Patient accounts receivable 135,314$ -$ 135,314$

Due from (to) intercompany - (243,665) (243,665)

Property and equipment, net 1,058,400 26,233 1,084,633

1,193,714 (217,432) 976,282

LIABILITIES

Accounts payable and accrued expenses 420,169 - 420,169

Other accrued liabilities (374,609) - (374,609)

45,560 - 45,560

1,148,154$ (217,432)$ 930,722$

December 31, 2022

December 31, 2021

Astria Health and Subsidiaries

Notes to Consolidated Financial Statements

26

The operating results of the discontinued operation consists of the following for the years ended

December 31, 2022 and 2021:

ARMC Medical Supply 2021

Major classes

Net patient service revenue -$ 384,629$ 384,629$

Other operating revenue 2,672 - 2,672

Salaries and wages 2,399 (72,737) (70,338)

Employee benefits (5,424) (6,927) (12,351)

Professional fees (962) - (962)

Supplies 4,622 (61,767) (57,145)

Purchased services 157 - 157

Depreciation and amortization (50) (4,465) (4,515)

Interest expenses - (346) (346)

Facility expenses (26,400) (8,114) (34,514)

Insurance (9,948) - (9,948)

Other (489,885) (12,841) (502,726)

(522,819)$ 217,432$ (305,387)$

ARMC Medical Supply 2021

Major classes

Net patient service revenue 135,311$ 22,837$ 158,148$

Salaries and wages 32,564 (101,664) (69,100)

Employee benefits 34,855 (37,964) (3,109)

Professional fees (1,928) - (1,928)

Supplies (71,769) (90,574) (162,343)

Purchased services (15,198) (5,263) (20,461)

Depreciation and amortization - (558) (558)

Interest expenses (86,284) - (86,284)

Facility expenses (139,250) (12,690) (151,940)

Insurance (19,490) (250) (19,740)

Other (516,966) (32,488) (549,454)

Loss on bankruptcy settlements (1,735,303) - (1,735,303)

(2,383,458)$ (258,614)$ (2,642,072)$

Year ended December 31, 2022

Year ended December 31, 2021

Significant cash flows and noncash items from operating and investing activities of the discontinued

operation for the year ended December 31, 2022 and 2021, were as follows:

ARMC Medical Supply 2021

Operating cash flow items

Changes in operating assets and liabilities

Other receivables 135,314$ -$ 135,314$

Due from (to) intercompany 54,384$ (217,432)$ (163,048)$

Accounts payable and accrued expenses (420,169)$ -$ (420,169)$

Other accrued liabilities 374,609$ -$ 374,609$

There were no other capital expenditures or significant noncash investing cash flows during the years

ended December 31, 2022 and 2021.

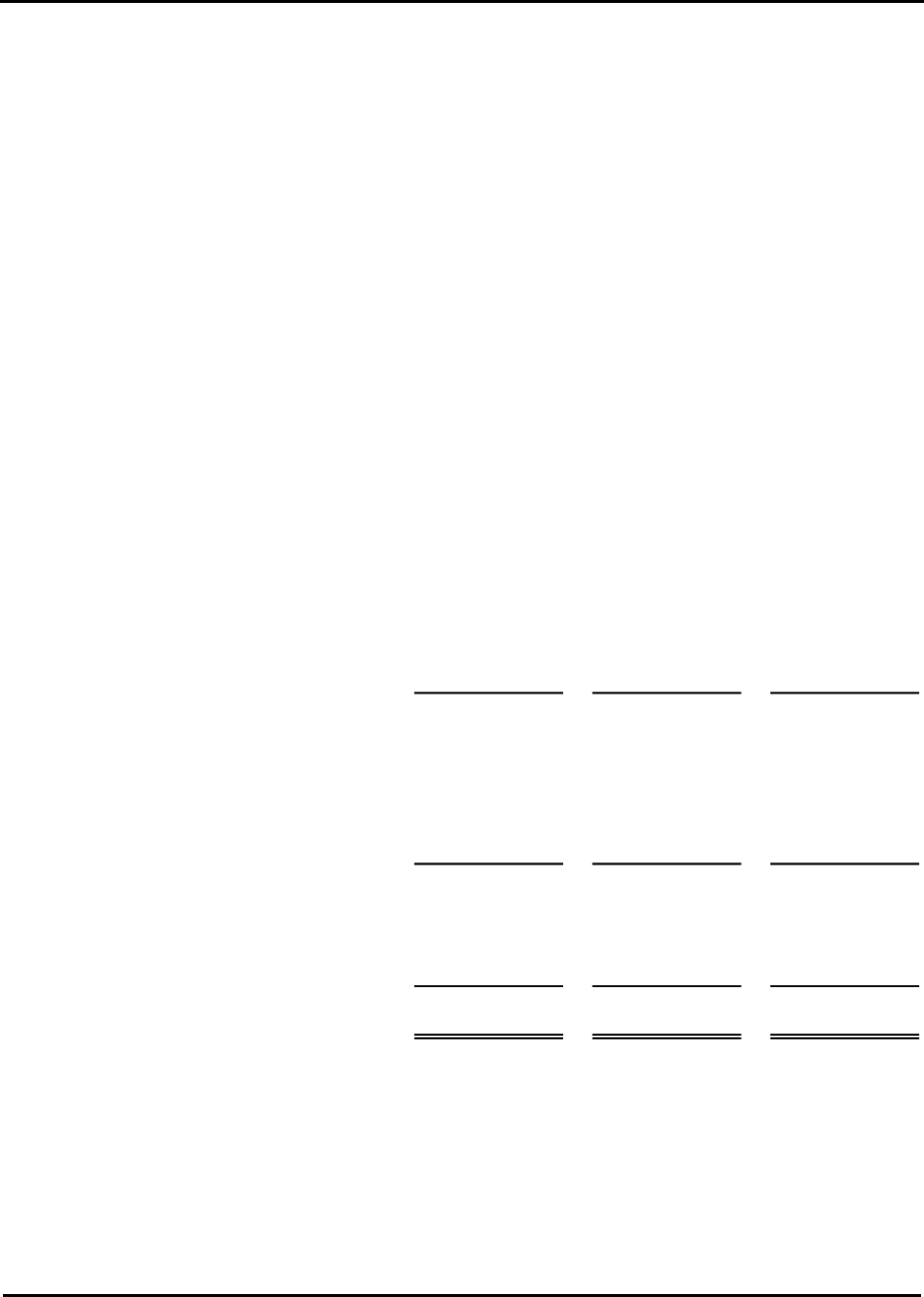

Supplementary Information

Astria Health and Subsidiaries

See report of independent auditors.

28

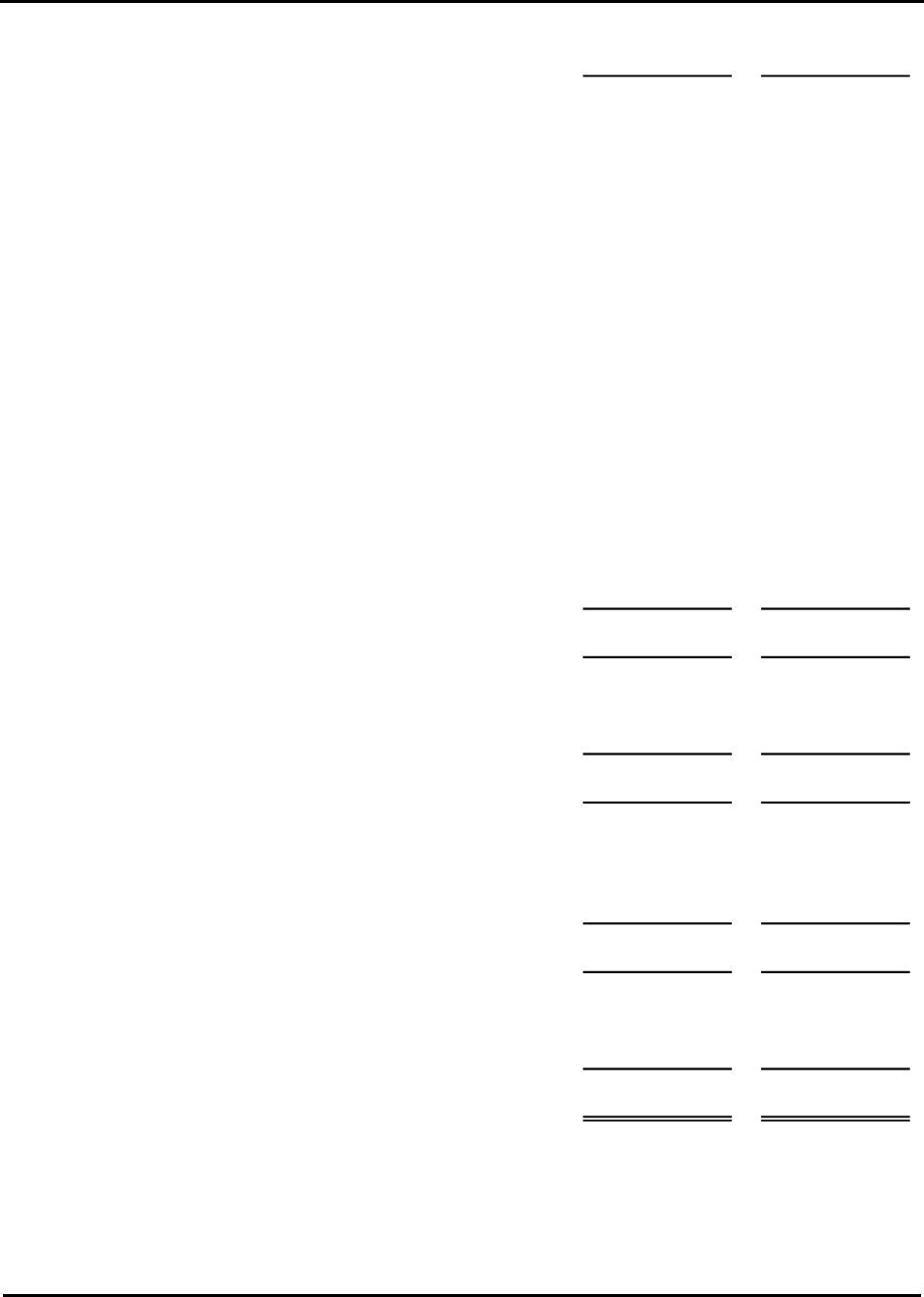

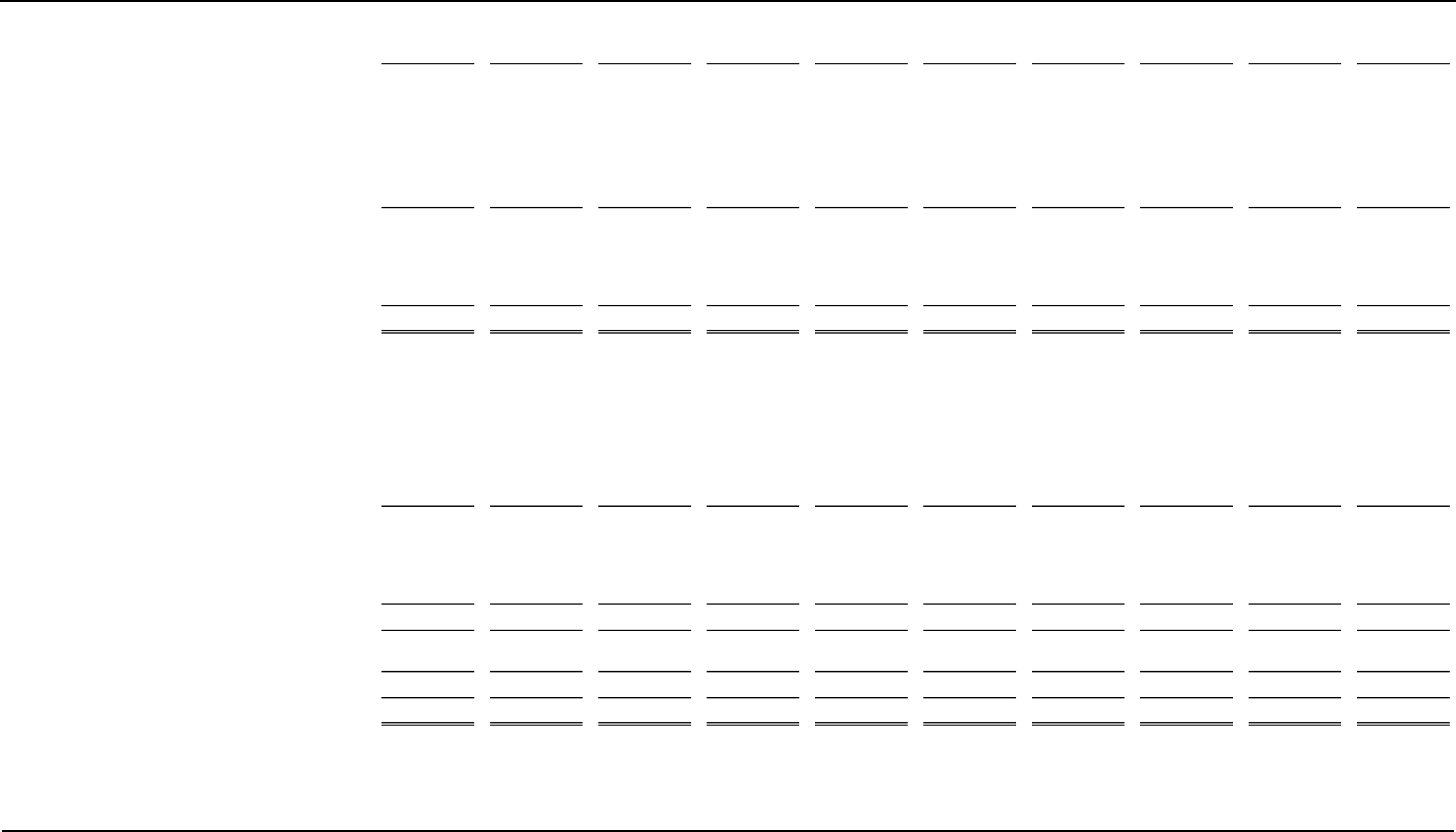

Consolidating Balance Sheet

December 31, 2022

Astria Astria Consolidated

Health Sunnyside Toppenish ARMC Home Health YHCH Medical Supply Foundation

Eliminations

Total

ASSETS

CURRENT ASSETS

Cash and cash equivalents 527,038$ 2,897,039$ 307,312$ -$ -$ -$ -$ 767,926$ -$ 4,499,315$

Patient accounts receivable - 16,664,604 10,850,256 - 225,275 401,707 - - - 28,141,842

Other receivables - 26,003 - - - - - - - 26,003

Inventory - 2,828,936 2,730,152 - - - - - - 5,559,088

Prepaid expenses and other assets 818,267 306,230 378,612 - - 17,247 - 185,713 - 1,706,069

Due from (to) intercompany 8,139,896 15,363,452 (25,171,592) 1,004,016 519,907 144,321 - - - -

Total current assets 9,485,201 38,086,264 (10,905,260) 1,004,016 745,182 563,275 - 953,639 - 39,932,317

PROPERTY AND EQUIPMENT, net 1,122,018 16,845,601 8,028,331 - - - - - - 25,995,950

OPERATING LEASE RIGHT-OF-USE ASSETS, net 495,318 2,410,244 3,871,623 - - - - - - 6,777,185

FINANCE LEASE RIGHT-OF-USE ASSETS, net - 248,693 65,741 - - - - - - 314,434

OTHER ASSETS - 858,022 - - - - - - - 858,022

Total assets 11,102,537$ 58,448,824$ 1,060,435$ 1,004,016$ 745,182$ 563,275$ -$ 953,639$ -$ 73,877,908$

LIABILITIES AND NET (DEFICIT) ASSETS

CURRENT LIABILITIES

Accounts payable and accrued expenses 2,088,306$ 5,406,846$ 4,931,802$ -$ 3,231$ 24,679$ -$ -$ -$ 12,454,864$

Accrued compensation and benefits 945,728 2,886,792 1,994,113 - - 141,948 - - - 5,968,581

Estimated third-party payor settlements - 1,878,006 (501,191) - - - - - - 1,376,815

Other accrued liabilities 853,050 1,345,960 25,182 - - 4,696 - - - 2,228,888

Current portion of long-term debt - - 10,998 - - - - - - 10,998

Current portion of operating lease liabilities 117,184 460,057 533,468 - - - - - - 1,110,709

Current portion of finance lease liabilities - 39,975 10,598 - - - - - - 50,573

Total current liabilities 4,004,268 12,017,636 7,004,970 - 3,231 171,323 - - - 23,201,428

LONG-TERM DEBT, net of current portion 75,000,000 - 147,867 - - - - - - 75,147,867

OPERATING LEASE LIABILITIES, less current portion 380,182 1,894,488 3,354,128 - - - - - - 5,628,798

FINANCE LEASE LIABILITIES, less current portion - 210,897 55,675 - - - - - - 266,572

OTHER LONG-TERM LIABILITIES 400,000 - - - - - - - - 400,000

Total liabilities 79,784,450 14,123,021 10,562,640 - 3,231 171,323 - - - 104,644,665

NET (DEFICIT) ASSETS

Without donor restrictions (68,681,913) 44,325,803 (9,502,205) 1,004,016 741,951 391,952 - 953,639 - (30,766,757)

Total net (deficit) assets (68,681,913) 44,325,803 (9,502,205) 1,004,016 741,951 391,952 - 953,639 - (30,766,757)

Total liabilities and net (deficit) assets 11,102,537$ 58,448,824$ 1,060,435$ 1,004,016$ 745,182$ 563,275$ -$ 953,639$ -$ 73,877,908$

Astria Health and Subsidiaries

See report of independent auditors.

29

Consolidating Balance Sheet

December 31, 2021

Astria Astria Consolidated

Health Sunnyside Toppenish ARMC Home Health YHCH Medical Supply Foundation

Eliminations

Total

ASSETS

CURRENT ASSETS

Cash and cash equivalents 848,693$ 3,260,687$ 114,438$ -$ -$ -$ -$ 388,259 - 4,612,077$

Patient accounts receivable - 14,479,183 8,865,278 135,314 95,288 573,260 - - - 24,148,323

Inventory - 2,889,559 2,450,432 - - - - - - 5,339,991

Prepaid expenses and other assets 832,754 193,519 305,615 - - 14,514 - 225,408 - 1,571,810

Due from (to) intercompany 151,961 14,698,896 (14,576,096) - 237,137 (268,233) (243,665) - - -

Total current assets 1,833,408 35,521,844 (2,840,333) 135,314 332,425 319,541 (243,665) 613,667 - 35,672,201

PROPERTY AND EQUIPMENT, net 397,520 18,456,463 7,757,009 1,058,400 - - 26,233 - - 27,695,625

OTHER ASSETS - 897,331 - - - - - 355,520 - 1,252,851

Total assets 2,230,928$ 54,875,638$ 4,916,676$ 1,193,714$ 332,425$ 319,541$ (217,432)$ 969,187$ -$ 64,620,677$

LIABILITIES AND NET (DEFICIT) ASSETS

CURRENT LIABILITIES

Accounts payable and accrued expenses 3,845,569$ 6,469,357$ 3,686,794$ 420,169$ -$ 30,318$ -$ -$ -$ 14,452,207$

Accrued compensation and benefits 812,124 3,445,283 1,569,082 - - 152,016 - - - 5,978,505

Estimated third-party payor settlements - 1,974,956 (566,961) - - - - - - 1,407,995

Other accrued liabilities 412,476 982,333 38,005 (374,609) - 10,093 - - - 1,068,298

Current portion of long-term debt 80,417 208,333 632,874 - - 103,132 - - - 1,024,756

Total current liabilities 5,150,586 13,080,262 5,359,794 45,560 - 295,559 - - - 23,931,761

LONG-TERM DEBT, net of current portion 75,000,000 - 1,726,026 - - 281,268 - - - 77,007,294

OTHER LONG-TERM LIABILITIES 235,114 - - - - - - - - 235,114

Total liabilities 80,385,700 13,080,262 7,085,820 45,560 - 576,827 - - - 101,174,169

NET (DEFICIT) ASSETS

Without donor restrictions (78,154,772) 41,795,376 (2,169,144) 1,148,154 332,425 (257,286) (217,432) 969,187 - (36,553,492)

Total net (deficit) assets (78,154,772) 41,795,376 (2,169,144) 1,148,154 332,425 (257,286) (217,432) 969,187 - (36,553,492)

Total liabilities and net (deficit) assets 2,230,928$ 54,875,638$ 4,916,676$ 1,193,714$ 332,425$ 319,541$ (217,432)$ 969,187$ -$ 64,620,677$

Astria Health and Subsidiaries

See report of independent auditors.

30

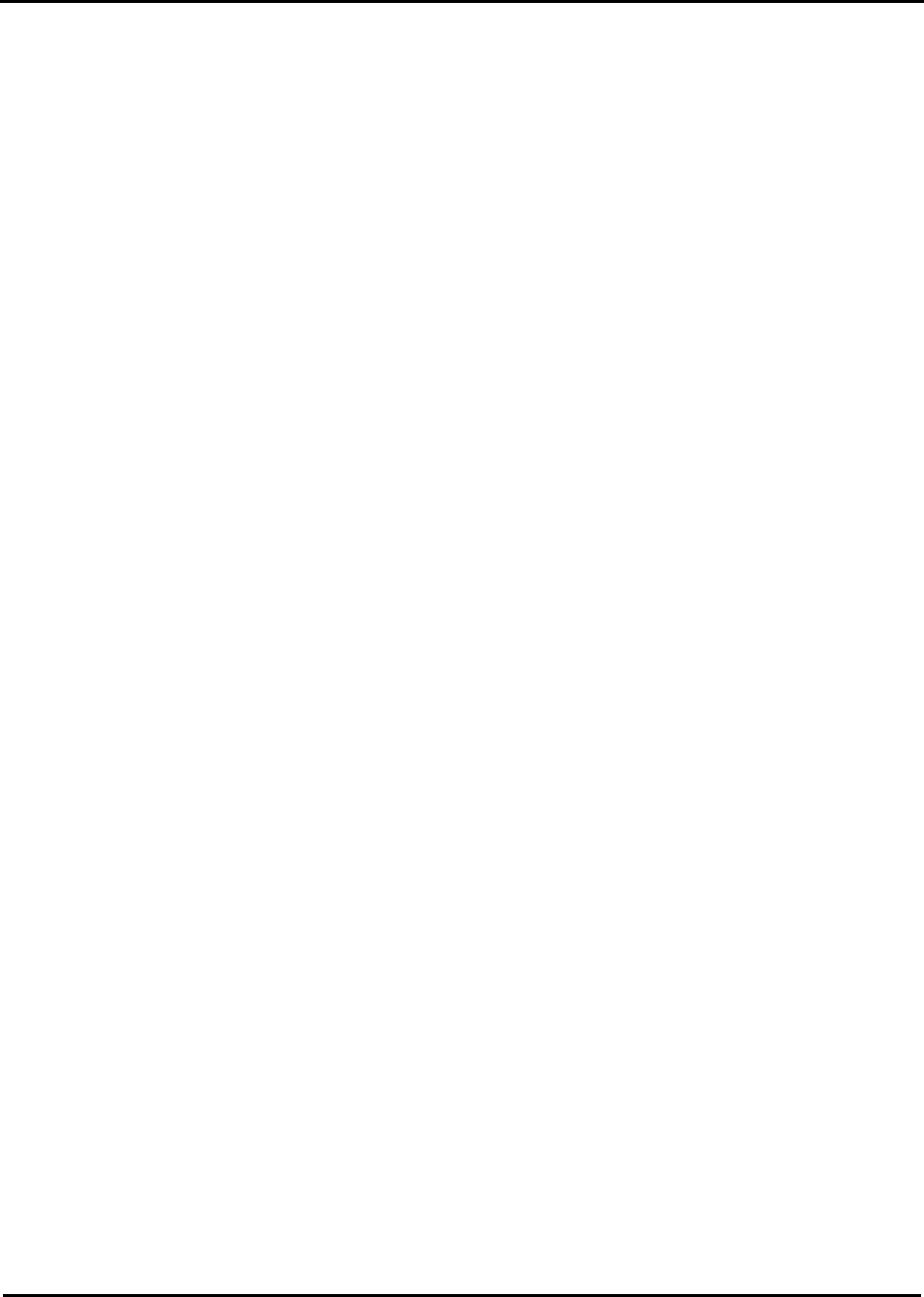

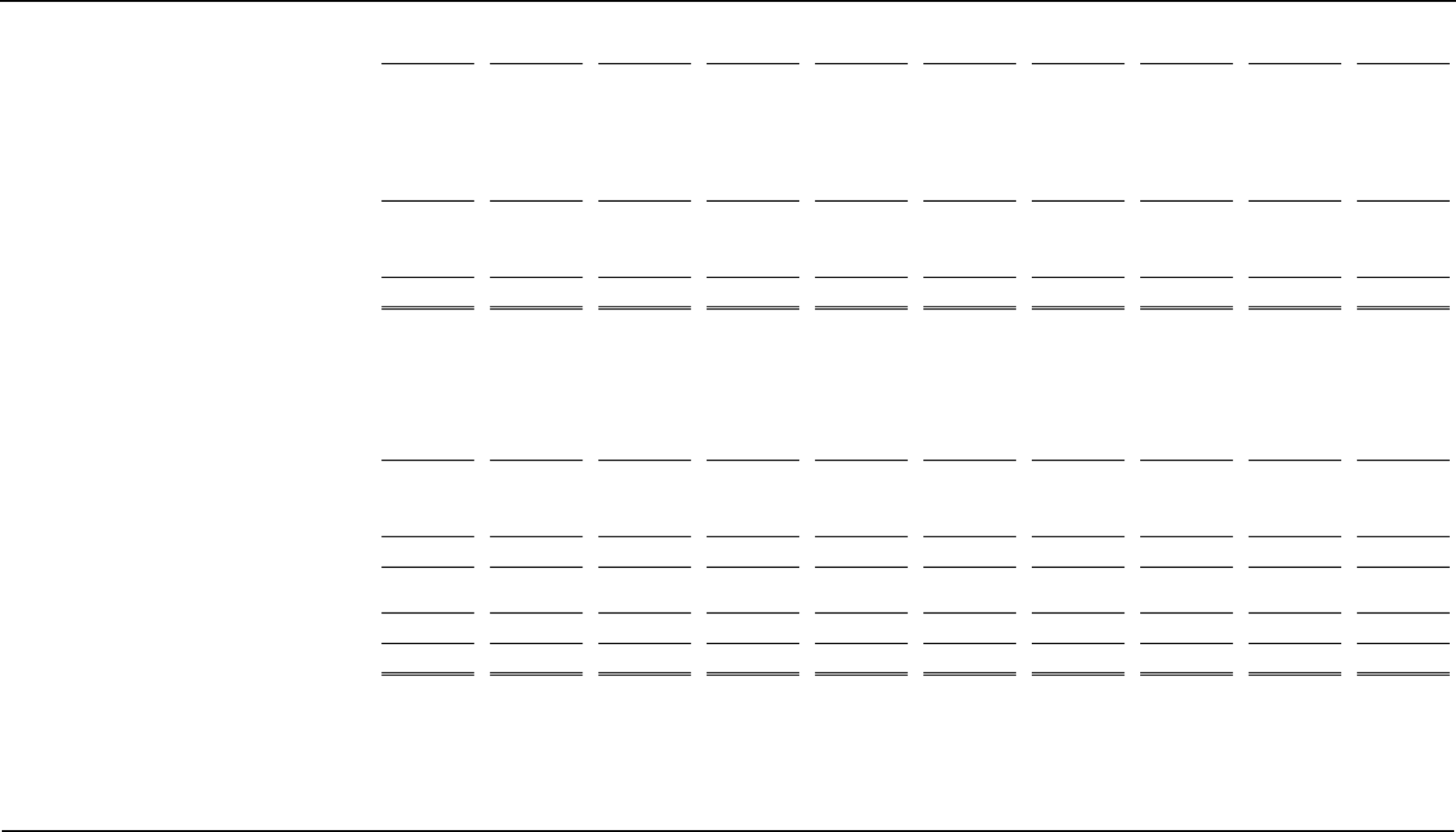

Consolidating Statement of Operations

Year Ended December 31, 2022

Astria Astria Consolidated

Health Sunnyside Toppenish ARMC Home Health YHCH Medical Supply Foundation Eliminations Total

REVENUES, GAINS, AND OTHER SUPPORT

Net patient service revenue -$ 102,776,838$ 53,743,909$ -$ 1,054,421$ 2,693,436$ -$ -$ -$ 160,268,604$

Other operating revenue 42,774,286 296,360 2,635,817 - 3,801 731,788 - - (34,216,486) 12,225,566

Grant income - 412,915 1,213,461 - - - - - - 1,626,376

Total unrestricted revenues, gains, and other support 42,774,286 103,486,113 57,593,187 - 1,058,222 3,425,224 - - (34,216,486) 174,120,546

OPERATING EXPENSES

Salaries and wages 6,800,472 30,739,421 21,035,919 - 413,321 1,763,926 - - - 60,753,059

Employee benefits 5,696,146 7,911,476 4,468,667 - 57,292 252,107 - - (5,159,127) 13,226,561

Professional fees (927,833) 8,580,384 11,710,352 - 750 26,447 - - - 19,390,100

Supplies 112,748 13,733,954 5,974,751 - 22,490 82,162 - 10,076 (1,491) 19,934,690

Purchased services 11,243,717 12,081,527 4,497,938 - 126 236,921 - - - 28,060,229

Depreciation and amortization 339,680 2,265,107 715,558 - - - - - - 3,320,345

Interest expense 7,133,925 4,629,848 2,483,700 - - 65,745 - - (7,133,925) 7,179,293

Facility expenses 489,761 1,848,448 1,706,893 - 2,928 41,813 - - - 4,089,843

Insurance 723,621 1,919,361 575,024 - - 5,019 - 349 (9,948) 3,213,426

Other expenses 989,027 16,741,291 11,757,446 - 151,475 340,161 - 3,293 (21,911,995) 8,070,698

Total operating expenses 32,601,264 100,450,817 64,926,248 - 648,382 2,814,301 - 13,718 (34,216,486) 167,238,244

OPERATING INCOME (LOSS) 10,173,022 3,035,296 (7,333,061) - 409,840 610,923 - (13,718) - 6,882,302

OTHER INCOME (LOSS)

Loss on bankruptcy settlements, net (730,373) - - - - - - - - (730,373)

Other income (loss), net 66 (58,043) - - - - - (1,830) - (59,807)

Total other income (loss), net (730,307) (58,043) - - - - - (1,830) - (790,180)

EXCESS (DEFICIENCY) OF REVENUES OVER EXPENSES

FROM CONTINUING OPERATIONS 9,442,715 2,977,253 (7,333,061) - 409,840 610,923 - (15,548) - 6,092,122

DISCONTINUED OPERATIONS

Loss on discontinued operations 30,144 (446,826) - (144,138) (314) 38,315 217,432 - - (305,387)

Changes in net (deficit) assets 9,472,859$ 2,530,427$ (7,333,061)$ (144,138)$ 409,526$ 649,238$ 217,432$ (15,548)$ -$ 5,786,735$

Astria Health and Subsidiaries

See report of independent auditors.

31

Consolidating Statement of Operations

Year Ended December 31, 2021

Astria Astria Consolidated

Health Sunnyside Toppenish ARMC Home Health YHCH Medical Supply Foundation Eliminations Total

REVENUES, GAINS, AND OTHER SUPPORT

Net patient service revenue -$ 76,623,198$ 49,188,242$ -$ 894,602$ 2,122,502$ -$ -$ -$ 128,828,544$

Other operating revenue 33,534,726 390,473 2,360,816 - - 481 - - (33,534,606) 2,751,890

Grant income - 10,636,714 414,385 - - - - - - 11,051,099

Contributions in-kind - 215,385 131,685 - - - - - - 347,070

Total unrestricted revenues, gains, and other support 33,534,726 87,865,770 52,095,128 - 894,602 2,122,983 - - (33,534,606) 142,978,603

OPERATING EXPENSES

Salaries and wages 5,896,580 26,555,480 19,210,314 - 538,292 1,654,847 - - - 53,855,513

Employee benefits 5,785,910 4,902,631 3,684,680 - 149,781 318,437 - - (5,349,601) 9,491,838

Professional fees 1,943,054 5,858,615 7,930,545 - - 16,962 - - (56,814) 15,692,362

Supplies 216,665 14,535,484 4,582,215 - 37,736 76,664 - - (188,001) 19,260,763

Purchased services 10,811,932 23,748,125 11,085,736 - 94,093 372,892 - - (20,091,157) 26,021,621

Depreciation and amortization 397,105 2,441,048 656,912 - - - - - - 3,495,065

Interest expense 7,121,315 4,580,014 2,566,238 - - 75,050 - - (7,120,651) 7,221,966

Facility expenses 256,050 1,872,822 1,449,609 - 3,324 32,696 - - (505) 3,613,996

Insurance 831,352 1,704,229 419,970 - - 1,621 - 349 (19,896) 2,937,625

Other expenses 1,002,549 2,285,917 2,269,662 - 53,109 170,637 - 545 (707,981) 5,074,438

Total operating expenses 34,262,512 88,484,365 53,855,881 - 876,335 2,719,806 - 894 (33,534,606) 146,665,187

OPERATING INCOME (LOSS) (727,786) (618,595) (1,760,753) - 18,267 (596,823) - (894) - (3,686,584)

OTHER INCOME (LOSS)

Gain on bankruptcy settlements, net 1,161,662 - - - - - - - - 1,161,662

Other income (loss), net 5,202 (137,105) 1 - - - - 45,982 - (85,920)

Total other income (loss), net 1,166,864 (137,105) 1 - - - - 45,982 - 1,075,742

EXCESS (DEFICIENCY) OF REVENUES OVER EXPENSES

FROM CONTINUING OPERATIONS 439,078 (755,700) (1,760,752) - 18,267 (596,823) - 45,088 - (2,610,842)

DISCONTINUED OPERATIONS

Loss on discontinued operations (462,321) - - (1,921,137) - - (258,614) - - (2,642,072)

Changes in net (deficit) assets (23,243)$ (755,700)$ (1,760,752)$ (1,921,137)$ 18,267$ (596,823)$ (258,614)$ 45,088$ -$ (5,252,914)$