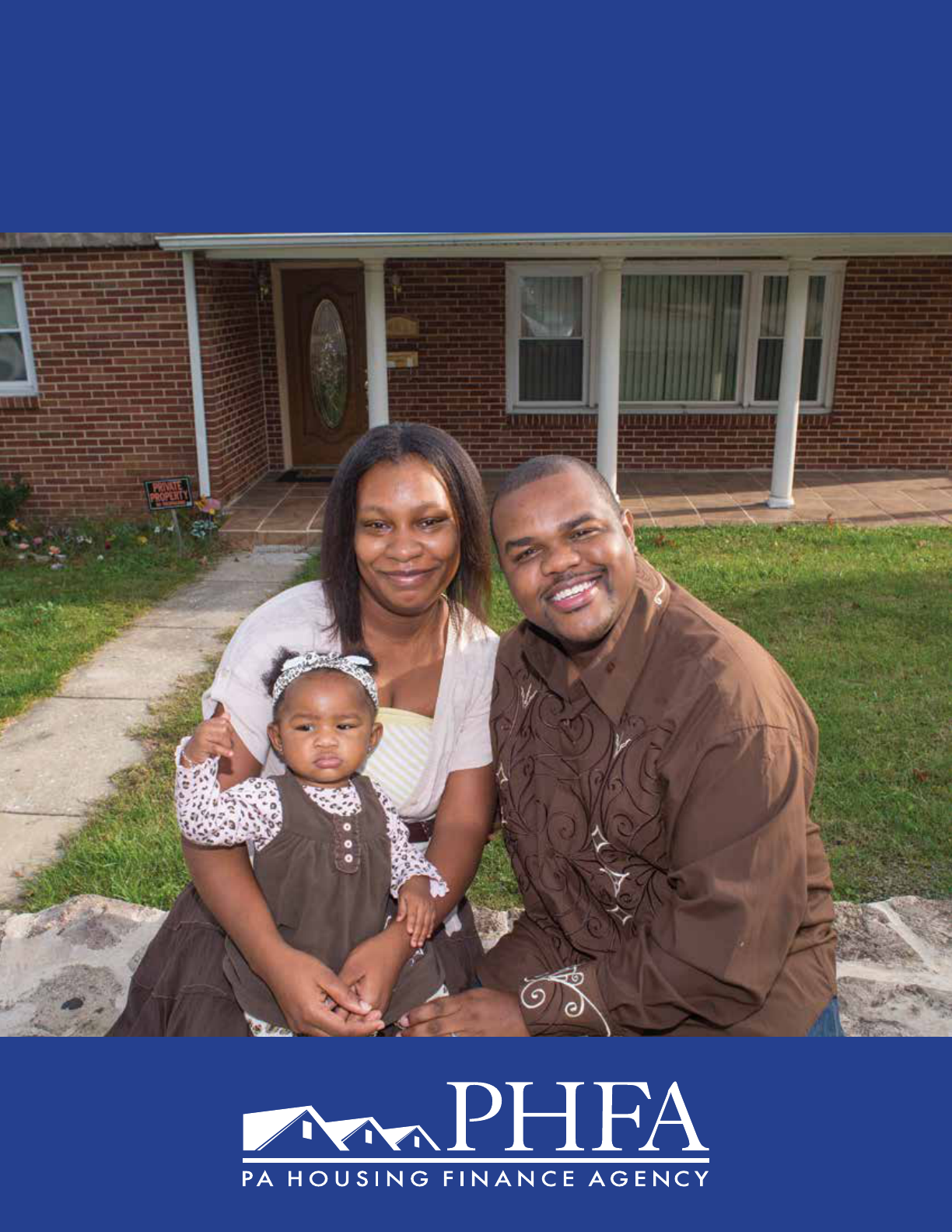

Homebuyer Workbook

PHFA homeowners

1855.827.3466

Introduction

e Pennsylvania Housing Finance Agency, a public corporation of the Commonwealth created in 1972,

began its Homeownership Program in 1982. To date, more than 166,500 families have successfully used

Agency-nanced mortgage loans to buy their homes.

Not only does the Homeownership Program help qualied buyers purchase homes, it also stimulates the

economy by creating thousands of jobs, thereby contributing millions of dollars in wages and enhancing

local tax bases.

is Homebuyer Workbook will introduce you to the Agency and guide you in selecting a home and ap-

plying for a mortgage loan. You may also wish to make an appointment with a homeownership counsel-

ing agency. PHFA will pay for you to attend a workshop or up to four hours of one-on-one counseling.

Visit the ‘Homebuyers’ section at www.phfa.org or call 1.855.827.3466 for the name of an agency in your

area or for more information about PHFA’s programs.

Budgeting

Budgeting is planning, which entails setting aside specic amounts of your earnings, usually on a

monthly basis. ese funds are used to pay bills, to buy food and other items, and to build up reserves

for future events and unexpected expenses. A budget is necessary if you are to control your nances. A

well-planned budget can tell you quickly if there is a problem, thus preventing future troubles with your

creditors.

Your mortgage payment will be a small budget in itself since you will be paying for property taxes and

insurance in your total monthly mortgage payment. Your mortgage payment is only one of the many ex-

penses included in your overall budget. Some of the other expenses you are budgeting for include: food,

electricity, heat, telephone, transportation, daycare, clothing, water, sewer, trash, car payments, bank/

nance company loans, credit cards, lines of credit, and life and auto insurance.

e dicult part of budgeting is setting aside sucient income to cover expenses for items such as un-

expected doctor and dentist visits, entertainment, and other miscellaneous expenditures.

Aer you add up the amounts for all these items and subtract the total from your monthly income, there

should be money le over to put away for property maintenance, repairs, and improvements.

Since you cannot know in advance what problems will occur or when, how much should you budget?

Homeownership

2 www.PHFA.org

A reasonable gure may be $30 to $50 per month. It is your budget; you make the decision that is cor-

rect based on your monthly income. What is saved can be used to pay a contractor or supplier when re-

pairs to your home are needed. You should also consider setting aside money for the future—weddings,

college, vacation, and retirement.

If your anticipated expenses are close to or exceed your total monthly income, you may be concerned

that it might not be possible for you to become a homeowner. We suggest you talk to your banker, real

estate agent, counselor, or someone else you have condence in and who understands budgets. It is bet-

ter to nd out now rather than later.

Budgeting is a continuous process. e principal and interest portion of your monthly payment will re-

main the same throughout the term of your mortgage. Due to increases or decreases in real estate taxes

and homeowners insurance premiums, your total monthly payment could change.

A budget is a good tool to help you fulll your dream. Homeownership is demanding, but the rewards

are worthwhile.

What it Means to be a Homeowner

e responsibilities you will have as a homeowner are a major consideration for you. As a renter, if the

roof in your apartment leaked or there was an electrical or a plumbing problem, you called the land-

lord who arranged to have the problem xed. ere will be no landlord to call if problems arise in your

home. You must make the repairs or pay a contractor to do the repairs for you.

As a condition of your mortgage, you are required to keep your home well maintained and in good

repair. Its value may decrease if you are negligent in doing this. If the property needs painting, paint it.

Keep the outside appearance acceptable to the public. Keep all plumbing, heating, and electrical systems

in proper working order.

ere are nancial advantages homeowners have that are not available to renters. You may deduct mort-

gage interest paid and real estate taxes on your federal income tax return each year. Plus, as your home

appreciates in value and you pay down the amount owed on your mortgage, you will accumulate equity

in your home (the amount you would prot upon selling your home).

Basic Eligibility

PHFA oers several mortgage options with dierent guidelines for each. In some cases, these may be a

“rst time homebuyer” requirement which means that the applicants have not had an ownership interest

in their principal residence within the last three years.

e home you are purchasing must be your principal residence. is means you intend to make the

house your permanent home rather than a second home or a property to be used for investment of com-

mercial use.

Closing cost and/or downpayment assistance loans may be available to eligible borrowers.

For additional guidelines specic to the dierent PHFA mortgage programs, please contact a participat-

ing housing counselor or visit PHFA on the web at www.PHFA.org (a full list of participating counselors

are on our webiste as well).

Credit Considerations

You should have a satisfactory history of paying your loans and charge accounts on time. Your credit

report, issued by local credit bureaus, shows the current status of your installment loans, mortgages, and

revolving charge accounts, the record of payment for open and paid o accounts (credit history) and a

3855.827.3466

public records check.

Regardless of where a credit account was opened, your name and the account information should ap-

pear in the credit bureau report. If you have no credit history, this does not mean you will be turned

down for a mortgage. A combination of other factors in your application may compensate for your lack

of a traditional credit history.

If you have an unsatisfactory credit history because of a catastrophic life event but wish to be consid-

ered for a loan, you will be required to submit a detailed written explanation of why you have had credit

problems and what has been done or is being done to correct them. is does not assure you that your

mortgage will be approved; however, the explanation will be considered in the credit decision.

Aordability

You must qualify for the loan in terms of your income as it relates to your outstanding monthly obliga-

tions. Your lender will calculate the percentage of gross monthly income required for monthly mortgage

payments (housing expense ratio) and the percentage of gross monthly income required for the pay-

ment of all debts (total expense ratio). ese calculations are called “underwriting ratios.”

HOUSING EXPENSE RATIO—includes the monthly mortgage principal and interest payment, one-

twelh of the annual payment for the property taxes, one-twelh of the annual payment for the home-

owner’s insurance and, if applicable, one-twelh of the annual payment for private mortgage insurance

(for further explanation of private mortgage insurance, see “Mortgage Categories” section on page 10).

e total of these items divided by your gross monthly income may not exceed 33 percent for a con-

ventional loan, 31 percent for an FHA-insured or a loan guaranteed by Rural Development (RD), or 41

percent for a VA-guaranteed loan.

TOTAL EXPENSE RATIO—includes the housing expense as detailed above, plus the monthly payments

of any obligations you may have such as installment loans, revolving charges (VISA, MasterCard, etc.),

child support payments, etc. e total of these divided by your gross monthly income may not exceed

38 percent for a conventional loan, 43 percent for an FHA-insured or RD-guaranteed loan, or 41 percent

for a VA-guaranteed loan.

Your lender will be able to tell you at the mortgage interview exactly which debts must be included in

the calculation of the underwriting ratios.

ere is a way in which you can approximate the maximum price you can aord. You must rst calcu-

late your gross monthly income as follows: (1) if you are paid by the hour, take your hourly rate times

40 hours per week (or the actual number of hours you work if it diers from 40 hours) times 52 weeks

in a year divided by 12; (2) if you are paid weekly, take your weekly gross pay times 52 divided by 12; (3)

if you are paid bi-weekly (every two weeks), take your biweekly gross pay times 26 divided by 12; (4) if

you are paid semi-monthly (two times a month), take your semi-monthly gross pay times 2; (5) if you

are paid a monthly wage, simply use the gross pay from any current month; (6) if you are paid an annual

salary, simply divide by 12.

For example, let’s use a family earning $48,000 per year or $4,000 per month.

Total Monthly Expense Limit is 38 percent (maximum) of $4,000 = $1,520.

From this “Total Monthly Expense” Limit of $1,520, deduct the family’s monthly obligations, the aver-

age monthly property tax escrow for the area where they plan to buy their home, the estimated monthly

escrow for the homeowner’s insurance, and an estimated monthly escrow for payment of private mort-

gage insurance (required if the downpayment is less than 20 percent of the purchase price).

4 www.PHFA.org

Total expense limit $1,520

Less monthly obligations (500)

Less property tax escrow (200)

Less homeowner’s insurance escrow (50)

Less monthly private mortgage insurance

premium (if required) (65)

Available for mortgage loan payment $705

If you divide the $705 available for the mortgage loan payment by an interest rate factor (for example,

seven percent = .00666, see page 9), you have the approximate maximum mortgage they can aord. By

dividing the mortgage amount by .95, you will have an approximate maximum aordable purchase price

with a minimum ve percent downpayment.

$705 ÷ .00666 = $105,855 (Maximum mortgage amount)

$105,855 ÷ .95 = $111,426 (Maximum aordable purchase price)

is means that a home priced beyond $111,426 will probably be beyond their ability to purchase (con-

sidering this family’s debts, income, and percentage of downpayment).

A larger downpayment will yield a higher maximum aordable purchase price. For example, if this fam-

ily makes a ten percent downpayment, the maximum-priced home they could aord would be deter-

mined by dividing as follows:

$105,855 ÷ .90 = $117,616 (Maxi mum aordable purchase price)

Your Worksheet

A worksheet follows which you can use to compute the maximum mortgage amount and maximum

purchase price you can aord. You might want to have your real estate agent, home counselor, or lender

check this worksheet for accuracy.

is worksheet provides some guidelines for determining aordability by taking into account the ex-

penses of homeownership plus other debt obligations in relation to your income. If you need help with

the calculations, see someone familiar with nances or someone you have condence or make an ap-

pointment with a homeownership counseling agency.

e maximum purchase price of the home you could aord (maximum aordable purchase price) could

be higher or lower, depending upon the interest rate, any changes in income, the amount, type and du-

ration of your debt, or the amount of the downpayment. However, this can serve as a guide so that you

do not waste time looking at homes that are obviously out of your price range.

1. Income Eligibility (to determine if you’re eligible for a PHFA loan)

Current annual household income is the total monthly income, multiplied by 12, of all persons who will

live in the property within 12 months from loan closing, regardless of whether they will be on the loan

or not. is calculation is based on income as of the date of application and does not include any in-

come received by full-time high school or undergraduate students.

See if your current annual household income is equal to or below the income limit for the county in

which the house is located by checking the program brochure.

5855.827.3466

Fill in the form below and multiply the gross total monthly income by 12.

Borrower Co-Borrower Other*

Gross pay $ _______ $ _______ $ _______

Overtime/part-time commissions _______ _______ _______

Bonuses/tips _______ _______ _______

Dividends/interest _______ _______ _______

Business or investment earnings** _______ _______ _______

Company car ($200 per month) _______ _______ _______

Car allowance _______ _______ _______

Income from rental property

(net income plus depreciation) _______ _______ _______

Pension or Social Security benets _______ _______ _______

Veterans Administration benets _______ _______ _______

Unemployment compensation _______ _______ _______

Public assistance _______ _______ _______

Any other income _______ _______ _______

Alimony/child support or separate

maintenance income*** _______ + _______ + _______ =

Gross monthly income $ _______ $ _______ $ _______

Gross total monthly income $ _______ $ _______ $ _______

Current annual

household income

* is column is for all other working members of the household who are not full-time high school or

undergraduate students.

** A self-employed borrower is to calculate income by adding the net income/loss plus the depreciation

from the Schedule Cs of the last two years’ federal income tax returns and then dividing the total by

24.

*** It is mandatory for the borrowers to include this type of income in the calculation of the current

annual household income to determine their eligibility under the federal income limit.

Now compare your current annual household income to the program income limit for the county in

which you intend to purchase the home. Fill in the appropriate program income limit and county name:

$ __________________ County name __________________

If your current annual household income calculated in #1 is over this limit, you may not be eligible for

the program. You may want to check with your lender or counselor to be sure your income is over the

income limit. If it is, they can help determine other mortgage programs for which you may be eligible.

2. Gross Monthly Income

Add all current regular monthly income for household members who will reside in the property and

also be borrowers on the mortgage loan. Consider all sources during the most recent 12 months. Add

the gross monthly income you calculated in #1 for the borrower and co-borrower only. Do not include

income from other household members that will not be on the loan. You may have to reduce the gross

monthly income if you included alimony/child support or separate maintenance income and you do not

want it to be used in the underwriting process. is type of income is optional for the borrowers to re-

6 www.PHFA.org

veal when the lender is determining underwriting ratios for total monthly payment and total expenses.

Certain types of income (such as overtime, that the borrower does not have a history of receiving for a

period of two years or more) that must be used in calculating income for income limit purposes may

not be considered when underwriting the loan.

Borrower $ _______ + Co-Borrower $_______ = $_______

Gross monthly

income

3. Monthly Personal Debt

List below all the monthly debt obligations of your household (other than your current housing costs).

Debts Average monthly amount

Car loans $ ______________

Installment loans ______________

Credit card accounts ______________

Student loans ______________

Alimony and/or child support payments ______________ =

Monthly personal debt TOTAL $ ______________

4. Total Expense Limit

_____________ x .38 = $ _____________

Gross monthly Total expense

income (from #2) limit

5. Available for mortgage payment

Total expense limit (from #4) $ ______________

Less estimated monthly property tax escrow* $ ______________

Less estimated monthly insurance escrow* $ ______________

Less monthly personal debt (from #3) $ ______________

Less estimated monthly private mortgage

insurance premium* $ ______________

Available for mortgage loan payment $ ______________

*Your lender, real estate agent, or home counselor can help you determine these amounts. You can use

the estimates from page 4, but keep in mind that these amounts can vary greatly depending on the loan

amount and location of the home.

6. Maximum Mortgage Amount

_____________ ÷ ( ____________ ) = $ _______________

(Available for mortgage (Rate factor (Maximum

loan payment see below) mortgage

from #5 above) amount)

Some of the mortgage interest rate factors that may be used in number 6 are listed at the top of the next

page:

7855.827.3466

RATE FACTORS

Select the mortgage interest rate closest to the current program interest rate and use the factor next to it.

Mortgage interest rate Factor Mortgage interest rate Factor

4%................................ .00470 5 3/4%......................... .00584

4 1/4%.......................... .00492 6%................................ .00600

4 1/2%.......................... .00507 6 1/4%......................... .00616

4 3/4%.......................... .00522 6 1/2%......................... .00633

5%................................. .00537 6 3/4%......................... .00649

5 1/4%.......................... .00552 7%................................ .00666

5 1/2%.......................... .00568

7. Maximum Purchase Price

_____________ ÷ .95 = $ _______________

(Maximum mortgage (Maximum aordable

amount from #6) purchase price)

Fees and Charges (Closing Costs)

Fees

At the initial interview, you may be required to pay a fee for a credit bureau report, appraisal, etc. (these

lender fees typically range from $250 to $350, and they are usually labeled the “application fee.”)

Charges

Settlement on the property occurs when all legal documents are signed, the title transfers to you as the

new owner, the money is paid to the seller or builder of the house, and all costs relating to the purchase

of the property are paid.

Settlement charges consist of two categories: closing costs and prepaid items. Settlement charges will

be estimated for you in a “loan estimate” which the lender is required to provide at or shortly aer you

complete the mortgage application. Closing costs include the costs for title insurance, legal fees, docu-

ment preparation, recording fees, transfer tax, etc.

e prepaid items are the interest on the mortgage loan from the settlement date to the end of that

month and the required lump-sum amounts to be escrowed for real estate taxes and insurances.

Amounts are set aside each month from your total monthly mortgage payment to pay property taxes

and insurance when they become due and payable (generally, taxes are paid early to take advantage of a

discount). You will pay the lender enough money at settlement so that this lump-sum payment, in addi-

tion to your monthly escrow payments, will allow real estate taxes and insurance to be paid in full when

future bills are due and payable. It is your responsibility to send real estate tax bills (not personal income

tax or head tax bills) you receive from your tax collector to the lender to whom you pay your mortgage

payment. ese usually include the school tax and a county or other local property tax. e insurance

payments required are: homeowner’s insurance, private mortgage insurance (if your downpayment is

less than 20 percent on a conventional loan) and ood insurance if the home is located in a ood hazard

zone that requires ood insurance as determined by the appraiser.

8 www.PHFA.org

Mortgage Categories

ere are many loans types available in today’s mortgage market. Listed below are some of the more

common ones. PHFA Homeownership Programs feature four categories of loans: Conventional,

FHA-insured, VA-Guaranteed, and RD-Guaranteed. Not all of these are oered by every participating

lender. Check with the local lender you choose to be sure the type of mortgage you want is oered or

see the participating lenders list in the ‘Homebuyers Section’ at www.phfa.org. All PHFA home purchase

loans are xed-rate and have a term of 30 years.

Adjustable rate mortgages, oen referred to as an ARM, permit the lender to adjust interest rates pe-

riodically on the basis of changes in a specied index. Be aware that although ARMs may start o with

a lower interest rate (also known as a teaser rate) than xed mortgages, the rate can increase over time

(the rst 2-10 years). Aer that, the interest rate becomes adjustable increasing the monthly payment

amount. Borrowers should be careful to fully understand the terms.

Conventional mortgages nanced by PHFA generally require a minimum of three to ve percent

down. Borrowers must contribute the lesser of $1,000 or 1 percent of the loan amount, from their own

veried funds and the remainder can be from a gi or approved community second. Borrowers are re-

quired to have a minimum middle FICO credit score of 620. is means, if you qualify, you can nance

up to 95 to 97 percent of the purchase price or the appraised value of the home, whichever is less. Con-

ventional loans are required to be insured by a private mortgage insurer if the downpayment is less than

20 percent of the purchase price or the appraised value, whichever is less. Private mortgage insurance

(not to be confused with mortgage life insurance) insures the lender against loses that it may incur if

you default on your mortgage loan and your home would be taken away from you through a foreclosure

sale.

FHA-insured mortgages are insured by the Federal Housing Administration (FHA) and require a

downpayment of three and one-half percent. Ideally they are for borrowers who want to purchase a

home but have little or no money saved for a downpayment - including those graduating college, newly

married couples, and also borrowers who have had credit problems in the past. FHA mortgages typically

have lower downpayments, lower closing costs, and may have easier qualifying criteria than convention-

al loans. Maximum loan amounts are determined by the median prices of homes in the area.

Fixed-rate mortgages are loans in which the principal and interest portion of the payment do not

change during the term of the loan. e most common type of residential home loan, it is repaid

through equal monthly payments over a specic period of time - ususally 15 or 30 years. In most cases,

payments made early in the life of the loan go mostly toward interest while later payments are applied

mostly to principal. All PHFA mortgages loans are xed-rate loans.

VA-guaranteed mortgages are guaranteed by the Department of Veterans Aairs (VA). VA loans are for

U S military veterans only and provide 100 percent nancing (no downpayment required). An upfront

VA funding fee is required but can be nanced in the mortgage. e amount of the fee may change from

time-to-time. Check with your lender for the amount of the current fee.

RD-guaranteed mortgages are guaranteed by the Rural Development division of the U S Department

of Agriculture. ese loans help low- and moderate-income applicants purchase adequate housing in

eligible rural areas. Loans may be for up to 100 percent of the appraised value of the property, plus the

guarantee fee. If the appraised value supports it, certain closing costs may be included in the mortgage

amount.

Subprime mortgages are normally made if you have a lower credit rating. As a result of the lowered

9855.827.3466

credit rating, a conventional mortgage is not oered because the lender views the borrower as having

a larger-than-average risk of defaulting on the loan. Borrowers with credit ratings below 600 may only

qualify for subprime mortgages and the higher interest rates that go with them. Making late payments

or declaring personal bankruptcy could land borrowers in situations where they can only qualify for

subprime mortgages. erefore, it is oen useful for those with low credit scores to wait for a period of

time and build up their scores before applying for mortgages to ensure they are eligible for the best rates.

Borrowers with scores in the upper 500’s may still be eligible for an FHA-insured or RD- or VA-guar-

anteed loan if they can satis fact orily explain and document their credit blemishes. PHFA provides free

credit counseling through a network of approved agencies. Please view the Home buyer Resources sec-

tion on page 11.

Homebuyer Resources

To learn more about these products and to nd out which program is right for you, PHFA strongly rec-

ommends that you visit a counseling agency.

e PHFA network of approved counseling agencies provides free home buyer counseling and education

that can include credit counseling. Buyers with a minimum middle FICO credit score lower than 680

are required to attend a course prior to closing on their PHFA loan. PHFA also has a number of coun-

seling initiatives that cover topics such as homeownership, predatory lending, rural development, and

credit repair.

To nd an approved Counseling Agency near you, visit www.phfa.org or call the Mortgage hotline at

1.855.827.3466.

How to Apply

1. Visit the ‘Homebuyers’ section at www.phfa.org or call 1.855.827.3466 for a list of participating

lenders in your area. Call a lender to schedule an appointment to get pre-approved or to com-

plete a mortgage application if you already have a signed sales agreement for a specic property.

(It is best to get pre-approved rst, before signing a sales agreement.) At the time of application,

the lender will reserve the funds needed for your trans action and will lock in your interest rate

for a period of time—usually 60 or 90 days. Interest rates may vary. Applicants are to contact a lo-

cal participating lender for interest rate information and to schedule an interview for a mortgage

application. Interviews are scheduled on a rst-come, rst-served basis.

2. Mortgage interviews run smoothly when the necessary information and documents are with you

when you apply. Bring this workbook to use as a reference, following the check list on page 17.

3. From the date of your mortgage application, you should allow at least six to eight weeks for pro-

cessing the loan. Full disclosure of the pertinent infor mation is an absolute necessity. You should

provide additional information requested by your lender or real estate agent as promptly as pos-

sible.

4. Closings are not to be scheduled prior to PHFA approval of the mortgage loan.

Home Considerations

ere is a House Evaluation Worksheet on pages 15 and 16 of this guide. Have copies of this form made

so that you can keep separate information for each home. Use them when you look at houses. e more

information you have about the houses you consider for purchase the better selection you may make.

e home that you select must be a single family dwelling, whether detached (free standing), semi-de-

10 www.PHFA.org

tached (connected), a row (townhouse), or a unit in a condominium or planned unit development

(PUD). Manufactured housing is eligible for PHFA nancing but must also meet other specic criteria.

Check with your lender to be certain the manufactured home you select is acceptable.

You may also consider two-unit properties, as long as you will occupy one of the units; the home is at

least ve years old and is typical for homes in the area; and, your loan will be conventional FHA-insured

or VA-guaranteed. e purchase price of a two-unit property can exceed the applicable PHFA purchase

price limit by ten percent.

e lot size of the property you are purchasing may not exceed four acres (exceptions may be consid-

ered due to building restrictions or township or county regulations). e purchase price listed in the

agreement of sale may not include items which are not built into the home, such as washers, dryers,

window air conditioners, portable dishwashers, area rugs, etc. However, a stove, refrigerator, and any

built-in appliances may be included. As stated earlier, the purchase price of the home may not exceed

the maximum purchase price for the county in which the home is located.

Here are a few tips to keep in mind when selecting a home:

1. Compare at least three homes. Don’t fall in love with the rst house you see.

2. Use the House Evaluation Worksheet to thoroughly inspect the home and survey the neighbor-

hood. Remember: “Buyer Beware” is the rule.

3. If you do not understand something in the agreement of sale, you should not sign it until that

item has been claried. If you have questions, you may want to seek the assistance of your real

estate agent, housing counselor, or attorney depending upon the complexity of the issue.

4. Make sure provisions are in the agreement of sale to get your deposit refunded to you if you

cannot obtain nancing. For example: “is transaction is contingent upon receiving nancing

through PHFA.”

5. It is a good idea to also make the agreement contingent on a satisfactory professional home in-

spection. If there are repairs to be completed, the sales agreement should specify who will pay for

them and when they will be completed.

6. A reasonable deposit is $1,000.

New Homes

e Agency does not provide temporary construction nancing. If you are planning to build a new

home, please note that Agency loans are for permanent nancing only. If the lender with whom you are

making application does not provide construction nancing, be sure you have a commitment for con-

struction loan nancing from another lender or that your builder is providing the construction nanc-

ing. You may be charged additional fees for the construction loan. Also, building a home may take a lot

longer and involve more complications than purchasing an existing home. See the participating lenders

list in the ‘Homebuyers’ section at www.phfa.org or call 855.827.3466 to nd a PHFA lender that also

provides construction nancing.

Protect Your Investment

Make your monthly mortgage payment to PHFA on time. At the loan closing, you will receive instruc-

tions on how and when to make your payments.

You will receive a monthly billing statement. It is your responsibility to make payments.

11855.827.3466

Your mortgage payment includes principal, interest, taxes, and insurance (PITI). e principal portion

of your payment reduces the amount borrowed. Interest is the cost of borrowing the money. e tax and

insurance portion of your payment is held each month in a separate account called an escrow account

to accumulate the money needed to pay your annual property tax, annual homeowner’s insurance, and

annual mortgage insurance. PHFA makes these annual payments for you using the funds in your escrow

account.

It is a good idea to be prepared for the money-lending oers you receive as a homeowner. ese may

come by phone, from personal contact, or by the Internet. Recently, a growing number of people are

being victimized by predatory lending practices.

Examples of predatory lending practices include:

- Loans to homeowners based on the value of the home, not their ability to repay.

- Unusually high interest rates.

- Excessive borrowing costs without lowering the interest rate.

Here’s how it might happen: Homeowners need money for an unexpected emergency, oen a small

amount. However, because of a current nancial situation, they aren’t able to borrow from a bank and

end up at a lender where credit history is “no problem.” Needing extra money in times of emergencies

can become a reality for anyone, but the details of the borrowing arrangement should be looked at care-

fully before signing.

Oers suggesting that “slow pay” or “bad credit” are not a problem are oen signs of predatory lending.

Don’t sign any forms before they’ve been reviewed and, if questions arise, ask an attorney or housing

counselor. Don’t rush into a loan that might be predatory or not in your best interest.

Remember, buying a house is likely the biggest investment you will ever make. Take your time, use

sound judgment, and seek advice. e PHFA Homeownership Program is designed to help you make

the dicult business of owning a home a little easier. If you use the program the way it is intended, you

will be able to save thousands of dollars over the life of the mortgage.

ere is a lot of satisfaction and comfort in owning your own home. ere is also a great deal of respon-

sibility, including paying the mortgage, taxes and insurances, and maintaining the property. Routine and

preventative maintenance can help reduce repair costs and keep your property value increasing.

12 www.PHFA.org

Borrower(s) _______________________________________ _______________________________________

Date ____________________

Property Address _____________________________________________________________________________

_____________________________________________________________________________

Listed Sales Price $ ________________________________ County ________________________________

PHFA Maximum Purchase Price $ ________________________________

Type of Housing (single, twin, row) ________________________________

ESCROWS (Monthly) HOUSE COSTS (Monthly)

Hazard Insurance $ _______________ Heating $ _______________

Property Taxes $ _______________ Electrical $ _______________

Condominium/PUD Fees $ _______________ Water/Sewer $ _______________

Flood Insurance (if required) $ _______________ Other $ _______________

LOCATION

Type of Neighborhood __________________________________________________________________________

Schools, how far ________________________________ Day Care, how far ________________________

Shopping, how far _______________________________ Medical Services, how far ___________________

Community Services (fire, police, ambulance) ___________ Distance from Work _______________________

Public Transportation, how far _______________________

DIMENSIONS

Lot Size _______________________________ House Size _______________________________

EXTERIOR

Style/Age/General Condition _____________________________________________________________________

Yard/Landscaping ______________________________________________________________________________

Garage, # cars ___________ built-in _________ attached _________ detached _________ carport _________

Siding, type ____________________________________ condition _______________________________

Driveway, type __________________________________ condition _______________________________

Windows/Doors, condition ______________________________________________________________________

Roof, type ______________________________________ condition _______________________________

INTERIOR

Floor plan (# of rooms) __________________________________________________________________________

Kitchen ______________________________________________________________________________________

PHFA House Evaluation Worksheet

13855.827.3466

Appliances ___________________________________________________________________________________

Bedrooms ____________________________________________________________________________________

Bathrooms ____________________________________________________________________________________

Living room __________________________________________________________________________________

Dining room _________________________________________________________________________________

Basement/attic storage _________________________________________________________________________

Other _______________________________________________________________________________________

EQUIPMENT/MECHANICALS

Heating system, type ______________________________ condition _______________________________

Water supply, type ______________________________ condition _______________________________

Hot water heater, type ________________ size ________ condition _______________________________

Sewerage, type ______________________________ condition _______________________________

Drainage ____________________________________________________________________________________

Plumbing _______________________________________ condition _______________________________

Electrical, # amps ________________________________ condition _______________________________

Insulation, type ________________________________ # of inches _______________________________

Attic, roof ________________________________ # of inches _______________________________

Walls ___________________________________ # of inches ______________________________

Storm windows/doors _________________________ condition _______________________________

The materials presented in this workbook are for informational use only.

Worksheet materials do not constitute qualification for a mortgage or any other financing.

PHFA House Evaluation Worksheet, continued

14 www.PHFA.org

Check List

Borrower _______________________________________________________________________

Social Security Number _______________________________________________________________________

Co-Borrower _______________________________________________________________________

Social Security Number _______________________________________________________________________

Mailing address _______________________________________________________________________

_______________________________________________________________________

Phone number _______________________________________________________________________

Property address _______________________________________________________________________

Property contact _______________________________________________________________________

Phone number _______________________________________________________________________

Real estate broker _______________________________________________________________________

Phone number _______________________________________________________________________

Attorney _______________________________________________________________________

Phone number _______________________________________________________________________

EMPLOYMENT (Past Two Years)

List most recent employment first.

Current or

Name of Employer Address Dates Employed Ending Salary

Borrower

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Co-Borrower

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Information Needed at Mortgage Interview

15855.827.3466

BANK ACCOUNTS (Savings, checking, etc.)

Name of Bank Address Account No. Type of Account Estimated Balance

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

LANDLORDS (Past three years)

Name of Landlord Address Dates You Rented

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

CREDIT CARDS (Department stores, banks, etc.)

Name of Creditor Address Account No. Estimated Balance Due

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

LOAN INFORMATION (Car, education, etc.)

Name of Lender Address Account No. Monthly Payment Estimated Balance Due

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

CREDIT REFERENCES (Paid-off loans and other credit)

Name of Lender Address Account No. Type of Loan Date Paid

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Information Needed at Mortgage Interview, continued

16 www.PHFA.org

Remember to bring the following with you to the mortgage interview:

1. Completed agreement of sale, signed and dated by you and the sellers.

2. Payroll stub(s) from each employer of each applicant for the previous 30 days or, if self-employed,

signed and dated prot/loss statement along with two years signed and dated federal income tax re-

turns with all schedules. Also, bring copies of court orders for child and/or spousal support, as well as

award letters or statements for any public assistance received such as social security benets.*

3. Copies of bank account statements for each account for the previous

90 days.

4. Separation or divorce agreement, divorce decree, support order.

5. Most recent two years’ W2 statements from all employers.*

6. Personal check for application fee and the PHFA program fees.

7. Social Security card and photo ID.

* Required for all adult members of household, excluding full-time undergraduate students.

18 www.PHFA.org

WKBK 11-18

211 North Front Street • Harrisburg, PA 17101

855.U.ARE.HOME (827.3466) • TTY: 800.654.5984

www.PHFA.org • @PHFAtweets • /PHFA.org

The Pennsylvania Housing Finance Agency is committed to the policy that all people shall have

equal access to its housing programs and employment without regard to age, disability, family

status, gender, national origin, political affiliation, race, or religion.